Forex broker forex sets the stage for this enthralling narrative, offering readers a glimpse into a world where financial markets meet technology. Forex brokers are the bridge between individual traders and the global foreign exchange market, facilitating the buying and selling of currencies. This comprehensive guide delves into the intricacies of forex broker forex, providing insights into the various types of brokers, trading platforms, and strategies employed in this dynamic arena.

From understanding the basics of forex trading to navigating the complexities of choosing the right broker, this exploration aims to equip readers with the knowledge and tools necessary to embark on their forex trading journey. We will explore the key features and services offered by forex brokers, examine the different types of trading accounts available, and delve into the critical aspects of regulation, security, and customer support.

Introduction to Forex Brokers

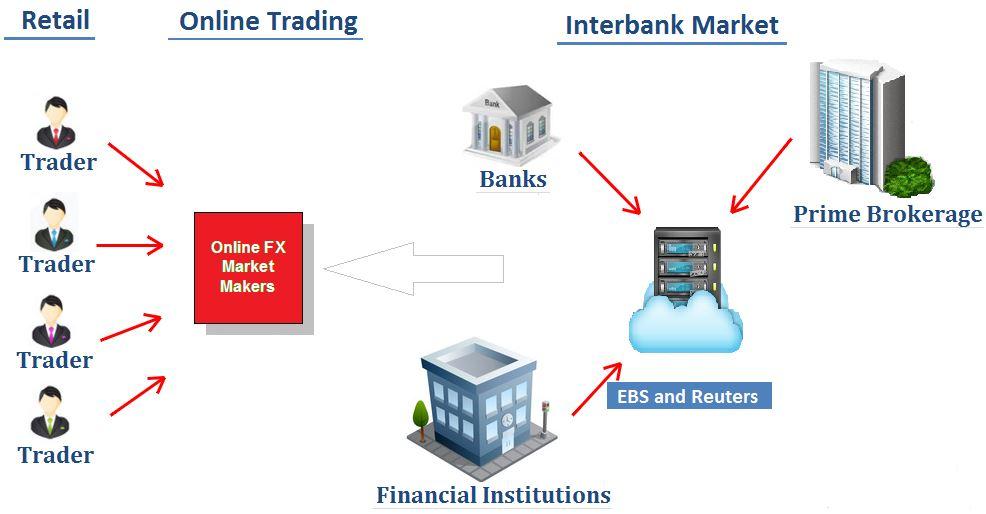

Forex brokers play a crucial role in the foreign exchange market, facilitating trading for individuals and institutions. They act as intermediaries between traders and the global forex market, providing access to trading platforms, execution services, and other essential tools.

Types of Forex Brokers

Forex brokers can be categorized into different types based on their business models and trading execution methods. Here are some common types:

- Market Makers: These brokers act as counterparties to their clients’ trades, taking the opposite side of their orders. They profit from the spread between the bid and ask prices, which is the difference between the price at which they buy and sell currencies. Market makers typically offer tight spreads and fast execution speeds but may have potential conflicts of interest.

- ECNs (Electronic Communication Networks): ECNs are platforms that connect multiple market participants, including brokers, banks, and other institutions, allowing them to trade directly with each other. ECN brokers typically offer transparent pricing and low spreads but may have higher commission fees.

- STP (Straight-Through Processing) Brokers: STP brokers route their clients’ orders directly to liquidity providers, such as banks and other institutions, without any manual intervention. They aim to provide transparent pricing and fast execution, but may have limited control over the order execution process.

Key Features and Services

Forex brokers offer a range of features and services to support traders. Some of the key features include:

- Trading Platforms: Forex brokers provide trading platforms that allow traders to place orders, manage their accounts, and analyze market data. Platforms can be web-based, desktop-based, or mobile-based, offering varying levels of functionality and features.

- Account Types: Brokers offer different account types to cater to the needs of various traders. These account types may differ in minimum deposit requirements, leverage levels, and trading tools and features.

- Leverage: Forex brokers provide leverage, allowing traders to control larger positions with a smaller amount of capital. Leverage can amplify both profits and losses, so it’s important to understand and manage risk effectively.

- Educational Resources: Many brokers offer educational resources, such as articles, tutorials, webinars, and trading courses, to help traders learn about forex trading and improve their skills.

- Customer Support: Reliable customer support is crucial for traders, especially when facing technical issues or needing assistance with their accounts.

- Security: Forex brokers should prioritize the security of their clients’ funds and personal information. They should use industry-standard security measures, such as encryption and two-factor authentication.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates. It is the largest and most liquid financial market globally, with trillions of dollars changing hands daily. This vast market offers opportunities for traders of all experience levels, from beginners to seasoned professionals.

Types of Forex Orders, Forex broker forex

Forex orders are instructions given to a broker to execute a trade at a specific price or under certain conditions. Understanding the different types of orders is crucial for successful trading.

- Market Orders: Market orders are executed immediately at the best available price in the market. They are used when a trader wants to enter or exit a trade quickly, regardless of the price. However, they can result in slippage, where the actual execution price differs from the expected price due to market volatility.

- Limit Orders: Limit orders are placed at a specific price or better. They are used when a trader wants to buy a currency at a certain price or sell it at a higher price. Limit orders help manage risk by preventing trades from being executed at unfavorable prices. If the desired price is not reached, the order will not be executed.

- Stop Orders: Stop orders are placed at a specific price, but they are executed only when the market price reaches that level. They are used to limit losses or protect profits. Stop-loss orders are placed below the entry price for a buy order and above the entry price for a sell order. Stop-limit orders combine the features of stop and limit orders, setting a stop price and a limit price. Once the stop price is reached, the order becomes a limit order, which is executed at the limit price or better.

Trading Strategies

Forex trading strategies are systematic approaches to trading that aim to maximize profits and minimize losses. They are based on various factors, including technical analysis, fundamental analysis, and risk management.

- Trend Trading: Trend trading involves identifying and trading in the direction of the prevailing trend. Traders use technical indicators like moving averages and trend lines to spot trends. They aim to enter trades when the trend is strong and exit when it weakens. This strategy is best suited for long-term trading.

- Scalping: Scalping is a short-term trading strategy that involves making small profits from quick price movements. Scalpers typically use high leverage and aim to capture small price fluctuations in a short period. This strategy requires a high level of skill and discipline, as it involves frequent trades and fast decision-making.

- News Trading: News trading involves capitalizing on price movements caused by economic news releases. Traders analyze economic data like inflation rates, unemployment figures, and interest rate decisions to anticipate price changes. They aim to enter trades before the news release and exit after the price reaction. This strategy requires a strong understanding of economic indicators and their impact on currency pairs.

Conclusive Thoughts

In conclusion, the world of forex broker forex is a fascinating landscape where individuals can access the global currency market. Choosing the right forex broker is paramount, as it lays the foundation for a successful trading experience. By carefully considering factors such as regulation, trading platforms, spreads, and customer support, traders can identify brokers that align with their individual needs and risk tolerance. The journey into the world of forex broker forex is an exciting one, offering opportunities for both experienced traders and newcomers alike.

Key Questions Answered: Forex Broker Forex

What are the risks associated with forex trading?

Forex trading involves inherent risks, including market volatility, leverage, and potential for losses. It’s crucial to understand and manage these risks through proper research, risk management strategies, and responsible trading practices.

How do I choose the best forex broker for my needs?

Consider factors such as regulation, trading platform, spreads, leverage, customer support, and account types when selecting a forex broker. Research and compare different brokers to find one that aligns with your trading style and goals.

What are the different types of forex trading accounts?

Forex brokers offer various account types, including demo accounts, standard accounts, micro accounts, and Islamic accounts. Each account type has specific requirements and features, so choose one that suits your trading experience and capital.