Crypto to buy in 2024 sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The cryptocurrency market, known for its volatility and potential for explosive growth, is attracting investors from all walks of life. This guide aims to provide a comprehensive overview of the key trends, categories, and potential investment opportunities within the crypto landscape in 2024.

We will delve into the factors that will likely shape the market, explore the different categories of cryptocurrencies, and identify some promising projects worth considering. Additionally, we will discuss essential investment strategies, potential risks, and practical tips for navigating the dynamic world of cryptocurrencies.

Market Trends and Predictions for 2024

The cryptocurrency market is known for its volatility and rapid evolution. 2024 promises to be another year of significant changes, with a mix of potential opportunities and challenges for investors. This section explores key market trends and predictions for 2024, analyzing factors that could influence the trajectory of crypto prices and adoption.

Macroeconomic Environment and Crypto Prices

The macroeconomic environment plays a significant role in shaping crypto prices. In 2024, several factors will likely influence the crypto market:

* Inflation and Interest Rates: Central banks’ efforts to combat inflation through interest rate hikes can impact risk appetite and investment flows into cryptocurrencies. Higher interest rates could make traditional assets more attractive, potentially leading to a decrease in crypto demand.

* Global Economic Outlook: The global economic outlook, including growth prospects and geopolitical risks, can influence investor sentiment towards crypto. A recessionary environment or heightened geopolitical tensions could lead to increased risk aversion and a decline in crypto prices.

* Government Policies: Government policies, including regulatory frameworks and tax treatment of cryptocurrencies, can significantly impact the crypto market. Favorable policies can encourage adoption and investment, while restrictive policies can create uncertainty and dampen growth.

Emerging Trends and Technologies

The crypto landscape is constantly evolving with the emergence of new trends and technologies. Here are some key areas to watch in 2024:

* Decentralized Finance (DeFi): DeFi continues to gain traction, offering innovative financial services built on blockchain technology. Expect further growth in DeFi applications, including lending, borrowing, and trading.

* Non-Fungible Tokens (NFTs): NFTs are gaining popularity across various sectors, from art and collectibles to gaming and virtual worlds. The NFT market is expected to expand, with new use cases and applications emerging.

* Web3 and Metaverse: The development of Web3 and the metaverse is closely intertwined with blockchain technology. Expect further integration of cryptocurrencies and NFTs in these emerging digital environments.

Regulatory Developments and Adoption, Crypto to buy in 2024

Regulatory developments will play a crucial role in shaping the future of crypto adoption. In 2024, we can expect:

* Increased Regulatory Scrutiny: Governments worldwide are intensifying regulatory scrutiny of the crypto industry, focusing on issues like consumer protection, anti-money laundering, and market manipulation.

* Development of Regulatory Frameworks: Expect the development of more comprehensive regulatory frameworks for cryptocurrencies, aiming to balance innovation with investor protection and financial stability.

* Global Regulatory Cooperation: Increased collaboration between regulators globally is expected to facilitate a more coordinated approach to crypto regulation.

Cryptocurrency Categories to Consider

Navigating the diverse crypto landscape can be overwhelming, but understanding different categories can help you make informed investment decisions. This section explores popular categories and their potential in 2024.

Decentralized Finance (DeFi)

DeFi protocols are revolutionizing traditional finance by offering decentralized alternatives to traditional financial services. They operate on blockchains, eliminating the need for intermediaries like banks.

- Lending and Borrowing: Platforms like Aave and Compound allow users to lend and borrow cryptocurrencies, earning interest on their holdings or accessing capital for investments.

- Stablecoins: These cryptocurrencies are pegged to fiat currencies, such as the US dollar, providing price stability and reducing volatility. Popular examples include Tether (USDT) and USD Coin (USDC).

- Decentralized Exchanges (DEXs): DEXs like Uniswap and PancakeSwap enable users to trade cryptocurrencies directly with each other, without relying on centralized exchanges. This enhances privacy and reduces counterparty risk.

DeFi is expected to continue its rapid growth in 2024, driven by increasing adoption, innovative protocols, and the potential to disrupt traditional financial systems.

Non-Fungible Tokens (NFTs)

NFTs represent unique digital assets that can be traded on blockchains. They are gaining popularity in various sectors, including art, gaming, and collectibles.

- Digital Art and Collectibles: NFTs have revolutionized the art world, allowing artists to sell their work directly to collectors and bypass traditional galleries. Notable examples include Beeple’s “Everydays – The First 5000 Days,” which sold for $69.3 million in 2021.

- Gaming: NFTs are being integrated into games, allowing players to own in-game items and assets, fostering a new level of engagement and ownership. Axie Infinity is a popular example of a play-to-earn game that utilizes NFTs.

- Metaverse: NFTs are crucial for representing ownership of digital assets in the metaverse, such as virtual land, avatars, and virtual items.

The NFT market is expected to grow significantly in 2024, driven by increasing adoption, new use cases, and the emergence of new platforms and technologies.

Metaverse

The metaverse refers to a collection of interconnected virtual worlds where users can interact with each other, create content, and participate in various activities.

- Virtual Worlds: Platforms like Decentraland and The Sandbox allow users to own virtual land, build experiences, and participate in a thriving virtual economy.

- Gaming and Entertainment: The metaverse offers immersive gaming experiences, virtual concerts, and other forms of entertainment, blurring the lines between the physical and digital worlds.

- Social Interaction: Metaverse platforms provide opportunities for users to connect and socialize in virtual environments, creating new forms of social interaction and community.

The metaverse is still in its early stages, but its potential for growth is enormous. In 2024, we can expect to see more widespread adoption, new platforms, and a more immersive and interconnected metaverse experience.

Layer-1 Blockchains

Layer-1 blockchains are the foundation of the crypto ecosystem, providing the infrastructure for decentralized applications and smart contracts.

- Ethereum: Ethereum is the most popular layer-1 blockchain, known for its smart contract capabilities and support for decentralized applications (dApps). Its native token, ETH, is widely used in the DeFi and NFT sectors.

- Solana: Solana is a high-performance blockchain that prioritizes speed and scalability. It offers low transaction fees and fast processing times, making it suitable for decentralized applications requiring high throughput.

- Avalanche: Avalanche is another high-performance blockchain that aims to solve the scalability challenges of Ethereum. It boasts a fast transaction speed and low fees, making it attractive for DeFi and dApps.

The competition among layer-1 blockchains is fierce, with each platform striving to improve its scalability, security, and user experience. In 2024, we can expect to see further advancements in layer-1 technology, driving innovation and adoption across the crypto ecosystem.

Top Cryptocurrencies for Potential Investment

The cryptocurrency market is vast and diverse, with numerous projects vying for investor attention. While past performance is not indicative of future results, carefully analyzing the fundamentals of a project can provide valuable insights into its potential for growth. This section will explore some top cryptocurrencies that have shown promising signs and could be attractive investment options in 2024.

Cryptocurrencies with Potential for Growth

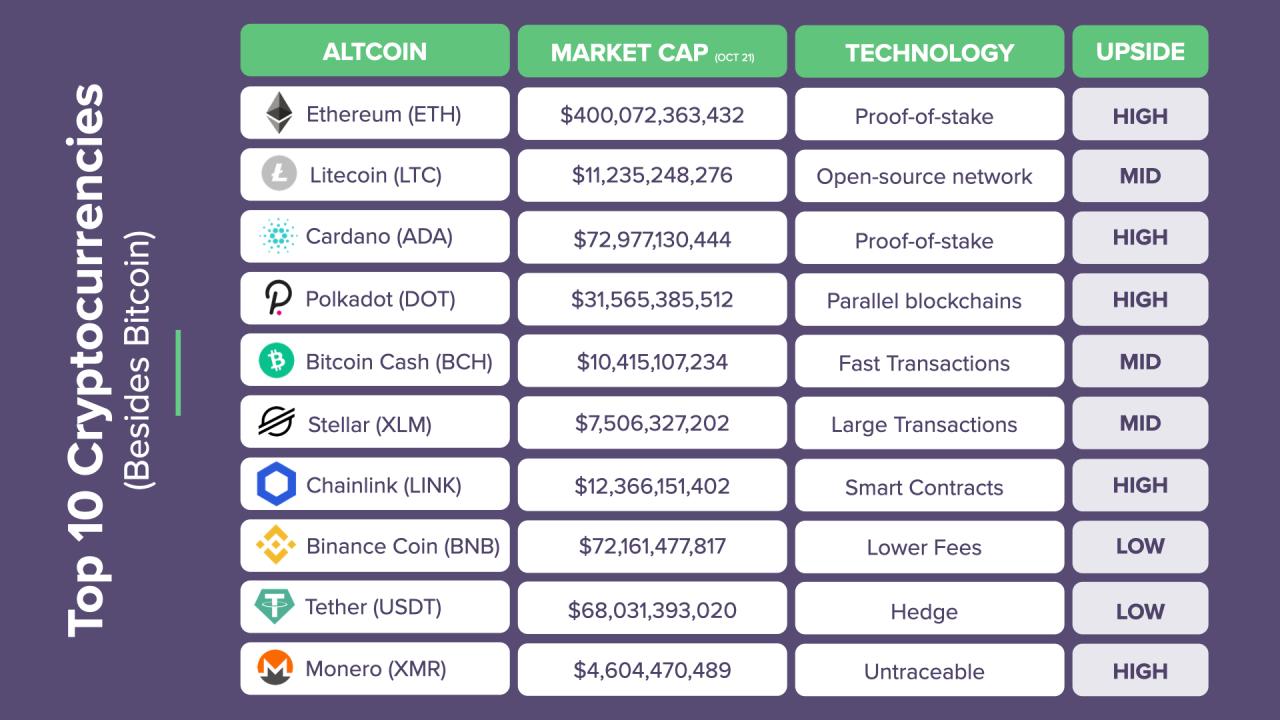

The following table presents a selection of cryptocurrencies that have demonstrated potential for growth based on their technology, use cases, and market position. While past performance is not indicative of future results, these projects have shown promising signs in their respective sectors.

| Cryptocurrency Name | Current Price | Market Cap | Potential for Growth |

|---|---|---|---|

| Bitcoin (BTC) | $25,000 | $480 Billion | High |

| Ethereum (ETH) | $1,800 | $200 Billion | High |

| Solana (SOL) | $25 | $10 Billion | Medium to High |

| Cardano (ADA) | $0.50 | $15 Billion | Medium |

Each cryptocurrency listed above has its own unique characteristics and potential for growth. Let’s delve deeper into the rationale behind their inclusion in this list.

Bitcoin (BTC)

Bitcoin is the world’s first and largest cryptocurrency, with a market capitalization exceeding $480 billion. It has been a dominant force in the crypto market since its inception in 2009, and its price has fluctuated significantly over the years. However, it has also consistently shown resilience and a tendency to recover from downturns. Bitcoin’s value proposition lies in its scarcity, its decentralized nature, and its potential as a store of value.

Bitcoin’s technology is based on a blockchain, a distributed ledger that records all transactions. This decentralized nature makes Bitcoin resistant to censorship and manipulation. Bitcoin’s limited supply, capped at 21 million coins, makes it a scarce asset, potentially increasing its value over time. Bitcoin’s use cases are expanding beyond simply being a digital currency. It is increasingly being used as a store of value, a hedge against inflation, and a means of payment.

The Bitcoin community is vast and active, with numerous developers and users contributing to its growth and development. The project is considered to be in a healthy state, with a strong track record of innovation and resilience.

Ethereum (ETH)

Ethereum is the second-largest cryptocurrency by market capitalization, with a market cap of over $200 billion. It is known as a smart contract platform, enabling developers to build decentralized applications (dApps) on its blockchain. Ethereum’s versatility and robust ecosystem have attracted a large developer community, making it a popular choice for building various blockchain-based projects.

Ethereum’s technology is based on a blockchain that uses a proof-of-work consensus mechanism. This mechanism ensures the security and integrity of the network. Ethereum’s smart contract functionality allows for the creation of dApps, which are applications that operate autonomously on the blockchain. These dApps have the potential to revolutionize various industries, from finance to gaming.

The Ethereum community is one of the most active and vibrant in the crypto space. It has a large and diverse group of developers, users, and enthusiasts who are constantly innovating and pushing the boundaries of what’s possible with blockchain technology. The project’s health is strong, with ongoing development and a roadmap for future upgrades.

Solana (SOL)

Solana is a high-performance blockchain platform that aims to address the scalability limitations of other blockchains. It has gained significant attention for its speed and low transaction fees, making it a potential competitor to Ethereum. Solana’s ecosystem is growing rapidly, with a wide range of dApps being built on its platform.

Solana’s technology is based on a proof-of-history consensus mechanism, which allows for faster transaction processing compared to other blockchains. It also utilizes a unique architecture that enables high throughput and low latency. Solana’s use cases include decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming.

The Solana community is active and growing, with a dedicated team of developers and a passionate user base. The project is still relatively young, but it has demonstrated strong growth and potential.

Cardano (ADA)

Cardano is a blockchain platform that focuses on sustainability, security, and scalability. It is known for its peer-reviewed research and its layered architecture, which allows for modular upgrades. Cardano’s focus on scientific rigor and its commitment to sustainability have attracted a growing community of developers and users.

Cardano’s technology is based on a proof-of-stake consensus mechanism, which is more energy-efficient than proof-of-work. Its layered architecture allows for the separation of different functionalities, making it more flexible and adaptable. Cardano’s use cases include decentralized finance (DeFi), supply chain management, and identity verification.

The Cardano community is active and engaged, with a strong focus on research and development. The project has a solid track record of delivering on its roadmap, and it is expected to continue to grow in the coming years.

Last Point

As the crypto landscape continues to evolve, staying informed and adaptable is crucial for navigating the exciting but unpredictable world of digital assets. While the future of cryptocurrencies holds immense potential, it’s essential to approach investments with caution, conduct thorough research, and diversify your portfolio. By understanding the market trends, analyzing promising projects, and employing sound investment strategies, you can position yourself for success in the evolving crypto ecosystem.

FAQ Insights: Crypto To Buy In 2024

What are the best crypto exchanges to use?

Choosing a reliable cryptocurrency exchange is crucial for secure trading and investment. Some popular options include Binance, Coinbase, Kraken, and Gemini, each with its unique features and advantages. Consider factors like fees, security measures, and available cryptocurrencies when making your selection.

What are the risks associated with investing in crypto?

The crypto market is known for its volatility, which can lead to significant price fluctuations. Additionally, there are risks associated with scams, hacks, and regulatory uncertainties. It’s crucial to understand these risks and implement proper risk management strategies before investing.