- Understanding Forex.com Leverage

- Forex.com Leverage Levels

- Margin Requirements

- The Impact of Leverage on Risk and Reward

- Responsible Leverage Management

- Leverage and Trading Strategies

- Leverage and Risk Management

- Leverage and Forex.com Account Types

- Last Point

- Commonly Asked Questions: Forex.com Leverage

Forex.com leverage, a powerful tool in the world of forex trading, can significantly amplify both potential profits and losses. It allows traders to control a larger position in the market with a smaller initial investment. Understanding how leverage works, its benefits, and risks is crucial for successful trading.

Leverage is essentially borrowed capital that allows traders to control a larger position than their initial investment would normally permit. For example, with a 1:100 leverage, a $1,000 deposit can control a $100,000 position. This magnification effect can lead to substantial gains, but it’s equally important to recognize the potential for magnified losses.

Understanding Forex.com Leverage

Leverage is a powerful tool in forex trading that allows traders to control a larger position in the market than their initial investment would normally permit. Forex.com offers leverage to its clients, enabling them to amplify their potential profits and losses.

Leverage Explained

Leverage essentially acts as a multiplier, allowing traders to control a larger position with a smaller initial investment. It is expressed as a ratio, such as 1:50 or 1:100. For instance, a leverage ratio of 1:50 means that for every $1 you deposit, you can control $50 worth of currency in the market.

Impact of Leverage on Profits and Losses

Leverage magnifies both profits and losses. With higher leverage, a small price movement in your favor can result in significant profits, but conversely, a small price movement against you can lead to substantial losses. It is crucial to understand that leverage is a double-edged sword, and it is essential to manage risk effectively when using it.

Leverage Examples in Forex Trading

Let’s illustrate how leverage works in practice. Suppose you have a $1,000 account and want to buy 10,000 units of EUR/USD at a price of 1.1000. With a leverage ratio of 1:100, you would only need to deposit $100 to control the full $1,100,000 position (10,000 units x 1.1000). If the EUR/USD rises to 1.1100, you would make a profit of $1,000 (10,000 units x 0.0100), representing a 10% return on your initial investment. However, if the EUR/USD falls to 1.0900, you would incur a loss of $1,000 (10,000 units x 0.0100), representing a 10% loss on your initial investment.

Forex.com Leverage Levels

Forex.com offers various leverage levels to suit different trading styles and risk tolerances. Leverage allows traders to control a larger position in the market with a smaller initial investment. However, it’s crucial to understand that leverage can amplify both profits and losses.

Leverage Levels Offered by Forex.com

Forex.com provides a range of leverage levels, with the maximum leverage varying depending on the account type and the specific trading instrument. The leverage levels typically range from 1:1 to 1:500. For instance, with a leverage of 1:100, a trader can control a position worth $100,000 with a margin of only $1,000.

Benefits and Risks of Different Leverage Levels

- Higher Leverage: Higher leverage levels can magnify potential profits. However, they also increase the risk of significant losses. With higher leverage, even small market movements can lead to substantial gains or losses.

- Lower Leverage: Lower leverage levels reduce the risk of substantial losses but also limit potential profits. With lower leverage, traders need to commit more capital to control the same position size.

Influence of Leverage on Trading Strategies and Risk Management

Leverage can significantly impact trading strategies and risk management practices. Here’s how:

- Trading Strategies: High leverage levels can facilitate scalping strategies, where traders aim to profit from small price fluctuations. However, high leverage can also make it difficult to manage risk effectively.

- Risk Management: Traders using high leverage must implement strict risk management measures to mitigate potential losses. This includes setting stop-loss orders to limit potential losses and using position sizing strategies to control the overall risk exposure.

Margin Requirements

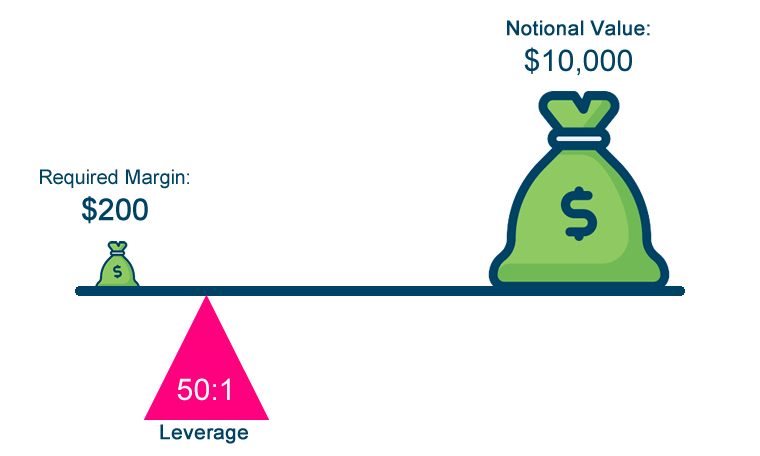

Margin is a crucial concept in forex trading, closely linked to leverage. It represents the amount of money you need to deposit in your trading account to open and maintain a position. This deposit acts as a security for your broker, ensuring they can cover potential losses if the trade moves against you.

Margin Calculation

Margin requirements are calculated based on the size of your trade and the leverage offered by your broker. The formula for calculating margin is:

Margin = (Trade Size / Leverage) x Contract Size

For example, if you want to trade 1 standard lot (100,000 units) of EUR/USD with a leverage of 1:100, the margin requirement would be:

Margin = (100,000 / 100) x 1 = $1,000

This means you need to deposit $1,000 in your account to open and maintain this position.

Impact on Traders’ Capital, Forex.com leverage

Margin requirements significantly impact traders’ capital. A higher leverage translates to a lower margin requirement, allowing traders to control larger positions with a smaller initial investment. However, this also amplifies potential losses, as even small price movements can lead to substantial losses.

Consequences of Insufficient Margin

Insufficient margin can lead to several consequences:

Margin Calls

If the market moves against your position and your account equity falls below the margin requirement, your broker may issue a margin call. This means you need to deposit additional funds into your account to cover the potential losses and maintain the open position. Failure to meet the margin call will result in the closure of your position.

Account Liquidation

If you fail to meet a margin call, your broker may liquidate your position to recover their losses. This means your position will be automatically closed at the current market price, resulting in potential significant losses.

The Impact of Leverage on Risk and Reward

Leverage is a powerful tool in forex trading, allowing traders to control larger positions with a smaller initial investment. However, it’s crucial to understand that leverage amplifies both potential profits and losses. This means that while leverage can lead to significant gains, it can also result in substantial losses if the market moves against your position.

Understanding the Relationship Between Leverage and Risk

Leverage magnifies the potential returns on your investment, but it also amplifies the potential losses. The higher the leverage, the greater the risk. This is because leverage increases the size of your position relative to your initial investment, meaning that even small price fluctuations can lead to significant gains or losses.

Illustrating the Amplification of Profits and Losses

Consider the following scenario:

* You have $1,000 to invest in forex.

* The current EUR/USD exchange rate is 1.1000.

* You decide to buy 1 lot of EUR/USD, which is equivalent to 100,000 euros.

* Without leverage, you would need $110,000 to buy this position.

However, with a leverage of 1:100, you can control this position with only $1,000. If the EUR/USD exchange rate rises to 1.1100, you will make a profit of $1,000 (100,000 euros x 0.0100). This represents a 100% return on your initial investment.

However, if the exchange rate falls to 1.0900, you will lose $1,000 (100,000 euros x 0.0100). This represents a 100% loss on your initial investment.

Comparing Leverage Levels and Associated Risks and Rewards

The following table demonstrates the potential rewards and risks associated with different leverage levels, assuming a $1,000 initial investment and a 1% price movement in the underlying currency pair.

| Leverage | Position Size | Potential Profit | Potential Loss |

|—|—|—|—|

| 1:10 | $10,000 | $100 | $100 |

| 1:50 | $50,000 | $500 | $500 |

| 1:100 | $100,000 | $1,000 | $1,000 |

| 1:200 | $200,000 | $2,000 | $2,000 |

As you can see, higher leverage levels result in larger potential profits but also larger potential losses. It’s crucial to choose a leverage level that aligns with your risk tolerance and trading strategy.

Responsible Leverage Management

Leverage is a powerful tool in forex trading, allowing traders to amplify their potential profits. However, it also amplifies potential losses. Responsible leverage management is crucial for protecting your trading capital and achieving long-term success.

Determining the Appropriate Leverage Level

Determining the appropriate leverage level for individual traders depends on various factors, including trading experience, risk tolerance, and trading strategy. Here are some practical tips to consider:

- Start with a lower leverage level: New traders should start with a lower leverage level to gain experience and build confidence before gradually increasing it.

- Assess your risk tolerance: Leverage amplifies both profits and losses. It’s crucial to determine your comfort level with potential losses before deciding on a leverage level.

- Consider your trading strategy: Scalpers, who trade frequently with small profits, may require higher leverage. Swing traders, who hold positions for longer periods, may prefer lower leverage.

- Use leverage as a tool, not a crutch: Leverage should not be used to compensate for poor trading decisions. It should be a tool to enhance your trading strategy, not a substitute for sound risk management.

Setting Up and Managing Risk Parameters

Setting up and managing risk parameters based on leverage levels is essential for responsible trading. Here’s a step-by-step guide:

- Determine your risk per trade: This is the maximum amount of money you’re willing to lose on a single trade. It should be a percentage of your trading capital, typically 1-2%.

- Calculate your position size: This is the amount of currency you’ll buy or sell based on your risk per trade and the leverage level.

- Set stop-loss orders: Stop-loss orders automatically close your position when the price reaches a predetermined level, limiting your potential losses.

- Monitor your trades: It’s important to monitor your trades closely, especially when using leverage. Be prepared to adjust your risk parameters if needed.

Managing Leverage Risks

Leverage can significantly amplify both profits and losses. Therefore, it’s essential to understand and manage the risks associated with leverage:

- Margin calls: When the market moves against your position, your broker may issue a margin call, requiring you to deposit additional funds to maintain your position. If you fail to meet the margin call, your position may be liquidated.

- Account blow-ups: In extreme market conditions, leverage can lead to significant losses that exceed your initial investment, resulting in an account blow-up.

- Overtrading: Leverage can tempt traders to take on larger positions than they can handle, leading to overtrading and increased risk.

Leverage and Trading Strategies

Leverage can significantly impact different trading strategies, influencing their potential for both profit and loss. Understanding how leverage interacts with various trading styles is crucial for traders seeking to optimize their approach and manage risk effectively.

Leverage in Scalping

Scalping involves making numerous small trades to capture minor price fluctuations. This strategy often relies on high leverage to amplify profits from small price movements.

- High leverage magnifies gains: Even slight price changes can generate substantial profits when leverage is employed, allowing scalpers to profit from rapid price movements.

- Increased risk: The same leverage that amplifies profits also amplifies losses. Scalpers must carefully manage their positions and exit trades quickly to avoid significant losses if the market turns against them.

Leverage in Day Trading

Day trading involves opening and closing positions within a single trading day, seeking to capitalize on intraday price fluctuations.

- Leverage can enhance profits: By employing leverage, day traders can control larger positions with a smaller capital investment, potentially increasing their profit potential.

- Increased risk exposure: Leverage magnifies both profits and losses. Day traders need to closely monitor market movements and exit trades strategically to mitigate risks.

Leverage in Swing Trading

Swing trading focuses on capturing price swings that occur over several days or weeks, aiming to benefit from larger market trends.

- Lower leverage is often preferred: Swing traders typically hold positions for longer durations, making them less susceptible to short-term market volatility. Lower leverage helps manage risk while maintaining the ability to profit from larger price movements.

- Leverage can amplify profits: While swing traders may not need high leverage, using moderate leverage can still enhance their profit potential on longer-term trends.

Leverage and Risk Management

Leverage in forex trading magnifies both potential profits and losses. Therefore, implementing a robust risk management strategy is crucial when utilizing leverage. This strategy should encompass various aspects, including defining your risk tolerance, setting appropriate stop-loss orders, and diversifying your portfolio.

Stop-Loss Orders

Stop-loss orders are essential tools for mitigating potential losses in leveraged forex trading. They automatically close a position when the price reaches a predetermined level, limiting potential losses. Stop-loss orders serve as a safety net, preventing substantial losses due to market fluctuations.

Comprehensive Risk Management Plan

A comprehensive risk management plan should be tailored to your individual trading style and risk tolerance. Here’s a framework for a robust plan:

- Define Your Risk Tolerance: Before engaging in leveraged trading, understand your risk appetite. Determine the maximum percentage of your trading capital you are willing to lose on a single trade. This will guide your position sizing and leverage choices.

- Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. The stop-loss level should be determined based on your risk tolerance and market analysis.

- Diversify Your Portfolio: Diversifying your portfolio across different currency pairs can help mitigate risk. Avoid concentrating your capital on a single currency pair, as market movements in one currency can impact multiple pairs.

- Position Sizing: Calculate the appropriate position size based on your risk tolerance and leverage. Use a risk management calculator to determine the maximum position size that aligns with your predefined risk parameters.

- Regularly Monitor and Adjust: Continuously monitor your trading activity and adjust your risk management plan as needed. Market conditions and your trading experience can change, requiring adjustments to your risk parameters.

Leverage and Forex.com Account Types

Forex.com offers a range of account types, each with its own leverage options and features. Understanding these differences is crucial for choosing the account that best suits your trading style, risk tolerance, and financial goals.

Leverage Options for Different Account Types

The leverage available on Forex.com accounts varies depending on the account type. Here’s a breakdown of the leverage options for each account type:

- Standard Account: This account offers leverage up to 50:1, which means that for every $1 you deposit, you can control $50 worth of currency.

- Direct Account: This account offers leverage up to 100:1, providing a higher potential for both profits and losses.

- Zero Account: This account offers commission-free trading and leverage up to 50:1.

Account Type and Leverage Impact on Trading Costs and Fees

Account type and leverage can significantly influence trading costs and fees.

- Spread: The spread is the difference between the bid and ask price of a currency pair. Forex.com typically offers tighter spreads for Direct Accounts compared to Standard Accounts. The spread can be a significant factor in trading costs, especially when trading high-volume or volatile currency pairs.

- Commissions: Some account types, such as the Zero Account, offer commission-free trading, while others, such as the Standard and Direct Accounts, may charge commissions. The commission structure can vary depending on the account type and trading volume.

- Margin Requirements: Margin requirements are the amount of money you need to deposit to open a trade. Higher leverage levels typically result in lower margin requirements, which can be beneficial for traders with limited capital. However, it’s important to note that higher leverage also increases the risk of losses.

Account Type Features and Benefits in Relation to Leverage

Each Forex.com account type offers unique features and benefits related to leverage:

- Standard Account: This account provides a balance between leverage and trading costs, making it suitable for beginners and experienced traders alike. It offers a lower leverage level compared to the Direct Account, which can be advantageous for managing risk.

- Direct Account: This account offers higher leverage, allowing traders to control larger positions with smaller capital. However, it comes with higher margin requirements and spreads, making it more suitable for experienced traders with a higher risk tolerance.

- Zero Account: This account provides commission-free trading and a moderate leverage level, making it an attractive option for traders who prioritize cost-effectiveness and risk management. However, the lower leverage level may limit the potential for high profits.

Last Point

Navigating the world of forex leverage requires a deep understanding of its mechanics and a commitment to responsible risk management. By carefully considering your trading goals, risk tolerance, and the leverage levels offered by Forex.com, you can harness the power of leverage to maximize your trading potential while mitigating potential losses.

Commonly Asked Questions: Forex.com Leverage

What is the maximum leverage offered by Forex.com?

The maximum leverage offered by Forex.com varies depending on the account type and the specific trading instrument. It’s essential to check the specific leverage details for your chosen account and trading pair.

How can I calculate my potential profit or loss with leverage?

To calculate your potential profit or loss, multiply your leverage by the size of your position and the price movement. For example, with a 1:100 leverage and a $1,000 position, a 1% price movement would result in a $100 profit or loss.

What are the consequences of insufficient margin?

If your margin balance falls below the required margin level, you may receive a margin call, requiring you to deposit additional funds to maintain your position. If you fail to meet the margin call, your position may be liquidated to cover your losses.