Showing posts by category INSURANCE. Show all posts

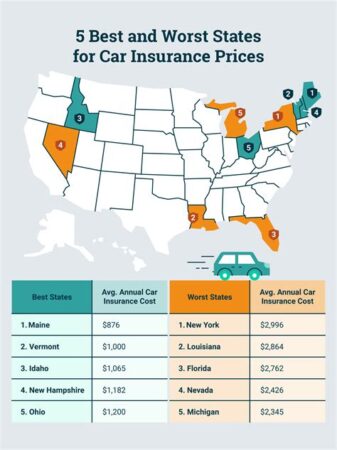

workmans comp insurance near me

Introduction Hey readers, Are you a business owner seeking comprehensive protection against workplace accidents and...

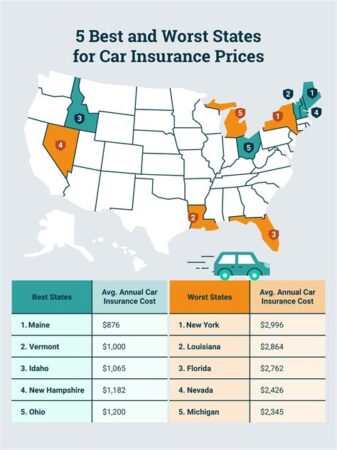

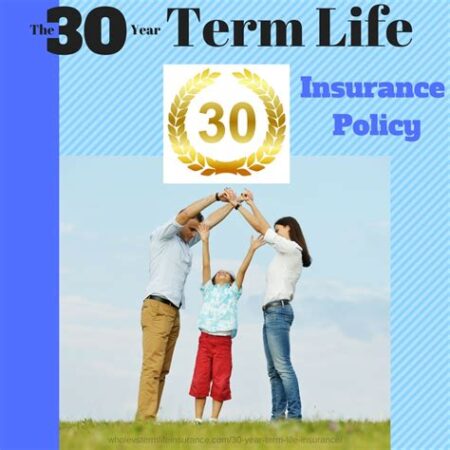

a cheap car insurance

Introduction Hey there, readers! Welcome to our in-depth guide on how to find a cheap...

5 year term life insurance

Introduction Hey there, readers! Are you contemplating securing your loved ones’ financial future but feeling...

will renters insurance cover mold damage

Will Renters Insurance Cover Mold Damage: A Comprehensive Guide for Renters Introduction Hey there, readers!...

20 year term insurance

A Comprehensive Guide to 20 Year Term Insurance Introduction Hey readers, welcome to our in-depth...

workers comp insurance online

Introduction Hey there, readers! Are you curious about workers’ compensation insurance and how it can...

workers comp insurance florida

Introduction Hey readers! Are you seeking a helping hand to navigate the complexities of workers’...

30 year term insurance

Introduction Hey readers! Are you in the market for life insurance but feeling overwhelmed by...

1 month car insurance

1 Month Car Insurance: The Ultimate Guide for Flexible Coverage Introduction Hello readers! Are you...

a affordable car insurance

A Comprehensive Guide to Affordable Car Insurance Introduction Hey there, readers! Are you looking for...