Crypto buying apps have revolutionized the way people interact with the cryptocurrency market. These user-friendly platforms allow individuals to easily buy, sell, and trade digital assets, opening up the world of crypto to a wider audience.

From the early days of Bitcoin, when buying crypto required technical expertise and navigating complex exchanges, we’ve seen a surge in accessible apps designed for everyday users. These apps simplify the process, providing intuitive interfaces and a range of features, making crypto investing more accessible than ever before.

Introduction to Crypto Buying Apps

Crypto buying apps have revolutionized the way people interact with the cryptocurrency market. These platforms offer a user-friendly and accessible gateway to the world of digital assets, enabling individuals to buy, sell, and manage cryptocurrencies with ease.

Crypto buying apps act as intermediaries between users and cryptocurrency exchanges, simplifying the process of buying and selling digital assets. They provide a platform for users to trade cryptocurrencies, track their investments, and manage their portfolios.

Evolution of Crypto Buying Apps

The evolution of crypto buying apps mirrors the growth of the cryptocurrency market itself. Initially, buying and selling cryptocurrencies required technical expertise and involved navigating complex exchanges. However, as the market matured, user-friendly platforms emerged to cater to a broader audience.

Early crypto buying apps focused primarily on providing basic functionalities, such as buying and selling cryptocurrencies. Over time, they incorporated features like portfolio tracking, price alerts, and educational resources to enhance the user experience.

Popular Crypto Buying Apps and Features

Numerous crypto buying apps are available, each offering a unique set of features and functionalities. Here are some popular examples:

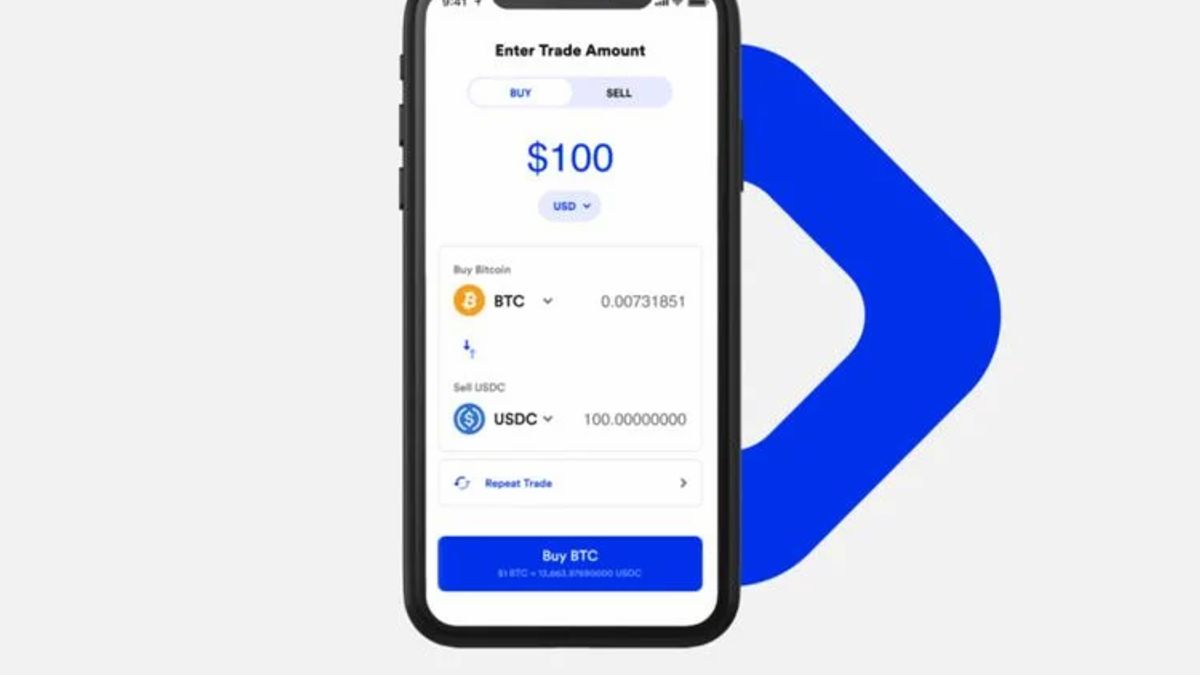

- Coinbase: One of the largest and most well-known crypto buying apps, Coinbase offers a wide range of cryptocurrencies for purchase and boasts a user-friendly interface. It provides features like secure storage, educational resources, and a built-in exchange.

- Robinhood: Known for its commission-free stock trading platform, Robinhood also allows users to buy and sell cryptocurrencies. It offers a simple interface and limited cryptocurrency selection, making it suitable for beginners.

- Kraken: A popular exchange among experienced traders, Kraken also offers a mobile app for buying and selling cryptocurrencies. It provides advanced trading features, such as margin trading and futures trading, catering to more sophisticated investors.

- Binance: One of the largest cryptocurrency exchanges globally, Binance offers a comprehensive app for buying, selling, and trading cryptocurrencies. It provides a wide range of features, including spot trading, margin trading, and futures trading.

Crypto buying apps have democratized access to the cryptocurrency market, making it easier for individuals to participate in the digital asset revolution.

Types of Crypto Buying Apps

Crypto buying apps are platforms that allow users to buy, sell, and trade cryptocurrencies. They come in various forms, each catering to different needs and levels of experience. This section delves into the different types of crypto buying apps and their distinctive features.

Centralized Exchanges

Centralized exchanges (CEXs) are platforms that act as intermediaries between buyers and sellers of cryptocurrencies. They typically offer a wide range of cryptocurrencies, trading pairs, and advanced features, including margin trading, leverage, and futures contracts.

The advantages of CEXs include:

- User-friendly interfaces and intuitive navigation.

- High liquidity and trading volume, ensuring quick order execution.

- Wide range of cryptocurrencies and trading pairs.

- Advanced features like margin trading, leverage, and futures contracts.

- Stronger security measures, with robust KYC/AML procedures.

However, CEXs also have some disadvantages:

- Custodial nature: Users relinquish control of their private keys to the exchange, potentially exposing them to security risks.

- Potential for platform downtime or outages.

- Centralized control: Exchanges can potentially freeze accounts or restrict access to funds.

- Higher fees compared to decentralized exchanges.

Popular examples of CEXs include:

- Coinbase: One of the largest and most popular CEXs, known for its user-friendly interface and wide range of cryptocurrencies. It also offers a Coinbase Pro platform for more advanced traders.

- Binance: A leading CEX with a global user base, offering a wide range of cryptocurrencies, trading pairs, and advanced features. It also has its own native cryptocurrency, BNB, which offers discounts on trading fees.

- Kraken: Known for its robust security features and focus on institutional investors, Kraken offers a wide range of cryptocurrencies and trading pairs, along with advanced features like margin trading and futures contracts.

Decentralized Exchanges, Crypto buying apps

Decentralized exchanges (DEXs) are platforms that operate without a central authority. Instead, they rely on smart contracts and peer-to-peer (P2P) networks to facilitate trades. This eliminates the need for intermediaries and provides users with greater control over their funds.

The advantages of DEXs include:

- Non-custodial nature: Users retain control of their private keys, enhancing security and privacy.

- Decentralized control: No single entity can freeze accounts or restrict access to funds.

- Lower fees compared to CEXs.

- Greater privacy and anonymity.

However, DEXs also have some disadvantages:

- Lower liquidity and trading volume compared to CEXs.

- More complex user interface and navigation, requiring technical expertise.

- Limited features and trading pairs.

- Potentially higher slippage and price discrepancies.

Popular examples of DEXs include:

- Uniswap: A leading DEX on the Ethereum blockchain, known for its simplicity and ease of use. It allows users to swap tokens directly without the need for an order book.

- PancakeSwap: A popular DEX on the Binance Smart Chain, offering a wide range of features, including yield farming and staking.

- SushiSwap: A decentralized exchange built on the Ethereum blockchain, known for its innovative features and governance model.

Crypto Wallets

Crypto wallets are software applications that allow users to store, manage, and transact with cryptocurrencies. They provide a secure and convenient way to access and control digital assets.

Crypto wallets can be categorized into two main types:

- Hot wallets: These wallets are stored online and are typically more convenient for frequent transactions. However, they are also more vulnerable to hacking and security breaches.

- Cold wallets: These wallets are stored offline, making them more secure but less convenient for frequent transactions.

Popular examples of crypto wallets include:

- MetaMask: A popular browser extension wallet that allows users to interact with decentralized applications (DApps) and trade cryptocurrencies on DEXs.

- Ledger Nano S: A hardware wallet that stores private keys offline, providing a high level of security.

- Trezor Model T: Another popular hardware wallet known for its advanced security features and user-friendly interface.

Crypto Trading Bots

Crypto trading bots are automated software programs that execute trades based on pre-defined parameters. They can help traders save time, improve efficiency, and potentially generate higher returns.

The advantages of crypto trading bots include:

- Automated trading: Bots can execute trades 24/7, eliminating the need for manual intervention.

- Improved efficiency: Bots can analyze market data and execute trades faster than humans.

- Reduced emotional bias: Bots operate based on pre-defined parameters, eliminating the impact of emotions on trading decisions.

- Potential for higher returns: Bots can identify and exploit trading opportunities that humans might miss.

However, crypto trading bots also have some disadvantages:

- Complexity: Setting up and configuring trading bots can be challenging for novice traders.

- Risk of loss: Bots can be susceptible to market volatility and unexpected events.

- Potential for technical issues: Bots can malfunction or experience errors, leading to losses.

- Ethical considerations: Some bots engage in aggressive trading strategies that can negatively impact market liquidity.

Popular examples of crypto trading bots include:

- 3Commas: A cloud-based trading bot platform that offers a range of features, including automated trading, backtesting, and portfolio management.

- Cryptohopper: Another cloud-based platform that provides a user-friendly interface for setting up and managing trading bots.

- Gunbot: A popular open-source trading bot that offers a wide range of strategies and customization options.

Key Features of Crypto Buying Apps

Crypto buying apps have become increasingly popular, providing a convenient and accessible way for individuals to enter the world of cryptocurrencies. These apps offer a wide range of features that cater to different user needs and preferences.

Essential Features of Crypto Buying Apps

Crypto buying apps typically offer a range of essential features that make it easy for users to buy, sell, and manage their cryptocurrencies. These features are crucial for both novice and experienced crypto investors, ensuring a seamless and secure experience.

| Feature | Description | Example |

|---|---|---|

| Cryptocurrency Selection | The app should offer a diverse selection of cryptocurrencies, including popular and emerging coins. | Coinbase offers over 100 cryptocurrencies, including Bitcoin, Ethereum, and Solana. |

| Easy Onboarding and Verification | The onboarding process should be straightforward and user-friendly, with clear instructions for identity verification. | Coinbase allows users to create an account in minutes and verify their identity using a government-issued ID. |

| Secure Storage (Wallets) | The app should provide secure wallets for storing cryptocurrencies, offering features like multi-factor authentication and offline storage options. | Coinbase offers both online and offline wallets, with features like multi-factor authentication and cold storage for added security. |

| Buying and Selling Functionality | The app should allow users to buy and sell cryptocurrencies quickly and easily, with competitive fees. | Coinbase offers a user-friendly interface for buying and selling cryptocurrencies, with competitive trading fees. |

| Price Charts and Market Data | The app should provide real-time price charts, market data, and other analytical tools to help users make informed trading decisions. | Coinbase provides real-time price charts, market data, and historical price information for all listed cryptocurrencies. |

Additional Features

While the essential features are crucial for any crypto buying app, some additional features can enhance the user experience and offer greater flexibility and control.

- Limit Orders: Allows users to set specific buy or sell orders at predetermined prices, helping to manage risk and potentially achieve better prices.

- Stop-Loss Orders: Automatically sell a cryptocurrency if its price falls below a certain threshold, minimizing potential losses.

- Educational Resources: Offers educational content and articles to help users learn about cryptocurrencies and the market.

- Customer Support: Provides responsive and helpful customer support to assist users with any issues or questions.

- Integration with Other Services: Enables users to connect their crypto accounts with other financial services, such as bank accounts or debit cards, for seamless transactions.

Importance of Features for Users and the Competitive Landscape

The features offered by crypto buying apps are crucial for both users and the competitive landscape. Users benefit from a user-friendly interface, security features, and a wide selection of cryptocurrencies. In the competitive landscape, apps with a comprehensive feature set and strong security measures are more likely to attract and retain users.

“The best crypto buying apps are those that offer a user-friendly interface, a wide selection of cryptocurrencies, and robust security features.” – Expert Opinion

Choosing the Right Crypto Buying App

Navigating the world of crypto buying apps can be overwhelming, especially for beginners. With numerous options available, finding the right app that aligns with your needs and preferences is crucial. This section provides a comprehensive guide to help you choose the perfect app for your crypto journey.

Factors to Consider When Choosing a Crypto Buying App

The selection process involves evaluating various factors, ensuring the app meets your specific requirements.

- Supported Cryptocurrencies: Consider the cryptocurrencies you want to buy and sell. Ensure the app supports your preferred coins or tokens. For example, if you are interested in Bitcoin and Ethereum, choose an app that offers these cryptocurrencies.

- Fees: Crypto buying apps typically charge fees for transactions. Compare the fee structures of different apps to find one with competitive rates. Look for apps that offer transparent fee breakdowns and avoid hidden charges.

- Security: Security is paramount when dealing with cryptocurrencies. Choose an app with robust security measures such as two-factor authentication (2FA), cold storage for assets, and encryption. Consider the app’s track record and any past security breaches.

- User Interface and Experience (UI/UX): The app’s user interface should be intuitive and easy to navigate, regardless of your technical expertise. Look for apps with clear instructions, user-friendly dashboards, and responsive customer support.

- Features: Different apps offer a variety of features, such as trading charts, price alerts, portfolio tracking, and educational resources. Choose an app that provides the features you need for your investment strategy.

- Customer Support: Reliable customer support is crucial for resolving any issues or answering questions. Choose an app with responsive support channels, such as live chat, email, or phone. Consider the availability and quality of their support.

- Regulations and Compliance: Ensure the app complies with relevant regulations and licensing requirements in your jurisdiction. This ensures the app operates legally and protects your investments.

Comparing Popular Crypto Buying Apps

Once you have identified the essential factors, you can compare popular crypto buying apps based on your needs.

- Coinbase: Coinbase is a widely recognized and user-friendly platform known for its intuitive interface and wide range of supported cryptocurrencies. It offers both a mobile app and a web platform, making it accessible from various devices. Coinbase provides robust security features and educational resources for beginners. However, it may have higher transaction fees compared to some competitors.

- Binance: Binance is a leading cryptocurrency exchange with a vast selection of cryptocurrencies and advanced trading features. It offers a mobile app and a desktop platform with a wide range of trading tools, including margin trading and futures contracts. Binance’s fees are generally competitive, but its interface can be overwhelming for new users.

- Kraken: Kraken is a reputable cryptocurrency exchange known for its security and advanced trading features. It offers a user-friendly interface with support for various cryptocurrencies and fiat currencies. Kraken has a focus on institutional investors and offers a range of tools for professional traders. However, its fees can be higher for smaller transactions.

- Crypto.com: Crypto.com is a popular platform offering a wide range of cryptocurrencies, a user-friendly app, and a Visa debit card that allows users to spend their crypto holdings. The app features a comprehensive portfolio tracker and educational resources. Crypto.com’s fees are competitive, and it offers various rewards programs for users.

- eToro: eToro is a social trading platform that allows users to copy the trades of experienced investors. It offers a user-friendly app with a wide range of cryptocurrencies and a social trading feature that can be helpful for beginners. eToro’s fees are competitive, and it offers a range of educational resources.

Choosing the Right App for Your Needs

After evaluating the factors and comparing popular apps, you can make an informed decision.

“The best crypto buying app for you will depend on your individual needs and preferences. Consider your investment goals, technical expertise, and risk tolerance when making your selection.”

Security and Safety Considerations

Crypto buying apps offer a convenient way to buy, sell, and manage cryptocurrencies. However, it is crucial to understand the security risks associated with these platforms and take necessary precautions to protect your funds and personal information.

Security Risks Associated with Crypto Buying Apps

Crypto buying apps are susceptible to various security threats, including:

- Hacking and Data Breaches: Hackers may attempt to gain unauthorized access to user accounts and steal crypto assets or personal information.

- Phishing Attacks: Phishing scams involve fraudulent emails or websites that trick users into revealing sensitive information, such as login credentials or seed phrases.

- Malware: Malicious software can be installed on your device to steal your crypto assets or compromise your account security.

- Scams and Fraud: Crypto buying apps can be targets of scams, where users are tricked into sending their assets to fake addresses or engaging in fraudulent activities.

- Internal Security Weaknesses: Crypto buying apps themselves may have security vulnerabilities that can be exploited by hackers.

Measures to Protect Users’ Funds and Personal Information

To mitigate these risks, it is essential to implement robust security measures. Here are some key steps:

- Use Strong Passwords and Two-Factor Authentication (2FA): Create complex passwords that are difficult to guess and enable 2FA, which adds an extra layer of security by requiring a second verification step, such as a code sent to your phone or email.

- Keep Your Software Up-to-Date: Regularly update your operating system, apps, and antivirus software to patch vulnerabilities and protect against malware.

- Be Cautious of Phishing Attempts: Be wary of suspicious emails, links, or messages, and never share your sensitive information with anyone you don’t trust.

- Use a Secure Internet Connection: Avoid using public Wi-Fi networks for sensitive transactions and always connect to a secure, private network.

- Enable Security Features: Many crypto buying apps offer additional security features, such as transaction limits, withdrawal confirmations, and cold storage for offline storage of your assets.

Choosing Apps with Robust Security Features

When selecting a crypto buying app, it is crucial to prioritize security. Consider the following factors:

- Reputation and Track Record: Choose apps with a strong reputation and a history of protecting user funds. Look for reviews and testimonials from other users.

- Security Measures: Ensure the app offers robust security features, including 2FA, encryption, and multi-signature wallets.

- Transparency and Disclosure: Look for apps that are transparent about their security practices and disclose their policies for handling user data.

- Customer Support: Choose an app with reliable customer support that can assist you in case of any security issues.

Regulatory Landscape and Compliance

The cryptocurrency industry is evolving rapidly, and regulators worldwide are working to establish frameworks to address the unique challenges posed by digital assets. This regulatory landscape is dynamic, with varying approaches across different jurisdictions, impacting the development and operation of crypto buying apps.

Regulatory Environment

Crypto buying apps operate within a complex regulatory environment, subject to various laws and regulations depending on their location and the services they offer. Some key areas of regulation include:

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Crypto buying apps are required to implement robust AML and KYC procedures to prevent money laundering and terrorist financing. This involves verifying user identities, monitoring transactions, and reporting suspicious activities.

- Securities Laws: Cryptocurrencies can be classified as securities in some jurisdictions, subject to regulations governing the issuance, trading, and investment of securities. Crypto buying apps need to comply with these laws, including registration requirements and investor protection measures.

- Consumer Protection Laws: Crypto buying apps are subject to consumer protection laws, which aim to protect users from fraud, unfair practices, and misleading information. This includes requirements for clear disclosures, security measures, and dispute resolution mechanisms.

- Data Protection Laws: Crypto buying apps collect and process user data, which is subject to data protection laws like the General Data Protection Regulation (GDPR) in the European Union. They need to ensure compliance with data privacy principles, including consent, data security, and user rights.

Challenges and Opportunities

Regulation presents both challenges and opportunities for crypto buying apps.

- Challenges:

- Compliance Costs: Implementing and maintaining compliance programs can be costly, especially for smaller apps.

- Regulatory Uncertainty: The regulatory landscape is evolving, creating uncertainty for app developers.

- Competition: Regulation can create a more level playing field, but it can also increase competition among app providers.

- Opportunities:

- Increased Trust and Legitimacy: Compliance with regulations can enhance user trust and legitimacy, attracting more users and investors.

- Market Growth: Clear regulations can foster a more stable and predictable market environment, encouraging investment and growth.

- Innovation: Regulation can stimulate innovation by providing a framework for responsible development and adoption of crypto technologies.

Importance of Compliance

Compliance with regulations is crucial for both users and app developers.

- For Users:

- Protection from Fraud: Compliance with AML and KYC regulations helps prevent fraud and protect users from scams.

- Security and Privacy: Compliance with data protection laws ensures user data is handled securely and responsibly.

- Transparency and Accountability: Compliance with regulations promotes transparency and accountability in the crypto industry.

- For App Developers:

- Reduced Risk: Compliance with regulations helps mitigate legal and financial risks.

- Enhanced Reputation: Compliance builds trust and enhances the reputation of crypto buying apps.

- Market Access: Compliance with regulations can open up new markets and opportunities for app developers.

Future Trends in Crypto Buying Apps

The crypto buying app market is constantly evolving, driven by technological advancements, changing user preferences, and the ever-growing adoption of cryptocurrencies. As the industry matures, we can expect to see several emerging trends that will shape the future of these apps. These trends will not only impact user experience but also reshape the crypto buying app landscape.

Integration of Decentralized Finance (DeFi)

DeFi has gained significant traction in recent years, offering users a range of financial services, including lending, borrowing, and trading, without relying on traditional intermediaries. Crypto buying apps are increasingly integrating DeFi features, enabling users to access these services directly within their app.

- For example, some apps allow users to earn interest on their crypto holdings by lending them to others through DeFi protocols.

- Other apps provide access to decentralized exchanges (DEXs), offering users more control over their funds and greater privacy.

This integration is likely to enhance user experience by providing a wider range of financial tools within a single platform.

Increased Focus on Security and Privacy

Security and privacy are paramount in the crypto world. Crypto buying apps are continuously developing advanced security measures to protect user funds and data.

- Multi-factor authentication (MFA) is becoming standard practice, requiring users to provide multiple forms of verification before accessing their accounts.

- Apps are also implementing advanced encryption technologies to safeguard user data.

- Some apps offer cold storage solutions, where user funds are stored offline in secure hardware wallets, further enhancing security.

These efforts aim to build trust and confidence among users, contributing to the overall adoption of cryptocurrencies.

Personalized User Experiences

Crypto buying apps are increasingly using data analytics and artificial intelligence (AI) to personalize user experiences.

- AI-powered chatbots can provide instant support and answer user queries.

- Apps can recommend cryptocurrencies based on user preferences, investment goals, and risk tolerance.

- Personalized dashboards can provide users with relevant insights and data based on their trading history.

By tailoring the user experience to individual needs, these apps aim to make crypto investing more accessible and engaging for a wider audience.

Expansion into Emerging Markets

The crypto buying app market is expanding rapidly into emerging markets, where internet penetration and smartphone adoption are growing rapidly.

- Apps are adapting their features and interfaces to cater to local user preferences and language requirements.

- They are also partnering with local payment providers to facilitate seamless transactions.

This expansion is crucial for driving broader adoption of cryptocurrencies and fostering financial inclusion in these regions.

Integration with Web3 Technologies

Web3 technologies, such as non-fungible tokens (NFTs) and decentralized applications (dApps), are gaining momentum. Crypto buying apps are starting to integrate these technologies, offering users access to a wider range of services.

- Apps may allow users to buy, sell, and manage NFTs directly within the platform.

- They may also provide access to dApps that offer decentralized finance, gaming, and other services.

This integration will create new opportunities for user engagement and further enhance the utility of crypto buying apps.

Conclusion

Navigating the crypto landscape can be overwhelming, but with the right crypto buying app, you can confidently explore the world of digital assets. By understanding the different types of apps, their key features, and the security considerations involved, you can make informed decisions and embark on your own crypto journey.

Commonly Asked Questions

What are the fees associated with crypto buying apps?

Fees can vary depending on the app, the cryptocurrency you’re trading, and the transaction amount. Most apps charge trading fees, withdrawal fees, and sometimes deposit fees. It’s important to compare fees across different platforms before choosing an app.

Are crypto buying apps safe?

While crypto buying apps can be secure, it’s crucial to choose reputable platforms with strong security measures in place. Look for apps that offer two-factor authentication, cold storage for user funds, and regular security audits.

Do I need to verify my identity to use a crypto buying app?

Most crypto buying apps require identity verification to comply with regulations and prevent money laundering. This typically involves providing personal information and documentation, such as a government-issued ID and proof of address.

Can I use a crypto buying app to buy and sell NFTs?

Some crypto buying apps offer support for buying and selling non-fungible tokens (NFTs). However, not all apps provide this functionality. It’s essential to check the features of each app before choosing one for NFT trading.