Cheapest crypto to buy – the phrase conjures up images of hidden gems, waiting to be discovered. While the allure of low prices is undeniable, it’s crucial to remember that the cryptocurrency market is far more nuanced than just chasing the lowest price tag. Investing in crypto requires a balanced approach, considering factors beyond just the initial cost.

This guide delves into the complexities of finding the cheapest crypto to buy, examining the factors that influence cryptocurrency prices, and offering insights into evaluating projects, managing risk, and leveraging research tools. By understanding the intricacies of the market, you can make informed decisions and navigate the dynamic world of cryptocurrency investing.

Resources and Tools for Research: Cheapest Crypto To Buy

Before diving into the exciting world of cryptocurrency investment, it’s crucial to equip yourself with the right tools and resources. Thorough research is key to making informed decisions and minimizing risks. This section will guide you through reliable sources for cryptocurrency research and provide insights into analyzing whitepapers and utilizing technical analysis tools.

Reliable Resources for Cryptocurrency Research

Reliable resources are essential for staying informed about the cryptocurrency market. Here are some of the most trusted sources:

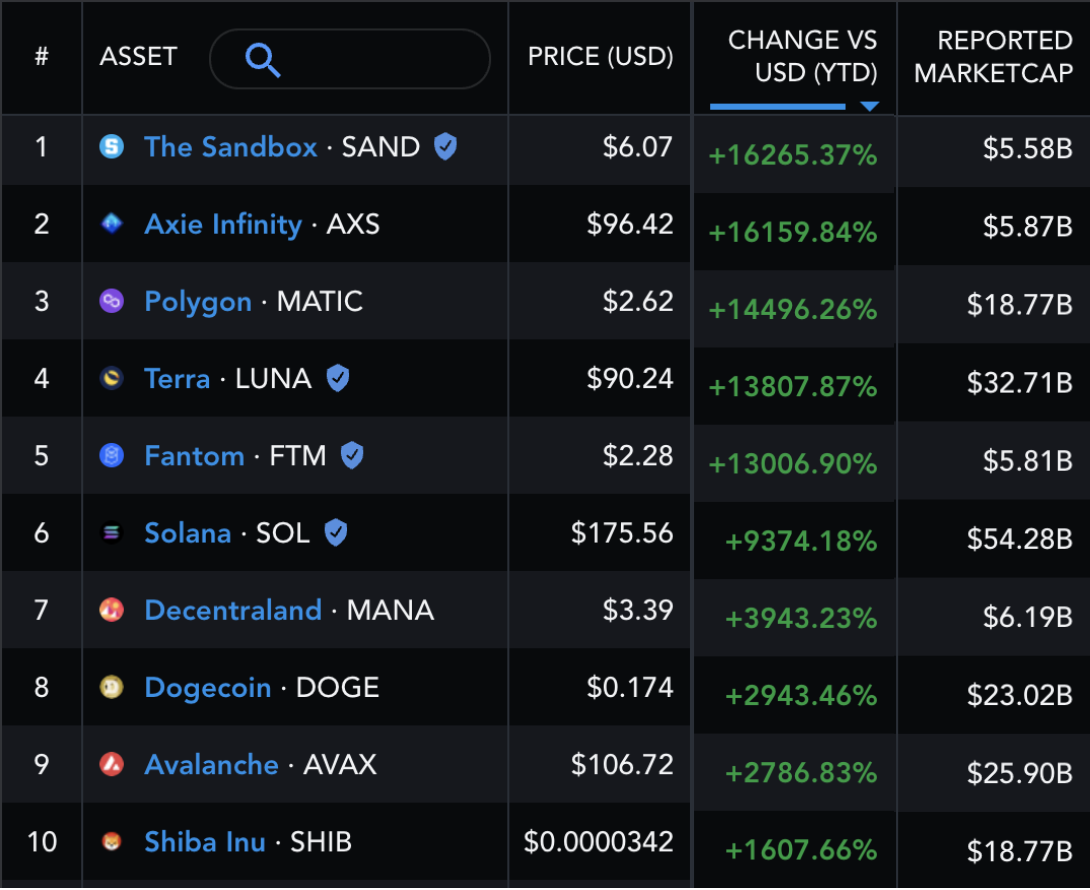

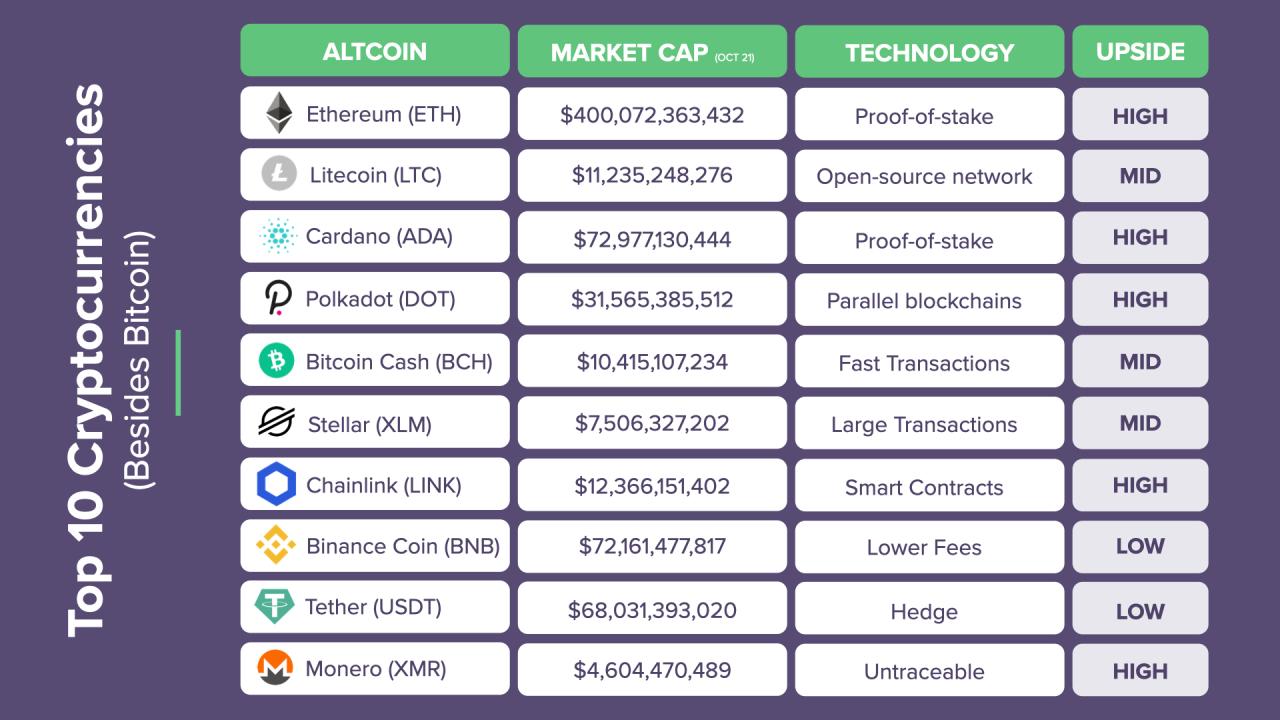

- CoinMarketCap: A comprehensive platform that provides real-time data on cryptocurrency prices, market capitalization, trading volume, and more. It offers detailed information about each cryptocurrency, including its whitepaper, website, and social media links.

- CoinGecko: Similar to CoinMarketCap, CoinGecko provides comprehensive cryptocurrency data and insights. It offers a wide range of metrics, including price history, trading volume, and developer activity.

- CryptoCompare: A platform that offers real-time cryptocurrency price data, exchange comparisons, and technical analysis tools. It also provides news and insights from industry experts.

- Messari: A research platform that provides in-depth analysis of crypto projects, including their tokenomics, team, and market potential. It offers a wide range of reports and data visualizations.

- The Block: A leading news and analysis platform that covers the blockchain and cryptocurrency industry. It offers insightful articles, podcasts, and data visualizations.

Analyzing Cryptocurrency Whitepapers

A whitepaper is a document that Artikels the vision, technology, and economics of a cryptocurrency project. Carefully analyzing a whitepaper is crucial to understanding the project’s potential and risks.

- Project Overview: Start by understanding the project’s mission, goals, and target audience. Assess whether the project addresses a real-world problem and if its solution is innovative and viable.

- Technology: Evaluate the underlying technology, such as the blockchain platform, consensus mechanism, and smart contract functionality. Look for evidence of security, scalability, and efficiency.

- Tokenomics: Analyze the token’s purpose, distribution, and utility within the ecosystem. Assess the token’s potential for value appreciation and the risks associated with its supply and demand dynamics.

- Team and Community: Research the project’s team, their experience, and their track record. Assess the community’s engagement and the project’s overall reputation.

- Financial Projections: If the whitepaper includes financial projections, analyze their feasibility and the assumptions underlying them. Be wary of overly optimistic projections.

Using Technical Analysis Tools, Cheapest crypto to buy

Technical analysis involves studying price charts and trading patterns to identify potential buying and selling opportunities. It is based on the assumption that historical price movements can predict future price trends.

- Moving Averages: Moving averages are used to smooth out price fluctuations and identify trends. Common moving averages include the 50-day moving average (DMA) and the 200-day moving average (DMA). When the price crosses above the moving average, it is considered a bullish signal, and vice versa.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI reading above 70 suggests an overbought market, while a reading below 30 indicates an oversold market.

- MACD: The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages. A crossover of the MACD lines can signal a potential trend change.

- Fibonacci Retracement: Fibonacci retracement levels are based on the Fibonacci sequence and are used to identify potential support and resistance levels. These levels can help traders identify potential entry and exit points.

Final Thoughts

The journey to finding the cheapest crypto to buy is not a simple one. It requires a thorough understanding of the market, careful project evaluation, and a strategic approach to risk management. By embracing a well-informed and calculated investment strategy, you can potentially unlock opportunities within the dynamic world of cryptocurrencies.

General Inquiries

What are the biggest risks associated with buying cheap cryptocurrencies?

Investing in cheap cryptocurrencies carries inherent risks, including potential scams, lack of liquidity, and volatility. It’s crucial to conduct thorough research and due diligence before investing in any cryptocurrency, regardless of its price.

How can I find reliable resources for researching cryptocurrencies?

Reliable resources for researching cryptocurrencies include reputable news outlets, cryptocurrency analysis platforms, and whitepaper repositories. It’s important to cross-reference information from multiple sources to ensure accuracy.