Demo account forex trading sets the stage for your journey into the exciting world of foreign exchange markets. It’s a risk-free environment where you can hone your trading skills, experiment with strategies, and gain confidence before venturing into real-world trading.

A demo account provides a realistic simulation of live trading, allowing you to familiarize yourself with the trading platform, understand market dynamics, and develop your trading strategies without risking any real money. It’s an invaluable tool for beginners, offering a safe and educational space to learn the ropes of forex trading.

Features of a Forex Demo Account: Demo Account Forex Trading

A Forex demo account is a valuable tool for traders of all levels, offering a risk-free environment to practice trading strategies, explore different platforms, and familiarize themselves with the Forex market.

Virtual Funds

Demo accounts provide traders with virtual funds, allowing them to execute trades without risking real money. This enables traders to experiment with various trading strategies, manage their risk, and gain confidence before entering the live market.

Trading Platforms

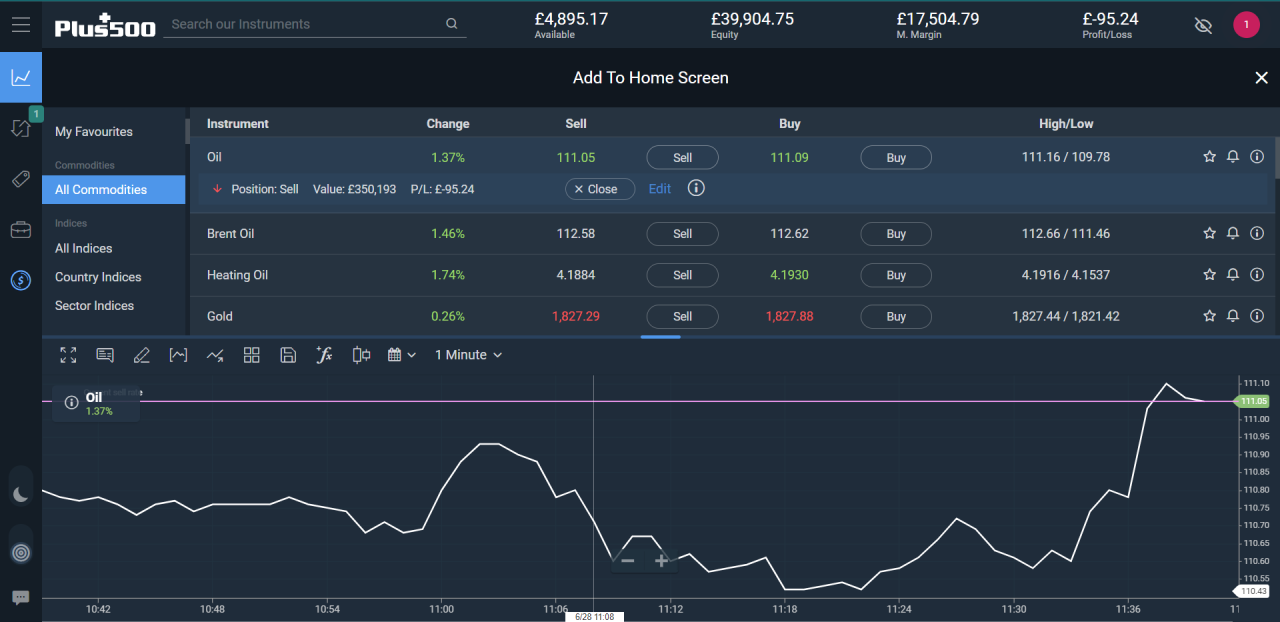

Forex demo accounts typically offer access to the same trading platforms used in live trading. This provides traders with a realistic trading experience, allowing them to familiarize themselves with the platform’s features, order types, and charting tools.

Market Data

Demo accounts provide access to real-time market data, including price quotes, charts, and economic indicators. This allows traders to analyze market trends, identify trading opportunities, and test their trading strategies in a live market environment.

Advantages of Using a Demo Account

Using a demo account offers numerous advantages for traders, including:

- Risk-Free Trading: Demo accounts allow traders to practice trading without risking real money, reducing the potential for financial losses.

- Developing Trading Skills: Demo accounts provide a safe space to develop and refine trading strategies, test different indicators and tools, and improve trading discipline.

- Familiarization with Platforms: Demo accounts enable traders to familiarize themselves with the features, functionalities, and interface of different trading platforms before using them in live trading.

- Testing Trading Strategies: Demo accounts allow traders to backtest their trading strategies on historical data and evaluate their effectiveness before implementing them in live trading.

- Building Confidence: Demo accounts help traders gain confidence in their trading abilities by providing a risk-free environment to practice and experiment.

Common Indicators and Tools

Forex demo accounts typically provide access to a wide range of technical indicators and trading tools, including:

- Moving Averages: Used to identify trends and support/resistance levels.

- MACD (Moving Average Convergence Divergence): Used to identify momentum and potential trend changes.

- RSI (Relative Strength Index): Used to measure the strength of price movements and identify overbought/oversold conditions.

- Bollinger Bands: Used to measure volatility and identify potential trading opportunities.

- Fibonacci Retracement: Used to identify potential support and resistance levels.

- Stochastic Oscillator: Used to identify overbought/oversold conditions and potential trend changes.

- Pivot Points: Used to identify potential support and resistance levels based on previous price action.

How to Use a Forex Demo Account

A Forex demo account is a powerful tool for learning the ropes of Forex trading without risking any real money. It’s a simulated trading environment that mirrors real-world market conditions, allowing you to experiment with different strategies, analyze market movements, and develop your trading skills. Here’s a step-by-step guide on how to use a Forex demo account effectively:

Opening and Setting Up a Demo Account, Demo account forex trading

To start using a demo account, you need to sign up with a Forex broker that offers demo accounts. This process is usually straightforward and involves providing some basic information, such as your name, email address, and phone number. Once you’ve created your account, you’ll be provided with a demo trading platform.

The demo platform will typically have a virtual balance of funds, which you can use to place trades. You can adjust the leverage and other settings to match your desired trading style. Most brokers offer a wide range of currency pairs and other financial instruments for you to practice with.

Navigating the Trading Platform and Placing Trades

Forex trading platforms are designed to be user-friendly, but they can seem overwhelming at first. Here’s a breakdown of the key components of a typical platform:

- Charting: The chart displays the price history of a specific currency pair, allowing you to identify trends, patterns, and potential trading opportunities. Most platforms offer various chart types, including line, bar, and candlestick charts.

- Order Entry Panel: This panel allows you to place buy and sell orders. You can specify the entry price, the volume (the amount of currency you want to trade), and the stop-loss and take-profit levels.

- Trade History: This section provides a record of your past trades, including the entry and exit prices, profit or loss, and the duration of the trade.

- Market Watch: This section displays the current prices of various currency pairs and other financial instruments.

- News and Analysis: Some platforms offer access to real-time news feeds and market analysis reports, which can help you stay informed about current market events.

Once you’re familiar with the platform’s interface, you can start placing trades. The process is similar to placing trades with real money:

- Choose a currency pair: Select the currency pair you want to trade based on your analysis and trading strategy.

- Set your entry price: Determine the price at which you want to enter the trade.

- Set your stop-loss and take-profit levels: These are crucial for managing your risk and protecting your profits. A stop-loss order automatically closes your trade at a predetermined price, while a take-profit order closes your trade when the price reaches your target profit level.

- Enter your trade: Once you’ve set your entry price, stop-loss, and take-profit levels, you can execute your trade by clicking the “Buy” or “Sell” button.

Maximizing the Learning Experience

A Forex demo account is a valuable tool for learning, but it’s important to use it effectively to maximize your learning experience. Here are some tips:

- Experiment with different strategies: Use the demo account to test various trading strategies, including scalping, day trading, and swing trading. Try different indicators and technical analysis tools to see what works best for you.

- Practice risk management: Demo accounts allow you to experiment with different risk management techniques without risking real money. Set realistic stop-loss levels and take-profit targets, and avoid overtrading.

- Analyze your trades: After each trading session, review your trades and identify areas for improvement. Analyze your wins and losses, and try to understand why you made certain decisions. This will help you refine your trading strategy and avoid repeating mistakes.

- Stay up-to-date with market news: Keep abreast of economic news and events that can impact currency markets. This will help you make informed trading decisions.

Importance of Demo Trading for Beginners

The forex market is a complex and dynamic environment, and trading it without proper preparation can be risky. This is where demo trading comes in, offering a safe and risk-free environment for beginners to learn the ropes and hone their skills before venturing into real-world trading.

Benefits of Demo Trading for Beginners

Demo trading provides a valuable opportunity for beginners to learn and practice forex trading without risking their capital. It allows them to familiarize themselves with the market dynamics, experiment with different trading strategies, and develop their trading skills in a simulated environment.

- Risk-Free Learning: Demo accounts allow traders to explore the forex market without risking their own money. They can experiment with different trading strategies, analyze market trends, and learn from their mistakes without financial consequences.

- Building Confidence and Experience: Demo trading helps beginners build confidence and gain experience in forex trading. By practicing in a simulated environment, they can familiarize themselves with the platform, learn to manage their trades, and develop a trading plan before risking real capital.

- Understanding Market Dynamics: Demo accounts allow traders to observe and analyze real-time market data, understand how different factors influence currency prices, and learn how to identify trading opportunities. This knowledge is crucial for developing successful trading strategies.

- Developing Trading Skills: Demo trading provides a platform to practice and refine trading skills, such as analyzing charts, managing risk, and executing trades. Beginners can experiment with different indicators, strategies, and timeframes to find what works best for them.

Transitioning from Demo to Live Trading

The transition from a demo trading account to a live trading account is a crucial step in your forex journey. It marks the point where you move from simulated trading to real-world trading with actual money. This transition requires careful planning and a thorough understanding of the differences between demo and live trading.

Key Considerations for Transitioning

The transition from demo to live trading involves several key considerations:

- Real-World Market Conditions: Demo accounts often simulate market conditions, which may not accurately reflect the volatility and unpredictability of live markets. Live trading involves real-time price fluctuations, unexpected news events, and market sentiment that can significantly impact your trading decisions.

- Emotional Impact of Real Money: When trading with real money, emotions such as fear, greed, and anxiety can play a significant role in your decision-making. These emotions can lead to impulsive trades and poor risk management, which can have a detrimental effect on your trading results.

- Financial Risk Management: In live trading, you are directly responsible for managing your financial risk. This involves setting realistic profit targets, determining appropriate stop-loss orders, and managing your position sizes to avoid significant losses.

Preparing for Live Trading

Transitioning to live trading requires careful preparation to ensure a smooth and successful transition. Here is a checklist of steps to consider:

- Develop a Trading Plan: A well-defined trading plan Artikels your trading strategy, risk management approach, and exit criteria. It provides a framework for making consistent and disciplined trading decisions.

- Refine Your Trading Strategy: Based on your demo trading experience, refine your trading strategy and identify the trading style that best suits your risk tolerance and market knowledge. Consider factors such as timeframes, indicators, and entry and exit points.

- Practice Risk Management: Before going live, practice your risk management strategies on a demo account to ensure you understand the implications of different position sizes, stop-loss orders, and leverage.

- Choose a Reputable Broker: Select a reliable and regulated forex broker with competitive trading conditions, a user-friendly platform, and excellent customer support.

- Start Small and Gradually Increase Position Sizes: When you begin live trading, start with a small position size and gradually increase it as you gain confidence and experience. This allows you to minimize potential losses and learn from your mistakes.

Managing Risk and Emotions

Managing risk and emotions is crucial for success in live trading. Here are some key considerations:

- Emotional Control: Avoid impulsive trading decisions driven by fear or greed. Develop a strategy for managing your emotions, such as taking breaks, practicing mindfulness, or journaling your trading experiences.

- Risk Management Rules: Adhere to strict risk management rules, such as setting stop-loss orders, limiting your maximum loss per trade, and never risking more than a predetermined percentage of your trading capital.

- Trading Psychology: Understanding the psychological aspects of trading can help you make more rational decisions. Consider factors such as confirmation bias, anchoring bias, and herd mentality, which can influence your trading behavior.

Conclusive Thoughts

Mastering forex trading requires practice and experience, and a demo account is the perfect stepping stone. By utilizing the features and tools available on a demo account, you can build a solid foundation for successful trading. As you gain confidence and expertise, you can confidently transition to live trading, equipped with the knowledge and skills to navigate the complexities of the forex market.

FAQ Section

How long can I use a demo account?

Most forex brokers offer demo accounts with unlimited access, allowing you to practice and learn at your own pace.

Do demo accounts reflect real market conditions?

Yes, demo accounts provide real-time market data and prices, mimicking the live trading environment.

Can I use a demo account on my mobile device?

Many forex brokers offer mobile trading platforms compatible with demo accounts, allowing you to practice on the go.