Demo forex accounts provide a risk-free environment to learn and practice forex trading strategies before risking real money. These accounts offer a realistic simulation of live market conditions, allowing you to explore different trading techniques, test your strategies, and gain valuable experience without any financial risk. They are an invaluable tool for both beginners and experienced traders, enabling them to hone their skills, build confidence, and make informed trading decisions.

Demo accounts are typically equipped with a variety of features, including access to real-time market data, charting tools, technical indicators, and trading platforms. They also provide access to a range of trading instruments, such as currency pairs, commodities, and indices, allowing you to experiment with different asset classes and develop a comprehensive understanding of the forex market.

What are Demo Forex Accounts?

A demo forex account is a virtual trading environment that allows you to practice forex trading without risking real money. It is a powerful tool for beginners and experienced traders alike, providing a safe space to learn the ropes, experiment with different strategies, and build confidence before venturing into live trading.

Purpose of Demo Forex Accounts

Demo accounts serve a crucial purpose in forex trading, offering a risk-free platform for:

- Learning the basics of forex trading: Demo accounts provide a hands-on experience, allowing you to familiarize yourself with the trading platform, understand order types, and explore different market indicators without financial risk.

- Testing trading strategies: You can experiment with various trading strategies, such as scalping, day trading, or swing trading, and analyze their effectiveness without impacting your real capital.

- Developing trading skills: By practicing in a risk-free environment, you can refine your trading skills, improve your decision-making, and gain valuable experience before entering the live market.

- Building confidence: Demo accounts allow you to build confidence in your trading abilities by simulating real-world trading conditions, helping you overcome the fear of losing money when you eventually transition to live trading.

Benefits of Using a Demo Account

Demo accounts offer a plethora of benefits, making them an invaluable tool for forex traders of all levels. Here are some key advantages:

- Risk-free trading: The most significant advantage of a demo account is that you can practice trading without risking your own money. This allows you to make mistakes and learn from them without incurring any financial losses.

- Access to real-time market data: Demo accounts provide access to the same real-time market data and trading tools available to live traders, allowing you to practice with up-to-date information.

- Flexibility and control: You can customize your demo account to match your trading style and preferences, adjusting leverage, account size, and trading instruments to suit your needs.

- Experimentation and strategy development: Demo accounts provide a safe environment to test new trading strategies, analyze market trends, and refine your trading approach without any financial risk.

Features of Demo Forex Accounts

Demo accounts typically offer a range of features designed to replicate the live trading experience as closely as possible. These features include:

- Realistic trading platform: Demo accounts provide access to the same trading platform used by live traders, with similar functionalities, charts, indicators, and order types.

- Virtual funds: You are provided with a virtual account balance that you can use to place trades and manage your portfolio, simulating real-world trading conditions.

- Real-time market data: Demo accounts offer access to the same real-time market data and price feeds available to live traders, ensuring that your practice reflects actual market movements.

- Trading tools and indicators: Demo accounts provide access to a wide range of trading tools and indicators, such as technical analysis tools, economic calendars, and news feeds, to enhance your trading experience.

- Historical data: Demo accounts often offer access to historical market data, allowing you to test your strategies on past market conditions and analyze their performance.

How to Choose a Demo Forex Account: Demo Forex Accounts

Choosing the right demo forex account can be crucial for your learning journey. A good demo account allows you to practice trading strategies, test your trading skills, and gain confidence before risking real money. Here’s how to make the right choice:

Key Factors to Consider, Demo forex accounts

It’s important to carefully evaluate different demo accounts before making your decision. Consider these key factors:

- Platform Features: Demo accounts should offer features similar to real trading accounts, including charting tools, technical indicators, order types, and risk management tools. The platform should be user-friendly and intuitive.

- Trading Conditions: Compare factors like spreads, leverage, and trading hours. Look for demo accounts that mirror the trading conditions of the broker’s real accounts.

- Account Funding: Some demo accounts have virtual funds, while others allow you to deposit real money. Consider your learning goals and choose the option that best suits your needs.

- Customer Support: Ensure the demo account provider offers reliable customer support in case you encounter any technical issues or have questions.

- Reputation and Security: Select a demo account from a reputable broker with a strong track record and robust security measures. Look for regulatory licenses and certifications.

Comparing Demo Accounts

Once you’ve identified the key factors, compare different demo accounts based on their features, platforms, and trading conditions.

- Platform: Some platforms are more advanced than others, offering features like real-time market data, news feeds, and economic calendars. Evaluate the platform’s ease of use, customization options, and available charting tools.

- Trading Conditions: Compare spreads, leverage, and trading hours offered by different demo accounts. Choose an account that reflects the trading conditions of the broker’s real accounts.

- Account Funding: Some demo accounts have virtual funds, while others allow you to deposit real money. Consider the advantages and disadvantages of each option.

Finding a Reputable Provider

Finding a reliable and reputable demo account provider is crucial. Here are some tips:

- Research: Read reviews and testimonials from other traders. Look for brokers with a positive reputation in the industry.

- Regulatory Oversight: Ensure the broker is regulated by a reputable financial authority. This indicates that the broker is subject to certain standards and compliance requirements.

- Security Measures: Look for brokers that use advanced security measures, such as encryption and two-factor authentication, to protect your account information.

- Customer Support: Check if the broker offers reliable customer support, including live chat, email, and phone support. This is essential for resolving any technical issues or addressing questions.

Using a Demo Forex Account Effectively

A demo forex account is an invaluable tool for aspiring traders, providing a risk-free environment to practice trading strategies and hone their skills. It allows you to experiment with different trading techniques and develop a solid understanding of the forex market before risking real money.

Developing a Trading Strategy

A well-defined trading strategy is essential for success in forex trading. A demo account allows you to test and refine your strategy without the pressure of real-time market fluctuations.

- Identify Your Trading Style: Determine whether you prefer scalping, day trading, swing trading, or long-term investing. Each style has its own set of strategies and risk management approaches.

- Choose Your Indicators and Tools: Explore various technical indicators, such as moving averages, MACD, RSI, and Bollinger Bands, and experiment with different chart patterns.

- Backtesting and Optimization: Test your strategy on historical data to assess its performance and identify potential areas for improvement.

- Develop a Risk Management Plan: Determine your risk tolerance, set stop-loss orders, and define position sizing based on your account balance.

Practicing Different Trading Techniques

Demo accounts provide a safe space to experiment with various trading techniques, including:

- Trend Trading: Identify and capitalize on the direction of price movements using trendlines, moving averages, and other technical indicators.

- Breakout Trading: Trade based on price breakouts from support or resistance levels, aiming to profit from a significant price movement.

- Scalping: Aim for small profits by entering and exiting trades quickly, taking advantage of minor price fluctuations.

- News Trading: Trade based on economic news releases and events, aiming to capitalize on market reactions.

Importance of Risk Management and Money Management

Risk management and money management are crucial for success in forex trading. A demo account provides a safe environment to practice these essential skills.

“Risk management is not about avoiding risk, but about managing risk.” – Warren Buffett

- Setting Stop-Loss Orders: Limit potential losses by setting stop-loss orders to automatically exit a trade when the price reaches a predetermined level.

- Position Sizing: Determine the appropriate size of your trades based on your account balance and risk tolerance. This helps you avoid risking too much on any single trade.

- Capital Preservation: Focus on preserving your capital by avoiding excessive leverage and managing your risk effectively.

Transitioning from Demo to Live Trading

The thrill of successful demo trading is exciting, but it’s only the first step in your forex journey. Transitioning to live trading requires a different mindset and a strategic approach. The key is to bridge the gap between simulated and real-world trading by understanding the differences and preparing yourself for the challenges ahead.

Understanding the Differences

Demo trading provides a risk-free environment to experiment with strategies, test trading platforms, and gain experience. However, it lacks the emotional and financial pressures of live trading. Here are some key differences to consider:

- Emotional Impact: Live trading involves real money, which can trigger emotions like fear, greed, and anxiety. These emotions can cloud judgment and lead to impulsive decisions. Demo trading doesn’t expose you to these psychological pressures.

- Market Conditions: Demo accounts often use historical data, which may not accurately reflect current market conditions. Live trading exposes you to real-time market fluctuations, including volatility and unexpected events.

- Slippage and Execution: In demo trading, trades are typically executed instantly without slippage. Live trading involves delays and price discrepancies, which can impact profit and loss.

- Account Management: Demo trading doesn’t require managing account balances, risk, or trading fees. Live trading necessitates careful planning and monitoring to ensure sustainable profitability.

Tips for a Smooth Transition

To minimize the transition shock and maximize your chances of success, consider these tips:

- Gradually Increase Risk: Start with a small live account and gradually increase your trading volume as you gain confidence and experience. This approach allows you to test your strategies and manage risk effectively.

- Focus on Discipline: Stick to your trading plan, manage your emotions, and avoid impulsive decisions. Remember, patience and discipline are crucial for long-term success in forex trading.

- Record and Analyze: Keep a detailed journal of your trades, including entry and exit points, reasons for each decision, and the outcome. Analyze your performance to identify areas for improvement and refine your strategies.

- Seek Guidance: Connect with experienced traders, join forex forums, and participate in educational webinars. Learning from others can provide valuable insights and support during the transition.

Checklist for Going Live

Before venturing into live trading, it’s essential to have a clear understanding of your trading goals, risk tolerance, and the necessary tools and resources. Here’s a checklist to ensure you’re fully prepared:

- Define Trading Goals: Set realistic and achievable trading objectives, such as profit targets, risk limits, and time commitment. Clearly define what you want to achieve with forex trading.

- Assess Risk Tolerance: Determine your ability to handle potential losses and manage your risk effectively. Choose a trading strategy and account size that aligns with your risk appetite.

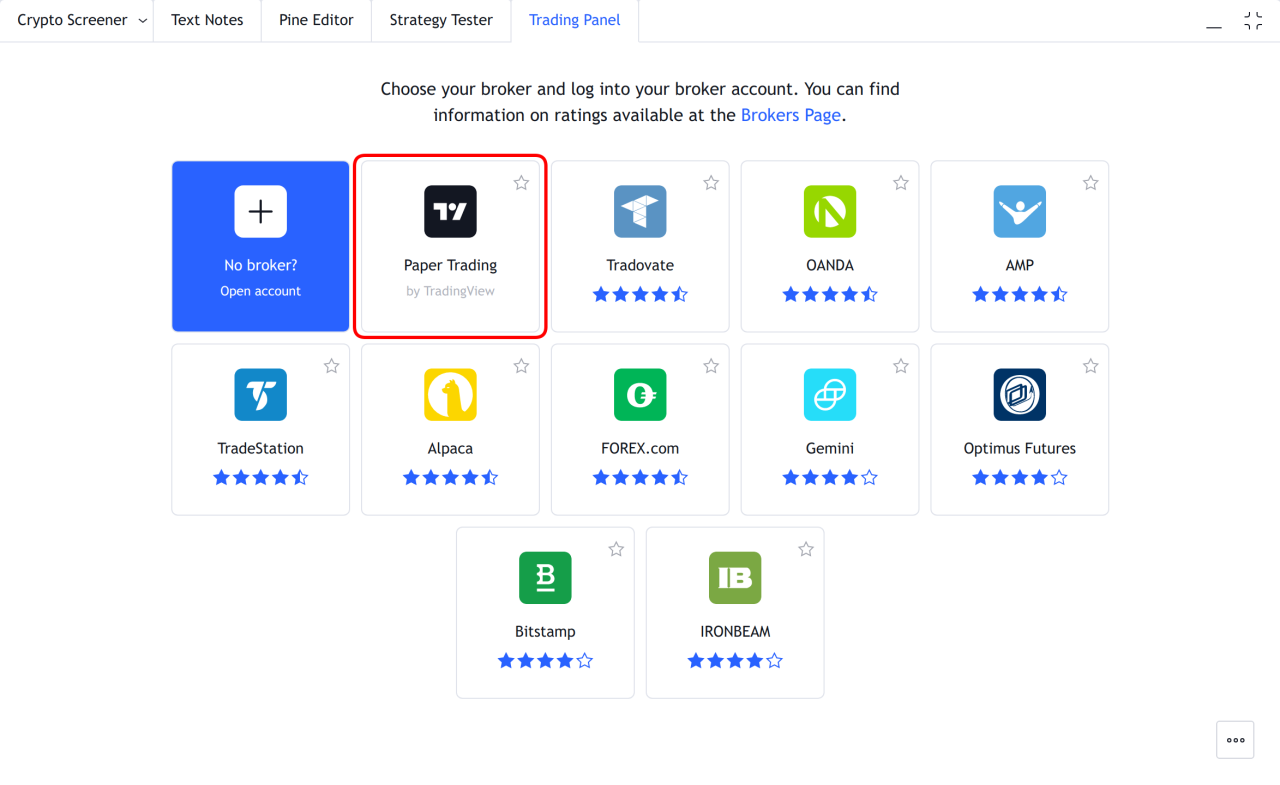

- Select a Broker: Research and choose a reputable forex broker with a reliable trading platform, competitive fees, and excellent customer support. Consider factors like regulation, security, and account types.

- Fund Your Account: Deposit sufficient funds into your live trading account to cover your initial trades and ensure you have enough capital to manage your risk effectively.

- Test Your Strategy: Before going live, thoroughly backtest and forward-test your trading strategy using historical and real-time data. Ensure it aligns with your trading goals and risk tolerance.

- Develop a Trading Plan: Create a comprehensive trading plan outlining your entry and exit strategies, risk management rules, and trading schedule. This plan serves as a roadmap for your live trading journey.

The Importance of Demo Trading

Demo trading is an invaluable tool for both novice and seasoned traders. It provides a risk-free environment to practice trading strategies, learn the ins and outs of the forex market, and develop essential trading skills without risking real capital.

Benefits of Demo Trading for Beginners

The benefits of demo trading are particularly significant for beginners entering the forex market. It allows them to gain hands-on experience with trading platforms, understand market dynamics, and familiarize themselves with various trading tools and indicators without the pressure of real-money losses.

- Familiarization with trading platforms: Demo accounts allow beginners to explore different trading platforms and understand their functionalities, such as placing orders, setting stop-loss and take-profit levels, and managing positions. This hands-on experience helps them navigate the platform efficiently and confidently when they transition to live trading.

- Understanding market dynamics: By observing price movements, analyzing charts, and experimenting with different strategies in a demo environment, beginners can gain a deeper understanding of market dynamics, such as trends, volatility, and news events. This knowledge is crucial for making informed trading decisions.

- Learning technical analysis: Demo accounts provide a platform to practice technical analysis techniques, such as identifying patterns, using indicators, and interpreting chart formations. This hands-on experience helps beginners develop their analytical skills and learn how to apply technical analysis to real-world trading scenarios.

- Developing risk management skills: Demo trading allows beginners to experiment with different risk management strategies, such as setting stop-loss orders and managing position sizes. This practice helps them develop a disciplined approach to risk management, which is essential for long-term trading success.

Benefits of Demo Trading for Experienced Traders

Experienced traders can also benefit significantly from demo trading. It allows them to test new strategies, fine-tune existing ones, and stay ahead of the curve in a constantly evolving market.

- Testing new trading strategies: Demo accounts provide a safe space to experiment with new trading strategies and indicators without risking real capital. This allows traders to backtest their ideas, identify potential flaws, and refine their approach before implementing them in live trading.

- Fine-tuning existing strategies: Experienced traders can use demo accounts to optimize their existing strategies by testing different parameters, entry and exit points, and risk management techniques. This process can help them improve their strategy’s performance and increase their chances of success in live trading.

- Staying ahead of the curve: The forex market is constantly evolving, with new trends, indicators, and trading strategies emerging regularly. Demo accounts allow experienced traders to stay ahead of the curve by experimenting with new techniques and adapting to changing market conditions.

- Practicing trading psychology: Demo trading helps traders manage their emotions and develop a disciplined approach to trading. By simulating real-world trading scenarios, they can learn to control their impulses, avoid emotional decisions, and stick to their trading plan.

Epilogue

Mastering the art of forex trading requires a combination of knowledge, skill, and discipline. Demo accounts play a crucial role in this journey, offering a safe space to experiment, learn from mistakes, and refine your trading strategies. By utilizing demo accounts effectively, you can lay a solid foundation for success in the dynamic and exciting world of forex trading.

FAQ Insights

What are the main differences between a demo account and a live account?

A demo account uses virtual money, while a live account uses real money. Demo accounts are risk-free, while live accounts involve financial risk. The trading conditions in a demo account may not perfectly reflect real-time market conditions.

Can I use a demo account to earn real money?

No, demo accounts are for practice and learning only. You cannot withdraw any profits made on a demo account.

How long should I use a demo account before going live?

There is no set time frame. It depends on your individual learning pace and level of comfort with forex trading. It’s recommended to use a demo account until you feel confident in your trading skills and strategies.

Are demo accounts available for all forex brokers?

Most reputable forex brokers offer demo accounts. However, it’s always a good idea to check the broker’s website or contact their customer support to confirm.