- Introduction to Forex Forward Contracts

- How Forex Forward Contracts Work

- Applications of Forex Forward Contracts

- Advantages and Disadvantages of Forex Forward Contracts

- Types of Forex Forward Contracts

- Risks Associated with Forex Forward Contracts

- Regulation and Legal Considerations

- Conclusion

- Epilogue

- Answers to Common Questions

Forex forward contracts are agreements to buy or sell a specific currency at a predetermined exchange rate on a future date. These contracts provide businesses and individuals with a way to manage currency risk, ensuring that they can buy or sell foreign currency at a known price, regardless of fluctuations in the market.

Imagine you are a U.S. importer who needs to pay for a shipment of goods from Europe in three months. You know that the euro could appreciate against the dollar, increasing the cost of your purchase. By entering into a forward contract, you can lock in a specific exchange rate today, guaranteeing that you will not be affected by any unfavorable currency movements.

Introduction to Forex Forward Contracts

A Forex Forward Contract is an agreement between two parties to exchange one currency for another at a predetermined exchange rate on a future date. These contracts are crucial in the foreign exchange market, enabling businesses and investors to manage currency risk and hedge against potential losses.

Forex forward contracts are tailor-made agreements that offer flexibility and customization to meet specific needs.

Key Characteristics of Forex Forward Contracts

The core features of a Forex Forward Contract include:

- Agreed-upon Exchange Rate: This is the rate at which the currencies will be exchanged on the maturity date. It is locked in at the time the contract is initiated, ensuring price certainty for both parties.

- Maturity Date: This is the date on which the exchange of currencies will take place. It can be any date in the future, ranging from a few days to several years.

- Underlying Currency Pair: This refers to the two currencies involved in the contract. For instance, a contract might involve exchanging US Dollars (USD) for Euros (EUR).

Comparison with Spot Contracts and Futures Contracts

Understanding the distinctions between Forex Forward Contracts, Spot Contracts, and Futures Contracts is crucial for making informed decisions in the foreign exchange market.

- Spot Contracts: These contracts involve the immediate exchange of currencies at the prevailing market rate. Unlike forward contracts, spot contracts have no predetermined exchange rate or maturity date. The exchange occurs almost instantly.

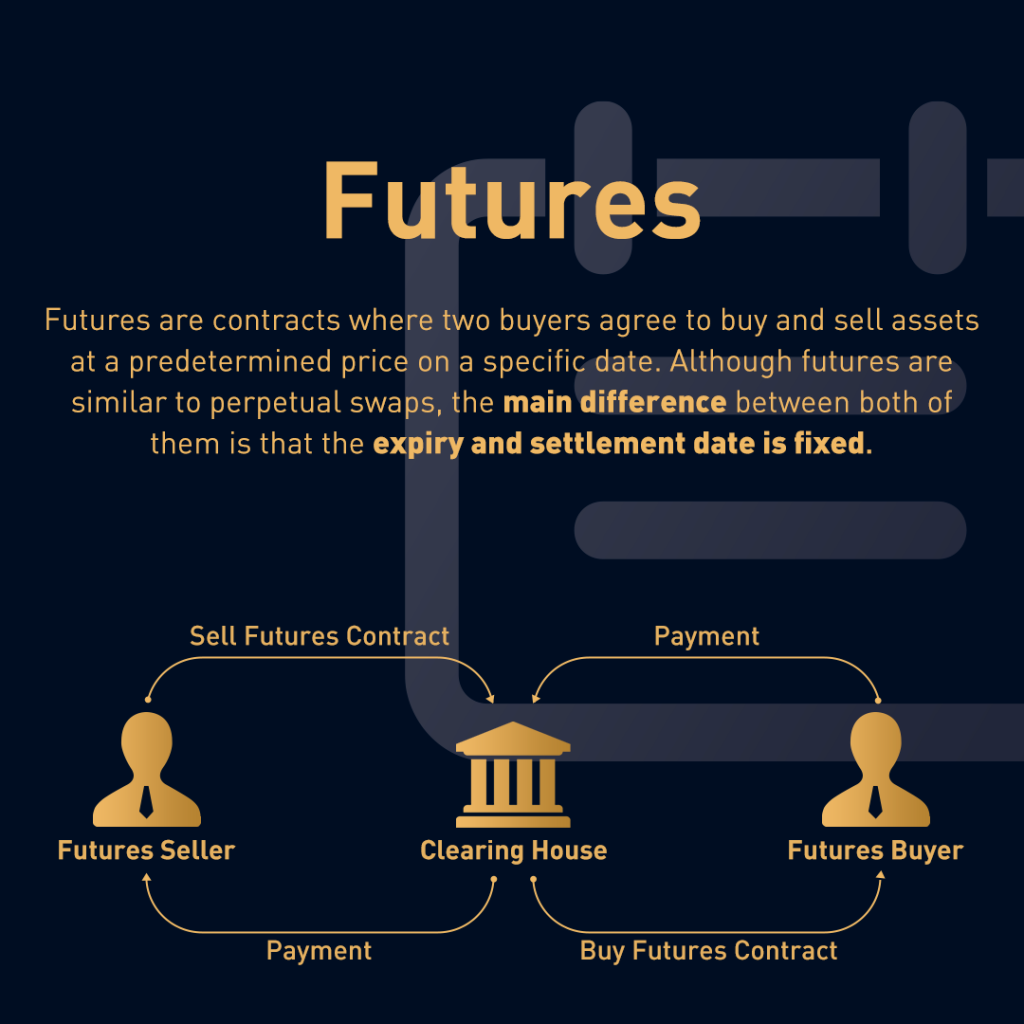

- Futures Contracts: These are standardized contracts traded on exchanges. They involve the exchange of currencies at a predetermined exchange rate on a specific future date. However, futures contracts are standardized and traded on exchanges, unlike forward contracts, which are customized and traded over-the-counter (OTC).

| Characteristic | Spot Contract | Forward Contract | Futures Contract |

|---|---|---|---|

| Exchange Rate | Current market rate | Predetermined at contract initiation | Predetermined at contract initiation |

| Maturity Date | Immediate (almost instantly) | Agreed upon at contract initiation | Agreed upon at contract initiation |

| Customization | Not customizable | Highly customizable | Standardized |

| Trading Venue | Over-the-counter (OTC) | Over-the-counter (OTC) | Exchanges |

How Forex Forward Contracts Work

A Forex Forward Contract is a legally binding agreement between two parties, the buyer and the seller, to exchange one currency for another at a predetermined exchange rate on a future date. It allows parties to lock in an exchange rate for a future transaction, eliminating uncertainty and mitigating potential losses from currency fluctuations.

The Process of Entering into a Forex Forward Contract

The process of entering into a Forex Forward Contract involves the buyer and seller agreeing on the following terms:

- Currency pair: The two currencies being exchanged, such as EUR/USD or GBP/JPY.

- Amount of currency: The volume of each currency being exchanged.

- Forward rate: The predetermined exchange rate at which the currencies will be exchanged on the settlement date.

- Settlement date: The future date on which the exchange will take place.

The forward rate is usually negotiated between the buyer and seller based on factors like market conditions, interest rate differentials, and the time to maturity of the contract. The forward rate can be either higher or lower than the spot rate (the current exchange rate).

The Role of the Forward Rate

The forward rate is crucial in Forex Forward Contracts as it defines the exchange rate at which the currencies will be exchanged on the settlement date. This predetermined rate provides certainty and allows businesses to budget and plan for future foreign exchange transactions.

Factors Influencing the Forward Rate

The forward rate is determined by various factors that influence the expected future exchange rate. These factors include:

- Interest rate differentials: The difference in interest rates between the two currencies involved in the contract. A higher interest rate in one currency compared to the other can lead to an appreciation of that currency, influencing the forward rate.

- Market expectations: Market sentiment and expectations about future economic conditions, political stability, and other factors can influence the forward rate. For example, if the market expects a currency to appreciate in the future, the forward rate will be higher than the spot rate.

- Economic conditions: The economic performance of the countries whose currencies are involved in the contract can influence the forward rate. Factors like inflation, economic growth, and government policies can affect currency values and thus the forward rate.

For example, if the interest rate in the United States is higher than the interest rate in the Eurozone, investors may be attracted to US dollar investments. This increased demand for US dollars can lead to an appreciation of the US dollar against the euro, resulting in a higher forward rate for EUR/USD.

Applications of Forex Forward Contracts

Forex forward contracts offer a versatile tool for managing currency risk and speculating on currency movements. They are widely used by businesses, individuals, and financial institutions to mitigate potential losses arising from fluctuating exchange rates.

Hedging Against Currency Risk

Businesses that operate internationally often face currency risk, which is the potential for losses due to changes in exchange rates. For example, a US-based company that imports goods from Europe may be exposed to currency risk if the euro strengthens against the US dollar. To mitigate this risk, the company can enter into a forward contract to buy euros at a predetermined exchange rate on a future date. This locks in the exchange rate and protects the company from potential losses if the euro appreciates.

- Example: A US-based company needs to pay €1 million to a European supplier in three months. The current exchange rate is $1.10/€. To hedge against the risk of the euro appreciating, the company enters into a forward contract to buy €1 million at a rate of $1.12/€. If the euro strengthens to $1.15/€ in three months, the company will still be able to buy €1 million for $1.12 million, effectively locking in the exchange rate and saving $30,000.

Speculating on Currency Movements

Forex forward contracts can also be used for speculating on currency movements. If an investor believes that a particular currency will appreciate in value, they can enter into a forward contract to buy that currency at a predetermined exchange rate. If the currency does appreciate, the investor can sell the currency at the higher market rate and make a profit.

- Example: An investor believes that the Australian dollar will appreciate against the US dollar in the next six months. They enter into a forward contract to buy AUD 100,000 at a rate of $0.70/AUD. If the Australian dollar appreciates to $0.75/AUD in six months, the investor can sell the AUD 100,000 at the higher market rate, making a profit of $5,000.

Advantages and Disadvantages of Forex Forward Contracts

Forex forward contracts offer a compelling tool for managing currency risk and securing future exchange rates. However, like any financial instrument, they come with their own set of advantages and disadvantages. Understanding these aspects is crucial for making informed decisions about whether a forex forward contract is the right fit for your specific needs.

Advantages of Forex Forward Contracts

Forex forward contracts offer several advantages, making them a popular choice for businesses and individuals seeking to manage currency risk. These benefits include:

- Price Certainty: Forex forward contracts lock in a specific exchange rate for a future date. This eliminates the uncertainty associated with fluctuating exchange rates, providing peace of mind and allowing for better financial planning. For instance, an importer can secure a forward contract to purchase foreign currency at a fixed rate, ensuring they know the exact cost of their imports in their domestic currency, regardless of future exchange rate movements.

- Risk Management: Forex forward contracts act as a hedging instrument, allowing businesses and individuals to mitigate the risk of adverse currency fluctuations. By locking in a forward rate, they can protect themselves from potential losses arising from unfavorable exchange rate movements. For example, an exporter can use a forward contract to sell foreign currency at a predetermined rate, shielding their profits from the potential decline in the value of the foreign currency.

- Flexibility: Forex forward contracts offer flexibility in terms of the contract size, maturity date, and currency pairs. This allows businesses and individuals to tailor the contract to their specific needs and risk tolerance. For example, a company with a large foreign currency exposure can enter into a forward contract with a longer maturity date to manage their risk over an extended period.

- Accessibility: Forex forward contracts are readily available through banks and other financial institutions, making them accessible to a wide range of participants. This ease of access further enhances their attractiveness as a risk management tool.

Disadvantages of Forex Forward Contracts

While forex forward contracts offer significant advantages, they also have some drawbacks that should be carefully considered before entering into such an agreement. These disadvantages include:

- Counterparty Risk: Forex forward contracts are subject to counterparty risk, which is the risk that the other party to the contract will default on their obligations. This risk is particularly relevant for smaller or less established financial institutions. If the counterparty defaults, the investor may lose their entire investment. For instance, if a company enters into a forward contract with a bank that subsequently goes bankrupt, the company may not be able to receive the agreed-upon exchange rate, potentially incurring significant losses.

- Liquidity Constraints: Forex forward contracts are not as liquid as spot contracts, meaning it can be difficult to exit the contract before maturity. This lack of liquidity can be a significant drawback, especially in volatile market conditions. For example, if a company needs to unwind a forward contract before maturity due to unforeseen circumstances, it may have to accept a less favorable exchange rate or incur significant costs. The liquidity of a forward contract is also dependent on the specific currency pair and maturity date, with contracts involving less popular currencies or longer maturities typically being less liquid.

- Opportunity Cost: Entering into a forward contract means forfeiting the potential to benefit from favorable exchange rate movements. If the actual spot rate at maturity turns out to be more favorable than the agreed-upon forward rate, the investor will miss out on this potential gain. For instance, if a company enters into a forward contract to buy foreign currency at a fixed rate, but the spot rate at maturity falls below the agreed-upon rate, the company will have paid a higher price for the currency than necessary.

Comparison with Other Hedging Instruments

Forex forward contracts are just one of many hedging instruments available to manage currency risk. Other popular options include:

- Currency Options: Currency options provide the right, but not the obligation, to buy or sell a currency at a predetermined price on or before a specific date. This offers greater flexibility than forward contracts, allowing investors to profit from favorable exchange rate movements while limiting their losses in unfavorable scenarios. However, options also have a premium associated with them, which can be costly.

- Currency Futures: Currency futures are standardized contracts traded on exchanges, offering greater liquidity and transparency than forward contracts. They are also subject to margin requirements, which can limit potential losses. However, futures contracts may not be suitable for all hedging needs, as they require a certain level of market knowledge and expertise.

Types of Forex Forward Contracts

Forex forward contracts are agreements to buy or sell a specific currency at a predetermined exchange rate on a future date. While the basic structure remains the same, various types of forward contracts cater to different needs and risk profiles.

Outright Forwards

Outright forwards are the most basic type of forward contract. They involve a simple agreement to buy or sell a specific amount of currency at a fixed exchange rate on a future date. These contracts are used to hedge against currency fluctuations or to lock in a specific exchange rate for future transactions.

- Example: A company expects to receive EUR 1 million in three months. To hedge against a potential decline in the EUR/USD exchange rate, they can enter into an outright forward contract to sell EUR 1 million at a predetermined rate of 1.10 USD/EUR. This guarantees that the company will receive USD 1.1 million in three months, regardless of the spot rate at that time.

Forward Contracts with Options, Forex forward contract

Forward contracts with options provide the buyer or seller with the right, but not the obligation, to execute the transaction at the agreed-upon rate. This flexibility allows for greater control over potential risks and rewards.

Forward Contracts with Call Options

A forward contract with a call option gives the buyer the right to buy the underlying currency at the agreed-upon rate on the maturity date. This allows the buyer to profit if the spot rate rises above the forward rate.

- Example: An investor believes that the GBP/USD exchange rate will rise in the next six months. They can enter into a forward contract with a call option to buy GBP at a rate of 1.30 USD/GBP. If the spot rate rises to 1.35 USD/GBP at maturity, the investor can exercise the option and buy GBP at the lower forward rate, generating a profit. However, if the spot rate falls below 1.30 USD/GBP, the investor can choose not to exercise the option and avoid losses.

Forward Contracts with Put Options

A forward contract with a put option gives the buyer the right to sell the underlying currency at the agreed-upon rate on the maturity date. This allows the buyer to profit if the spot rate falls below the forward rate.

- Example: An exporter expects to receive USD 1 million in three months. They are concerned about a potential decline in the USD/JPY exchange rate. They can enter into a forward contract with a put option to sell USD 1 million at a rate of 110 JPY/USD. If the spot rate falls to 105 JPY/USD at maturity, the exporter can exercise the option and sell USD at the higher forward rate, protecting their revenue.

Risks Associated with Forex Forward Contracts

Forex forward contracts, while offering advantages for hedging and speculation, are not without their risks. These risks can arise from various factors, including counterparty default, market fluctuations, and interest rate changes. Understanding these risks is crucial for investors to make informed decisions and implement appropriate risk management strategies.

Counterparty Risk

Counterparty risk refers to the possibility that the other party to the forward contract will default on their obligations. This can happen if the counterparty experiences financial difficulties or goes bankrupt.

- Example: A company enters into a forward contract to buy USD at a specific rate in the future. If the counterparty defaults, the company may not be able to purchase USD at the agreed-upon rate, leading to losses.

Liquidity Risk

Liquidity risk arises from the difficulty of exiting a forward contract before its maturity date. Forward contracts are typically not traded on exchanges, making it challenging to find a counterparty willing to buy or sell the contract.

- Example: A trader enters into a forward contract to sell EUR in three months. However, the market moves against the trader, and they want to exit the contract early. Finding a buyer willing to take on the contract at a favorable rate can be difficult, potentially leading to losses.

Interest Rate Risk

Interest rate risk stems from changes in interest rates during the life of the forward contract. Interest rate differentials between the two currencies involved in the contract can affect the profitability of the forward position.

- Example: A company enters into a forward contract to sell USD against GBP. If interest rates in the US rise, the USD will strengthen, making the forward contract less profitable for the company.

Mitigating Risks

- Counterparty Risk: Investors can mitigate counterparty risk by dealing with reputable financial institutions with strong credit ratings. They can also consider using credit default swaps (CDS) as insurance against counterparty default.

- Liquidity Risk: To manage liquidity risk, investors can choose a shorter maturity period for their forward contracts. They can also consider using options, which provide the right but not the obligation to enter into a forward contract.

- Interest Rate Risk: Interest rate risk can be mitigated through strategies like hedging with interest rate derivatives or adjusting the maturity date of the forward contract.

Real-World Scenarios

- Counterparty Default: In 2008, Lehman Brothers, a major investment bank, filed for bankruptcy. This event resulted in significant losses for many investors who had entered into forward contracts with Lehman Brothers.

- Liquidity Risk: During the 2011 European sovereign debt crisis, the euro experienced significant volatility. Investors who had entered into forward contracts to buy euro were unable to find buyers at favorable rates when they wanted to exit their positions, resulting in losses.

- Interest Rate Risk: In 2016, the Federal Reserve raised interest rates in the US, leading to a strengthening of the US dollar. Investors who had entered into forward contracts to sell USD against other currencies experienced losses due to the unfavorable interest rate differentials.

Regulation and Legal Considerations

Forex forward contracts, like other financial instruments, operate within a regulatory framework designed to ensure fair and transparent markets, protect investors, and mitigate systemic risk. These regulations vary across jurisdictions, but generally involve oversight by central banks, financial regulators, and other relevant authorities.

Regulatory Framework

Regulatory frameworks for Forex forward contracts are designed to address potential risks and promote market integrity. Key aspects of this framework include:

- Licensing and Supervision: Financial institutions involved in Forex forward contracts are typically required to obtain licenses and operate under the supervision of relevant authorities. This ensures compliance with regulatory standards and helps mitigate risks associated with unauthorized or unregulated activities.

- Capital Requirements: Financial institutions dealing in Forex forward contracts are often subject to capital adequacy requirements to ensure they have sufficient financial resources to cover potential losses. These requirements are determined by regulatory bodies and may vary depending on the institution’s size and the nature of its operations.

- Reporting and Transparency: Regulatory frameworks typically require financial institutions to report their Forex forward contract positions and related activities to relevant authorities. This data helps regulators monitor market activity, identify potential risks, and intervene if necessary.

- Market Conduct: Regulations governing Forex forward contracts often include rules related to market conduct, such as prohibiting market manipulation, insider trading, and other forms of misconduct. These rules aim to maintain a fair and orderly market environment.

- Consumer Protection: Regulatory frameworks may include provisions to protect retail investors who engage in Forex forward contracts. These provisions can include requirements for disclosure, suitability assessments, and complaint resolution mechanisms.

Legal Considerations

Entering into and executing Forex forward contracts involves several legal considerations, including:

- Contract Formation: Forex forward contracts are legally binding agreements. To be enforceable, these contracts must meet the essential elements of contract formation, such as offer, acceptance, consideration, and intention to create legal relations.

- Terms and Conditions: The terms and conditions of Forex forward contracts should be clearly defined and agreed upon by all parties. This includes specifying the currency pair, the forward rate, the settlement date, and any other relevant details.

- Counterparty Risk: Forex forward contracts involve counterparty risk, meaning the risk that one party may default on its obligations. Parties entering into these contracts should assess the creditworthiness of their counterparty and consider using credit derivatives or other risk mitigation measures.

- Legal Dispute Resolution: In case of disputes arising from Forex forward contracts, parties may need to resort to legal dispute resolution mechanisms. This could involve arbitration, mediation, or litigation, depending on the terms of the contract and the applicable laws.

Examples of Legal Disputes and Regulations

Several examples illustrate the legal and regulatory landscape surrounding Forex forward contracts:

- Libor Scandal: The Libor scandal, which involved manipulation of the London Interbank Offered Rate (LIBOR), highlighted the importance of regulatory oversight and the potential for misconduct in financial markets. LIBOR is a benchmark interest rate used in various financial instruments, including Forex forward contracts, and its manipulation had significant implications for the financial system.

- Foreign Exchange Margin Requirements: In 2016, the US Commodity Futures Trading Commission (CFTC) implemented margin requirements for foreign exchange (FX) transactions, including Forex forward contracts, for non-clearing members. These margin requirements were intended to mitigate counterparty risk and enhance financial stability in the FX market.

- Forex Forward Contract Disputes: Numerous legal disputes have arisen over Forex forward contracts, involving issues such as contract interpretation, breach of contract, and fraud. These cases highlight the importance of carefully drafting and reviewing the terms of these contracts to minimize the risk of disputes.

Conclusion

This article has delved into the multifaceted world of Forex Forward Contracts, highlighting their significance in the foreign exchange market. From the fundamental workings of these contracts to their diverse applications, advantages, and risks, we have explored the key aspects that shape their role in global finance.

The Evolving Landscape of Forex Forward Contracts

The future of Forex Forward Contracts is marked by a dynamic interplay of technological advancements, regulatory shifts, and evolving market needs. Several factors are shaping their evolving role:

- Increased Automation and Digitalization: The adoption of sophisticated trading platforms and algorithmic trading is streamlining the execution and management of Forex Forward Contracts, enhancing efficiency and accessibility.

- Growing Demand for Risk Management Tools: In a volatile global economy, businesses and individuals are increasingly seeking effective tools to manage currency risk. Forex Forward Contracts are proving to be valuable instruments for hedging against potential losses arising from currency fluctuations.

- Regulatory Developments: Regulatory bodies worldwide are actively shaping the landscape of the foreign exchange market. Increased transparency and stricter regulations are likely to influence the use and structure of Forex Forward Contracts, promoting greater stability and investor confidence.

Epilogue

Forex forward contracts are a powerful tool for managing currency risk, offering businesses and individuals the ability to mitigate potential losses and secure favorable exchange rates. By understanding the mechanics and applications of these contracts, participants can make informed decisions and navigate the complexities of the global foreign exchange market with greater confidence.

Answers to Common Questions

What are the main differences between a spot contract and a forward contract?

A spot contract involves the immediate exchange of currencies at the current market rate, while a forward contract involves the exchange of currencies at a predetermined rate on a future date.

How do I determine the forward rate for a forex forward contract?

The forward rate is determined by several factors, including interest rate differentials between the two currencies, market expectations about future exchange rate movements, and general economic conditions.

What are some of the risks associated with forex forward contracts?

Risks include counterparty risk (the risk that the other party to the contract will default), liquidity risk (the risk that you will not be able to easily close out the contract), and interest rate risk (the risk that interest rates will change, affecting the profitability of the contract).