- Cheap California Health Insurance Plans: Affordable Coverage for Golden State Residents

- Understanding California’s Health Insurance Landscape

- Types of Cheap California Health Insurance Plans

- Eligibility for Cheap California Health Insurance Plans

- Choosing the Right Plan for You

- Table of Affordable California Health Insurance Plans

- Conclusion

-

FAQ About Cheap California Health Insurance Plans

- What are the cheapest health insurance plans in California?

- What is the income limit for Covered California?

- Can I get free health insurance in California?

- What are the different types of health insurance plans available through Covered California?

- How do I enroll in a health insurance plan through Covered California?

- When is the open enrollment period for Covered California?

- What is a deductible?

- What is coinsurance?

- What is a copayment?

- How can I find a low-cost health insurance plan in California?

Cheap California Health Insurance Plans: Affordable Coverage for Golden State Residents

Introduction

Hey readers! We know finding affordable health insurance in California can be a challenge, but don’t worry. We’ve got your back! In this guide, we’ll delve into the world of cheap California health insurance plans, exploring their features, eligibility requirements, and where to find the best deals.

Understanding California’s Health Insurance Landscape

Covered California Marketplace

The Covered California Marketplace is a government-run platform where you can compare and purchase health insurance plans from various insurance companies. These plans are subsidized by the federal government, making them more affordable for low- and moderate-income individuals and families.

Off-Exchange Options

If you don’t qualify for subsidies on the Covered California Marketplace, you can explore off-exchange options. These plans are sold directly by insurance companies and are often more expensive than Covered California plans. However, they may offer more flexibility and fewer restrictions.

Types of Cheap California Health Insurance Plans

Essential Health Plans

Essential Health Plans are the most basic and affordable health insurance plans available in California. They cover a range of essential health benefits, including doctor visits, hospitalization, prescription drugs, and maternity care.

HMOs and PPOs

Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) are the two most common types of health insurance plans. HMOs offer lower premiums and out-of-pocket costs, but they restrict you to a specific network of providers. PPOs provide more flexibility, allowing you to see any provider within the network, but they come with higher premiums.

Eligibility for Cheap California Health Insurance Plans

Income Limits

Eligibility for subsidized health insurance plans on the Covered California Marketplace depends on your income. Individuals with incomes below a certain threshold can qualify for subsidies that reduce their monthly premiums.

Special Enrollment Periods

In addition to the annual open enrollment period, you may also be eligible for special enrollment periods if you experience certain life events, such as losing your job or getting married.

Choosing the Right Plan for You

Compare Plan Details

When choosing a cheap California health insurance plan, compare the following details:

- Premium: The monthly cost of the plan.

- Deductible: The amount you must pay out-of-pocket before your insurance starts paying for covered services.

- Copayments: Fixed amounts you must pay for certain services, such as doctor visits or prescription drugs.

- Coverage: The services and procedures that are covered by the plan.

Consider Your Health Needs

Think about your current health status and future health goals. If you have any pre-existing conditions or expect to need specialized care, you may need a plan with more comprehensive coverage.

Table of Affordable California Health Insurance Plans

| Plan Type | Monthly Premium | Deductible | Copayment | Coverage |

|---|---|---|---|---|

| Essential Health Plan | $200-$300 | $2,000 | $20 | Basic essential health benefits |

| HMO | $300-$400 | $1,500 | $15 | Restricted provider network |

| PPO | $400-$500 | $1,000 | $25 | Flexible provider network |

Conclusion

Finding cheap California health insurance plans doesn’t have to be overwhelming. By understanding your eligibility, comparing plans, and choosing the right option for your needs, you can get the affordable coverage you deserve. If you still have questions or want to explore other health insurance topics, check out our other articles. Stay healthy, California!

FAQ About Cheap California Health Insurance Plans

What are the cheapest health insurance plans in California?

Answer: Covered California, California’s health insurance marketplace, offers a variety of health insurance plans that range in price and coverage. The cheapest plans available through Covered California are the Bronze plans.

What is the income limit for Covered California?

Answer: To qualify for Covered California, your household income must be between 138% and 400% of the federal poverty level. This means that a single person can earn up to $51,040 per year and still qualify for Covered California.

Can I get free health insurance in California?

Answer: If you have a low income, you may be eligible for Medi-Cal, California’s Medicaid program. Medi-Cal provides free or low-cost health insurance to low-income adults, children, and families.

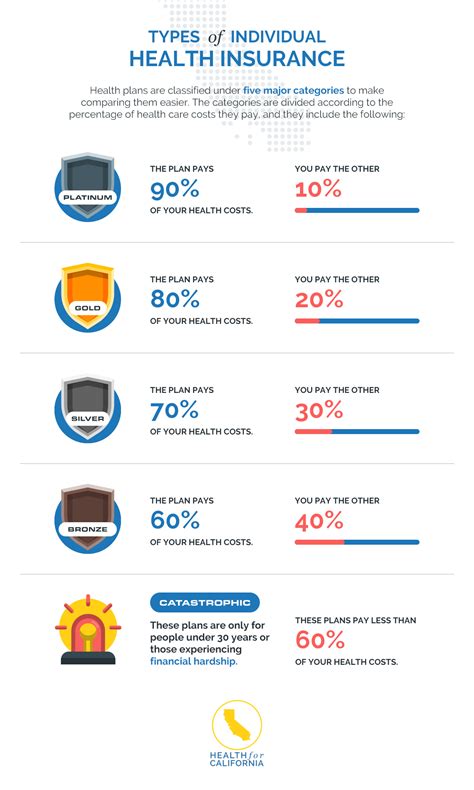

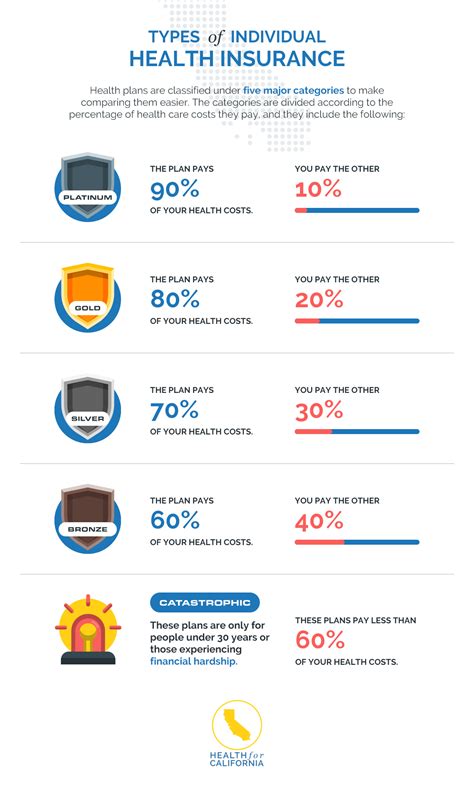

What are the different types of health insurance plans available through Covered California?

Answer: Covered California offers four different types of health insurance plans: Bronze, Silver, Gold, and Platinum. Bronze plans have the lowest monthly premiums but also the highest deductibles and out-of-pocket costs. Platinum plans have the highest monthly premiums but also the lowest deductibles and out-of-pocket costs.

How do I enroll in a health insurance plan through Covered California?

Answer: You can enroll in a health insurance plan through Covered California by visiting their website or contacting their customer service center.

When is the open enrollment period for Covered California?

Answer: The open enrollment period for Covered California runs from November 1st to January 31st. This is the time period when you can enroll in or change your health insurance plan.

What is a deductible?

Answer: A deductible is the amount of money you have to pay out-of-pocket before your health insurance coverage begins to pay.

What is coinsurance?

Answer: Coinsurance is the percentage of a medical expense that you have to pay after you have met your deductible.

What is a copayment?

Answer: A copayment is a fixed amount of money that you have to pay for certain medical services, such as doctor’s visits or prescriptions.

How can I find a low-cost health insurance plan in California?

Answer: There are a number of ways to find a low-cost health insurance plan in California. You can compare plans through Covered California’s website, contact a health insurance agent, or consult with a non-profit organization that provides health insurance counseling.