- What is a Forex Demo Trading Account?

- How to Open a Forex Demo Trading Account

- Forex Demo Trading Account Features and Functionality

- Benefits of Using a Forex Demo Trading Account

- Limitations of Forex Demo Trading Account

- Transitioning from Demo to Live Trading

- Closure

- Expert Answers: Forex Demo Trading Account

Forex demo trading accounts provide a risk-free environment to learn and practice forex trading. They offer virtual funds, real-time market data, and access to various trading platforms, allowing traders to hone their skills and test strategies before venturing into live trading.

Whether you’re a beginner or an experienced trader, a forex demo account can be invaluable. It helps you understand the intricacies of the forex market, experiment with different trading strategies, and gain confidence before risking real capital.

What is a Forex Demo Trading Account?

A Forex demo trading account is a simulated trading environment that allows you to practice trading foreign exchange (Forex) without risking real money. It provides a safe and risk-free way to learn about Forex trading, experiment with different strategies, and get comfortable with trading platforms before venturing into live trading.

Purpose of a Forex Demo Trading Account

A Forex demo account serves several important purposes:

- Learning the Basics: Demo accounts provide a platform to understand the fundamentals of Forex trading, including terminology, market dynamics, and order execution.

- Testing Trading Strategies: Traders can experiment with various trading strategies and analyze their effectiveness without risking capital.

- Familiarizing with Trading Platforms: Demo accounts allow you to become familiar with the features and functionalities of different trading platforms, including placing orders, managing positions, and analyzing charts.

- Developing Trading Skills: By practicing with virtual funds, traders can refine their trading skills, manage risk, and improve their decision-making abilities.

Key Features of a Forex Demo Trading Account

Forex demo accounts typically include the following key features:

- Virtual Funds: Demo accounts provide a predetermined amount of virtual currency, which you can use to trade without risking real money.

- Real-Time Market Data: Demo accounts offer access to real-time market data, including currency prices, charts, and economic indicators, mirroring the live market environment.

- Trading Platforms: Demo accounts usually come with access to the same trading platforms used for live trading, providing a realistic experience.

Benefits of Using a Forex Demo Trading Account

Forex demo accounts offer several benefits for both beginners and experienced traders:

- Risk-Free Learning: Beginners can learn the ropes of Forex trading without the fear of losing money.

- Experimentation: Traders can test new strategies and refine their existing ones without risking real capital.

- Confidence Building: Practice with a demo account can build confidence and prepare you for live trading.

- Improved Decision-Making: By observing how your strategies perform in a simulated environment, you can identify areas for improvement and develop better trading decisions.

How to Open a Forex Demo Trading Account

Opening a Forex demo trading account is a straightforward process that allows you to practice your trading skills and familiarize yourself with the Forex market without risking real money. This guide will walk you through the steps involved in opening a demo account with a reputable Forex broker.

Choosing a Reputable Forex Broker

Choosing a reliable Forex broker is crucial for a successful trading experience. Here are some factors to consider:

- Regulation and Licensing: Ensure the broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US. This indicates the broker adheres to specific standards and regulations, safeguarding your funds.

- Trading Platform: Choose a broker with a user-friendly and feature-rich trading platform. Look for platforms with advanced charting tools, technical indicators, and order execution capabilities.

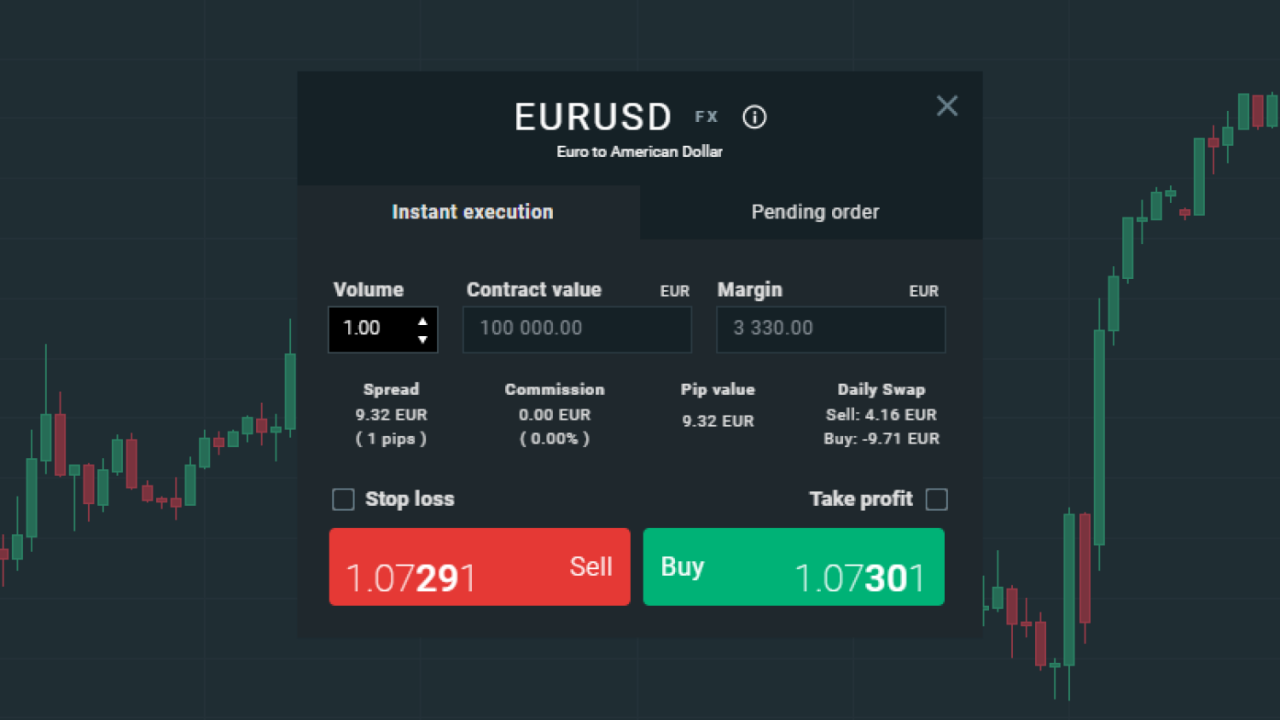

- Spreads and Commissions: Compare the broker’s trading costs, including spreads (the difference between the buy and sell price) and commissions. Lower spreads generally result in higher profitability.

- Customer Support: Assess the broker’s customer support channels and responsiveness. Reliable brokers offer multiple contact options, including live chat, email, and phone support.

Steps to Open a Forex Demo Trading Account

Once you’ve chosen a Forex broker, follow these steps to open a demo account:

- Visit the Broker’s Website: Navigate to the broker’s website and locate the “Demo Account” or “Practice Account” section.

- Register for an Account: Click on the registration link and fill out the online application form. You will typically need to provide your name, email address, and phone number.

- Choose Your Account Type: Some brokers offer different demo account types, such as standard or mini accounts. Select the account type that best suits your trading needs.

- Set Your Account Balance: You will be given a virtual balance to trade with. Choose a realistic amount that reflects your typical trading capital.

- Download the Trading Platform: Most brokers provide downloadable trading platforms for desktop or mobile devices. Download and install the platform to access your demo account.

- Start Trading: You can now access the trading platform, place orders, and experiment with different trading strategies using virtual funds.

Requirements and Documents

While opening a demo account generally doesn’t require extensive documentation, you might need to provide some basic information, such as:

- Name and Email Address: These are essential for account registration and communication.

- Phone Number: This may be required for verification purposes or to receive important updates.

- Proof of Identity: Some brokers may request a copy of your passport or driver’s license for verification.

Funding a Demo Account

Demo accounts are funded with virtual currency. You don’t need to deposit real money to trade on a demo account. The virtual funds are provided by the broker to simulate real-world trading conditions.

“The virtual funds in a demo account are not real money. You cannot withdraw or transfer them. They are solely for practice purposes.”

Forex Demo Trading Account Features and Functionality

A Forex demo trading account offers a realistic trading environment to practice your skills and experiment with different strategies without risking real money. This allows you to learn the ins and outs of Forex trading without the pressure of financial losses.

Demo Account Features Comparison

The features of a Forex demo account vary depending on the broker. Here is a comparison of some popular Forex brokers and their demo account offerings:

| Broker | Trading Platforms | Indicators & Tools | Account Funding | Expiry Date |

|---|---|---|---|---|

| MetaTrader 4 (MT4) | MT4 | Standard indicators and tools | Virtual funds | Typically 30-90 days, but can be extended |

| MetaTrader 5 (MT5) | MT5 | More advanced indicators and tools | Virtual funds | Typically 30-90 days, but can be extended |

| cTrader | cTrader | Advanced charting and analysis tools | Virtual funds | Typically 30-90 days, but can be extended |

Trading Platforms, Indicators, and Tools

Demo accounts provide access to various trading platforms, indicators, and tools, similar to live accounts.

- Trading Platforms: Most brokers offer popular platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms provide real-time quotes, charting tools, order execution, and account management features.

- Indicators: Demo accounts typically include a wide range of technical indicators, such as moving averages, MACD, RSI, and Bollinger Bands. These indicators help traders identify trends, support and resistance levels, and potential trading opportunities.

- Tools: Demo accounts often provide tools for analysis and trading, including:

- Charting Tools: Advanced charting tools for drawing lines, shapes, and trend lines.

- Economic Calendars: Access to economic calendars that display important economic events and their potential impact on the market.

- News Feeds: Real-time news feeds that provide updates on market-moving events.

Accessing and Using Demo Account Features

Once you open a demo account, you will typically be provided with login credentials to access the trading platform.

- Login: Log in to the trading platform using your credentials.

- Explore Features: Explore the different features and tools available on the platform. Experiment with various indicators and charting tools to understand their functionality.

- Practice Trading: Place practice trades using the virtual funds provided in your demo account. This allows you to test your strategies and gain experience in executing trades.

- Monitor Performance: Review your trading history and analyze your performance. Identify areas where you can improve your trading strategies and risk management techniques.

Benefits of Using a Forex Demo Trading Account

A Forex demo trading account is an invaluable tool for traders of all experience levels. It provides a risk-free environment to practice trading strategies, test new ideas, and gain confidence before venturing into live trading.

Risk-Free Trading Environment

Demo accounts allow traders to experiment with different trading strategies and market analysis techniques without risking any real money. This is particularly beneficial for new traders who are still learning the ropes of Forex trading. By using a demo account, they can familiarize themselves with the trading platform, understand how orders are executed, and develop their trading skills without financial consequences.

Limitations of Forex Demo Trading Account

While Forex demo accounts offer a valuable learning platform, it’s crucial to acknowledge their inherent limitations. These limitations stem from the fact that demo trading doesn’t fully replicate the complexities and pressures of real-time trading.

Trading Conditions Differ from Live Trading

Demo accounts typically provide simulated market conditions that may not accurately reflect real-time market fluctuations. This discrepancy arises from the absence of real traders and their influence on market sentiment. Consequently, demo trading environments may not fully capture the dynamic and unpredictable nature of live trading.

Absence of Psychological Factors

Demo trading eliminates the psychological factors that significantly influence live trading decisions. In real trading, emotions like fear, greed, and anxiety can cloud judgment and lead to impulsive actions. These psychological factors are absent in demo trading, where traders can make decisions without the pressure of real financial consequences.

Potential Slippage

Slippage, the difference between the expected trade execution price and the actual price, is a common phenomenon in live trading. This occurs due to market volatility and order volume. Demo accounts often fail to accurately simulate slippage, potentially leading to unrealistic expectations of trade execution.

Bridging the Gap Between Demo and Live Trading

To bridge the gap between demo and live trading, consider these tips:

- Start Small: Begin with a small live account to test your strategies and build confidence in real-time trading. This approach allows you to experience the psychological pressures and market dynamics without risking substantial capital.

- Practice Risk Management: Implement strict risk management strategies in your demo account and transition them to your live account. This disciplined approach will help you manage potential losses and protect your capital.

- Record Your Trades: Keep a detailed journal of your demo trading activity, noting your strategies, entry and exit points, and any emotional factors that influenced your decisions. This record will provide valuable insights into your trading behavior and identify areas for improvement.

- Seek Guidance: Consult with experienced traders or mentors to gain insights into real-world trading challenges and learn from their experience. This guidance can help you refine your strategies and develop a more realistic understanding of the market.

Transitioning from Demo to Live Trading

The transition from a demo trading account to a live trading account is a significant step for any forex trader. It involves moving from a risk-free environment where you can experiment and learn without consequences, to a real-money environment where every decision has real financial implications. This transition requires careful planning and preparation to minimize the risk of losses and ensure a smooth and successful transition.

Developing a Trading Plan

A trading plan is a crucial component of successful forex trading. It Artikels your trading strategy, risk management approach, and trading goals. It serves as a roadmap to guide your trading decisions and helps you stay disciplined and consistent.

- Define your trading style: Determine whether you prefer scalping, day trading, swing trading, or long-term investing. This will influence your trading strategy and the time frame you choose for your trades.

- Identify your trading goals: What are you hoping to achieve with your trading? Set realistic and measurable goals, such as a specific profit target or a desired risk-reward ratio.

- Develop a risk management strategy: This involves setting limits on the amount of capital you are willing to risk on each trade and overall. It’s essential to protect your capital and avoid significant losses.

- Choose your trading instruments: Select the currency pairs or other financial instruments that align with your trading style and goals.

- Set your entry and exit points: Determine the specific conditions that will trigger your entry and exit decisions. This could involve technical indicators, price action patterns, or fundamental analysis.

Managing Risk

Managing risk is crucial in forex trading, as it involves trading with real money. A well-defined risk management plan can help you protect your capital and prevent significant losses.

- Set a stop-loss order: A stop-loss order automatically closes your position when the price reaches a predetermined level, limiting your potential losses.

- Use a risk-reward ratio: This ratio compares the potential profit of a trade to the potential risk. Aim for a risk-reward ratio that is favorable, such as 1:2 or 1:3, where the potential profit is twice or three times the potential loss.

- Avoid overtrading: Resist the temptation to trade too frequently or with too much capital. This can lead to emotional trading and impulsive decisions.

- Stay disciplined and consistent: Stick to your trading plan and avoid deviating from it, even when faced with tempting opportunities or market volatility.

Tips for Transitioning to Live Trading

Here are some tips to make the transition from demo to live trading smoother and reduce the risk of losses:

- Start small: Begin with a smaller trading account than you would on a demo account. This allows you to test your strategy with real money without risking too much capital.

- Simulate live trading: Practice trading on a demo account with the same conditions as your live trading account, including the same trading size and leverage.

- Review your trading history: Analyze your trading performance on the demo account and identify any areas for improvement. This can help you refine your strategy and risk management approach.

- Monitor your emotions: Trading with real money can evoke strong emotions, such as fear, greed, and excitement. Be aware of these emotions and try to manage them to avoid impulsive decisions.

- Seek guidance: If you are new to forex trading, consider seeking guidance from experienced traders or mentors. They can provide valuable insights and support as you transition to live trading.

Closure

While demo accounts offer a valuable learning tool, it’s crucial to remember that they don’t fully replicate the live trading experience. The absence of real-time market emotions and potential slippage can create a gap between demo and live trading. Transitioning to live trading requires careful planning, risk management, and a gradual approach to ensure a successful and profitable journey.

Expert Answers: Forex Demo Trading Account

How long can I use a forex demo account?

Most forex brokers offer unlimited access to demo accounts, allowing you to practice and learn for as long as you need.

Do demo accounts have expiration dates?

Some demo accounts may have expiration dates, but most reputable brokers offer unlimited access. Check the terms and conditions of your chosen broker.

Can I use a demo account to test automated trading systems?

Yes, you can use a demo account to test automated trading systems and strategies. Many brokers offer access to trading platforms that support automated trading features.

What are the differences between a demo account and a live account?

The main difference is that a demo account uses virtual funds, while a live account uses real money. Demo accounts also lack real-time market emotions and potential slippage, which can impact trading results in live markets.