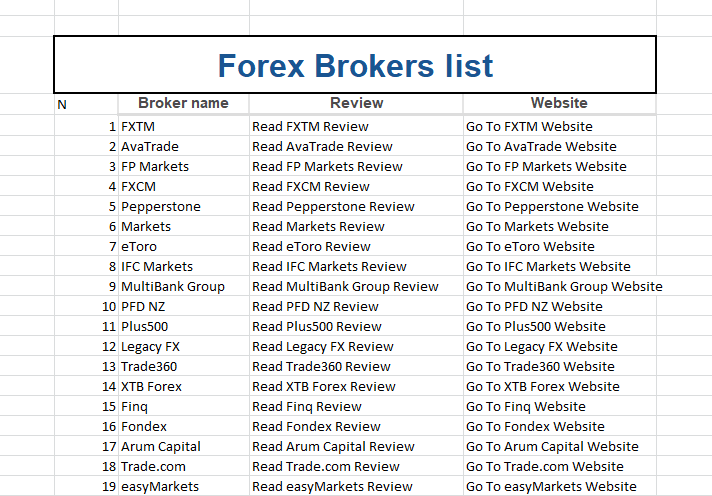

Forex brokers list is your one-stop shop for navigating the complex world of foreign exchange trading. Whether you’re a seasoned trader or just starting out, understanding the role of forex brokers is crucial for success. These intermediaries connect you to the global forex market, providing access to trading platforms, tools, and resources.

Choosing the right forex broker can significantly impact your trading experience. Factors like regulation, trading platforms, spreads, and customer support play a vital role in ensuring a secure and efficient trading environment. By carefully considering these factors and exploring the brokers listed in this guide, you can find the perfect partner to navigate the exciting and dynamic world of forex trading.

Introduction to Forex Brokers: Forex Brokers List

Forex brokers act as intermediaries between traders and the foreign exchange market, facilitating the buying and selling of currencies. They provide traders with access to trading platforms, market data, and execution services, allowing them to participate in the global currency market.

Types of Forex Brokers

Forex brokers can be categorized into different types based on their business models and trading execution methods. Understanding these types is crucial for traders to choose a broker that aligns with their trading style and risk tolerance.

- Market Makers: These brokers act as counterparties to their clients’ trades, taking the opposite side of each transaction. They profit from the bid-ask spread, which is the difference between the buying and selling prices of a currency pair. Market makers offer tight spreads and fast execution but may be susceptible to conflicts of interest.

- ECN (Electronic Communication Network) Brokers: These brokers connect traders directly to the interbank market, allowing them to access the best available prices. ECN brokers typically charge a commission on trades, but they offer transparency and competitive pricing.

- STP (Straight-Through Processing) Brokers: These brokers act as intermediaries, routing orders to liquidity providers without taking the opposite side of the trade. They offer transparency and competitive pricing but may have slower execution speeds than market makers.

Key Features and Benefits of Using a Forex Broker

Forex brokers offer a range of features and benefits that enhance the trading experience for their clients. These features can include:

- Trading Platforms: Forex brokers provide trading platforms that allow traders to access the market, place orders, and monitor their positions. These platforms often come with advanced charting tools, technical indicators, and real-time market data.

- Educational Resources: Many forex brokers offer educational resources, such as webinars, tutorials, and articles, to help traders learn about forex trading and improve their skills. These resources can be invaluable for both beginner and experienced traders.

- Customer Support: Forex brokers provide customer support to assist traders with any questions or issues they may encounter. This support can be accessed through phone, email, or live chat.

- Account Types: Forex brokers offer different account types to cater to the needs of various traders. These account types may vary in terms of minimum deposit requirements, leverage levels, and trading conditions.

- Security and Regulation: Reputable forex brokers are regulated by financial authorities, ensuring that they meet certain standards of security and transparency. This regulation provides traders with an added layer of protection.

Factors to Consider When Choosing a Forex Broker

Choosing the right Forex broker is crucial for success in the market. It’s like picking the right tools for a job – the wrong choice can lead to frustration and losses. This section will guide you through key factors to consider when selecting a Forex broker.

Regulation and Licensing

Regulation is essential for ensuring the safety and security of your funds. Regulated brokers are subject to strict rules and oversight by financial authorities, providing a layer of protection for traders. Here are some key benefits of choosing a regulated broker:

- Financial Security: Regulated brokers are required to maintain adequate capital reserves, safeguarding your funds even if the broker faces financial difficulties.

- Transparency and Accountability: Regulated brokers are subject to regular audits and reporting requirements, ensuring transparency in their operations.

- Dispute Resolution: If you encounter a dispute with a regulated broker, you have access to independent dispute resolution mechanisms.

Trading Platform

The trading platform is your interface with the Forex market. It should be user-friendly, reliable, and offer the features you need to execute trades effectively.

- Ease of Use: The platform should be intuitive and easy to navigate, allowing you to place orders, manage your positions, and monitor market movements effortlessly.

- Order Execution: Look for a platform that offers fast and reliable order execution, minimizing slippage and ensuring your orders are filled at the desired price.

- Charting and Analysis Tools: A robust platform will provide a range of charting tools and technical indicators to help you analyze market trends and make informed trading decisions.

- Mobile App: A mobile app allows you to trade on the go, giving you access to the market from anywhere with an internet connection.

Spreads and Commissions, Forex brokers list

Spreads and commissions are the fees charged by brokers for providing access to the Forex market. They can significantly impact your profitability, so it’s essential to compare different brokers and their fee structures.

- Spreads: The spread is the difference between the buy and sell price of a currency pair. A lower spread generally means lower trading costs.

- Commissions: Some brokers charge commissions on top of spreads, especially for ECN accounts. Ensure you understand the full cost structure before opening an account.

- Variable vs. Fixed Spreads: Variable spreads fluctuate with market volatility, while fixed spreads remain constant. Choose the spread type that best suits your trading style and risk tolerance.

Account Types

Forex brokers offer different types of trading accounts to cater to various trading styles and levels of experience.

- Demo Accounts: Demo accounts allow you to practice trading in a risk-free environment using virtual funds. This is a great way to familiarize yourself with the platform and develop your trading strategies before risking real money.

- Standard Accounts: Standard accounts are the most common type of account and offer a balance between features and costs. They are suitable for both beginners and experienced traders.

- ECN Accounts: ECN (Electronic Communication Network) accounts offer direct access to the interbank market, typically with lower spreads but higher commissions. These accounts are suitable for high-volume traders who seek the best possible execution prices.

Customer Support

Reliable and responsive customer support is crucial, especially when you encounter technical issues or have questions about your account.

- Availability: Look for a broker that offers 24/5 or 24/7 customer support through various channels, such as email, phone, and live chat.

- Responsiveness: Customer support should be prompt and helpful, resolving your issues quickly and efficiently.

- Knowledge and Expertise: The support team should have a good understanding of Forex trading and be able to provide accurate and relevant information.

Educational Resources

Many Forex brokers offer educational resources to help traders improve their skills and knowledge.

- Tutorials and Articles: Educational materials can cover topics such as fundamental and technical analysis, trading strategies, and risk management.

- Webinars and Seminars: Live webinars and seminars provide interactive learning experiences and allow you to ask questions directly to experts.

- Trading Courses: Some brokers offer comprehensive trading courses that cover various aspects of Forex trading in detail.

Last Word

With a comprehensive understanding of the factors to consider when choosing a forex broker, you can make an informed decision that aligns with your trading goals and risk tolerance. By leveraging the information provided in this guide, you can confidently navigate the forex market and maximize your trading potential. Remember, selecting the right forex broker is an essential step towards achieving success in the dynamic world of foreign exchange trading.

Detailed FAQs

What is the minimum deposit required for forex trading?

Minimum deposit requirements vary significantly among brokers. Some brokers may offer accounts with low minimum deposits, while others may require a higher initial investment. It’s essential to check the specific requirements of each broker before opening an account.

What are the risks associated with forex trading?

Forex trading carries inherent risks, including the potential for significant financial losses. Fluctuations in exchange rates can lead to rapid price movements, and leverage can amplify both profits and losses. It’s crucial to understand and manage these risks before engaging in forex trading.

How can I learn more about forex trading?

Many resources are available to help you learn about forex trading, including online courses, webinars, and educational materials provided by brokers. It’s essential to invest time in learning the fundamentals of forex trading before making any real-money trades.