- Cheap Health Insurance in Pennsylvania: A Comprehensive Guide for Saving Money

- Section 1: Understanding Your Health Insurance Options

- Section 2: Finding Cheap Health Insurance

- Section 3: Saving Money on Health Insurance

- Section 4: Table of Resources

- Section 5: Conclusion

-

FAQ about Cheap Health Insurance PA

- What is the cheapest health insurance plan in PA?

- How can I get cheap health insurance in PA?

- What is the income limit for Medicaid in PA?

- What is CHIP?

- What are the different types of health insurance plans available in PA?

- How do I choose the right health insurance plan for me?

- What is the open enrollment period for health insurance in PA?

- What if I miss the open enrollment period?

- How do I apply for Medicaid or CHIP?

- Where can I get more information about health insurance in PA?

Cheap Health Insurance in Pennsylvania: A Comprehensive Guide for Saving Money

Introduction

Hey readers,

Are you looking for ways to save money on your health insurance in Pennsylvania? If so, you’re not alone. Health insurance costs have been rising steadily for years, and it can be tough to find a plan that fits your budget. But there are some things you can do to find cheap health insurance pa.

In this article, we’ll discuss various options for finding affordable health insurance in Pennsylvania. We’ll also provide a table of resources that can help you compare plans and find the best deal.

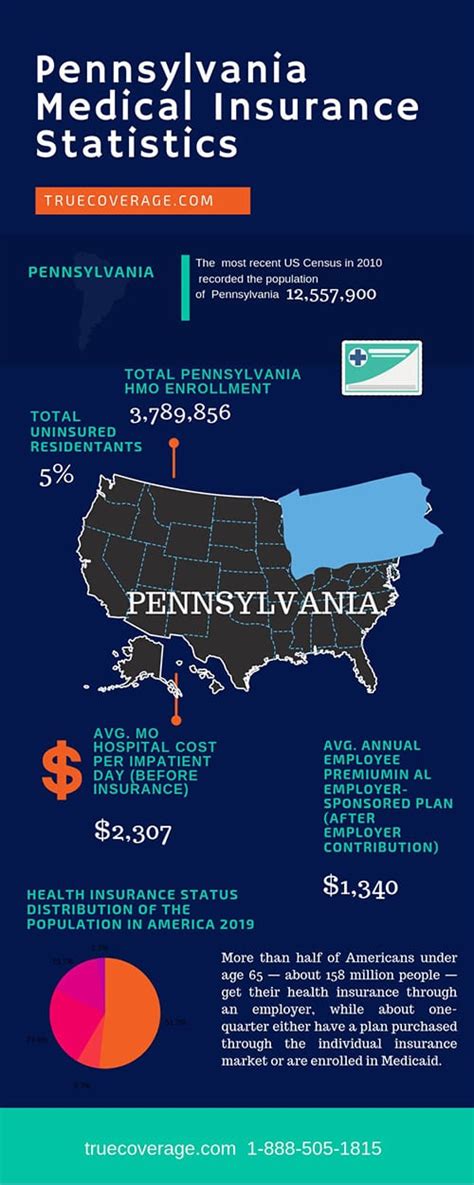

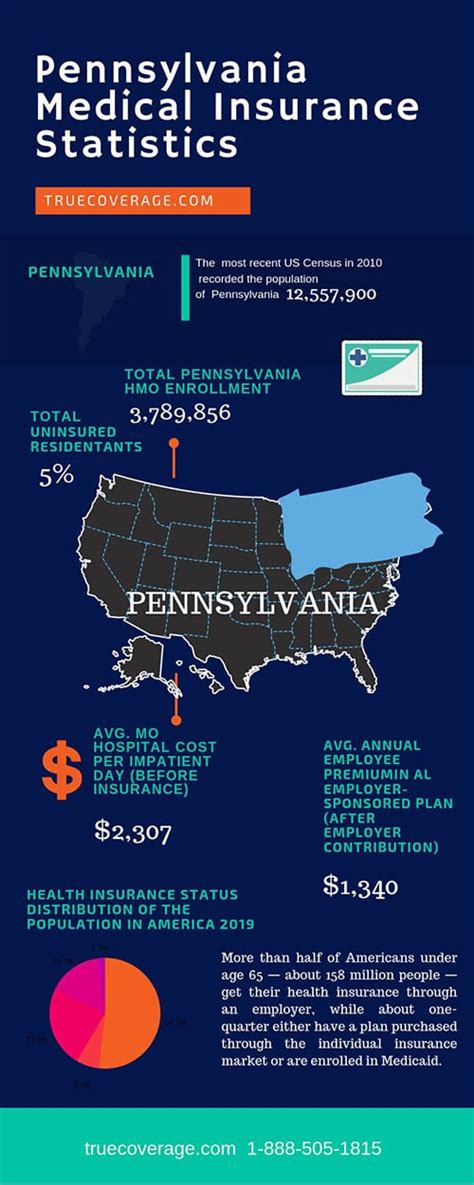

Section 1: Understanding Your Health Insurance Options

Types of Health Insurance Plans

There are several types of health insurance plans available in Pennsylvania. The most common types are:

- Health Maintenance Organizations (HMOs): HMOs are a type of managed care plan that requires you to choose a primary care physician (PCP). Your PCP will refer you to specialists if you need to see one.

- Preferred Provider Organizations (PPOs): PPOs are a type of managed care plan that allows you to see any doctor or specialist you want. However, you will pay more for out-of-network care.

- Point-of-Service (POS) plans: POS plans are a hybrid of HMOs and PPOs. You can choose a PCP, but you can also see out-of-network providers if you are willing to pay a higher copayment.

How to Compare Health Insurance Plans

Once you understand the different types of health insurance plans available, you can start comparing plans. Here are a few things to consider:

- Monthly premium: This is the amount you will pay each month for your health insurance.

- Deductible: This is the amount you will have to pay out-of-pocket before your insurance coverage kicks in.

- Copayments: This is the amount you will pay for each doctor’s visit or prescription.

- Coinsurance: This is the percentage of the cost of covered services that you will pay after you meet your deductible.

Section 2: Finding Cheap Health Insurance

Government Programs

There are several government programs that can help you find cheap health insurance. These programs include:

- Medicaid: Medicaid is a government health insurance program for low-income individuals and families.

- Children’s Health Insurance Program (CHIP): CHIP is a government health insurance program for children and teens from low-income families.

- Medicare: Medicare is a government health insurance program for people who are 65 or older or who have certain disabilities.

Employer-Sponsored Health Insurance

If you are employed, you may be able to get health insurance through your employer. Employer-sponsored health insurance is often cheaper than individual health insurance.

Health Insurance Exchanges

Health insurance exchanges are online marketplaces where you can compare and purchase health insurance plans. The exchanges are run by the federal government and the states.

Section 3: Saving Money on Health Insurance

Ways to Lower Your Monthly Premium

There are several things you can do to lower your monthly health insurance premium. These include:

- Choosing a plan with a higher deductible: Plans with higher deductibles typically have lower monthly premiums.

- Getting a discount for multiple policies: If you have multiple health insurance policies, such as a policy for yourself and a policy for your spouse, you may be able to get a discount.

- Taking advantage of employer-sponsored health insurance: If your employer offers health insurance, it is usually cheaper than individual health insurance.

Ways to Save Money on Out-of-Pocket Costs

There are also several things you can do to save money on your out-of-pocket costs. These include:

- Using generic drugs: Generic drugs are just as effective as brand-name drugs, but they are much cheaper.

- Getting preventive care: Preventive care can help you stay healthy and avoid costly medical problems down the road.

- Negotiating with your doctor or hospital: If you are facing a large medical bill, you may be able to negotiate a lower price with your doctor or hospital.

Section 4: Table of Resources

The following table provides a list of resources that can help you compare health insurance plans and find the best deal:

| Resource | Description |

|---|---|

| HealthCare.gov | The federal government’s health insurance exchange |

| PA HealthChoices | Pennsylvania’s Medicaid and CHIP program |

| Medicare.gov | The federal government’s Medicare program |

| eHealthInsurance | A private health insurance exchange |

| NerdWallet | A website that compares health insurance plans |

Section 5: Conclusion

We hope this article has helped you understand your health insurance options and how to find cheap health insurance pa. If you are still struggling to find affordable health insurance, you may want to contact a health insurance agent or broker. They can help you compare plans and find the best deal for your needs.

Check Out Our Other Articles

- How to Choose the Right Health Insurance Plan

- How to Save Money on Health Insurance

- The Best Health Insurance Companies in Pennsylvania

FAQ about Cheap Health Insurance PA

What is the cheapest health insurance plan in PA?

- The cheapest health insurance plan in PA can vary depending on your individual circumstances, but some of the most affordable options include Keystone Health Plan East, AmeriHealth Caritas Pennsylvania, and UPMC Health Plan.

How can I get cheap health insurance in PA?

- There are a number of ways to get cheap health insurance in PA, including:

- Applying for Medicaid or CHIP if you qualify.

- Shopping for a plan on the Health Insurance Marketplace (healthcare.gov).

- Contacting an insurance agent or broker to compare plans.

What is the income limit for Medicaid in PA?

- The income limit for Medicaid in PA is 138% of the federal poverty level (FPL). For a single person, this means an annual income of $18,754 or less.

What is CHIP?

- CHIP (Children’s Health Insurance Program) is a health insurance program for children and teens who are not eligible for Medicaid. The income limit for CHIP in PA is 400% of the FPL.

What are the different types of health insurance plans available in PA?

- There are three main types of health insurance plans available in PA:

- HMOs (Health Maintenance Organizations): These plans require you to choose a primary care physician (PCP) who will refer you to specialists if necessary.

- PPOs (Preferred Provider Organizations): These plans allow you to see any doctor or specialist you want, but you will pay less if you see a doctor or specialist within the plan’s network.

- EPOs (Exclusive Provider Organizations): These plans are similar to HMOs, but they have a smaller network of doctors and specialists.

How do I choose the right health insurance plan for me?

- When choosing a health insurance plan, you should consider your budget, your health needs, and the type of care you want. You should also compare the plans available to you and choose the plan that best meets your needs.

What is the open enrollment period for health insurance in PA?

- The open enrollment period for health insurance in PA is from November 1st to January 15th. During this time, you can enroll in or change health insurance plans.

What if I miss the open enrollment period?

- If you miss the open enrollment period, you can still enroll in or change health insurance plans if you have a qualifying life event, such as losing your job, getting married, or having a baby.

How do I apply for Medicaid or CHIP?

- You can apply for Medicaid or CHIP online, by phone, or by mail. You can also apply in person at your local county assistance office.

Where can I get more information about health insurance in PA?

- You can get more information about health insurance in PA from the Pennsylvania Insurance Department website (www.insurance.pa.gov) or by calling the Pennsylvania Health Insurance Marketplace (1-800-783-2009).