Cash value, a key feature of certain life insurance policies, offers a compelling blend of financial protection and investment growth. This guide delves into the intricacies of cash value, exploring its various facets, from understanding its fundamental concept to leveraging its potential for wealth building and estate planning. We will examine the different types of policies offering cash value, compare its growth potential against other investment vehicles, and analyze its tax implications. Ultimately, we aim to provide a comprehensive understanding of cash value’s benefits and drawbacks, empowering you to make informed financial decisions.

We will dissect the differences between cash value and term life insurance, highlighting scenarios where each type proves most advantageous. Further, we’ll explore strategies for maximizing cash value growth, including mitigating the impact of fees and expenses, and considering various investment options within the policy itself. The implications of cash value for estate planning will also be thoroughly discussed, alongside illustrative examples showcasing its practical applications in various life situations.

Cash Value in Life Insurance

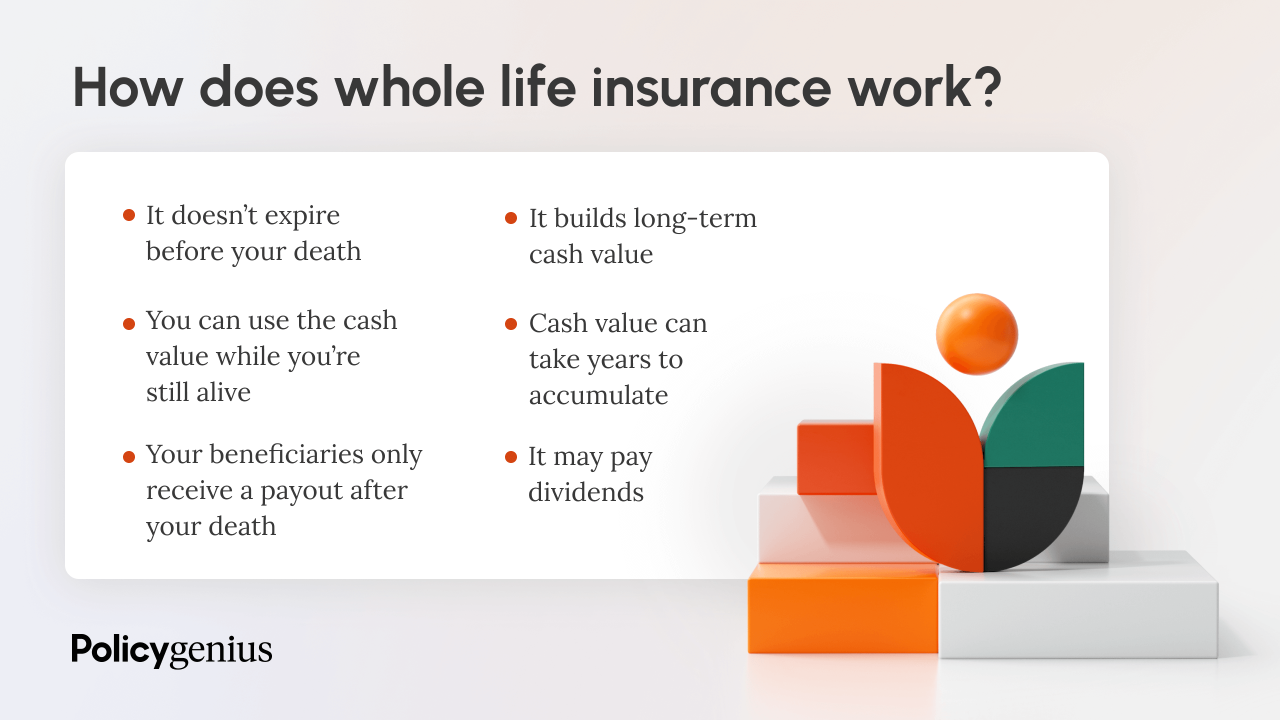

Cash value life insurance offers a unique blend of financial protection and savings. Unlike term life insurance, which provides coverage for a specific period, cash value policies build a cash reserve that grows over time. This reserve can be accessed through various methods, providing financial flexibility alongside the death benefit. Understanding the nuances of cash value is crucial for making informed decisions about your financial future.

Cash Value Explained

Cash value represents the accumulated savings within a life insurance policy. A portion of your premium payments goes towards the death benefit, while the remainder contributes to the cash value component. This cash value grows tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them. The growth rate varies depending on the type of policy and the underlying investment options. Think of it as a forced savings plan with a built-in death benefit.

Types of Cash Value Life Insurance

Several types of life insurance policies offer cash value accumulation. These include whole life insurance, universal life insurance, variable universal life insurance, and indexed universal life insurance. Whole life insurance provides a fixed premium and a guaranteed cash value growth rate, offering predictable returns. Universal life insurance offers more flexibility with adjustable premiums and death benefits, but the cash value growth is not guaranteed. Variable universal life insurance allows you to invest your cash value in various sub-accounts, potentially offering higher returns but also carrying greater risk. Indexed universal life insurance ties the cash value growth to a market index, offering potential for higher returns while limiting downside risk.

Cash Value Growth Potential Comparison

The growth potential of cash value varies significantly across policy types. Whole life insurance generally offers slower, more predictable growth, while variable universal life insurance has the potential for faster growth but also the risk of losses. Universal life and indexed universal life policies fall somewhere in between, offering a balance of growth potential and risk. For example, a whole life policy might yield a consistent 3-4% annual growth, while a variable universal life policy could see higher growth in a bull market but might even experience a decline in a bear market. The specific growth rate depends on various factors, including the policy’s terms, the underlying investment performance (for variable policies), and the insurer’s management fees.

Accessing and Using Cash Value

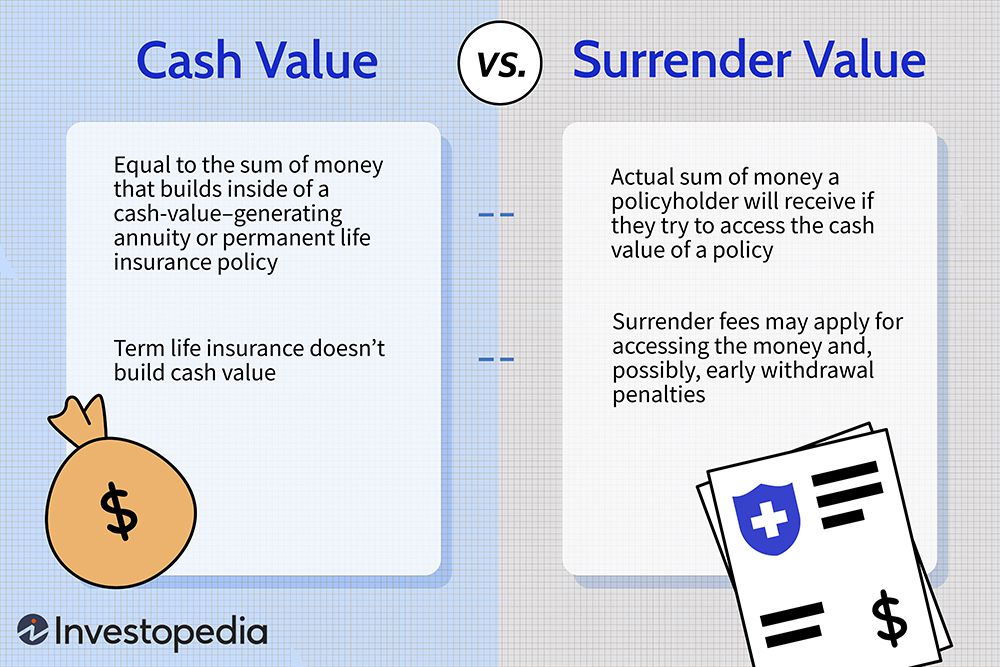

Policyholders can access their cash value through several methods: withdrawals, loans, and policy surrenders. Withdrawals reduce the cash value and death benefit, while loans allow you to borrow against the cash value without affecting the death benefit (although interest accrues). Surrendering the policy means terminating it and receiving the cash value as a lump sum.

Methods of Accessing Cash Value: Pros and Cons

| Access Method | Pros | Cons | Considerations |

|---|---|---|---|

| Withdrawals | Easy access to funds, flexible amounts. | Reduces cash value and death benefit, may incur fees. | Suitable for smaller, infrequent needs; consider tax implications. |

| Loans | Maintains death benefit, tax-deferred interest. | Interest accrues, loan repayment is crucial. | Best for short-term needs; consider long-term interest burden. |

| Surrenders | Receives lump sum cash value. | Policy terminates, loses future growth potential. | Suitable only as a last resort or if the policy is no longer needed. |

Cash Value vs. Term Life Insurance

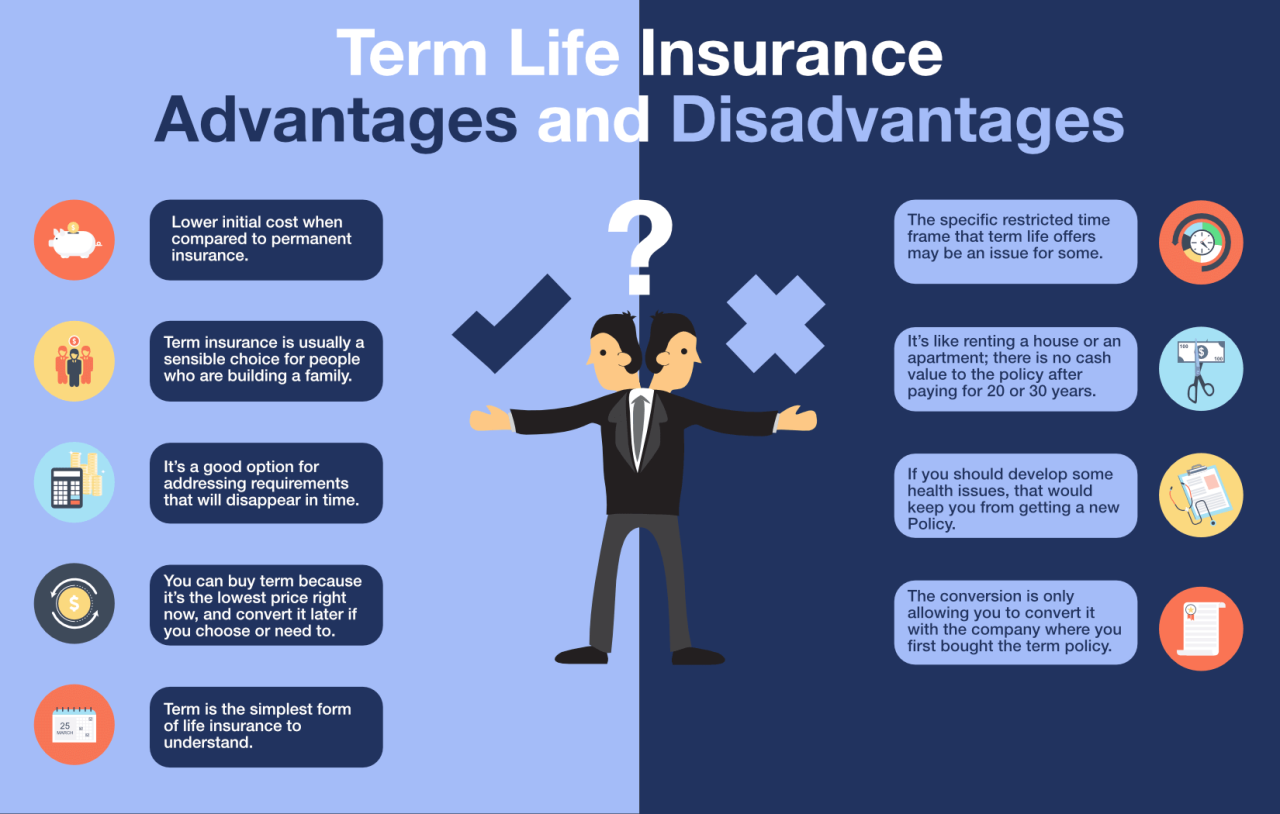

Choosing between cash value and term life insurance depends heavily on individual financial goals and risk tolerance. Both offer death benefit protection, but they differ significantly in their structure, cost, and long-term implications. Understanding these differences is crucial for making an informed decision.

Feature Comparison: Cash Value and Term Life Insurance

Cash value life insurance policies build a cash value component alongside the death benefit. This cash value grows tax-deferred and can be borrowed against or withdrawn under certain circumstances. Term life insurance, conversely, provides coverage for a specific period (the term), offering a pure death benefit without any cash value accumulation. The policy expires at the end of the term unless renewed, usually at a higher premium.

Cost Differences: Cash Value and Term Life Insurance

Cash value life insurance premiums are generally higher than term life insurance premiums because of the cash value component. The higher premiums reflect the cost of building the cash value, which is essentially a savings element within the policy. Term life insurance premiums are typically much lower, reflecting only the cost of the pure death benefit coverage for the specified term. For example, a 30-year-old purchasing a $500,000 policy might pay significantly less annually for a 20-year term policy compared to a comparable whole life cash value policy.

Suitability of Cash Value Life Insurance

Cash value life insurance is often a suitable choice for individuals who: desire a long-term, permanent life insurance policy; want to build tax-advantaged savings; need access to funds for emergencies or retirement; and are comfortable paying higher premiums for the added benefits. For example, a high-net-worth individual might use a cash value policy as part of their long-term financial strategy, utilizing the cash value for supplemental retirement income.

Suitability of Term Life Insurance

Term life insurance is generally a better choice for individuals who: need temporary life insurance coverage; prioritize affordability over long-term savings; have a limited budget; and are primarily concerned with providing a death benefit for a specific period, such as covering mortgage payments or children’s education. A young family with a mortgage might opt for a 30-year term policy to ensure coverage until their mortgage is paid off.

Key Differences: Benefits and Risks

The following points summarize the key differences between cash value and term life insurance:

- Premiums: Cash value policies have higher premiums than term policies.

- Coverage: Cash value offers lifelong coverage (depending on the type), while term provides coverage for a specific period.

- Cash Value: Cash value policies build cash value that can be borrowed against or withdrawn, term policies do not.

- Investment Growth: Cash value policies offer potential for tax-deferred investment growth, term policies do not.

- Risk: Cash value policies have higher initial costs and may not always yield high investment returns. Term policies have a higher risk of expiring before the need for coverage ends.

Investing and Cash Value Growth

Cash value life insurance policies offer a unique opportunity to combine life insurance coverage with a tax-advantaged savings component. Understanding how cash value grows is crucial for maximizing its potential. This section explores strategies for growth, influencing factors, and the role of market performance and fees.

Strategies for Maximizing Cash Value Growth

Several strategies can help maximize the growth of cash value within a life insurance policy. These strategies often involve a combination of policy selection, premium payment choices, and understanding the investment options available within the policy. Careful consideration of these aspects can significantly impact long-term cash value accumulation. For example, selecting a policy with a higher interest rate or a more aggressive investment option (where available) can lead to faster growth. Similarly, paying higher premiums earlier in the policy’s life can accelerate cash value accumulation through the power of compounding.

Factors Influencing Cash Value Growth

Several key factors influence the rate at which cash value grows. These include the underlying interest rate credited to the policy, the policy’s fees and expenses, and the performance of any investment options within the policy (if available). External economic factors, such as prevailing interest rates and market conditions, also play a significant role. For instance, a period of low interest rates will generally result in slower cash value growth compared to a period of higher rates. Furthermore, the policy’s death benefit and cash surrender value are directly influenced by the cash value’s growth.

Market Performance’s Effect on Cash Value

Market performance significantly affects cash value growth, particularly in policies that offer variable investment options. These options, such as mutual funds or sub-accounts, invest in various asset classes, and their performance directly impacts the cash value accumulation. For example, a strong stock market performance may lead to substantial cash value growth in a variable universal life (VUL) policy invested heavily in equities. Conversely, a market downturn could lead to a decrease in cash value, although the underlying death benefit might remain intact, depending on the policy structure. Consider a scenario where a VUL policy is invested primarily in a stock market index fund. If the index performs well, yielding a 10% return, the cash value would increase by 10%, assuming no fees or charges. However, a -5% market return would reduce the cash value by a similar percentage.

The Role of Fees and Expenses

Fees and expenses associated with a cash value life insurance policy can significantly impact cash value growth. These fees can include mortality and expense charges, administrative fees, and potentially surrender charges if the policy is surrendered before a specific period. High fees can erode the potential gains from interest and investment returns, reducing the overall growth of the cash value. It’s crucial to carefully review the policy’s fee structure before purchasing it to understand the potential impact on long-term cash value accumulation. For instance, a policy with a 2% annual fee will effectively reduce the annual growth by 2%, regardless of the investment performance.

Comparison of Investment Options

Understanding the various investment options within cash value policies is essential for making informed decisions. The availability of these options varies greatly depending on the specific policy type.

| Investment Option | Risk Level | Potential Return |

|---|---|---|

| Fixed Account | Low | Low to Moderate |

| Guaranteed Interest Account | Low | Low to Moderate (Guaranteed) |

| Variable Account (e.g., Mutual Funds) | Medium to High | Moderate to High (Fluctuating) |

Tax Implications of Cash Value

Understanding the tax implications of accessing your life insurance cash value is crucial for effective financial planning. The tax treatment depends significantly on how you access the funds and the type of policy you hold. Incorrectly managing this aspect can lead to unexpected tax liabilities.

Loans from Cash Value

Loans taken against your cash value are generally not taxable. This is because the loan is considered debt against your policy, not a distribution of funds. However, it’s important to remember that if you die with an outstanding loan, the death benefit will be reduced by the loan amount. Also, if the policy lapses, and the cash value is less than the loan, the difference is considered taxable income.

Withdrawals from Cash Value

Withdrawals from cash value are treated differently than loans. A portion of the withdrawal is generally considered a return of your basis (the premiums you’ve paid), which is tax-free. The remaining amount is considered gain and is subject to ordinary income tax. The tax implications depend on the amount withdrawn and the policy’s cash value. For example, if you have a cash value of $100,000 and a basis of $60,000, a $20,000 withdrawal would result in $10,000 being tax-free and $10,000 being taxable.

Tax Benefits for Beneficiaries

When the policy owner dies, the death benefit paid to the beneficiary is generally received income tax-free. This is a significant advantage of life insurance, providing a tax-advantaged way to transfer wealth to heirs. However, if the beneficiary receives the death benefit in installments rather than a lump sum, some portion might be subject to taxation. This is less common, however.

Examples of Tax Scenarios

Let’s consider two scenarios: In Scenario A, a policyholder takes a $20,000 loan against a policy with a $50,000 cash value and a $30,000 basis. No tax is owed at the time of the loan. In Scenario B, the same policyholder withdraws $20,000. $10,000 is considered a return of basis (tax-free), and the remaining $10,000 is considered a gain, subject to income tax. The tax liability would depend on the policyholder’s tax bracket.

Tax Law Variations, Cash value

The specific tax implications can vary depending on the type of policy (e.g., whole life, universal life, variable universal life) and the method of access (loan, withdrawal, surrender). Variable universal life policies, for example, often have more complex tax implications due to the investment component. Consulting a tax professional is highly recommended for accurate tax planning. Understanding the specific tax rules associated with your policy is essential for managing your financial affairs effectively.

Last Recap

Understanding cash value life insurance requires a holistic perspective, encompassing its investment potential, tax implications, and role in estate planning. While it offers the advantage of building wealth alongside death benefits, careful consideration of its costs, access methods, and potential risks is crucial. By weighing the pros and cons and understanding how cash value aligns with individual financial goals, one can effectively utilize this valuable tool for long-term financial security and wealth transfer.

General Inquiries

What are the risks associated with accessing cash value?

Risks include potential tax penalties, reduction of death benefit, and erosion of long-term growth potential depending on the access method and policy terms.

Can I borrow against my cash value without paying taxes?

While you generally don’t pay taxes on loans against your cash value, interest accrues and must be repaid. Failure to repay can impact your policy.

How does inflation affect cash value growth?

Inflation can erode the purchasing power of your cash value over time. Growth rates need to outpace inflation to maintain real value.

What happens to my cash value if I die?

The cash value, along with the death benefit, is typically paid to your beneficiaries.