- Introduction to Forex Trading

- Understanding Forex.com

- Forex.com Trading Accounts

- Forex.com Trading Platforms

- Forex.com Trading Tools and Resources

- Forex.com Customer Support and Security

- Forex.com Fees and Commissions

- Forex.com Regulation and Licensing

- Forex.com Advantages and Disadvantages

- Forex.com Conclusion: Forex Com Review

- Ending Remarks

- Frequently Asked Questions

Forex com review – Forex.com review sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Forex.com is a popular Forex trading platform that has gained significant traction in the global financial market. This review provides a comprehensive analysis of Forex.com, exploring its history, features, trading accounts, platforms, tools, customer support, fees, regulation, and overall advantages and disadvantages. We delve into the intricacies of Forex trading, examining the factors that influence currency exchange rates and the role of Forex.com in facilitating these transactions. Through a detailed exploration of Forex.com’s offerings, we aim to equip readers with the knowledge and insights needed to make informed decisions about their Forex trading endeavors.

Introduction to Forex Trading

Forex trading, also known as foreign exchange trading, is the simultaneous buying of one currency and selling of another. It is the largest and most liquid financial market in the world, with trillions of dollars changing hands every day. Forex trading offers opportunities for investors to profit from fluctuations in exchange rates.

The forex market is a global marketplace where currencies are traded. It is decentralized, meaning there is no central exchange or location for trading. Instead, transactions take place electronically through a network of banks, brokers, and other financial institutions.

Currency Pairs

Currency pairs are the fundamental units of trading in the forex market. Each pair consists of two currencies, where one currency is bought and the other is sold. For example, the EUR/USD currency pair represents the exchange rate between the Euro (EUR) and the US Dollar (USD). If you buy EUR/USD, you are buying Euros and selling US Dollars.

The value of a currency pair is determined by the relative value of the two currencies. For example, if the EUR/USD exchange rate is 1.1000, it means that one Euro is worth 1.1000 US Dollars. If the Euro strengthens against the US Dollar, the exchange rate will rise, and the EUR/USD pair will increase in value. Conversely, if the Euro weakens against the US Dollar, the exchange rate will fall, and the EUR/USD pair will decrease in value.

Factors Influencing Forex Exchange Rates

Several factors influence the exchange rates between currencies. These factors can be categorized into economic, political, and social factors.

Economic Factors

- Interest Rates: Higher interest rates in a country tend to attract foreign investment, increasing demand for its currency and strengthening its value. Conversely, lower interest rates can lead to a decrease in demand for the currency and weaken its value.

- Economic Growth: A country with a strong economy and high economic growth tends to have a stronger currency. Conversely, a country with a weak economy and low economic growth may experience a weakening of its currency.

- Inflation: High inflation can erode the purchasing power of a currency, leading to a decrease in its value. Conversely, low inflation can help to stabilize the currency and maintain its value.

- Government Debt: High government debt can raise concerns about a country’s financial stability, potentially leading to a decrease in the value of its currency. Conversely, low government debt can increase confidence in a country’s financial health, supporting its currency’s value.

- Trade Balance: A country with a trade surplus (exports exceeding imports) tends to have a stronger currency, as demand for its currency is higher due to increased exports. Conversely, a country with a trade deficit (imports exceeding exports) may experience a weakening of its currency.

Political Factors

- Political Stability: A country with a stable political system and low levels of political risk tends to have a stronger currency. Conversely, political instability and high levels of political risk can weaken a currency.

- Government Policies: Government policies, such as tax changes, spending programs, and regulations, can influence the value of a currency. For example, a government that implements policies to promote economic growth may see its currency strengthen.

- Geopolitical Events: Global events, such as wars, natural disasters, and political upheavals, can impact exchange rates. For example, a major war in a region could lead to a flight to safety, where investors seek refuge in currencies considered to be safe havens, such as the US Dollar or Swiss Franc.

Social Factors

- Consumer Confidence: High consumer confidence can indicate a strong economy, which may support the currency. Conversely, low consumer confidence can signal a weakening economy, potentially leading to a decline in the currency’s value.

- Demographics: Population growth, aging demographics, and other social trends can impact the value of a currency. For example, a country with a growing population may see its currency strengthen as demand for goods and services increases.

Understanding Forex.com

Forex.com is a well-established and reputable online Forex trading platform that provides a comprehensive suite of tools and resources for traders of all experience levels. It is a subsidiary of GAIN Capital Holdings, a publicly traded company listed on the New York Stock Exchange.

History and Mission

Forex.com was founded in 2001 with a mission to empower individuals to trade the global Forex market with ease and transparency. The platform has evolved over the years, consistently adapting to the changing needs of Forex traders. Its commitment to innovation and client satisfaction has been instrumental in its growth and success.

Values

Forex.com’s core values are centered around providing a secure, reliable, and user-friendly trading environment. The platform prioritizes transparency, accountability, and client education, striving to foster a culture of trust and confidence among its users.

Key Features and Functionalities

Forex.com offers a wide range of features and functionalities designed to enhance the trading experience. Here are some key highlights:

- Multiple Account Types: Forex.com provides various account types to cater to different trading styles and risk appetites. These include standard accounts, premium accounts, and Islamic accounts, each with unique features and benefits.

- Wide Range of Trading Instruments: The platform offers access to a diverse selection of Forex currency pairs, including major, minor, and exotic pairs. Traders can also access other financial instruments like commodities, indices, and CFDs.

- Advanced Trading Platforms: Forex.com provides multiple trading platforms, including the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as its proprietary platform, Forex.com WebTrader. These platforms offer advanced charting tools, technical indicators, and order execution capabilities.

- Competitive Pricing: Forex.com offers competitive spreads and trading fees, ensuring that traders can maximize their profit potential. The platform also provides transparent pricing information and commission structures.

- Educational Resources: Forex.com is committed to educating its clients about the Forex market. The platform offers a comprehensive library of educational resources, including articles, webinars, and video tutorials, to help traders develop their trading skills and knowledge.

- Excellent Customer Support: Forex.com provides 24/5 customer support via phone, email, and live chat. The platform’s support team is highly responsive and knowledgeable, ready to assist traders with any questions or concerns they may have.

- Secure and Reliable Trading Environment: Forex.com prioritizes the security and reliability of its trading platform. The platform uses advanced security measures to protect client funds and data, ensuring a safe and secure trading experience.

Forex.com Trading Accounts

Forex.com offers a variety of trading accounts to cater to different trader needs and experience levels. These accounts are designed to provide flexibility and support, allowing traders to customize their trading experience based on their preferences and trading strategies.

Account Types

Forex.com offers four main types of trading accounts: Standard, Direct, Micro, and Islamic. Each account type comes with its own set of features, benefits, and trading conditions.

- Standard Account: The Standard Account is the most basic account type offered by Forex.com. It is suitable for beginner traders who are just starting their journey in the forex market. The Standard Account provides access to a wide range of currency pairs and other trading instruments, with competitive spreads and a user-friendly trading platform.

- Direct Account: The Direct Account is designed for more experienced traders who seek tighter spreads and faster execution speeds. This account type offers direct access to the interbank market, providing traders with the best possible prices and a more transparent trading environment.

- Micro Account: The Micro Account is specifically designed for traders who want to start trading with smaller amounts of capital. It allows traders to trade in micro-lots, which are smaller than standard lots. This account type is ideal for beginner traders who are still learning the ropes of forex trading.

- Islamic Account: The Islamic Account is designed for traders who follow Islamic financial principles. It adheres to Sharia law by prohibiting interest payments and charging swap fees. This account type is a great option for Muslim traders who want to trade forex without violating their religious beliefs.

Account Features and Benefits

The specific features and benefits of each Forex.com trading account type are as follows:

- Standard Account:

- Access to a wide range of currency pairs and other trading instruments

- Competitive spreads

- User-friendly trading platform

- Educational resources and support

- Direct Account:

- Direct access to the interbank market

- Tighter spreads

- Faster execution speeds

- Advanced trading tools and analysis

- Micro Account:

- Ability to trade in micro-lots

- Lower minimum deposit requirements

- Suitable for beginner traders

- Islamic Account:

- Compliant with Sharia law

- No interest payments or swap fees

- Access to a wide range of trading instruments

Minimum Deposit Requirements and Trading Conditions

The minimum deposit requirements and trading conditions vary depending on the account type.

- Standard Account: The minimum deposit requirement for the Standard Account is $100. The trading conditions include variable spreads, leverage up to 50:1, and a minimum trade size of 0.01 lots.

- Direct Account: The minimum deposit requirement for the Direct Account is $10,000. The trading conditions include tighter spreads, leverage up to 50:1, and a minimum trade size of 0.1 lots.

- Micro Account: The minimum deposit requirement for the Micro Account is $50. The trading conditions include variable spreads, leverage up to 50:1, and a minimum trade size of 0.01 micro-lots.

- Islamic Account: The minimum deposit requirement for the Islamic Account varies depending on the specific account type. The trading conditions are similar to the Standard Account, with the exception of no interest payments or swap fees.

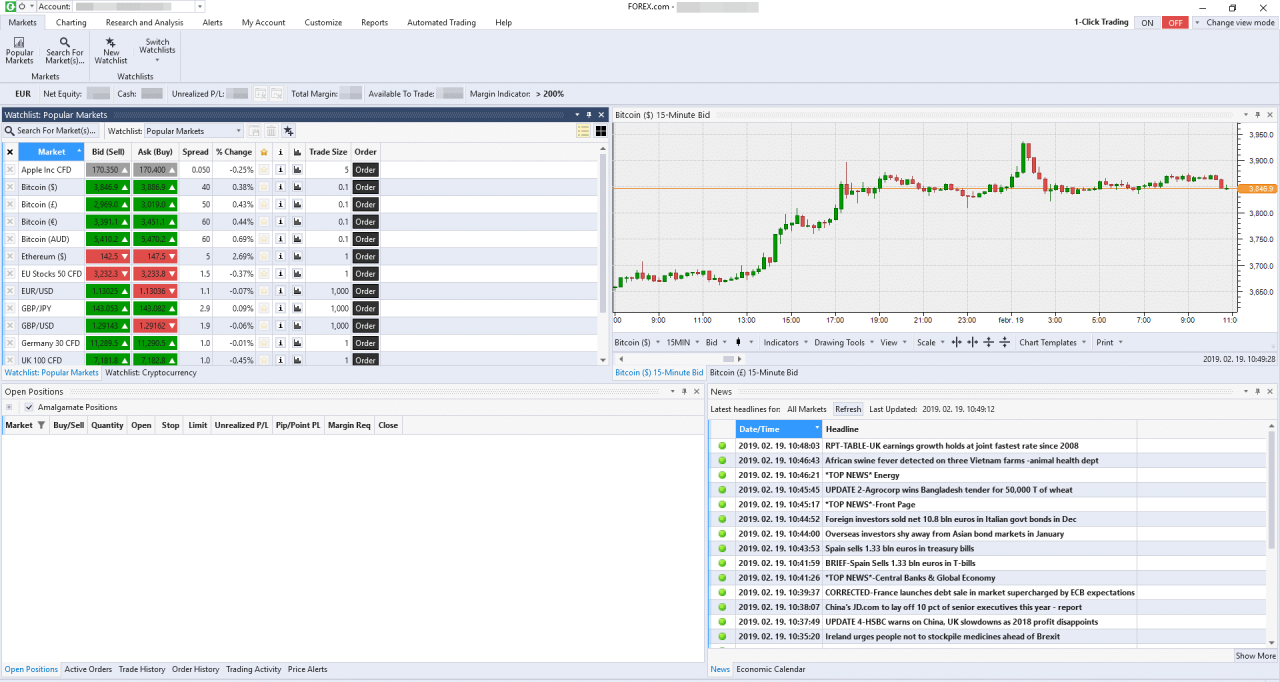

Forex.com Trading Platforms

Forex.com offers a variety of trading platforms to cater to the needs of different traders, from beginners to experienced professionals. The platforms are designed to provide a user-friendly and efficient trading experience, with features that enhance trading analysis, order execution, and risk management.

Forex.com Trading Platforms

Forex.com offers three main trading platforms:

- The Forex.com Web Platform: This platform is accessible through any web browser and does not require any downloads. It is user-friendly and ideal for beginners, offering basic charting and analysis tools.

- The Forex.com Desktop Platform: This platform is available for download on Windows and Mac operating systems. It provides more advanced features than the web platform, including real-time charting, multiple timeframes, and customizable layouts.

- The Forex.com Mobile App: This platform is available for iOS and Android devices, allowing traders to access their accounts and trade on the go. It provides a streamlined interface with essential trading tools and features.

User Interface and Functionality

The Forex.com platforms feature intuitive and user-friendly interfaces, designed to be easy to navigate for both beginners and experienced traders. The platforms offer a range of features, including:

- Real-time charting: Provides access to live price data and charts with various technical indicators and drawing tools.

- Multiple timeframes: Allows traders to analyze price movements across different time scales, from intraday to long-term.

- Order types: Offers a variety of order types, including market, limit, stop, and trailing stop orders, to suit different trading strategies.

- Trading tools: Includes advanced technical analysis tools, such as moving averages, Bollinger Bands, and Fibonacci retracements.

- Risk management tools: Features stop-loss orders and other risk management tools to help traders control their potential losses.

- Educational resources: Provides access to market analysis, trading strategies, and educational materials to help traders improve their skills.

User Testimonials and Reviews

Forex.com’s trading platforms have received generally positive feedback from users, who praise their user-friendliness, functionality, and performance. Users appreciate the platform’s intuitive interface, advanced features, and reliable order execution.

“I’ve been using the Forex.com platform for a few months now, and I’m really impressed. It’s easy to use, even for a beginner like me. The charting tools are great, and the order execution is fast and reliable.” – John S.

“I’m a seasoned trader, and I’ve tried a lot of different platforms. Forex.com’s platform is one of the best I’ve used. It has all the features I need, and the performance is excellent.” – Mary L.

Forex.com Trading Tools and Resources

Forex.com provides a comprehensive suite of trading tools and resources designed to empower traders of all levels. These resources are designed to enhance trading strategies, improve decision-making, and facilitate a more informed approach to trading.

Educational Resources

Forex.com offers a wide range of educational resources to help traders learn about the forex market and develop their trading skills. This includes:

- Beginner’s Guides: Forex.com provides a series of beginner-friendly guides that introduce traders to the basics of forex trading, including concepts such as currency pairs, pips, and leverage. These guides serve as a foundation for understanding the core principles of forex trading.

- Trading Courses: Forex.com offers comprehensive trading courses that delve deeper into forex trading strategies, technical analysis, and risk management. These courses are designed to equip traders with the knowledge and skills necessary to navigate the complexities of the forex market.

- Trading Glossary: Forex.com provides a glossary of trading terms and definitions, which is particularly helpful for beginners who are unfamiliar with the jargon used in the forex market. This resource clarifies the meaning of key concepts and helps traders understand the language of trading.

- Webinars and Seminars: Forex.com hosts regular webinars and seminars led by experienced traders and market analysts. These sessions offer insights into current market trends, trading strategies, and industry best practices. Participants can benefit from the expertise of seasoned professionals and gain valuable perspectives on the forex market.

Analytical Tools

Forex.com offers a range of analytical tools to help traders analyze market trends and make informed trading decisions. These tools include:

- Technical Analysis Indicators: Forex.com provides a variety of technical analysis indicators, such as moving averages, MACD, and RSI, that traders can use to identify potential trading opportunities based on historical price data. These indicators help traders identify trends, momentum, and overbought or oversold conditions.

- Charting Tools: Forex.com offers advanced charting tools that allow traders to visualize price movements and identify patterns. Traders can customize charts with different timeframes, indicators, and drawing tools to suit their analysis needs. This visual representation of market data facilitates a more intuitive understanding of price trends.

- Economic Calendar: Forex.com provides an economic calendar that displays upcoming economic events and their potential impact on currency prices. This tool helps traders stay informed about economic releases that could influence market sentiment and volatility. By understanding the potential impact of these events, traders can adjust their trading strategies accordingly.

Market Analysis, Forex com review

Forex.com provides access to a variety of market analysis resources to help traders stay informed about current market conditions and trends. These resources include:

- Daily Market Commentary: Forex.com offers daily market commentary from experienced analysts who provide insights into current market trends, key economic indicators, and potential trading opportunities. This commentary provides traders with a concise overview of market conditions and potential areas of focus.

- Market News and Research: Forex.com provides access to a library of market news and research reports from reputable sources. These reports offer in-depth analysis of various economic and political factors that could impact the forex market. This information helps traders stay informed about global events and their potential implications for currency prices.

- Trading Signals: Forex.com offers trading signals based on technical analysis and market sentiment. These signals provide traders with buy or sell recommendations based on real-time market data. While trading signals can be helpful, it’s important to use them in conjunction with your own analysis and risk management strategies.

Forex.com Customer Support and Security

Forex.com offers a variety of customer support channels to assist traders with any questions or concerns. The platform prioritizes user security by implementing robust measures to protect account information and data.

Customer Support Channels

Forex.com provides multiple ways for traders to get in touch with their support team. This includes:

- Live Chat: Available 24/5, offering immediate assistance for urgent inquiries.

- Phone: A dedicated phone line is available for traders to speak directly with a representative.

- Email: Forex.com provides an email address for submitting inquiries and receiving detailed responses.

- FAQ Section: An extensive FAQ section addresses common questions and concerns.

Traders can choose the most convenient channel based on their needs and urgency.

Security Measures

Forex.com prioritizes user security by implementing a comprehensive set of measures, including:

- Two-Factor Authentication (2FA): An extra layer of security requiring users to provide a code from their mobile device in addition to their password for account access.

- Data Encryption: All user data is encrypted using industry-standard protocols, ensuring confidentiality and integrity.

- Regular Security Audits: Forex.com conducts regular security audits to identify and address potential vulnerabilities.

- Secure Trading Platform: The trading platform is built on a secure infrastructure with advanced firewalls and intrusion detection systems.

These measures protect user accounts and sensitive information from unauthorized access and cyber threats.

User Experiences and Feedback

Forex.com’s customer support has generally received positive feedback from users. Many traders appreciate the responsiveness and helpfulness of the support team, particularly through live chat and phone support. The platform’s security measures are also highly regarded, with users feeling confident in the protection of their accounts and data. However, some users have reported occasional delays in email responses and difficulties navigating the FAQ section. Overall, Forex.com strives to provide a secure and supportive trading environment for its users.

Forex.com Fees and Commissions

Forex.com, like most Forex brokers, charges fees for its services. These fees are crucial to consider when choosing a broker, as they can significantly impact your trading profitability.

Spreads

Spreads are the difference between the bid and ask prices of a currency pair. Forex.com charges variable spreads, meaning they fluctuate based on market conditions. The spreads on Forex.com are generally competitive, especially for major currency pairs. However, they can widen during periods of high volatility or low liquidity.

Inactivity Fees

Forex.com charges an inactivity fee if your account remains inactive for a specific period. This fee is generally a small amount, but it’s important to be aware of it.

Withdrawal Fees

Forex.com charges a withdrawal fee for certain withdrawal methods. The fee amount varies depending on the chosen method. It’s recommended to check the Forex.com website for the most up-to-date fee information.

Comparison with Other Forex Brokers

Forex.com’s fee structure is generally considered competitive within the Forex market. However, it’s essential to compare fees with other brokers before making a decision. Some brokers offer lower spreads or fewer fees, while others may offer more advanced trading features or tools.

Forex.com Regulation and Licensing

Forex.com operates within a robust regulatory framework, ensuring the safety and security of its clients’ funds and trading activities. The platform holds licenses and certifications from reputable financial authorities in multiple jurisdictions, demonstrating its commitment to transparency and compliance.

Regulatory Oversight and Compliance Measures

Forex.com adheres to strict regulatory oversight and compliance measures to maintain a high standard of ethical and responsible trading practices. These measures include:

- Segregation of Client Funds: Forex.com maintains client funds in segregated accounts, separate from its own operating funds. This ensures that client funds are protected even in the event of financial difficulties.

- Regular Audits: The platform undergoes regular audits by independent financial auditors to ensure compliance with regulatory requirements and maintain transparency in its operations.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Procedures: Forex.com implements stringent AML and KYC procedures to prevent money laundering and identify potential fraud. This includes verifying client identities and monitoring transactions for suspicious activity.

Forex.com Advantages and Disadvantages

Forex.com is a well-established forex broker with a strong reputation in the industry. However, like any other broker, it has its strengths and weaknesses. It’s crucial to consider these factors before deciding if Forex.com is the right fit for your trading needs.

Forex.com Advantages

Forex.com offers several advantages that make it an attractive choice for many traders.

- User-friendly platform: Forex.com’s trading platform is intuitive and easy to navigate, even for beginners. It provides access to a wide range of tools and features, including charting, technical indicators, and real-time market data.

- Competitive pricing: Forex.com offers competitive spreads and commissions, which can help traders maximize their profits. The broker’s pricing structure is transparent and easy to understand.

- Strong regulation: Forex.com is regulated by reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK and the National Futures Association (NFA) in the US. This ensures that the broker operates within a robust regulatory framework, protecting traders’ funds and interests.

- Excellent customer support: Forex.com provides 24/5 customer support via phone, email, and live chat. The broker’s support team is knowledgeable and responsive, providing assistance with any trading-related queries or issues.

- Comprehensive educational resources: Forex.com offers a wealth of educational resources, including articles, videos, and webinars, to help traders improve their knowledge and skills. These resources cover various aspects of forex trading, from fundamental analysis to risk management.

Forex.com Disadvantages

While Forex.com has many strengths, it also has some drawbacks that traders should consider.

- Limited research tools: While Forex.com offers basic research tools, it lacks the advanced research capabilities of some other brokers. This can be a disadvantage for traders who rely heavily on fundamental analysis or market insights.

- Higher minimum deposit: Forex.com has a higher minimum deposit requirement compared to some other brokers. This can be a barrier for new or budget-conscious traders.

- Limited account types: Forex.com offers a limited number of account types, which may not cater to the needs of all traders. For example, it doesn’t have a dedicated Islamic account.

Comparison with Other Forex Brokers

Forex.com is a strong competitor in the forex market, but it’s important to compare it with other leading brokers to determine the best fit for your needs. For example, if you’re looking for a broker with advanced research tools and a wide range of account types, you might consider brokers like IG or FXCM. However, if you prioritize user-friendliness, competitive pricing, and strong regulation, Forex.com remains a solid option.

Overall Perspective

Forex.com is a reliable and reputable forex broker that offers a user-friendly platform, competitive pricing, and excellent customer support. However, it lacks some advanced features, such as comprehensive research tools and a wider range of account types. Ultimately, the best forex broker for you will depend on your individual trading needs and preferences.

Forex.com Conclusion: Forex Com Review

Forex.com presents a comprehensive platform for forex traders of varying experience levels, offering a wide range of features, tools, and resources to support their trading endeavors. This review has delved into the platform’s key aspects, providing insights into its strengths and potential areas for improvement.

Key Findings and Insights

Forex.com stands out for its user-friendly interface, robust trading platforms, and diverse educational resources. The platform caters to both beginners and experienced traders, offering a range of account types, trading tools, and educational materials to support their learning and trading journey. The platform’s competitive pricing, advanced charting capabilities, and comprehensive research tools contribute to its appeal. However, the platform’s limited customer support options and high minimum deposit requirements may pose challenges for some users.

Assessment of Forex.com

Forex.com emerges as a reputable and competitive forex trading platform, offering a robust set of features and resources for traders of all levels. The platform’s user-friendly interface, diverse account types, and comprehensive educational materials make it an attractive option for both beginners and experienced traders. However, its limited customer support options and high minimum deposit requirements may deter some users.

Recommendations for Potential Users

- Traders seeking a user-friendly platform with a wide range of features and resources should consider Forex.com.

- Beginners can benefit from the platform’s comprehensive educational materials and demo account.

- Experienced traders may appreciate the platform’s advanced charting capabilities, research tools, and competitive pricing.

- Users with limited capital may find the high minimum deposit requirements a barrier to entry.

- Traders seeking extensive customer support options may find the platform’s limited support channels a drawback.

Ending Remarks

In conclusion, Forex.com emerges as a reputable and well-established Forex trading platform with a comprehensive suite of features, tools, and resources. Its user-friendly platforms, educational materials, and responsive customer support cater to traders of all levels of experience. While Forex.com offers numerous advantages, potential users should carefully consider its fee structure, regulatory landscape, and overall suitability for their trading needs and preferences. By thoroughly evaluating Forex.com’s offerings and comparing it with other leading Forex brokers in the market, traders can make informed decisions and optimize their trading strategies for success.

Frequently Asked Questions

Is Forex.com regulated?

Yes, Forex.com is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US. This ensures that the platform operates within a robust regulatory framework and adheres to strict compliance standards.

What is the minimum deposit for a Forex.com account?

The minimum deposit requirement for a Forex.com account varies depending on the account type. However, it is generally a relatively low amount, making it accessible to traders with different capital levels.

Does Forex.com offer educational resources?

Yes, Forex.com provides a wide range of educational resources, including articles, tutorials, webinars, and trading courses. These resources aim to equip traders with the knowledge and skills needed to navigate the complexities of Forex trading.

What types of trading platforms does Forex.com offer?

Forex.com offers multiple trading platforms, including its proprietary platform, Trading Station, as well as popular third-party platforms like MetaTrader 4 (MT4). This provides traders with flexibility and the ability to choose the platform that best suits their preferences and trading style.