- Introduction to Forex Demo Accounts

- Benefits of Using a Forex Demo Account

- Features of Forex Demo Accounts: Demo Account On Forex

- How to Use a Forex Demo Account Effectively

- Transitioning from Demo to Live Trading

- Examples of Demo Accounts in Action

- Risks and Considerations

- Last Point

- General Inquiries

Demo account on forex, a virtual playground for aspiring traders, offers a risk-free environment to learn the ropes of forex trading. Before venturing into the volatile world of live trading, a demo account allows you to experiment with strategies, analyze market trends, and develop your trading skills without risking your hard-earned capital. This digital sandbox is a valuable tool for both beginners and seasoned traders, providing a space to refine their techniques, test different approaches, and build confidence before committing real funds.

Forex trading, the largest financial market globally, involves exchanging currencies to profit from fluctuations in exchange rates. With a demo account, you can access a wide range of trading instruments, including major, minor, and exotic currency pairs, and practice executing orders, managing positions, and understanding market dynamics. It’s a simulated environment that closely mirrors real-world trading conditions, allowing you to familiarize yourself with the platform’s functionalities, learn to read charts, and understand the intricacies of order execution and risk management.

Introduction to Forex Demo Accounts

Forex, short for foreign exchange, is the global marketplace where currencies are traded. It is the world’s largest and most liquid financial market, with trillions of dollars changing hands every day. In Forex trading, you buy one currency and simultaneously sell another, aiming to profit from the price difference between the two currencies. The value of currencies fluctuates constantly, driven by various factors such as economic data, political events, and market sentiment.

Demo accounts play a crucial role in Forex trading, offering a risk-free environment to learn and practice trading strategies before risking real money. They provide access to real-time market data, trading platforms, and functionalities, allowing traders to familiarize themselves with the market dynamics and develop their trading skills without financial risk.

Popular Forex Brokers Offering Demo Accounts

Many reputable Forex brokers offer demo accounts to their clients. These demo accounts provide a simulated trading environment where traders can practice their strategies and get accustomed to the trading platform without risking real money. Here are some popular Forex brokers known for their demo account offerings:

- MetaTrader 4 (MT4): A popular trading platform widely used by Forex brokers, MT4 offers a user-friendly interface and advanced charting tools. Many brokers provide demo accounts for MT4, allowing traders to familiarize themselves with the platform’s features and functionalities.

- MetaTrader 5 (MT5): The latest version of the MetaTrader platform, MT5 offers enhanced features and functionalities compared to MT4. Many brokers provide demo accounts for MT5, allowing traders to experience the advanced features and tools available on the platform.

- cTrader: A modern and intuitive trading platform known for its advanced charting capabilities and customizable features. Several brokers offer demo accounts for cTrader, providing traders with a sophisticated trading environment to practice their strategies.

Benefits of Using a Forex Demo Account

A Forex demo account is a powerful tool that allows you to experience the Forex market without risking any real money. It provides a simulated trading environment where you can practice your skills, test strategies, and gain confidence before entering the live market.

Risk-Free Practice with Virtual Funds

A demo account lets you trade with virtual funds, providing a risk-free environment to explore the Forex market. This allows you to make mistakes and learn from them without incurring any financial losses. You can experiment with different trading strategies and explore the intricacies of the market without the pressure of real money.

Testing Trading Strategies and Systems

Demo accounts offer a platform to test your trading strategies and systems in a real-time environment. You can analyze market data, identify trends, and evaluate the effectiveness of your chosen trading methods. By backtesting your strategies on historical data and then testing them in a live demo environment, you can gain valuable insights into their performance and make necessary adjustments before deploying them in the live market.

Improving Trading Skills and Confidence

Regular practice on a demo account can significantly improve your trading skills and boost your confidence. You can learn how to manage your trades, identify market opportunities, and develop a consistent trading approach. By understanding the dynamics of the Forex market and practicing your strategies, you can gain valuable experience and build the confidence needed to transition to live trading.

Features of Forex Demo Accounts: Demo Account On Forex

Forex demo accounts are designed to mimic the real trading environment, providing traders with a risk-free platform to practice their skills and test strategies before committing real money. They offer a range of features that make them invaluable tools for aspiring and experienced traders alike.

Platform Access

Demo accounts usually provide access to the same trading platform used for live trading, allowing traders to familiarize themselves with its functionalities and user interface. The platform may offer various features such as charting tools, technical indicators, order types, and risk management tools. For instance, popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are often available in demo versions, providing traders with a seamless transition to live trading.

Trading Instruments

Demo accounts typically offer a wide range of trading instruments, mirroring the options available in live trading. This includes currency pairs, commodities, indices, and sometimes even cryptocurrencies. Traders can experiment with different asset classes, analyzing their price movements and developing trading strategies without financial risk.

Virtual Funds

Demo accounts provide virtual funds, usually in the form of a predetermined amount of virtual currency. This allows traders to execute trades without risking their real money. The virtual funds can be used to place orders, manage positions, and test different trading strategies. While the virtual funds are not real, they offer a realistic trading experience, enabling traders to understand the impact of their decisions on their virtual portfolio.

Real-Time Market Data

Demo accounts typically provide access to real-time market data, just like live trading accounts. This includes live price quotes, charts, and news feeds, allowing traders to stay informed about market trends and make informed trading decisions. The availability of real-time data helps traders develop their market analysis skills and refine their trading strategies.

Educational Resources, Demo account on forex

Many demo account providers offer educational resources, such as tutorials, webinars, and articles, to help traders learn about forex trading. These resources can cover topics such as fundamental and technical analysis, risk management, and trading strategies. Access to educational resources can be particularly beneficial for new traders, helping them gain a better understanding of the forex market and develop their trading skills.

Benefits of Using a Forex Demo Account

Demo accounts offer several advantages, making them a valuable tool for traders of all experience levels. They provide a safe and risk-free environment to practice trading skills, test strategies, and gain confidence before risking real money. Furthermore, they allow traders to familiarize themselves with trading platforms and tools, understand market dynamics, and develop their trading strategies without any financial risk.

How to Open and Activate a Forex Demo Account

Opening a demo account is typically a straightforward process. Most forex brokers offer demo accounts as part of their services. To open a demo account, traders typically need to provide some basic information, such as their name, email address, and phone number. The demo account will then be activated, allowing traders to access the platform and start practicing.

Key Features Comparison

| Feature | Broker A | Broker B | Broker C |

|—|—|—|—|

| Platform Access | MetaTrader 4, MetaTrader 5 | cTrader, NinjaTrader | TradingView, ProRealTime |

| Trading Instruments | Currency pairs, commodities, indices | Currency pairs, commodities, indices, cryptocurrencies | Currency pairs, commodities, indices, ETFs |

| Virtual Funds | $10,000 | $50,000 | $100,000 |

| Real-Time Market Data | Yes | Yes | Yes |

| Educational Resources | Tutorials, webinars | Articles, trading courses | Live trading sessions, market analysis reports |

“Demo accounts provide a valuable opportunity to hone your trading skills and experiment with different strategies without risking your capital.”

How to Use a Forex Demo Account Effectively

A forex demo account is a valuable tool for learning the ins and outs of forex trading without risking real money. To maximize its benefits, you need to approach it strategically, setting realistic goals, managing virtual funds, and analyzing your performance.

Setting Realistic Trading Goals and Objectives

It’s essential to define clear goals for your demo account practice. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, you might aim to learn how to identify and execute specific trading patterns, improve your risk management skills, or achieve a consistent profit margin within a set timeframe.

Managing Virtual Funds and Simulating Real-World Market Conditions

Treat your demo account funds as if they were real money. This discipline helps you develop a realistic trading mindset and avoid reckless trading decisions. You can also adjust the account balance to simulate different trading scenarios, such as starting with a smaller capital or managing a larger portfolio.

Recording and Analyzing Trading Performance

Keeping detailed records of your trades on the demo account is crucial for identifying areas of improvement. Track your entry and exit points, profit and loss, and the rationale behind each trade. This data allows you to analyze your trading strategy, identify recurring patterns, and refine your approach.

Transitioning from Demo to Live Trading

The transition from a demo account to live trading is a crucial step in any forex trader’s journey. While a demo account provides a risk-free environment to practice and develop your trading skills, live trading introduces real money and the associated emotional and psychological challenges. Understanding the key differences and preparing yourself for these changes is essential for success.

Psychological and Emotional Differences

The psychological and emotional aspects of live trading are often underestimated. While demo trading may feel like a game, live trading involves real money and the potential for financial loss. This can lead to increased stress, anxiety, and emotional decision-making.

“Trading psychology is arguably the most important aspect of trading. It is crucial to understand and manage your emotions to make rational decisions.”

Here are some key psychological and emotional differences between demo and live trading:

- Fear of Loss: In live trading, the fear of losing money can significantly impact your trading decisions, leading to impulsive actions or hesitation.

- Greed: The desire for quick profits can lead to overtrading and taking unnecessary risks, especially in live trading.

- Emotional Attachment: In demo trading, you might not feel the same emotional attachment to your trades. In live trading, losses can feel more personal and emotionally draining.

Managing Risk and Capital Effectively

Effective risk management is crucial for success in live trading. It involves understanding your risk tolerance, setting appropriate stop-loss orders, and managing your capital wisely.

“Risk management is the foundation of successful trading. Without it, even the best trading strategies can fail.”

Here are some essential tips for managing risk and capital effectively in live trading:

- Define Your Risk Tolerance: Understand how much risk you are comfortable taking with your capital.

- Set Stop-Loss Orders: Use stop-loss orders to limit your potential losses on each trade.

- Manage Your Position Size: Determine the appropriate position size based on your risk tolerance and account balance.

- Diversify Your Portfolio: Spread your capital across multiple trading instruments to reduce risk.

- Avoid Overtrading: Avoid trading too frequently, as this can lead to emotional decision-making and increased risk.

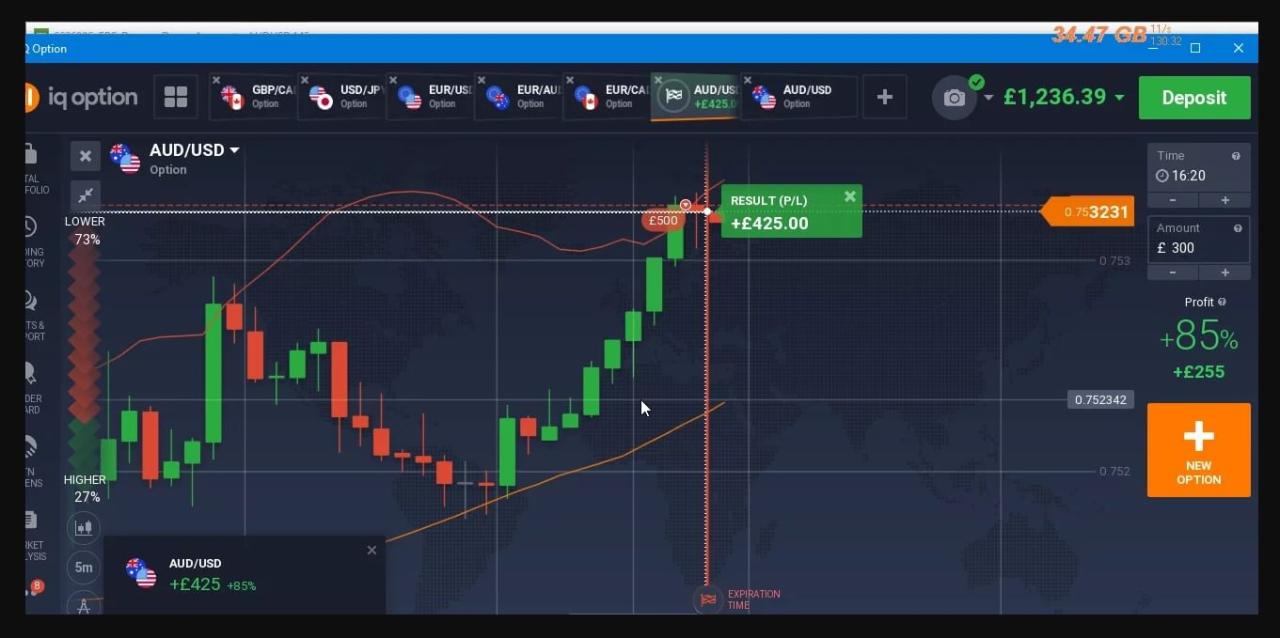

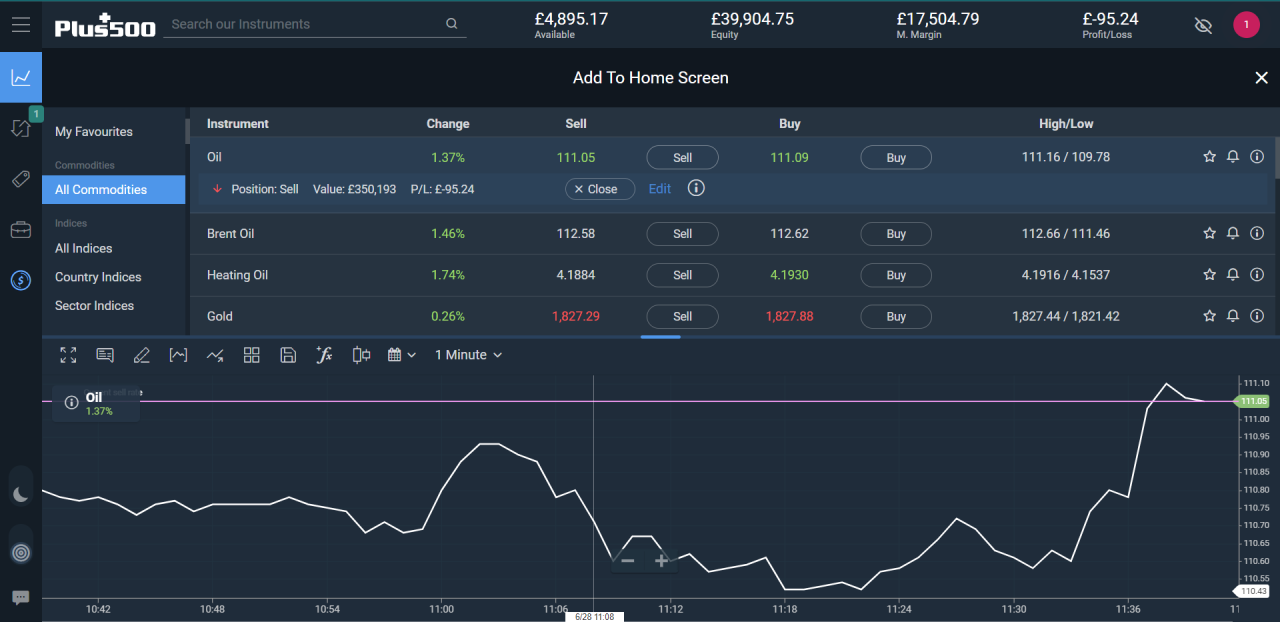

Examples of Demo Accounts in Action

Demo accounts offer a valuable opportunity to explore the forex market without risking real capital. By observing the behavior of different brokers and their demo account features, you can gain insights into the trading experience and identify the platforms that best suit your needs.

Examples of Demo Account Features

Here is a table showcasing popular Forex brokers and their demo account features:

| Broker | Platform | Demo Account Features | Other Notable Features |

|---|---|---|---|

| XM | MetaTrader 4 & 5 | Unlimited demo account, $100,000 virtual funds, access to all trading instruments, real-time market data | Award-winning customer support, educational resources, and competitive trading conditions |

| FXTM | MetaTrader 4 & 5, FXTM Trader | Unlimited demo account, $50,000 virtual funds, access to all trading instruments, real-time market data | Multiple account types, competitive spreads, and a wide range of trading tools |

| FBS | MetaTrader 4 & 5, FBS Trader | Unlimited demo account, $100,000 virtual funds, access to all trading instruments, real-time market data | Low minimum deposit, fast order execution, and a variety of educational materials |

| Exness | MetaTrader 4 & 5 | Unlimited demo account, $100,000 virtual funds, access to all trading instruments, real-time market data | Competitive spreads, fast order execution, and a user-friendly platform |

Hypothetical Trading Scenario

Imagine you are interested in testing a scalping strategy that aims to capitalize on small price movements within a short timeframe. Using a demo account, you can backtest your strategy on historical data and observe its performance under different market conditions. You can also experiment with different trading parameters, such as stop-loss and take-profit levels, to optimize your strategy for maximum profitability. By practicing on a demo account, you can identify potential weaknesses in your strategy and make necessary adjustments before risking real capital.

Common Trading Mistakes

Demo accounts can help you identify and correct common trading mistakes that can lead to losses in live trading. Here are some examples:

- Overtrading: Demo accounts allow you to practice discipline and avoid impulsive trading decisions. You can learn to stick to your trading plan and avoid chasing profits or cutting losses too early.

- Lack of Risk Management: By experimenting with different risk management techniques on a demo account, you can develop a sound strategy for managing your risk and protecting your capital.

- Emotional Trading: Demo accounts provide a safe environment to practice emotional control and avoid letting emotions cloud your judgment. You can learn to detach yourself from the market and make rational trading decisions.

- Ignoring Market Trends: Demo accounts allow you to practice identifying market trends and aligning your trades with the direction of the market. You can learn to filter out noise and focus on the bigger picture.

Risks and Considerations

While demo accounts offer a valuable tool for learning and practicing forex trading, it’s crucial to understand that they are not without limitations. These limitations stem from the fact that demo accounts do not replicate the real-world trading environment perfectly. This is because real-world trading involves a range of factors that are not present in demo accounts, such as emotions, market volatility, and real financial consequences.

Differences between Demo and Live Trading

There are several key differences between demo and live trading that traders need to be aware of:

- Emotional Impact: Demo accounts lack the emotional component of real trading. In live trading, emotions like fear, greed, and excitement can significantly influence trading decisions, which is not experienced in a demo environment.

- Market Conditions: Demo accounts often use simulated market data, which may not accurately reflect real-time market conditions. Real markets are dynamic and constantly evolving, influenced by a multitude of factors that are not always captured in demo environments.

- Trading Costs: Demo accounts typically do not factor in trading costs like spreads, commissions, and rollover fees. These costs are an integral part of real trading and can significantly impact profitability.

- Slippage: Slippage, the difference between the expected price and the actual execution price, can occur in real trading due to market volatility and liquidity. Demo accounts may not accurately simulate slippage, which can lead to unrealistic trading results.

- Psychological Factors: The psychological aspects of trading, such as risk tolerance, decision-making under pressure, and managing losses, are not fully replicated in demo accounts. These factors are crucial for success in real trading.

Addressing Risks and Considerations

To mitigate the risks associated with demo accounts, traders should be aware of the following:

- Transition Gradually: Avoid transitioning from demo to live trading too quickly. Gradually increase the amount of capital you use in live trading, starting with a small amount and gradually increasing it as you gain experience and confidence.

- Focus on Realistic Strategies: Develop trading strategies that are realistic and sustainable for real-world trading. Avoid strategies that rely heavily on simulated market conditions or unrealistic assumptions.

- Understand Trading Costs: Thoroughly research and understand the trading costs associated with your chosen broker and trading platform. Factor these costs into your trading strategy and risk management plan.

- Develop a Risk Management Plan: A robust risk management plan is essential for both demo and live trading. This plan should include clear stop-loss orders, position sizing strategies, and a defined risk tolerance.

- Practice Psychological Discipline: Practice trading with a clear mind and avoid emotional decision-making. Develop a trading journal to track your trades and analyze your performance, identifying any emotional biases or patterns.

Last Point

Embracing the benefits of a demo account on forex empowers traders to gain valuable experience, hone their skills, and build confidence before venturing into live trading. By understanding the intricacies of the market, testing strategies, and managing virtual funds, you can transition to live trading with a greater sense of preparedness and a solid foundation for success. Remember, practice makes perfect, and a demo account provides the ideal platform to refine your skills, manage risks effectively, and ultimately, navigate the exciting world of forex trading with greater confidence and control.

General Inquiries

What is the difference between a demo account and a live account?

A demo account uses virtual funds to simulate real-world trading conditions, while a live account uses real money.

How long can I use a demo account?

Most brokers offer unlimited access to demo accounts, allowing you to practice as long as you need.

Can I use a demo account to test automated trading systems?

Yes, many demo accounts support automated trading systems, allowing you to backtest and optimize your strategies.

Is it necessary to switch to a live account after using a demo account?

While it’s recommended to eventually transition to live trading, some traders continue using demo accounts for ongoing practice and strategy testing.