Forex.com Review: Navigating the world of forex trading can be both exciting and daunting, especially for beginners. Forex.com, a well-established forex broker, aims to make this journey smoother by providing a comprehensive platform for traders of all levels. This review delves into the key features, advantages, and disadvantages of Forex.com, offering insights into its suitability for different trading styles and risk appetites.

From its diverse account types and trading instruments to its robust security measures and educational resources, this review examines the strengths and weaknesses of Forex.com, comparing it to its competitors and providing a clear understanding of its value proposition.

Forex.com Overview

Forex.com is a well-established online forex broker that offers a wide range of trading instruments and platforms. It is owned by GAIN Capital Holdings, a publicly traded company listed on the New York Stock Exchange. Forex.com is regulated by multiple financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US.

Target Audience

Forex.com caters to a diverse range of traders, from beginners to experienced professionals. The platform provides educational resources and tools for novice traders, while also offering advanced features for more experienced individuals. The broker’s user-friendly interface and comprehensive support make it suitable for traders of all levels.

Advantages of Forex.com

- Regulation and Security: Forex.com is regulated by reputable authorities, ensuring the safety of client funds and adherence to industry standards.

- Trading Platforms: The broker offers multiple trading platforms, including the popular MetaTrader 4 (MT4) and its proprietary platform, Forex.com WebTrader.

- Educational Resources: Forex.com provides a wide range of educational resources, including articles, videos, and webinars, to help traders learn about forex trading.

- Account Types: Forex.com offers various account types to suit different trading needs and levels of experience, including standard, premium, and professional accounts.

- Customer Support: The broker provides 24/5 customer support through multiple channels, including phone, email, and live chat.

Disadvantages of Forex.com

- Spread Fees: Forex.com’s spreads can be higher compared to some other brokers, especially for less popular currency pairs.

- Limited Research Tools: While Forex.com offers some research tools, it may not be as extensive as some other platforms.

- Account Minimums: Some account types have minimum deposit requirements, which may not be suitable for all traders.

Trading Platforms and Tools

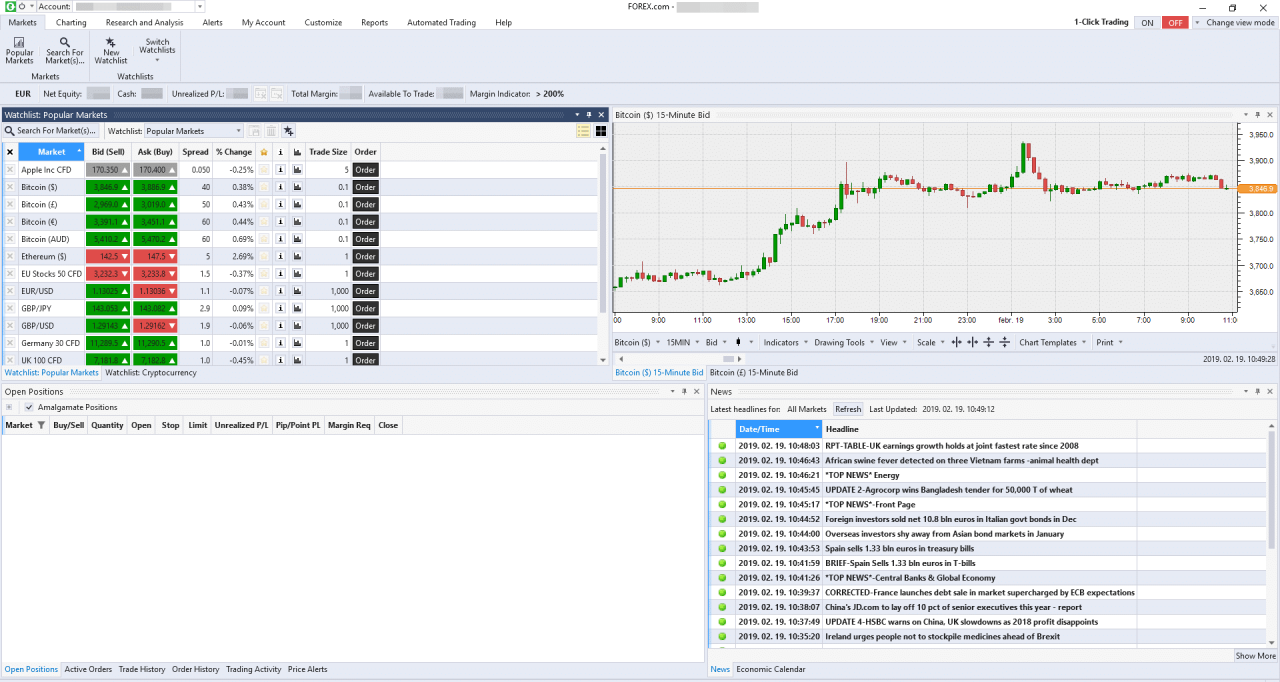

Forex.com offers a selection of trading platforms designed to cater to diverse trader needs and preferences. These platforms provide a comprehensive suite of tools and resources to facilitate informed trading decisions.

Trading Platforms

Forex.com provides two main trading platforms:

- MetaTrader 4 (MT4): A popular and versatile platform renowned for its robust charting capabilities, advanced technical analysis tools, and automated trading capabilities.

- Advanced Trading Platform (ATP): A proprietary platform developed by Forex.com, offering a user-friendly interface, customizable layouts, and a wide range of order types.

MetaTrader 4 (MT4)

MT4 is a widely used platform in the forex industry, known for its flexibility and adaptability. It offers a user-friendly interface with customizable layouts and a range of features, including:

- Advanced Charting: MT4 provides a comprehensive set of charting tools, allowing traders to analyze price movements, identify trends, and create technical indicators.

- Technical Analysis Tools: The platform offers a wide array of technical indicators, including moving averages, oscillators, and momentum indicators, to assist traders in identifying trading opportunities.

- Automated Trading: MT4 supports expert advisors (EAs), which are automated trading programs that execute trades based on predefined rules and parameters.

- Multiple Order Types: MT4 offers various order types, including market orders, limit orders, stop-loss orders, and take-profit orders, to manage risk and optimize trading strategies.

- Mobile Trading: MT4 is available on mobile devices, allowing traders to monitor their positions and execute trades from anywhere.

Advanced Trading Platform (ATP)

The Advanced Trading Platform (ATP) is a proprietary platform developed by Forex.com, offering a user-friendly interface and a comprehensive set of features, including:

- User-Friendly Interface: ATP is designed with a clean and intuitive interface, making it easy for traders to navigate and execute trades.

- Customizable Layouts: Traders can customize their ATP workspace to suit their individual trading preferences and needs.

- Advanced Order Types: ATP offers a range of order types, including market orders, limit orders, stop-loss orders, and take-profit orders, as well as advanced order types like trailing stops and one-cancels-the-other (OCO) orders.

- Real-Time Market Data: ATP provides access to real-time market data, including price quotes, charts, and news feeds.

- Integrated Analytics: ATP offers integrated analytics tools, such as performance reports and trade history analysis, to help traders evaluate their trading strategies and identify areas for improvement.

Trading Tools and Resources

Forex.com provides a range of trading tools and resources to support traders in making informed decisions.

- Charting Tools: Forex.com offers a comprehensive set of charting tools, including candlestick charts, line charts, and bar charts, to analyze price movements and identify trends.

- Technical Indicators: The platform provides a wide range of technical indicators, including moving averages, oscillators, and momentum indicators, to assist traders in identifying trading opportunities.

- Economic Calendar: Forex.com offers an economic calendar that provides information on upcoming economic events, such as interest rate announcements and employment data, which can impact currency prices.

- Educational Materials: Forex.com provides a variety of educational materials, including articles, videos, and webinars, to help traders improve their understanding of forex trading.

- Customer Support: Forex.com offers 24/5 customer support via phone, email, and live chat to assist traders with any questions or issues they may have.

Account Types and Fees

Forex.com offers a variety of account types designed to cater to different trading styles and risk appetites. These accounts vary in their features, minimum deposit requirements, and trading conditions. Understanding these differences is crucial for selecting the most suitable account for your individual needs.

Account Types

Forex.com offers four main account types: Standard, Direct, Active Trader, and Islamic. Each account type has its own unique features and benefits, allowing traders to choose the best option based on their trading experience, capital, and trading style.

- Standard Account: This account is ideal for beginners and those with limited capital. It offers a minimum deposit of $50, competitive spreads, and access to a wide range of trading instruments.

- Direct Account: Designed for more experienced traders seeking tighter spreads and lower commissions, the Direct Account requires a minimum deposit of $25,000. It provides access to advanced trading tools and a dedicated account manager.

- Active Trader Account: This account is specifically designed for high-volume traders who execute a significant number of trades. It offers tiered commission discounts based on trading volume, making it more cost-effective for active traders.

- Islamic Account: This account complies with Islamic Sharia law, which prohibits the payment of interest. It offers swap-free trading, eliminating overnight financing charges, and is suitable for traders who adhere to Islamic financial principles.

Fees

Forex.com charges a variety of fees, including trading commissions, spreads, inactivity fees, and withdrawal fees. It is important to understand these fees to determine the overall cost of trading with Forex.com.

Trading Commissions

Forex.com charges commission fees for certain trading instruments, primarily for CFDs (Contracts for Difference). The commission rates vary depending on the specific instrument and account type. For example, the Standard account has a commission of $7 per lot for CFDs on US stocks, while the Direct account offers lower commission rates.

Spreads

Spreads represent the difference between the bid and ask prices of a trading instrument. Forex.com offers competitive spreads, which vary depending on the account type and the trading instrument. Generally, the Direct account offers tighter spreads compared to the Standard account.

Inactivity Fees

Forex.com charges an inactivity fee if an account remains inactive for a certain period. This fee is typically charged monthly if no trading activity is detected within the specified period.

Withdrawal Fees

Forex.com may charge withdrawal fees depending on the withdrawal method used. For example, wire transfers may incur a fee, while other methods, such as credit/debit card withdrawals, may be free.

Trading Instruments and Markets

Forex.com provides access to a wide range of trading instruments across various global markets, catering to diverse trading strategies and risk appetites. The platform offers a comprehensive selection of assets, allowing traders to diversify their portfolios and capitalize on various market opportunities.

Currency Pairs

Currency pairs represent the core of Forex trading. Forex.com offers a vast selection of major, minor, and exotic currency pairs, enabling traders to profit from fluctuations in exchange rates.

- Major currency pairs: These pairs involve the US dollar (USD) against other major currencies, such as the euro (EUR), Japanese yen (JPY), British pound (GBP), Australian dollar (AUD), and Swiss franc (CHF). These pairs are highly liquid and volatile, attracting significant trading volume.

- Minor currency pairs: These pairs involve two currencies that are not considered major. Examples include EUR/GBP, AUD/NZD, and GBP/CHF. While less liquid than major pairs, minor pairs can offer unique trading opportunities due to their specific economic and political factors.

- Exotic currency pairs: These pairs involve a major currency against a currency from a developing or emerging market. Examples include USD/ZAR (South African rand), USD/TRY (Turkish lira), and USD/MXN (Mexican peso). Exotic pairs are generally less liquid than major or minor pairs and can exhibit higher volatility due to their susceptibility to political and economic instability in their respective countries.

Commodities

Commodities are raw materials traded on global markets. Forex.com offers a variety of commodities, including precious metals, energy, and agricultural products.

- Precious metals: Gold (XAUUSD) and silver (XAGUSD) are popular commodities traded on Forex.com. They are often considered safe-haven assets during times of economic uncertainty, as their prices tend to rise when other assets decline.

- Energy: Oil (USOIL) and natural gas (NGAS) are traded on Forex.com, influenced by global supply and demand dynamics, geopolitical events, and economic growth.

- Agricultural products: Forex.com offers trading in agricultural commodities such as coffee (KC), sugar (SB), and wheat (ZW). These commodities are influenced by weather conditions, global demand, and government policies.

Indices

Indices represent the performance of a specific group of stocks or assets. Forex.com provides access to various indices, including:

- Stock indices: These indices track the performance of a specific stock market, such as the US S&P 500 (SPX500), the UK FTSE 100 (UK100), or the German DAX 30 (DE30). Trading indices allows traders to gain exposure to broader market trends and movements.

- Commodity indices: These indices track the performance of a specific commodity group, such as the Goldman Sachs Commodity Index (GSCI) or the Dow Jones-UBS Commodity Index (DJ-UBS).

Other Assets

Forex.com offers a variety of other assets, including:

- Cryptocurrencies: Forex.com offers trading in cryptocurrencies like Bitcoin (BTCUSD) and Ethereum (ETHUSD). Cryptocurrencies have gained significant popularity in recent years, attracting traders seeking high-growth potential and diversification.

- Bonds: Forex.com offers trading in bonds, which are debt securities issued by governments or corporations. Bonds are considered less risky than stocks but offer lower returns.

Security and Regulation

Forex.com prioritizes the security of its clients’ funds and data. It implements robust measures to protect user information and ensure a secure trading environment. The platform is regulated by reputable financial authorities, which adds another layer of security and trust for traders.

Security Measures

Forex.com employs various security measures to safeguard client funds and data. These measures include:

- Encryption: Forex.com uses industry-standard encryption protocols, such as SSL/TLS, to protect sensitive data transmitted between the client’s browser and the platform’s servers. This ensures that any information exchanged, including login credentials and financial details, is encrypted and secure.

- Two-Factor Authentication (2FA): Forex.com offers two-factor authentication, an extra layer of security that requires users to enter a unique code sent to their mobile device or email address in addition to their password when logging in. This makes it significantly more difficult for unauthorized individuals to access accounts.

- Account Verification: Forex.com adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This involves verifying the identity of its clients through document verification processes, ensuring the platform complies with international financial standards and helps prevent fraudulent activities.

- Secure Trading Environment: Forex.com uses advanced firewalls and intrusion detection systems to protect its servers and infrastructure from cyberattacks. These measures help prevent unauthorized access and ensure the integrity of the trading platform.

Regulatory Framework

Forex.com is regulated by reputable financial authorities, ensuring compliance with international financial standards and providing a secure and trustworthy trading environment for its clients. The regulatory framework governing Forex.com includes:

- Financial Conduct Authority (FCA): Forex.com is authorized and regulated by the FCA in the United Kingdom, ensuring compliance with strict financial regulations and providing a high level of protection for clients.

- National Futures Association (NFA): Forex.com is registered with the NFA in the United States, subject to its rules and regulations, providing another layer of oversight and ensuring compliance with US financial standards.

- CySEC: Forex.com is also regulated by the Cyprus Securities and Exchange Commission (CySEC), which further reinforces its commitment to regulatory compliance and provides additional protection for clients.

Client Support

Forex.com offers various client support options to assist traders with their inquiries and issues. These support channels include:

- Live Chat: Forex.com provides a live chat feature on its website, allowing users to connect with a customer service representative in real-time for immediate assistance. This is a convenient option for quick inquiries or urgent issues.

- Email: Clients can reach out to Forex.com’s customer support team via email for more detailed inquiries or to provide feedback. The platform aims to respond to emails within a reasonable timeframe.

- Phone Support: Forex.com offers phone support for clients who prefer a more direct and personalized communication method. This allows users to speak directly with a customer service representative and receive assistance over the phone.

- Help Center: Forex.com provides a comprehensive help center on its website, offering a wide range of resources, including FAQs, tutorials, and guides. This resource is valuable for clients who prefer to find answers independently or want to learn more about the platform’s features and functionalities.

Customer Experience and Reviews

Forex.com has a mixed reputation among traders, with some praising its features and customer service while others report negative experiences. Understanding both positive and negative feedback is crucial for prospective traders to make informed decisions.

Customer Reviews and Ratings

To get a comprehensive understanding of Forex.com’s customer experience, we’ve compiled reviews from various sources. The table below summarizes key insights:

| Review Source | Rating | Pros | Cons |

|---|---|---|---|

| Trustpilot | 3.5/5 | User-friendly platform, wide range of instruments, competitive pricing, excellent customer support. | Limited research tools, slow order execution, occasional platform glitches, complex withdrawal process. |

| Investopedia | 4/5 | Advanced trading tools, strong security measures, educational resources, multiple account types. | High minimum deposit requirements, limited mobile app features, customer support responsiveness varies. |

| ForexPeaceArmy | 3/5 | Good educational resources, responsive customer support, reliable platform performance. | High spreads, limited research tools, complex trading conditions. |

Positive Customer Experiences

Many traders have reported positive experiences with Forex.com, highlighting its user-friendly platform, comprehensive educational resources, and responsive customer support.

“I’ve been trading with Forex.com for a few years now and have consistently been impressed with their platform. It’s easy to navigate and offers a wide range of features. Their educational resources are also top-notch, which has been very helpful in improving my trading skills.” – John S., Forex.com customer

Another positive aspect is the availability of multiple account types catering to different trading styles and risk appetites. This allows traders to choose the best fit for their needs, potentially leading to a more positive trading experience.

Common Complaints and Negative Experiences

Despite positive feedback, Forex.com has also received criticism regarding certain aspects of its services. Common complaints include:

- High spreads: Some traders have found Forex.com’s spreads to be higher compared to other brokers, impacting their profitability.

- Limited research tools: The platform’s research tools are considered inadequate by some, lacking advanced features found with other brokers.

- Slow order execution: Several users have reported slow order execution, particularly during periods of high market volatility, which can negatively affect trading outcomes.

- Complex withdrawal process: The withdrawal process has been criticized for being cumbersome and time-consuming, leading to frustration for some traders.

- Limited mobile app features: The mobile app is considered basic compared to other brokers, lacking features that could enhance the trading experience.

It’s important to note that these complaints are not universal, and individual experiences may vary. However, these issues should be considered when evaluating Forex.com as a potential trading platform.

Forex.com vs. Competitors

Choosing the right forex broker is crucial for successful trading. Forex.com is a popular choice, but it’s essential to compare it with other leading brokers to determine if it’s the best fit for your needs. This section will analyze Forex.com’s strengths and weaknesses against its competitors, highlighting its unique selling propositions and areas for improvement.

Key Features Comparison

This section will compare Forex.com with other leading forex brokers, focusing on key factors such as trading platforms, fees, account types, and customer support.

| Feature | Forex.com | Competitor |

|---|---|---|

| Trading Platforms | Offers both proprietary (Trading Station) and third-party (MT4) platforms | [Competitor Name] offers [Competitor Platform(s)] |

| Fees | Competitive spreads and commission structure | [Competitor Name] has [Competitor Fee Structure] |

| Account Types | Offers various account types to suit different traders, including Standard, Direct, and Prime | [Competitor Name] offers [Competitor Account Types] |

| Customer Support | Provides 24/5 multilingual customer support via phone, email, and live chat | [Competitor Name] offers [Competitor Customer Support Options] |

Strengths and Weaknesses, Forex.com review

Forex.com offers several strengths, including:

- Multiple Trading Platforms: Forex.com provides access to both its proprietary Trading Station platform and the popular MT4 platform, catering to different trader preferences.

- Competitive Fees: Forex.com offers competitive spreads and commission structures, making it attractive for cost-conscious traders.

- Wide Range of Trading Instruments: Forex.com offers a wide range of trading instruments, including forex pairs, indices, commodities, and shares, providing traders with diverse investment opportunities.

- Robust Educational Resources: Forex.com offers a comprehensive educational resource library, including articles, tutorials, and webinars, helping traders develop their skills and knowledge.

- Strong Regulation: Forex.com is regulated by reputable financial authorities, ensuring a secure and trustworthy trading environment.

However, Forex.com also has some weaknesses:

- Limited Research Tools: Compared to some competitors, Forex.com offers a limited selection of research tools, which may not be sufficient for advanced traders.

- No Mobile Trading Platform: Forex.com does not offer a dedicated mobile trading platform, which can be a drawback for traders who prefer to trade on the go.

Unique Selling Propositions

Forex.com’s unique selling propositions include:

- Advanced Trading Tools: Forex.com’s Trading Station platform offers advanced trading tools, such as real-time charting, technical indicators, and order types, empowering traders to make informed decisions.

- Strong Risk Management Features: Forex.com provides robust risk management features, including stop-loss orders, take-profit orders, and margin calls, helping traders control their exposure and minimize potential losses.

- Focus on Education: Forex.com is committed to educating its clients, offering a comprehensive educational resource library and regular webinars to enhance traders’ knowledge and skills.

Areas for Improvement

Forex.com can improve in the following areas:

- Expanding Research Tools: Forex.com could enhance its research offerings by providing more in-depth market analysis, economic calendar data, and expert opinions.

- Developing a Mobile Trading Platform: Forex.com should develop a dedicated mobile trading platform to cater to the growing number of traders who prefer to trade on their smartphones or tablets.

- Improving Customer Support Response Times: While Forex.com offers 24/5 customer support, some users have reported slow response times, particularly during peak hours. Forex.com should strive to improve its response times and ensure prompt assistance for all clients.

Educational Resources and Support

Forex.com understands the importance of education in forex trading and provides a comprehensive suite of resources to empower traders of all levels. These resources aim to equip traders with the knowledge and skills necessary to navigate the complexities of the forex market.

Educational Materials

Forex.com offers a wide range of educational materials to cater to different learning styles and preferences.

- Online Courses: Forex.com provides a selection of online courses covering various aspects of forex trading, from the fundamentals of forex to advanced trading strategies. These courses are self-paced, allowing traders to learn at their own convenience.

- Webinars: Regular webinars hosted by experienced forex analysts and traders provide insights into market trends, trading strategies, and technical analysis. These webinars offer real-time interaction with experts, allowing traders to ask questions and engage in discussions.

- Trading Guides: Forex.com offers a collection of trading guides covering a variety of topics, such as fundamental analysis, technical analysis, risk management, and trading psychology. These guides provide step-by-step instructions and practical examples to enhance traders’ understanding of forex trading concepts.

- Market Analysis Reports: Forex.com publishes daily, weekly, and monthly market analysis reports that provide insights into current market conditions, economic indicators, and potential trading opportunities. These reports are designed to help traders stay informed about market movements and make informed trading decisions.

Support for Traders

Forex.com provides comprehensive support to its traders, ensuring a smooth and rewarding trading experience.

- Dedicated Account Managers: Traders with qualifying accounts can access dedicated account managers who provide personalized guidance, support, and assistance with trading strategies and account management.

- Live Chat Support: Forex.com offers 24/5 live chat support, allowing traders to get immediate assistance with any questions or concerns they may have.

- Educational Materials: The wide range of educational materials available on the Forex.com platform, including online courses, webinars, trading guides, and market analysis reports, provides traders with the knowledge and resources they need to succeed in the forex market.

Summary: Forex.com Review

Ultimately, Forex.com presents a compelling platform for forex traders seeking a reliable and user-friendly experience. With its comprehensive offerings, robust security, and educational resources, it caters to a wide range of traders, from beginners to seasoned professionals. While some aspects may require improvement, Forex.com’s commitment to innovation and customer satisfaction positions it as a strong contender in the competitive forex brokerage landscape.

FAQs

What is the minimum deposit required to open a Forex.com account?

The minimum deposit requirement varies depending on the account type you choose. For example, the Standard account has a minimum deposit of $50, while the Direct account requires a minimum of $25,000.

Does Forex.com offer demo accounts?

Yes, Forex.com offers a free demo account that allows you to practice trading in a risk-free environment. This is a great way to familiarize yourself with the platform and trading strategies before using real money.

What are the withdrawal fees associated with Forex.com?

Forex.com does not charge withdrawal fees for most methods. However, some third-party payment processors may charge their own fees.

Is Forex.com regulated?

Yes, Forex.com is regulated by several financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US. This ensures that the platform operates within a secure and compliant framework.