Forex account trading is the gateway to the dynamic world of foreign exchange, where individuals and institutions trade currencies to capitalize on price fluctuations. This guide delves into the essential aspects of Forex account trading, from understanding account types and trading platforms to navigating risk management and mastering trading strategies.

Understanding the different types of Forex accounts, such as standard, mini, and micro accounts, is crucial for selecting the one that aligns with your trading experience, capital, and trading style. This guide explores the features of each account type and provides insights into the associated fees and commissions.

Forex Trading Platforms

Choosing the right Forex trading platform is crucial for success in the market. A good platform provides the tools and features you need to analyze the market, execute trades, and manage your risk effectively.

Popular Forex Trading Platforms

Forex trading platforms offer a range of features, from basic order execution to advanced charting tools and automated trading strategies. Some of the most popular platforms include MetaTrader 4 (MT4), cTrader, and TradingView.

- MetaTrader 4 (MT4) is a widely used platform known for its stability, customizability, and extensive charting tools. It offers a wide range of order types, including market, limit, stop, and trailing stop orders. MT4 also supports Expert Advisors (EAs), which are automated trading strategies that can execute trades based on predefined rules.

- cTrader is another popular platform that emphasizes speed and execution quality. It is known for its advanced charting capabilities, including real-time market depth and customizable indicators. cTrader also supports copy trading, where you can follow the trades of experienced traders.

- TradingView is a web-based platform that focuses on charting and technical analysis. It offers a wide range of indicators, drawing tools, and real-time market data. TradingView also provides a social network where traders can share ideas and strategies.

Importance of Platform Features

The features of a Forex trading platform play a vital role in your trading success.

- Charting Tools are essential for technical analysis. Good charting tools allow you to identify trends, patterns, and support/resistance levels.

- Order Types provide flexibility in how you execute trades. Market orders are executed immediately at the current market price, while limit orders are executed only at a specific price or better. Stop orders help limit your losses, while trailing stop orders automatically adjust your stop loss as the price moves in your favor.

- Real-Time Market Data is crucial for making informed trading decisions. It allows you to see the current market price, order book, and other important information in real-time.

Trading Indicators and Automated Trading Strategies

Trading indicators and automated trading strategies can enhance your trading process.

- Trading Indicators are mathematical calculations that provide insights into market trends and sentiment. Popular indicators include the Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI), and Stochastic Oscillator.

- Automated Trading Strategies, also known as Expert Advisors (EAs), can execute trades based on predefined rules. EAs can automate tasks like placing orders, managing risk, and exiting trades. They can be particularly helpful for traders who want to automate their trading or are not available to monitor the market constantly.

Funding a Forex Account

Funding your Forex account is the first step in your trading journey. You need to deposit money into your account to start trading, and you can withdraw your profits once you start making money. The process is usually straightforward, but it’s essential to choose secure and reliable methods to protect your funds.

Deposit Methods

Several methods allow you to deposit funds into your Forex account. These methods offer different levels of convenience and security. Here’s a closer look at the most common deposit methods:

- Bank Transfers: This method involves transferring funds directly from your bank account to your Forex account. It is generally considered a secure method, as it involves direct transfers between financial institutions. However, bank transfers can be slower than other methods, sometimes taking several business days to complete.

- Credit/Debit Cards: Using credit or debit cards is a popular method for depositing funds into Forex accounts. It’s convenient and allows for instant deposits. However, some brokers may charge fees for using this method. You should also be aware of the potential risks associated with using credit cards for trading, as it can lead to debt if you are not careful.

- E-Wallets: E-wallets like PayPal, Skrill, and Neteller are popular choices for funding Forex accounts. They offer fast and secure transactions, and they can be used to withdraw funds as well. However, e-wallets may charge fees for deposits and withdrawals.

Choosing Secure Deposit Methods

Choosing a secure deposit method is crucial for protecting your funds. Here are some factors to consider:

- Security: Look for brokers that use secure encryption technology to protect your personal and financial information. You should also check if the broker has a license from a reputable regulatory body.

- Reliability: Choose a deposit method that is reliable and has a proven track record of security. Avoid using methods that are known to be unreliable or have a history of fraud.

- Fees: Consider the fees associated with different deposit methods. Some methods may have higher fees than others, so it’s important to compare the costs before making a decision.

Withdrawing Profits

Once you start making profits from Forex trading, you can withdraw your earnings. The process for withdrawing funds is usually similar to the deposit process. You can withdraw funds using the same methods you used to deposit them.

- Withdrawal Fees: Brokers may charge fees for withdrawing funds. These fees can vary depending on the withdrawal method and the amount you are withdrawing. It’s important to check the broker’s fee schedule before making a withdrawal.

- Withdrawal Timeframes: Withdrawal timeframes can vary depending on the method you choose. Bank transfers can take several business days to complete, while e-wallet withdrawals can be processed within a few hours. Some brokers may have minimum withdrawal amounts, so it’s essential to check their terms and conditions before requesting a withdrawal.

Forex Trading Strategies

Forex trading strategies are systematic approaches to making trading decisions in the foreign exchange market. These strategies aim to identify potential trading opportunities, manage risk, and ultimately, generate profits. While various strategies exist, they all share the fundamental principle of analyzing market trends and utilizing specific techniques to execute trades.

Comparison of Forex Trading Strategies

The choice of a Forex trading strategy depends on individual preferences, risk tolerance, and available time commitment. Here’s a comparison of three popular Forex trading strategies:

| Strategy | Timeframe | Risk Tolerance | Profit Potential |

|---|---|---|---|

| Scalping | Short-term (seconds to minutes) | High | Small, frequent profits |

| Day Trading | Intraday (minutes to hours) | Moderate | Moderate profits |

| Swing Trading | Medium-term (days to weeks) | Low | Larger profits, but less frequent |

Developing a Forex Trading Strategy

Developing a robust Forex trading strategy is crucial for success. The following flowchart illustrates the key steps involved:

Flowchart:

1. Market Analysis:

– Identify potential trading opportunities based on technical and fundamental analysis.

– Analyze price charts, economic indicators, and news events.

2. Strategy Selection:

– Choose a strategy that aligns with your risk tolerance, trading style, and available time.

3. Entry and Exit Points:

– Define clear entry and exit points based on technical indicators, price patterns, and support/resistance levels.

4. Risk Management:

– Determine appropriate stop-loss orders to limit potential losses.

– Set a risk management plan that aligns with your trading capital.

5. Trade Execution:

– Execute trades based on your pre-defined strategy and risk management plan.

6. Monitoring and Evaluation:

– Monitor your trades and adjust your strategy as needed based on market conditions and performance.

7. Backtesting and Forward Testing:

– Test your strategy on historical data to assess its performance.

– Simulate live trading conditions to evaluate the strategy’s effectiveness in real-time.

Importance of Backtesting and Forward Testing

Backtesting and forward testing are essential steps in developing and validating a Forex trading strategy.

– Backtesting: Analyzing historical data to evaluate a strategy’s past performance. This helps identify potential flaws and areas for improvement.

– Forward Testing: Simulating live trading conditions using historical data. This assesses the strategy’s effectiveness in a real-time environment, considering market volatility and potential biases.

“Backtesting and forward testing are essential for ensuring a Forex trading strategy is robust and has the potential to generate profits in live trading.”

By backtesting and forward testing, traders can:

– Validate the effectiveness of their strategies: Identify strengths and weaknesses, and refine the strategy based on real-world data.

– Optimize parameters: Adjust entry and exit points, stop-loss levels, and other parameters to improve performance.

– Reduce risk: Identify potential pitfalls and mitigate risks before deploying the strategy in live trading.

Forex Risk Management

Forex trading, like any other financial market, involves inherent risks. Effective risk management is crucial for safeguarding your capital and maximizing your trading potential. This involves a set of strategies and techniques aimed at minimizing potential losses while allowing you to take advantage of profitable opportunities.

Stop-Loss Orders

Stop-loss orders are essential tools for limiting potential losses on trades. They are pre-set instructions to automatically close a trade when the price reaches a specific level. For example, if you buy EUR/USD at 1.1000 and set a stop-loss order at 1.0950, your trade will automatically close if the price falls to 1.0950, limiting your loss to 50 pips.

Position Sizing

Position sizing refers to determining the appropriate amount of money to invest in each trade. It’s a key aspect of risk management because it directly influences the potential profit or loss from a trade. A good rule of thumb is to risk no more than 1-2% of your trading capital on any single trade. This ensures that even if a trade goes against you, you won’t lose a significant portion of your capital.

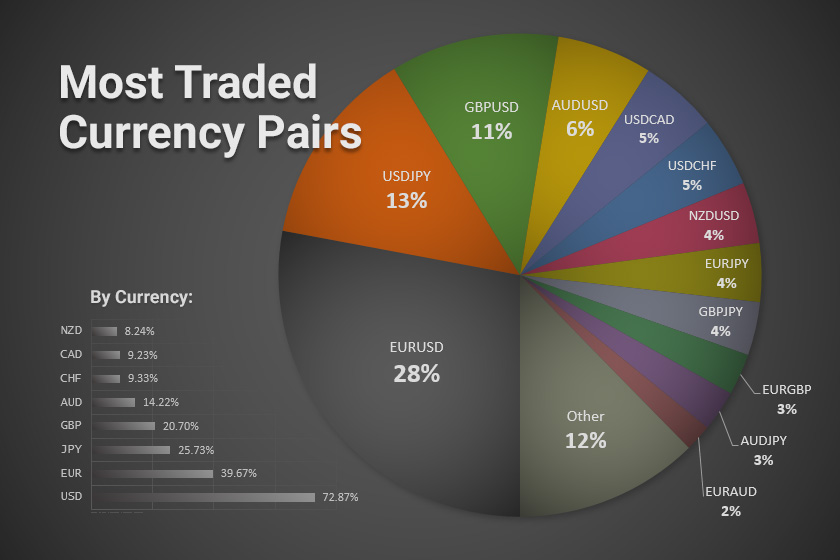

Diversification, Forex account trading

Diversification is the practice of spreading your trading capital across multiple currencies or asset classes. This helps to reduce overall risk by mitigating the impact of losses in any single currency pair. For example, instead of investing all your capital in EUR/USD, you might diversify your portfolio by investing in other pairs like GBP/USD, USD/JPY, or AUD/USD.

Leverage in Forex Trading

Leverage is a powerful tool in Forex trading that allows traders to control a larger position with a smaller amount of capital. For example, a leverage of 1:100 means that you can control $100,000 worth of currency with only $1,000 of your own money. While leverage can amplify potential profits, it also amplifies potential losses. It’s crucial to use leverage responsibly and only take positions you can afford to lose.

“Leverage can be a double-edged sword. It can amplify your profits, but it can also amplify your losses. It’s crucial to use leverage responsibly and only take positions you can afford to lose.”

Forex Market Analysis

Understanding how the Forex market moves is crucial for successful trading. Forex market analysis involves studying factors that influence currency prices, helping traders make informed decisions. There are two primary approaches to analyzing the Forex market: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis focuses on economic factors that affect currency values. These factors can include:

- Economic Growth: A country’s economic growth rate is a key indicator of its currency’s strength. Strong economic growth often leads to a stronger currency.

- Interest Rates: Central banks set interest rates to control inflation and economic growth. Higher interest rates attract foreign investment, boosting demand for the currency and strengthening it.

- Government Debt: High government debt can weaken a currency as it suggests a country’s financial instability.

- Political Stability: Political instability can negatively impact a currency’s value. Uncertainty about a country’s future can discourage investors and lead to a weaker currency.

- Trade Balance: A trade surplus (exports exceeding imports) indicates a strong economy and can support a currency’s value. A trade deficit (imports exceeding exports) can weaken the currency.

Traders analyze economic data releases, such as GDP growth, inflation figures, and interest rate decisions, to assess the economic health of a country and predict potential currency movements.

Key Economic Indicators and News Events

Several economic indicators and news events can significantly impact Forex prices:

- Non-Farm Payrolls (NFP): This report measures the change in employment in the United States, excluding agricultural, government, and non-profit sectors. A strong NFP report can boost the US dollar, while a weak report can weaken it.

- Consumer Price Index (CPI): This measures the change in prices of consumer goods and services. High inflation can weaken a currency as it erodes purchasing power.

- Interest Rate Decisions: Central banks’ decisions on interest rates can have a significant impact on currency values. A rate hike typically strengthens a currency, while a rate cut can weaken it.

- Political Events: Political events, such as elections, policy changes, or international conflicts, can also affect currency values. For example, a political crisis can lead to a weakening of the affected country’s currency.

- Economic Reports: Various economic reports, such as manufacturing PMI, retail sales, and trade balances, provide insights into a country’s economic health and can influence currency movements.

Technical Analysis

Technical analysis focuses on historical price data and trading patterns to identify trends and predict future price movements. It assumes that past price action reflects all relevant information and that patterns repeat themselves.

Popular Technical Indicators

Technical analysts use various indicators to analyze price charts and identify trading opportunities. Some common indicators include:

- Moving Averages: These are calculated by averaging a currency’s price over a specific period. They can identify trends and support/resistance levels.

- MACD (Moving Average Convergence Divergence): This indicator compares two moving averages to identify trend changes and potential buy/sell signals.

- RSI (Relative Strength Index): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- Stochastic Oscillator: This indicator compares a currency’s closing price to its price range over a specific period to identify overbought or oversold conditions.

Forex Trading Psychology

The Forex market is a highly emotional environment, and traders often struggle with psychological challenges that can negatively impact their trading decisions. Understanding and managing these emotions is crucial for consistent success in Forex trading.

The Psychological Challenges of Forex Trading

Forex trading involves dealing with a constant flow of information, market volatility, and the pressure of making potentially risky decisions. This can lead to a range of psychological challenges, including:

- Fear: Fear of losing money can lead to indecision, hesitation, and premature exits from trades. It can also lead to overtrading, where traders take on more risk than they can handle in an attempt to recover losses.

- Greed: The desire for quick profits can lead to overconfidence, ignoring risk management principles, and chasing losing trades. Greed can also lead to holding onto losing positions for too long, hoping for a reversal that may never come.

- Overconfidence: After a few successful trades, traders may become overconfident and believe they have a special ability to predict market movements. This can lead to taking on excessive risk and making poor decisions.

Strategies for Managing Trading Emotions

Managing trading emotions is an ongoing process that requires self-awareness, discipline, and a commitment to improving trading habits. Here are some strategies that can help:

- Develop a Trading Plan: A well-defined trading plan helps to eliminate emotional decisions by providing a framework for entering and exiting trades. It should Artikel your trading goals, risk tolerance, and specific entry and exit strategies.

- Practice Risk Management: Always use stop-loss orders to limit potential losses on trades. This helps to protect your capital and prevents emotional decisions when markets move against you.

- Keep a Trading Journal: Regularly record your trading decisions, including the rationale behind them, the outcome, and any emotional factors that influenced your decisions. This helps to identify patterns in your trading behavior and areas for improvement.

- Take Breaks: Trading can be mentally and emotionally draining. It’s important to take breaks from the markets to clear your head and avoid making impulsive decisions.

- Seek Professional Guidance: Consider working with a Forex trading coach or mentor who can provide support and guidance on managing trading emotions and improving your trading skills.

The Importance of a Trading Journal

A trading journal is an essential tool for Forex traders. It provides a record of your trading activity, allowing you to analyze your performance, identify patterns, and improve your decision-making.

- Track Performance: Your trading journal should include details about each trade, such as the entry and exit points, the profit or loss, and the rationale behind the trade.

- Identify Areas for Improvement: By reviewing your trading journal, you can identify areas where you consistently make mistakes or experience emotional biases. This allows you to develop strategies to address these weaknesses and improve your trading.

- Improve Discipline: Keeping a trading journal helps to hold you accountable for your trading decisions and promotes discipline by encouraging you to stick to your trading plan.

Ultimate Conclusion: Forex Account Trading

Mastering Forex account trading requires a blend of knowledge, discipline, and strategic thinking. By understanding the fundamentals of account types, trading platforms, risk management, and trading strategies, you can navigate the complexities of the Forex market and potentially achieve profitable outcomes. Remember, continuous learning and adaptation are key to success in this dynamic environment.

Essential FAQs

What are the minimum deposit requirements for Forex accounts?

Minimum deposit requirements vary widely among brokers. Some offer micro accounts with deposits as low as $5, while others require a few hundred or even thousands of dollars. It’s essential to research and choose a broker that aligns with your financial capacity.

How do I choose the right Forex broker?

Consider factors like regulation, trading platform features, spreads, customer support, and deposit/withdrawal options. Look for brokers with a good reputation, strong regulatory oversight, and a user-friendly platform that meets your trading needs.

What is leverage in Forex trading, and how does it work?

Leverage allows traders to control a larger position in the market with a smaller initial investment. For example, a 1:100 leverage means you can control $100,000 worth of currency with a $1,000 deposit. While leverage can amplify profits, it also magnifies losses, so it’s crucial to use it responsibly and manage risk effectively.