Claims and processing represent a critical function across diverse sectors, from insurance and healthcare to legal and finance. Understanding the intricacies of this process, from initial claim submission to final resolution, is crucial for both organizations and individuals. This guide delves into the various facets of claims and processing, exploring the different types of claims, the technologies employed, and the challenges faced in ensuring efficient and compliant operations.

We will examine the workflow stages involved in handling claims, comparing procedures across various industries and highlighting best practices for risk mitigation and regulatory compliance. The role of technology in streamlining processes, including automation and data analytics, will be a central focus, alongside a discussion of key performance indicators (KPIs) used to monitor and improve performance.

Challenges in Claims Processing

Efficient and accurate claims processing is crucial for the financial health and reputation of any organization, whether it’s an insurance company, a healthcare provider, or a government agency. However, numerous challenges can significantly impede this process, leading to delays, increased costs, and customer dissatisfaction. Understanding these challenges and implementing effective mitigation strategies is paramount for successful claims management.

Common Challenges in Claims Processing

Several factors contribute to difficulties in claims processing. These include incomplete or inaccurate claim information, leading to delays in verification and processing. Another common challenge is the complexity of claims, particularly those involving multiple parties or intricate medical procedures. Furthermore, the sheer volume of claims can overwhelm processing systems, causing backlogs and extended processing times. Finally, inadequate communication between stakeholders – claimants, processors, and other involved parties – can lead to misunderstandings and delays. These issues frequently interact, compounding the challenges faced.

Impact of Fraudulent Claims

Fraudulent claims represent a significant challenge, impacting both the efficiency and financial stability of claims processing systems. Fraudulent activities, such as exaggerating injuries or submitting false documentation, can lead to substantial financial losses for organizations. The detection and investigation of fraudulent claims require specialized expertise and resources, diverting time and effort away from legitimate claims. Furthermore, the presence of fraudulent claims necessitates stricter verification procedures for all claims, adding to the overall processing time and complexity. For example, a single large-scale fraudulent insurance claim scheme could bankrupt a smaller insurance company, illustrating the severe financial implications.

Strategies for Mitigating Risks and Improving Efficiency

Several strategies can be employed to mitigate the risks associated with claims processing and improve overall efficiency. Implementing robust automated systems can significantly reduce manual processing time and minimize human error. Investing in advanced fraud detection technologies, including data analytics and machine learning algorithms, can help identify and prevent fraudulent claims more effectively. Streamlining communication channels and improving data exchange between stakeholders can enhance transparency and reduce delays. Furthermore, comprehensive staff training on claims processing procedures and fraud detection techniques is crucial for improving accuracy and efficiency. For instance, the implementation of a secure online portal for claim submission and tracking can significantly improve transparency and reduce processing time.

Best Practices for Managing Claims and Processing Effectively

Effective claims management involves a multi-faceted approach. Clear and concise claim submission guidelines should be readily available to claimants. This ensures complete and accurate information is provided upfront, minimizing the need for subsequent clarifications and delays. Regular audits of claims processing procedures should be conducted to identify areas for improvement and ensure compliance with regulations. Establishing clear service level agreements (SLAs) with stakeholders sets expectations and promotes accountability. Finally, continuous monitoring and evaluation of key performance indicators (KPIs), such as processing times and error rates, are crucial for identifying trends and making data-driven improvements to the process. For example, a well-defined SLA might specify a target processing time of 10 business days for 95% of claims.

Regulatory Compliance in Claims Processing

Navigating the complex landscape of claims processing necessitates a thorough understanding and unwavering adherence to relevant regulations. Failure to comply can lead to significant financial penalties, reputational damage, and legal repercussions. This section details key regulatory aspects, potential consequences of non-compliance, and best practices for maintaining compliance.

Regulatory compliance in claims processing varies significantly depending on the jurisdiction and the type of insurance involved. For example, health insurance claims are subject to different regulations than property and casualty insurance claims. These regulations often dictate aspects such as data privacy, claim handling procedures, timeliness of payments, and the information that must be included in claim forms and supporting documentation.

Relevant Regulations and Compliance Requirements

Regulations governing claims processing are multifaceted and often intersect. They frequently involve federal and state/provincial laws, as well as industry-specific guidelines. These regulations aim to protect policyholders, ensure fair and efficient claim handling, and maintain the solvency of insurance companies. Specific regulations can cover areas like data security (e.g., HIPAA in the US, GDPR in Europe), anti-fraud measures, and consumer protection laws. For instance, the Affordable Care Act (ACA) in the US imposes specific requirements on health insurance claims processing, while the Gramm-Leach-Bliley Act (GLBA) addresses the protection of customer financial information. In the UK, the Financial Conduct Authority (FCA) sets standards for claims handling within the financial services sector. Variations exist globally, demanding a jurisdictional-specific approach to compliance.

Implications of Non-Compliance

Non-compliance with claims processing regulations carries substantial risks. Financial penalties can range from significant fines to complete business closure. Reputational damage can lead to loss of customer trust and market share. Legal action from regulators or aggrieved policyholders is a significant possibility, resulting in expensive litigation and potential compensation payments. Furthermore, non-compliance can impact an insurer’s ability to obtain or maintain necessary licenses and permits to operate. The severity of the consequences depends on the nature and extent of the non-compliance, the jurisdiction, and the specific regulations violated.

Best Practices for Ensuring Regulatory Compliance

Maintaining regulatory compliance requires a proactive and multi-faceted approach. This includes establishing robust internal controls, implementing comprehensive training programs for employees, and regularly reviewing and updating policies and procedures to reflect changes in legislation and best practices. Regular audits and assessments can identify potential vulnerabilities and ensure compliance. Investing in technology that facilitates data security and efficient claim processing is also crucial. A strong culture of compliance, fostered through leadership commitment and employee engagement, is paramount. Maintaining detailed records of all claim-related activities is vital for demonstrating compliance during audits or investigations. Finally, seeking expert legal advice to ensure understanding and adherence to relevant regulations is a sound strategy.

Key Regulatory Bodies and Their Relevant Guidelines

Understanding the key regulatory bodies and their guidelines is crucial for maintaining compliance. The following list provides examples, but it’s important to note that the specific regulatory landscape varies significantly by location.

- United States: Centers for Medicare & Medicaid Services (CMS), National Association of Insurance Commissioners (NAIC), State Insurance Departments (vary by state).

- European Union: European Insurance and Occupational Pensions Authority (EIOPA), individual national regulatory bodies (vary by country).

- United Kingdom: Financial Conduct Authority (FCA).

- Canada: Office of the Superintendent of Financial Institutions (OSFI), provincial insurance regulators (vary by province).

- Australia: Australian Prudential Regulation Authority (APRA).

Claims Processing Metrics and KPIs

Effective claims processing relies heavily on the consistent monitoring and analysis of key performance indicators (KPIs). These metrics provide valuable insights into the efficiency and effectiveness of the entire claims lifecycle, enabling proactive identification of bottlenecks and areas requiring improvement. By tracking and analyzing these KPIs, organizations can optimize their processes, reduce processing times, and enhance overall customer satisfaction.

Claims processing KPIs provide quantifiable data to assess performance against established goals. This data-driven approach facilitates informed decision-making, allowing for targeted interventions to address inefficiencies and enhance the overall quality of service. The selection of appropriate KPIs depends on the specific goals and operational context of the claims processing system.

Key Performance Indicators for Claims Processing, Claims and processing

A robust set of KPIs should encompass various aspects of the claims process. These metrics offer a holistic view of performance, highlighting both strengths and weaknesses within the system. For instance, some crucial KPIs include average handling time, claims processing cycle time, claims denial rate, and customer satisfaction scores.

- Average Handling Time (AHT): This metric measures the average time taken to process a single claim, from initial submission to final resolution. A lower AHT indicates greater efficiency.

- Claims Processing Cycle Time: This KPI tracks the total time elapsed between claim submission and payment or denial. A shorter cycle time reflects faster and more efficient processing.

- Claims Denial Rate: This represents the percentage of claims rejected or denied. A high denial rate suggests potential issues with claim submission, processing procedures, or documentation requirements.

- Customer Satisfaction (CSAT) Score: This metric measures customer satisfaction with the claims processing experience. Higher CSAT scores indicate improved customer service and a smoother claims process.

- First Pass Resolution Rate: This KPI measures the percentage of claims resolved on the first attempt, without requiring further investigation or resubmission. A higher rate suggests more accurate and efficient initial processing.

- Cost per Claim: This metric tracks the average cost associated with processing each claim, including personnel costs, technology expenses, and other operational overheads. Lower cost per claim indicates improved operational efficiency.

Using KPIs to Identify Areas for Improvement

Analyzing trends in these KPIs reveals potential areas for improvement within the claims processing system. For example, a consistently high average handling time might indicate a need for process automation or additional staff training. A high claims denial rate could point to deficiencies in claim submission guidelines or the need for clearer communication with claimants. Low customer satisfaction scores could suggest the need for improvements in customer service or communication strategies. By systematically reviewing and analyzing these metrics, organizations can pinpoint specific areas requiring attention and implement targeted solutions.

Tracking and Analyzing KPIs to Improve Performance

Effective KPI tracking involves establishing a system for data collection, analysis, and reporting. This might involve using specialized claims processing software, integrating with existing CRM systems, or employing dedicated data analytics tools. Regular monitoring of these KPIs, coupled with trend analysis, allows for the timely identification of potential problems and the implementation of corrective measures. For example, if the average handling time suddenly increases, an investigation into the root cause can be launched promptly, preventing further delays and negative impacts on customer satisfaction. Regular reporting on these KPIs to relevant stakeholders ensures transparency and accountability, fostering continuous improvement efforts.

Claims Processing Dashboard Design

A well-designed dashboard provides a visual overview of key claims processing metrics. It should be intuitive and easy to understand, allowing stakeholders to quickly grasp the current performance status and identify any potential issues.

The dashboard could include several key visual elements:

- Key Metric Charts: Line charts displaying trends in average handling time, claims processing cycle time, and claims denial rate over time. These charts should highlight significant fluctuations or deviations from established targets.

- Gauge Charts: Gauge charts illustrating the current status of key metrics, such as customer satisfaction scores and first pass resolution rates, against pre-defined targets. These provide a quick visual assessment of performance against goals.

- Bar Charts: Bar charts comparing performance across different claim types or processing teams, allowing for the identification of areas of strength and weakness.

- Geographic Maps (if applicable): If claims are geographically distributed, a map could visualize performance variations across different regions.

- Real-time Data Feeds: A section displaying real-time updates on key metrics, such as the number of claims currently in process and the average waiting time for claim resolution. This allows for immediate monitoring of system performance.

- Drill-down Capabilities: The dashboard should allow users to drill down into specific metrics to investigate the underlying data in more detail. For example, clicking on a high denial rate for a particular claim type could reveal the specific reasons for denials.

The dashboard should be designed with a clear and consistent color scheme, ensuring easy readability and interpretation of data. The use of clear labels, concise titles, and appropriate visual cues further enhances the dashboard’s usability and effectiveness. By providing a comprehensive and readily accessible view of key performance metrics, the dashboard supports data-driven decision-making and promotes continuous improvement in claims processing.

Future Trends in Claims Processing

The claims processing landscape is undergoing a rapid transformation, driven by technological advancements and evolving customer expectations. The next 5-10 years will see significant shifts in how claims are handled, impacting efficiency, cost, and the overall customer experience. This section explores the key trends shaping the future of claims processing.

Artificial Intelligence and Machine Learning in Claims Processing

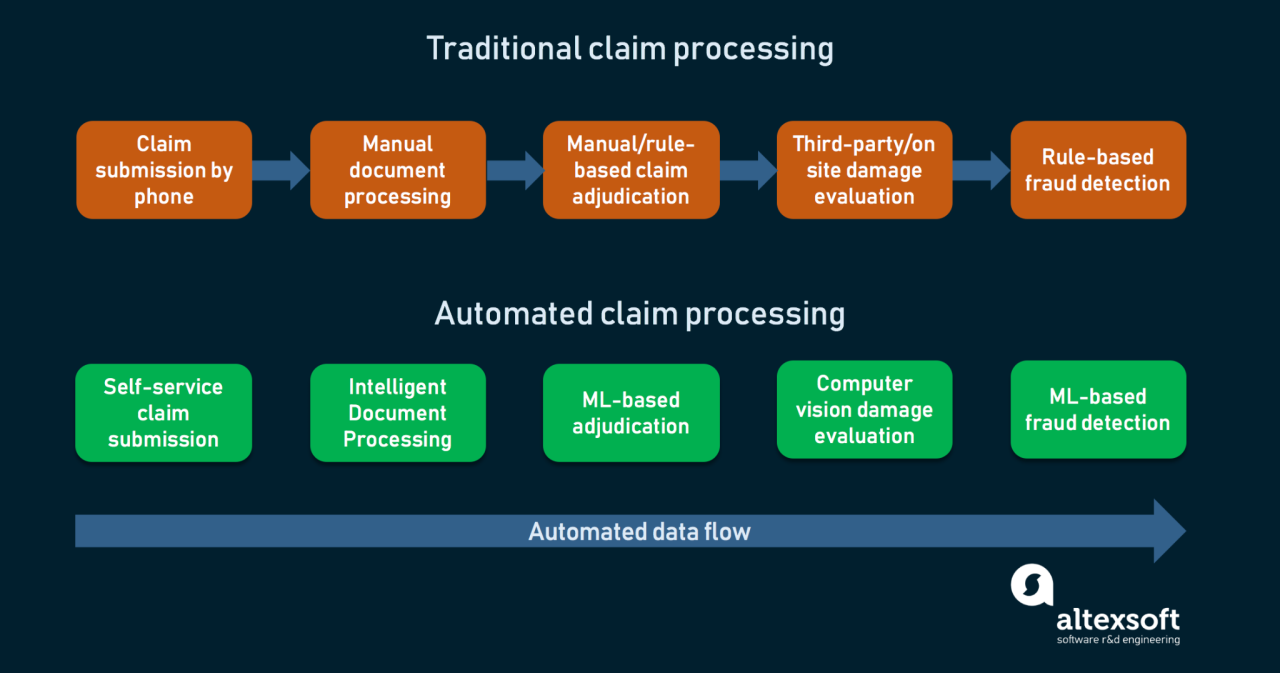

AI and ML are poised to revolutionize claims processing. These technologies can automate tasks like data entry, fraud detection, and initial claim assessment, significantly reducing processing times and human error. For example, AI-powered systems can analyze claim documents, identify inconsistencies, and flag potentially fraudulent claims far more efficiently than manual review. This leads to faster payouts for legitimate claims and a more robust defense against fraudulent activity. The implementation of AI, however, requires substantial investment in infrastructure and skilled personnel to manage and maintain these complex systems. Furthermore, ethical considerations around data privacy and algorithmic bias must be carefully addressed.

Robotic Process Automation (RPA) in Claims Handling

RPA involves using software robots to automate repetitive tasks, freeing up human employees to focus on more complex and value-added activities. In claims processing, RPA can automate tasks such as data extraction from various sources, routing claims to the appropriate departments, and generating reports. This can result in increased efficiency and reduced operational costs. A real-world example is a major insurance company using RPA to automate the process of verifying policy information, reducing processing time by 50%. The challenge lies in integrating RPA with existing legacy systems, which can be complex and time-consuming.

Blockchain Technology for Enhanced Security and Transparency

Blockchain technology offers the potential to enhance security and transparency in claims processing. By creating a secure and immutable record of all claim transactions, blockchain can reduce the risk of fraud and disputes. Furthermore, it can improve transparency by providing all stakeholders with access to the claim’s history and status. Imagine a system where all claim information is recorded on a blockchain, instantly accessible to both the claimant and the insurer. This would significantly reduce delays and disputes. However, widespread adoption requires overcoming challenges related to scalability, regulatory compliance, and the need for industry-wide standardization.

The Rise of Predictive Analytics

Predictive analytics leverages historical data and advanced algorithms to predict future claim outcomes. This allows insurers to proactively identify and manage high-risk claims, potentially reducing costs and improving customer satisfaction. For instance, predictive models can analyze claim data to identify patterns indicative of fraud, allowing for early intervention and prevention. While predictive analytics offers significant potential, it also presents challenges related to data quality, model accuracy, and the ethical implications of using algorithms to make decisions that impact individuals.

Timeline for the Evolution of Claims Processing (Next 5-10 Years)

The following timeline illustrates anticipated advancements:

| Year | Key Development |

|---|---|

| 2024-2026 | Widespread adoption of RPA for routine tasks; increased use of AI for fraud detection. |

| 2027-2029 | Integration of AI and ML for automated claim assessment; initial exploration of blockchain technology in specific use cases. |

| 2030-2035 | Mature implementation of blockchain for enhanced security and transparency; predictive analytics becoming integral to risk management; increased use of personalized customer portals. |

Final Thoughts

Efficient and effective claims processing is paramount for maintaining positive stakeholder relationships, minimizing financial losses, and ensuring regulatory compliance. By understanding the complexities involved, implementing appropriate technologies, and consistently monitoring key performance indicators, organizations can significantly improve their claims handling processes. The future of claims processing lies in leveraging emerging technologies to further streamline operations, enhance customer experiences, and adapt to evolving regulatory landscapes.

Popular Questions: Claims And Processing

What is the average processing time for a claim?

Processing times vary greatly depending on the type of claim, the industry, and the complexity of the case. Some claims may be processed within days, while others may take weeks or even months.

What happens if my claim is denied?

If your claim is denied, you typically have the right to appeal the decision. The appeals process will vary depending on the organization and the specific circumstances of your claim. Review the denial letter carefully and follow the instructions provided for appealing the decision.

How can I prevent claim denials?

Ensuring accurate and complete documentation is crucial to avoid claim denials. Follow all instructions carefully, submit all required forms and supporting evidence, and maintain clear and concise communication with the processing organization.