Forex.com MT4 download is your gateway to the world of forex trading. This powerful platform, renowned for its robust features and user-friendly interface, empowers you to analyze markets, execute trades, and manage your risk effectively. With its extensive charting capabilities, technical indicators, and customizable trading tools, MT4 offers a comprehensive trading environment that caters to both novice and experienced traders.

Whether you’re a seasoned investor or just starting your forex journey, understanding the intricacies of Forex.com MT4 is essential. This guide will take you through the entire process, from downloading and installing the platform to mastering its key features and exploring effective trading strategies.

Forex.com MT4 Overview

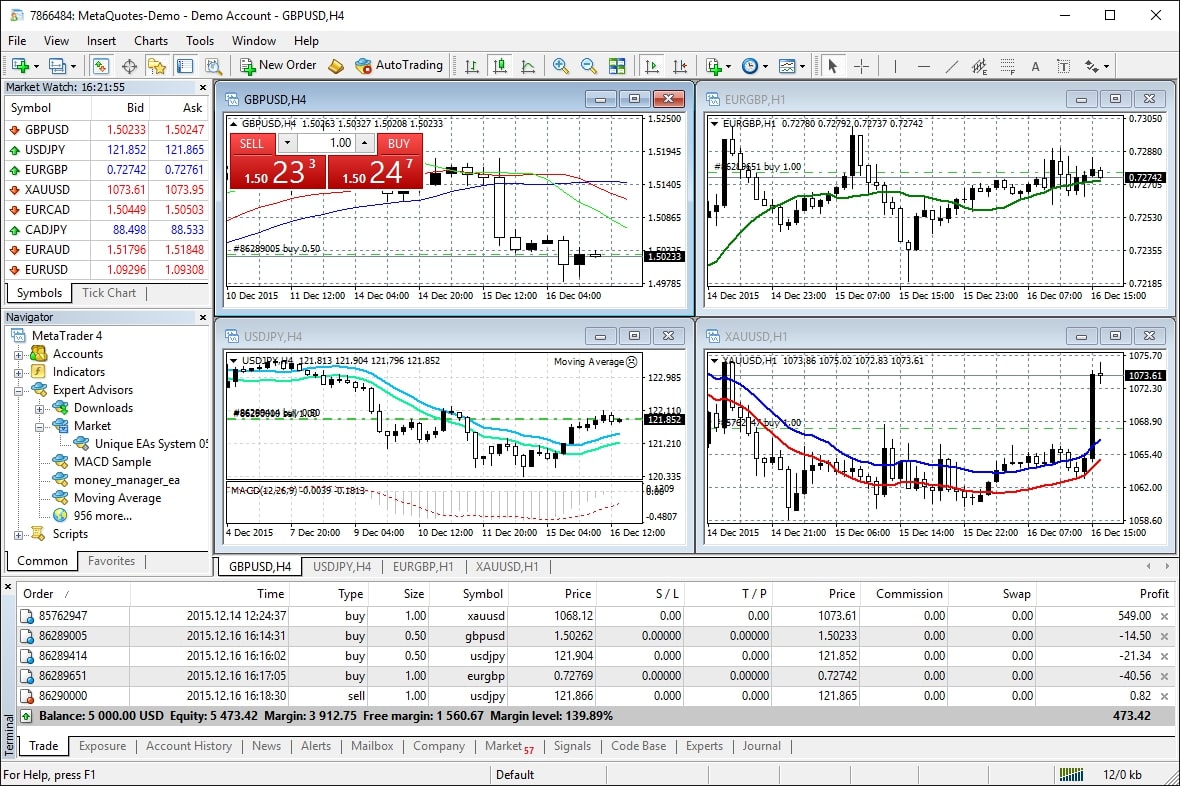

The MetaTrader 4 (MT4) platform is a popular and powerful trading platform used by forex traders worldwide. Forex.com’s MT4 platform offers a comprehensive suite of features and functionalities designed to enhance the trading experience for both beginners and experienced traders.

Key Features and Functionalities of Forex.com MT4

The Forex.com MT4 platform is known for its user-friendly interface, advanced charting capabilities, and extensive trading tools. The platform provides access to a wide range of features that cater to diverse trading styles and preferences.

- Advanced Charting Capabilities: MT4 offers a variety of charting tools and indicators that allow traders to analyze market trends and identify potential trading opportunities. Users can customize chart types, timeframes, and indicators to suit their individual analysis needs. Some of the key charting features include:

- Multiple Chart Types: Line, Bar, Candlestick, and Heikin-Ashi charts are available, providing diverse visual representations of price action.

- Technical Indicators: MT4 includes a vast library of built-in technical indicators, such as moving averages, MACD, RSI, and Bollinger Bands, to assist traders in identifying trends and potential trading signals.

- Customizable Timeframes: Traders can adjust the timeframes displayed on the charts, ranging from 1-minute to monthly, to analyze market behavior at different time scales.

- Drawing Tools: MT4 provides a range of drawing tools, such as trend lines, Fibonacci retracements, and support/resistance levels, to help traders identify key price levels and potential trading areas.

- Trading Tools: MT4 offers a variety of trading tools that facilitate order execution, risk management, and trade analysis. Some of the key trading tools include:

- Order Types: MT4 supports various order types, including market orders, limit orders, stop orders, and trailing stops, enabling traders to execute trades based on their specific trading strategies and risk tolerance.

- Trade Management Tools: The platform allows traders to manage their open positions, set stop-loss and take-profit orders, and monitor their trading performance.

- Expert Advisors (EAs): MT4 supports automated trading through expert advisors, which are programs that execute trades based on predefined rules and algorithms. This allows traders to automate their trading strategies and potentially improve efficiency.

Benefits of Using Forex.com MT4

Using Forex.com’s MT4 platform offers several benefits to forex traders, including:

- Customizability: MT4 is highly customizable, allowing traders to tailor the platform to their individual needs and preferences. Users can personalize the interface, adjust settings, and install custom indicators and expert advisors.

- Comprehensive Trading Tools: The platform provides a wide range of trading tools, including advanced charting capabilities, technical indicators, and order types, to support various trading styles and strategies.

- Automated Trading: MT4 supports automated trading through expert advisors, allowing traders to automate their strategies and potentially improve trading efficiency.

- Community Support: MT4 has a large and active online community, providing access to resources, forums, and expert advice. Traders can connect with other users, share ideas, and learn from each other’s experiences.

- Mobile Access: MT4 is available on mobile devices, allowing traders to access their accounts and monitor their trades from anywhere with an internet connection.

Download and Installation Process

Downloading and installing the Forex.com MT4 platform is a straightforward process that grants you access to a powerful trading environment. This guide will walk you through the steps involved, providing clear instructions and addressing common installation issues.

Downloading the MT4 Platform

To begin, you need to download the MT4 platform from the Forex.com website. This process is simple and typically involves the following steps:

- Visit the Forex.com website and navigate to the “Platforms” section.

- Locate the “MT4” platform option and click on it.

- You will be presented with a download button; click on it to initiate the download process.

- The MT4 setup file will be downloaded to your computer. The location of the downloaded file may vary depending on your browser settings.

Installing the MT4 Platform

Once the download is complete, you can proceed with installing the MT4 platform. This involves the following steps:

- Locate the downloaded setup file and double-click on it to launch the installation wizard.

- Follow the on-screen instructions provided by the wizard. This typically involves accepting the license agreement and selecting the desired installation directory.

- The installer will extract the necessary files and create the MT4 application on your computer.

- Once the installation is complete, you will be prompted to launch the MT4 platform. Click on the “Finish” button to complete the process.

Troubleshooting Common Installation Issues

While the installation process is generally straightforward, you may encounter some issues. Here are some common problems and solutions:

- Insufficient Permissions: If you encounter an error message stating that you lack the necessary permissions to install the platform, ensure you are logged in as an administrator on your computer. You may need to right-click on the setup file and select “Run as administrator” to resolve this issue.

- Antivirus Interference: Antivirus software can sometimes interfere with the installation process. Temporarily disable your antivirus software and try installing the platform again. Remember to re-enable your antivirus software after the installation is complete.

- Corrupted Download: If the downloaded setup file is corrupted, you may encounter errors during the installation. Re-download the setup file from the Forex.com website to ensure you have a valid copy.

Platform Setup and Configuration

The MetaTrader 4 (MT4) platform offers a range of customization options to tailor your trading experience. This section provides a step-by-step guide on setting up and configuring MT4 for optimal trading, focusing on customizing the platform’s interface, integrating indicators, and connecting your Forex.com trading account.

Customizing the MT4 Interface

Customizing the MT4 interface allows you to personalize your trading environment, enhancing your trading efficiency and clarity. You can modify the layout, colors, and charts to suit your preferences.

Modifying the Chart Layout

You can adjust the layout of the MT4 charts by adding or removing indicators, changing the timeframe, and modifying the chart type.

- Adding indicators: MT4 offers a vast library of indicators, including technical indicators, fundamental indicators, and custom indicators. To add an indicator, right-click on the chart and select “Indicators”. From the list, choose the desired indicator and configure its settings. You can add multiple indicators to your chart to analyze price movements from different perspectives.

- Changing the timeframe: MT4 provides various timeframes for analyzing price data, ranging from 1-minute to monthly. You can switch between timeframes by clicking the timeframe button at the top of the chart window. The choice of timeframe depends on your trading style and the time horizon of your trades.

- Modifying the chart type: MT4 offers different chart types, including line charts, bar charts, candlestick charts, and Heiken Ashi charts. Each chart type presents price data in a unique way, allowing you to identify patterns and trends differently. To change the chart type, right-click on the chart and select “Chart Properties”.

Adjusting Colors and Themes

You can adjust the colors and themes of the MT4 platform to improve visibility and readability.

- Color settings: MT4 allows you to customize the colors of the charts, indicators, and other elements. You can change the background color, line colors, and text colors. To access the color settings, go to “Tools” > “Options” > “Colors”.

- Themes: MT4 offers pre-defined themes that change the overall appearance of the platform. You can select a theme that suits your preferences and improves your trading experience. To change the theme, go to “Tools” > “Options” > “Themes”.

Creating Custom Layouts

MT4 allows you to create custom layouts for your trading environment. You can arrange the charts, indicators, and other windows to suit your trading workflow.

- Custom layouts: To create a custom layout, open the desired charts and indicators, then right-click on the chart and select “Save Template”. You can save multiple templates for different trading scenarios.

- Loading templates: To load a saved template, right-click on the chart and select “Load Template”. You can choose from the list of saved templates or create a new template.

Connecting a Forex.com Trading Account

Connecting your Forex.com trading account to the MT4 platform allows you to access your account balances, place trades, and manage your positions directly from the MT4 interface.

- Download the MT4 platform: Download the MT4 platform from the Forex.com website.

- Open a Forex.com trading account: If you do not have a Forex.com trading account, you can open one through the Forex.com website.

- Obtain login credentials: Once your Forex.com trading account is set up, you will receive your login credentials, including your account number and password.

- Connect to the Forex.com server: Launch the MT4 platform and select the Forex.com server from the list of available servers.

- Enter login credentials: Enter your Forex.com account number and password in the login window.

Configuring Trading Orders, Forex.com mt4 download

MT4 provides various order types and settings to execute trades according to your trading strategy.

Order Types

MT4 offers a range of order types, including market orders, limit orders, stop orders, and trailing stop orders. Each order type has unique characteristics and is suitable for different trading scenarios.

- Market orders: Market orders are executed immediately at the current market price. They are suitable for traders who want to enter a trade quickly, but they may not get the desired entry price.

- Limit orders: Limit orders are executed only when the market price reaches a specified price level. They are suitable for traders who want to buy at a lower price or sell at a higher price.

- Stop orders: Stop orders are executed when the market price reaches a specified price level. They are suitable for traders who want to limit their potential losses or protect their profits.

- Trailing stop orders: Trailing stop orders are stop orders that adjust automatically as the market price moves in your favor. They are suitable for traders who want to lock in profits while minimizing potential losses.

Order Settings

You can configure the settings of your trading orders, including the order type, stop-loss, take-profit, and lot size.

- Stop-loss: A stop-loss order automatically closes your position when the market price reaches a specified price level. This helps to limit potential losses.

- Take-profit: A take-profit order automatically closes your position when the market price reaches a specified price level. This helps to lock in profits.

- Lot size: The lot size determines the amount of money you are risking on each trade. It is important to choose a lot size that is appropriate for your risk tolerance and account balance.

Essential MT4 Features for Forex Trading

MetaTrader 4 (MT4) is a widely used and powerful trading platform for forex traders. It provides a wide range of features that are essential for successful trading, from technical analysis tools to order execution options. Understanding and utilizing these features effectively can significantly enhance your trading experience and improve your overall performance.

Technical Indicators

Technical indicators are mathematical calculations based on historical price data, helping traders identify trends, momentum, and potential reversal points. MT4 offers a vast library of indicators, each with its unique purpose and application.

- Moving Averages (MAs): MAs smooth out price fluctuations, revealing underlying trends. Common types include Simple Moving Average (SMA), Exponential Moving Average (EMA), and Weighted Moving Average (WMA). Traders use MAs to identify support and resistance levels, trend direction, and potential buy or sell signals.

- Relative Strength Index (RSI): RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Values above 70 typically suggest an overbought market, while values below 30 indicate an oversold market. Traders use RSI to identify potential trend reversals and entry points.

- Stochastic Oscillator: This indicator compares a security’s closing price to its price range over a given period. It oscillates between 0 and 100, with readings above 80 indicating overbought conditions and readings below 20 indicating oversold conditions. Traders use the Stochastic Oscillator to identify potential trend reversals and entry points.

- Bollinger Bands: Bollinger Bands are volatility indicators that consist of a moving average and two standard deviations above and below the moving average. They provide a measure of price volatility and can help identify potential breakouts or breakdowns. Traders use Bollinger Bands to identify overbought or oversold conditions, as well as potential trend reversals.

Charting Tools

MT4 offers a wide array of charting tools that enable traders to visualize price movements, identify patterns, and analyze market trends.

- Trend Lines: Trend lines are drawn on a chart to connect two or more price points, representing the direction of the trend. Upward sloping trend lines indicate an uptrend, while downward sloping trend lines indicate a downtrend. Traders use trend lines to identify support and resistance levels, as well as potential buy or sell signals.

- Fibonacci Retracement: Fibonacci retracement levels are based on the Fibonacci sequence, a mathematical series where each number is the sum of the two preceding numbers. These levels represent potential support and resistance areas within a trend. Traders use Fibonacci retracement levels to identify potential entry and exit points.

- Support and Resistance Levels: Support levels are price points where buying pressure is strong enough to prevent the price from falling further. Resistance levels are price points where selling pressure is strong enough to prevent the price from rising further. Traders use support and resistance levels to identify potential entry and exit points, as well as potential trend reversals.

Order Types

MT4 provides various order types that allow traders to execute trades based on specific criteria.

- Market Order: A market order is executed immediately at the current market price. This order type is best suited for traders who want to enter a trade quickly, but it may result in a less favorable price than a limit order.

- Limit Order: A limit order is executed only when the price reaches a specified level. This order type is best suited for traders who want to enter a trade at a specific price, but it may not be executed if the price does not reach the specified level.

- Stop Order: A stop order is executed when the price reaches a specified level, but only if the price moves in the desired direction. This order type is best suited for traders who want to limit their losses or lock in profits.

- Trailing Stop Order: A trailing stop order is a type of stop order that moves with the price of the asset. This order type is best suited for traders who want to protect their profits while allowing the trade to continue running in the desired direction.

Trading Strategies and Techniques

The MT4 platform offers a wide range of tools and features that can be utilized to implement various trading strategies. This section explores some common forex trading strategies and techniques that can be applied within the MT4 platform.

Trend Trading

Trend trading involves identifying and trading in the direction of the prevailing trend. This strategy aims to capitalize on the momentum of price movements and is often used by longer-term traders.

- Identifying Trends: Trend lines, moving averages, and other technical indicators can be used to identify trends. For example, an upward trend is indicated by a series of higher highs and higher lows, while a downward trend is characterized by lower highs and lower lows.

- Entry and Exit Points: Traders may enter long positions when the price breaks above resistance levels and short positions when the price breaks below support levels. Exit signals can be generated by trend reversals or when price action suggests a weakening trend.

- Strengths: Trend trading can be a profitable strategy, especially during strong trends. It is relatively simple to understand and implement.

- Weaknesses: Identifying the true trend can be challenging, especially during choppy market conditions. Trend trading can be less effective in ranging markets.

- Risks: Trend trading can result in significant losses if the market reverses unexpectedly. The risk of overstaying a trade is also a concern.

Scalping

Scalping is a high-frequency trading strategy that aims to profit from small price fluctuations. Scalpers typically open and close trades multiple times a day, seeking to capture small profits from each trade.

- Identifying Scalping Opportunities: Scalpers often use technical indicators like moving averages, stochastic oscillators, or price action patterns to identify potential trading opportunities.

- Entry and Exit Points: Scalpers may enter trades based on short-term price movements, such as price bounces off support or resistance levels.

- Strengths: Scalping can be profitable in volatile markets, and it allows traders to capture small profits from multiple trades.

- Weaknesses: Scalping requires significant time and focus, as traders must constantly monitor the market and react quickly to price changes. It can be emotionally demanding and stressful.

- Risks: Scalping carries a high risk of losses due to the rapid pace of trading. It is crucial to manage risk effectively to avoid significant losses.

Day Trading

Day trading involves opening and closing trades within the same trading day, aiming to profit from intraday price fluctuations. Day traders typically use technical analysis and charting techniques to identify trading opportunities.

- Identifying Day Trading Opportunities: Day traders may use a combination of technical indicators, chart patterns, and news events to identify potential trading opportunities.

- Entry and Exit Points: Entry and exit points are typically based on technical analysis, such as support and resistance levels, trend lines, and moving averages.

- Strengths: Day trading allows traders to capitalize on short-term market movements and avoid overnight risk. It can be a flexible trading style.

- Weaknesses: Day trading requires significant time, focus, and discipline. It can be emotionally draining and requires constant market monitoring.

- Risks: Day trading carries a high risk of losses due to the volatility of intraday price movements. It is essential to manage risk effectively and have a clear trading plan.

Swing Trading

Swing trading aims to capture price movements within a specific range, typically lasting for a few days to a few weeks. Swing traders use technical analysis to identify potential entry and exit points.

- Identifying Swing Trading Opportunities: Swing traders often use chart patterns, moving averages, and oscillators to identify potential trading opportunities.

- Entry and Exit Points: Entry points are typically based on breakouts from consolidation patterns or pullbacks to support levels. Exit points may be triggered by price reversals or when price action suggests a weakening trend.

- Strengths: Swing trading offers a balance between risk and reward, allowing traders to capture significant price movements while managing risk effectively.

- Weaknesses: Swing trading requires patience and discipline, as traders may have to wait for the right opportunity to enter or exit a trade.

- Risks: Swing trading carries the risk of losses if the market moves against the trader’s position. It is essential to manage risk effectively and have a clear trading plan.

News Trading

News trading involves capitalizing on market reactions to economic releases and other significant news events. Traders use fundamental analysis to identify potential trading opportunities.

- Identifying News Trading Opportunities: Traders may use economic calendars to track upcoming news releases and anticipate market reactions. They may also monitor news headlines and social media for market-moving events.

- Entry and Exit Points: Entry points are typically based on the anticipated market reaction to the news event. Exit points may be triggered by price reversals or when the market has fully reacted to the news.

- Strengths: News trading can be profitable when traders accurately predict market reactions to news events.

- Weaknesses: Predicting market reactions to news events can be challenging and requires a strong understanding of fundamental analysis.

- Risks: News trading carries a high risk of losses if the market reacts unexpectedly to news events. It is essential to manage risk effectively and have a clear trading plan.

Support and Resistance Trading

Support and resistance levels are key price points that often act as barriers to price movements. Traders use these levels to identify potential entry and exit points.

- Identifying Support and Resistance Levels: Support levels are price points where buying pressure is expected to be strong enough to prevent further declines. Resistance levels are price points where selling pressure is expected to be strong enough to prevent further gains.

- Entry and Exit Points: Traders may enter long positions when the price breaks above resistance levels and short positions when the price breaks below support levels. Exit signals may be generated by price reversals or when price action suggests a weakening trend.

- Strengths: Support and resistance trading can be a profitable strategy, especially when these levels are clearly defined and respected by the market.

- Weaknesses: Support and resistance levels can be subjective and may not always hold. It is important to consider other factors, such as market sentiment and volatility, when using this strategy.

- Risks: Support and resistance trading carries the risk of losses if the market breaks through these levels. It is essential to manage risk effectively and have a clear trading plan.

Technical Analysis

Technical analysis is a method of studying price charts and market data to identify trading opportunities. Traders use various technical indicators, chart patterns, and other tools to analyze price movements and predict future price trends.

- Technical Indicators: Technical indicators are mathematical formulas that are applied to price data to generate signals about potential trading opportunities. Common technical indicators include moving averages, MACD, RSI, and Bollinger Bands.

- Chart Patterns: Chart patterns are recurring price formations that can indicate potential trading opportunities. Some common chart patterns include head and shoulders, double tops, and triangles.

- Strengths: Technical analysis can provide valuable insights into market trends and sentiment. It can be used to identify potential entry and exit points and manage risk effectively.

- Weaknesses: Technical analysis is not always accurate, and signals can be misleading. It is important to use technical indicators and chart patterns in conjunction with other forms of analysis.

- Risks: Technical analysis can lead to false signals, resulting in losses. It is essential to manage risk effectively and have a clear trading plan.

Fundamental Analysis

Fundamental analysis involves examining economic data, political events, and other factors that can influence currency values. Traders use fundamental analysis to identify potential trading opportunities based on long-term economic trends.

- Economic Data: Economic data releases, such as GDP growth, inflation, and interest rate decisions, can significantly impact currency values. Traders monitor these releases to identify potential trading opportunities.

- Political Events: Political events, such as elections, trade agreements, and geopolitical tensions, can also influence currency values. Traders may use fundamental analysis to assess the potential impact of these events on currency markets.

- Strengths: Fundamental analysis can provide a long-term perspective on currency markets and identify potential trading opportunities based on economic fundamentals.

- Weaknesses: Fundamental analysis can be complex and time-consuming. It requires a deep understanding of economic and political factors.

- Risks: Fundamental analysis can be subject to unforeseen events and changes in economic conditions. It is essential to manage risk effectively and have a clear trading plan.

Automated Trading

Automated trading, also known as algorithmic trading, involves using computer programs to execute trades automatically based on predefined rules. MT4 supports automated trading through Expert Advisors (EAs).

- Expert Advisors (EAs): EAs are custom-programmed trading robots that can execute trades based on specific rules and parameters. They can automate trading strategies, manage risk, and execute trades even when the trader is not actively monitoring the market.

- Strengths: Automated trading can remove emotional biases from trading decisions and execute trades more efficiently than manual trading. It can also free up traders’ time to focus on other aspects of their trading.

- Weaknesses: EAs can be complex to develop and test. They may not always perform as expected, and their effectiveness can be influenced by market conditions.

- Risks: Automated trading carries the risk of unexpected losses due to errors in programming or changes in market conditions. It is crucial to test EAs thoroughly before deploying them in live trading.

Risk Management and Account Security: Forex.com Mt4 Download

In the dynamic and unpredictable world of forex trading, risk management is paramount. It’s not just about protecting your profits but also about safeguarding your capital and ensuring you can continue trading in the long run. Fortunately, the MT4 platform provides a robust set of tools and features that can help you implement effective risk management strategies.

Understanding Risk Management

Risk management involves identifying, assessing, and mitigating potential losses in your trading activities. It’s about establishing clear rules and guidelines for your trading decisions, aiming to minimize the impact of adverse market movements. The key is to strike a balance between taking calculated risks and preserving your capital.

Stop-Loss Orders

A stop-loss order is a crucial risk management tool that automatically closes your trade when the market reaches a predetermined price level. This helps limit your potential losses on a trade, as it acts as a safety net.

- Setting a Stop-Loss: When placing a trade, you specify the stop-loss level, which is typically set below the entry price for a long position or above the entry price for a short position. This level is the maximum amount you’re willing to lose on the trade.

- Example: If you buy EUR/USD at 1.1000 and set a stop-loss at 1.0950, your trade will automatically close if the price drops to 1.0950, limiting your loss to 50 pips.

Limit Orders

A limit order allows you to buy or sell a currency pair at a specific price or better. It’s a useful tool for locking in profits or entering a trade at a predetermined price.

- Example: If you want to sell EUR/USD at 1.1100, you can place a limit order at that price. If the price reaches 1.1100 or goes lower, your order will be executed, ensuring you sell at the desired price or better.

Other Risk Management Tools

Beyond stop-loss and limit orders, MT4 offers other features that can enhance your risk management approach. These include:

- Trailing Stop: This order automatically adjusts your stop-loss level based on price movements, helping you capture profits while minimizing losses.

- Take-Profit Order: This order allows you to close a trade automatically when the market reaches a specific profit target, locking in your gains.

- Trade Management Tools: MT4 offers tools for monitoring open positions, analyzing trades, and managing your overall risk exposure.

Securing Your MT4 Account

Protecting your trading data and account security is essential. Here are some tips:

- Strong Password: Use a complex password that combines uppercase and lowercase letters, numbers, and symbols.

- Two-Factor Authentication: Enable two-factor authentication (2FA) to add an extra layer of security to your account.

- Secure Connection: Ensure you’re using a secure internet connection, especially when trading.

- Regular Security Updates: Keep your MT4 platform updated with the latest security patches.

- Beware of Phishing: Be cautious of suspicious emails or websites that ask for your login credentials.

MT4 Resources and Support

The MetaTrader 4 platform offers a wealth of resources to enhance your trading experience. From comprehensive tutorials to interactive forums, Forex.com provides various tools to help you learn, refine your strategies, and stay informed about market trends.

Forex.com MT4 Documentation

Forex.com provides comprehensive documentation for the MT4 platform, covering various aspects, from installation and configuration to advanced trading features.

- User Guides: These guides offer step-by-step instructions on using the platform, including platform navigation, order placement, and account management.

- Technical Specifications: Forex.com provides detailed technical specifications for MT4, including system requirements, supported operating systems, and compatibility information.

- FAQ Section: The FAQ section addresses common questions regarding MT4 features, trading functionalities, and platform settings.

MT4 Community Resources

Forex.com fosters a vibrant community of traders who share knowledge, discuss strategies, and offer support.

- Trading Forums: Forex.com’s online forums provide a platform for traders to connect, share experiences, and engage in discussions on market analysis, trading strategies, and platform features.

- Educational Resources: Forex.com offers a library of educational resources, including articles, webinars, and video tutorials, covering various trading topics, from fundamental analysis to technical indicators.

- Social Media Groups: Forex.com maintains active social media groups on platforms like Facebook and Twitter, where traders can connect, share insights, and stay updated on market news and events.

Benefits of Utilizing MT4 Resources

Leveraging these resources can significantly enhance your trading journey:

- Enhanced Understanding: MT4 documentation and educational resources provide a comprehensive understanding of the platform’s features, functionalities, and trading capabilities.

- Improved Trading Skills: Engaging with the community, accessing educational materials, and participating in discussions can refine your trading skills, broaden your knowledge base, and help you develop effective trading strategies.

- Enhanced Support: The Forex.com community provides a supportive network where you can seek guidance, ask questions, and receive assistance from experienced traders.

Final Conclusion

By embracing the power of Forex.com MT4, you gain access to a sophisticated platform that can help you navigate the dynamic forex markets with confidence. From its intuitive interface to its advanced trading tools, MT4 equips you with the resources you need to make informed trading decisions and maximize your trading potential. So, dive into the world of Forex.com MT4 and embark on your journey towards successful forex trading.

FAQ Summary

What is Forex.com MT4?

Forex.com MT4 is a popular trading platform used for forex trading. It is developed by MetaQuotes Software Corp. and offers a wide range of features for technical analysis, order execution, and account management.

Is Forex.com MT4 free to download?

Yes, Forex.com MT4 is free to download and use. However, you will need to have a live trading account with Forex.com to access the platform’s full functionality.

Is Forex.com MT4 available for mobile devices?

Yes, Forex.com MT4 is available for both Android and iOS devices. You can download the mobile app from the respective app stores.

What are the system requirements for Forex.com MT4?

The system requirements for Forex.com MT4 are relatively modest. You will need a computer with a reasonably modern operating system (Windows, macOS, or Linux) and a stable internet connection.