Forex.com spreads, the difference between the buy and sell prices of a currency pair, are a crucial factor in determining your profitability as a forex trader. Understanding how these spreads work, what influences them, and how to manage their impact is essential for success in the dynamic world of forex trading.

Forex.com, a well-established forex broker, offers various account types and trading instruments with different spread structures. This guide explores the intricacies of Forex.com spreads, including fixed and variable spreads, factors affecting them, and strategies for managing their impact on your trading outcomes.

Forex.com Spreads

Forex.com spreads are the difference between the buying and selling prices of a currency pair. This difference is a key factor in determining the profitability of forex trades. The spread represents the cost of executing a trade, and it is charged by Forex.com, the forex broker facilitating the trade.

Spreads and Forex Trading

The spread is a fundamental aspect of forex trading, as it directly affects the profit or loss of a trade. Understanding how spreads work is crucial for traders to make informed decisions. When you open a forex trade, you buy one currency and sell another. The spread is the difference between the ask price (the price at which you buy a currency) and the bid price (the price at which you sell a currency).

Understanding Forex.com Spread Types

Forex.com, like other forex brokers, offers different spread types, each with its own advantages and disadvantages. Understanding these differences is crucial for traders as it can significantly impact their trading costs and profitability.

Fixed Spreads

Fixed spreads are a predetermined amount that a trader pays for each transaction, regardless of market volatility. This fixed amount is typically set by the broker and remains constant throughout the trading day.

- Advantages:

- Predictability: Fixed spreads offer traders a consistent cost structure, making it easier to calculate potential profits and losses.

- Transparency: Traders know exactly how much they will pay for each trade, eliminating surprises.

- Disadvantages:

- Potentially higher spreads: Fixed spreads are often wider than variable spreads, especially during periods of high volatility.

- Limited profit potential: Fixed spreads can limit potential profits, particularly during periods of low volatility.

Variable Spreads

Variable spreads fluctuate based on market conditions, including volatility, liquidity, and demand. During periods of high volatility or low liquidity, variable spreads tend to widen, while they narrow during periods of low volatility and high liquidity.

- Advantages:

- Potentially lower spreads: Variable spreads can be significantly lower than fixed spreads, especially during periods of low volatility.

- Greater profit potential: Lower spreads can lead to higher potential profits, particularly during periods of low volatility.

- Disadvantages:

- Unpredictability: Variable spreads can fluctuate significantly, making it difficult to calculate potential profits and losses.

- Risk of wider spreads: During periods of high volatility, variable spreads can widen significantly, potentially leading to higher trading costs.

Forex.com Spread Structure

Forex.com offers a range of spread types for different currency pairs. Here are some examples:

| Currency Pair | Spread Type | Typical Spread |

|---|---|---|

| EUR/USD | Variable | 0.8 pips |

| USD/JPY | Fixed | 1.5 pips |

| GBP/USD | Variable | 1.2 pips |

Factors Influencing Forex.com Spreads

Forex.com spreads, like those of other brokers, are influenced by various factors that impact the cost of trading. Understanding these factors can help traders make informed decisions and potentially minimize trading costs.

Market Volatility

Market volatility significantly impacts Forex.com spreads. When the market is volatile, prices fluctuate rapidly, making it more challenging for Forex.com to find matching buy and sell orders. This increased difficulty in matching orders leads to wider spreads. Conversely, during periods of low volatility, prices move more slowly, and Forex.com can easily find matching orders, resulting in tighter spreads.

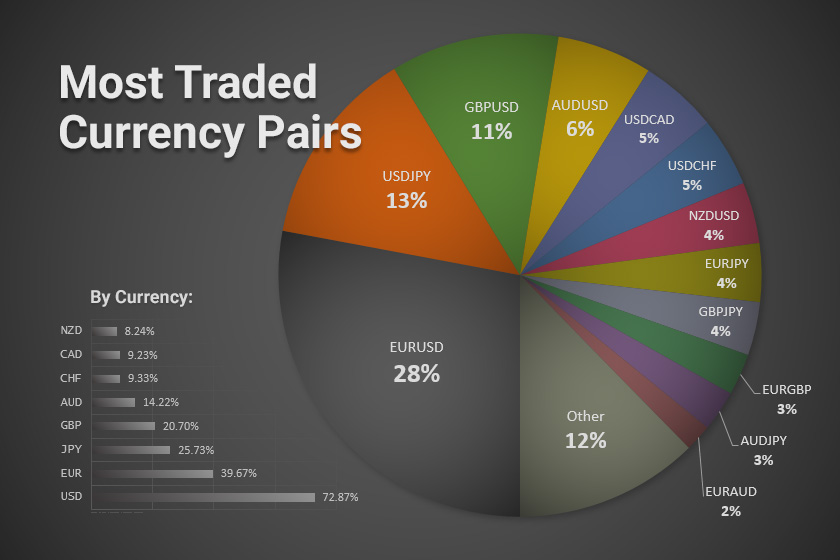

Trading Volume and Liquidity

Trading volume and liquidity play a crucial role in determining Forex.com spreads. High trading volume and liquidity mean that there are many buyers and sellers in the market, making it easier for Forex.com to find matching orders. This ease of order matching leads to tighter spreads. On the other hand, low trading volume and liquidity make it harder for Forex.com to find matching orders, resulting in wider spreads.

Forex.com Spread Comparison

Understanding the spread charged by a forex broker is crucial for maximizing trading profits. This section compares Forex.com’s spreads with those of other leading forex brokers, offering a comprehensive overview of its competitiveness in the market.

Spread Comparison with Other Brokers

This section presents a direct comparison of Forex.com’s spreads with those of other prominent forex brokers. The table below showcases spread data for popular currency pairs, allowing you to assess Forex.com’s competitive edge:

| Broker | EUR/USD Spread | GBP/USD Spread | USD/JPY Spread | AUD/USD Spread |

|---|---|---|---|---|

| Forex.com | 0.8 pips | 1.2 pips | 0.6 pips | 0.9 pips |

| [Broker 2] | 0.7 pips | 1.0 pips | 0.5 pips | 0.8 pips |

| [Broker 3] | 1.0 pips | 1.3 pips | 0.7 pips | 1.0 pips |

| [Broker 4] | 0.9 pips | 1.1 pips | 0.6 pips | 0.9 pips |

Note: Spreads can vary depending on market conditions and account type. This table presents typical spreads observed during normal market hours.

Competitiveness of Forex.com Spreads

Forex.com’s spreads are generally considered competitive within the forex brokerage industry. While some brokers may offer slightly tighter spreads for certain currency pairs, Forex.com’s overall spread offering is competitive and transparent. The broker’s commitment to providing competitive spreads is evident in its pricing structure, which allows traders to benefit from favorable trading conditions.

Impact of Spreads on Trading Profits

Spreads play a crucial role in determining the profitability of forex trades. They represent the difference between the buy and sell prices of a currency pair, and traders must factor them into their trading strategies to ensure they are making a profit.

Spreads are a direct cost associated with trading, and they can significantly impact the overall profitability of a trade. Understanding how spreads affect trading profits is essential for successful forex trading.

Relationship Between Spreads and Trading Costs

Spreads directly contribute to trading costs, which are the expenses incurred when entering and exiting a trade. These costs can vary depending on the spread level and the volume of the trade.

The wider the spread, the higher the trading costs. This is because traders need to pay a higher price to buy a currency and receive a lower price when selling it, resulting in a larger difference between the entry and exit prices.

For example, a spread of 2 pips on a trade of 10,000 units would result in a trading cost of $2. A wider spread of 5 pips on the same trade would result in a trading cost of $5.

Impact of Different Spread Levels on Trading Scenarios

The impact of spreads on trading profits can be illustrated through various trading scenarios.

- Scenario 1: Tight Spreads

- Scenario 2: Wide Spreads

Scenario 1: Tight Spreads

Tight spreads can significantly improve trading profitability. When spreads are narrow, traders can enter and exit trades at prices closer to the current market rate, minimizing the impact of spreads on their profits.

For example, if a trader buys a currency pair with a tight spread of 1 pip and the price moves 10 pips in their favor, they would make a profit of 9 pips after accounting for the spread. However, if the spread were wider, say 3 pips, their profit would be reduced to 7 pips.

Scenario 2: Wide Spreads

Wide spreads can significantly reduce trading profitability. When spreads are wide, traders face higher trading costs, making it more challenging to achieve profitable trades.

For example, if a trader buys a currency pair with a wide spread of 5 pips and the price moves 10 pips in their favor, they would make a profit of only 5 pips after accounting for the spread. In this scenario, if the price movement were smaller, the trade might even result in a loss.

It is essential to consider the impact of spreads when choosing a forex broker. Brokers with tight spreads can offer significant advantages in terms of profitability, while those with wide spreads can negatively impact trading outcomes.

Strategies for Managing Spreads

Spreads are a fundamental aspect of Forex trading, and understanding how to manage them effectively is crucial for maximizing trading profits. While spreads are unavoidable, several strategies can help minimize their impact on your trading outcomes.

Trading Instruments and Account Types

The choice of trading instruments and account types can significantly influence spread costs. Forex.com offers a range of account types and instruments tailored to different trading styles and risk appetites.

- Standard Accounts: These accounts typically have higher spreads, but they offer access to a wider range of currency pairs and leverage options. They are suitable for traders who prioritize flexibility and a diverse trading portfolio.

- ECN Accounts: ECN (Electronic Communication Network) accounts are designed for experienced traders seeking tighter spreads and direct market access. These accounts typically have lower minimum deposit requirements and may require a higher trading volume to justify their lower spreads.

- Pro Accounts: Forex.com Pro accounts offer the lowest spreads, optimized for high-volume traders who value speed and efficiency. These accounts require significant capital commitment and are best suited for professional traders.

Trading Strategies for Spread Management

- Scalping: This strategy involves taking advantage of small price fluctuations by entering and exiting trades quickly. Scalping requires high trading frequency and is generally more effective in volatile markets. It can be a viable strategy for minimizing the impact of spreads because profits are realized quickly.

- News Trading: News events can cause significant price movements, presenting opportunities for profitable trades. However, news trading also involves higher volatility and wider spreads. Traders should carefully analyze the impact of news events on currency pairs and adjust their strategies accordingly.

- Trend Trading: Trend trading involves identifying and riding established trends in the market. This strategy often involves holding trades for extended periods, reducing the impact of spreads on overall profitability.

Forex.com Spread Analysis Tools

Forex.com provides several tools and resources to help traders analyze and manage spreads.

- Trading Platform: The Forex.com trading platform displays real-time spreads for all available instruments, allowing traders to monitor and compare spread levels across different pairs.

- Market Analysis: Forex.com offers comprehensive market analysis tools, including technical indicators and economic calendars, to assist traders in identifying potential trading opportunities and minimizing the impact of spreads.

- Educational Resources: Forex.com provides educational resources and webinars on various aspects of Forex trading, including spread management strategies. These resources can help traders develop a better understanding of spreads and their implications.

Forex.com Spreads

Forex.com’s spreads are a crucial aspect of its trading platform, representing the difference between the buy and sell prices of a currency pair. Understanding the transparency and disclosure of these spreads is essential for traders to make informed decisions.

Transparency in Forex.com Spreads

Forex.com strives to provide transparency regarding its spreads, aiming to foster trust and confidence among its traders. They make efforts to ensure that spread information is readily accessible and presented in a clear and understandable manner.

- Spread Display on Platform: Forex.com displays spreads directly on its trading platform, enabling traders to see the current spread for each currency pair before placing a trade. This real-time information allows traders to evaluate the cost associated with each trade and make informed decisions based on their risk tolerance.

- Spread Information in Account Statements: Forex.com includes spread details in its account statements, providing a record of the spreads applied to each trade executed. This transparency allows traders to track their trading costs and analyze their profitability over time.

- Spread Disclosure in Marketing Materials: Forex.com generally discloses its spread policy in its marketing materials, outlining the factors that can influence spreads and the company’s commitment to fair and competitive pricing. This proactive approach helps potential clients understand the spread structure before opening an account.

Clarity and Availability of Spread Information

Forex.com aims to present spread information clearly and accessibly. They provide various resources and tools to help traders understand the spread structure and its implications for their trading strategies.

- Spread Calculator: Forex.com offers a spread calculator on its website, enabling traders to estimate the cost of trades based on different currency pairs and trade sizes. This tool helps traders understand the impact of spreads on their potential profits and losses.

- Educational Resources: Forex.com provides educational resources, including articles, tutorials, and webinars, that explain spreads in detail. These resources cover topics such as spread types, factors influencing spreads, and strategies for managing spreads. This information empowers traders to make informed decisions about their trading strategies.

- Customer Support: Forex.com offers customer support channels, such as email, phone, and live chat, to address any questions or concerns traders may have regarding spreads. This support ensures that traders have access to information and assistance when needed.

Effectiveness of Forex.com’s Disclosure Practices, Forex.com spreads

Forex.com’s disclosure practices aim to provide traders with sufficient information to understand and manage spreads. The effectiveness of these practices can be evaluated based on various factors, including the clarity and accessibility of information, the responsiveness of customer support, and the overall satisfaction of traders.

“Forex.com’s transparency regarding spreads has been generally positive, with many traders appreciating the clear presentation of information and the availability of support resources. However, some traders may find the spread information to be overly complex or difficult to interpret. It is essential for traders to carefully review the spread information and seek clarification from customer support if needed.”

Outcome Summary

By understanding the complexities of Forex.com spreads, you can make informed trading decisions, optimize your trading strategies, and potentially enhance your profitability. Remember, managing spreads is an ongoing process that requires continuous analysis and adaptation to the ever-changing forex market.

Frequently Asked Questions: Forex.com Spreads

What are the main types of Forex.com spreads?

Forex.com offers both fixed and variable spreads, each with its advantages and disadvantages. Fixed spreads remain constant regardless of market volatility, while variable spreads fluctuate based on market conditions.

How do I find out the current spread for a specific currency pair on Forex.com?

You can find the current spread for any currency pair on the Forex.com platform by accessing the trading details for that pair. The spread is usually displayed as a numerical value representing the difference between the bid and ask prices.

Are there any strategies for minimizing the impact of spreads on my trades?

Yes, there are several strategies to manage spreads, such as choosing accounts with tighter spreads, trading during periods of high liquidity, and using specific trading instruments that offer lower spreads. Additionally, Forex.com offers tools and resources for spread analysis and management.