- The Ultimate Guide to Car Insurance in Wichita, KS

-

FAQ about Car Insurance in Wichita, KS

- What is the minimum car insurance coverage required in Wichita, KS?

- How much does car insurance cost in Wichita, KS?

- What factors affect my car insurance rates?

- What is uninsured/underinsured motorist coverage?

- What is collision and comprehensive coverage?

- Do I need gap insurance?

- What is an SR-22?

- How can I find affordable car insurance in Wichita, KS?

- What if I can’t afford car insurance?

- How do I file a car insurance claim in Wichita, KS?

The Ultimate Guide to Car Insurance in Wichita, KS

Greetings, Readers!

Welcome to our comprehensive guide to car insurance in Wichita, KS. Whether you’re a seasoned driver or a new resident, this article will arm you with valuable information to make informed decisions about your auto insurance coverage.

Understanding Your Wichita Car Insurance Options

Liability Coverage: The Legal Essential

Liability insurance protects you financially if you’re responsible for an accident that causes bodily injury or property damage to others. Kansas requires a minimum of $25,000 per person/$50,000 per accident for bodily injury liability and $25,000 for property damage liability.

Collision and Comprehensive Coverage: Peace of Mind

Collision coverage pays for damage to your own vehicle after a collision with another object, while comprehensive coverage protects against non-collision events like theft, vandalism, and weather damage. While these coverages are optional, they’re highly recommended for financial peace of mind.

Factors Influencing Your Wichita Car Insurance Rates

Driving Record: A Tale of Your Driving History

Your driving record, including any accidents, speeding tickets, or DUIs, plays a significant role in determining your insurance rates. A clean driving record can lead to lower premiums.

Vehicle Type and Value: Your Ride’s Influence

The type and value of your vehicle also affect your insurance costs. Luxury cars, sports cars, and high-performance vehicles tend to have higher premiums than standard sedans or SUVs.

Customized Car Insurance for Wichita Drivers

Discounts and Savings: Earning Your Perks

Various insurance providers offer discounts for safe driving, multiple policies, and good credit scores. Ask your agent about available discounts to lower your premiums.

Personalized Coverage: Tailoring to Your Needs

In addition to the basic coverage options, you can customize your car insurance with additional coverages like rental car reimbursement, gap coverage, and roadside assistance. These add-ons provide tailored protection for your specific needs.

Comparison Table: Wichita Car Insurance Providers

| Insurance Provider | Coverage Options | Discounts | Customer Service |

|---|---|---|---|

| State Farm | Liability, collision, comprehensive | Safe driver, multi-policy, good student | 24/7 online chat and phone support |

| Geico | Liability, collision, comprehensive | Military, government employee, multi-vehicle | Mobile app for claims and policy management |

| Progressive | Liability, collision, comprehensive | Snapshot program for discounts | Online insurance quotes and policy changes |

| Allstate | Liability, collision, comprehensive | Good driver, renewals, autopay | Roadside assistance and claims handling |

| Farmers | Liability, collision, comprehensive | Loyalty, paperless billing, safety features | Dedicated agents for personalized service |

Conclusion: Insuring Your Ride with Confidence

Thank you for exploring our guide to car insurance in Wichita, KS. We hope this information has empowered you to make informed decisions about your auto coverage. Remember to compare quotes from reputable insurance providers and tailored your policy to meet your unique needs.

If you’re eager to discover more informative articles, visit our website and browse our extensive collection of insurance-related topics.

FAQ about Car Insurance in Wichita, KS

What is the minimum car insurance coverage required in Wichita, KS?

- Bodily injury liability: $25,000 per person, $50,000 per accident

- Property damage liability: $15,000 per accident

How much does car insurance cost in Wichita, KS?

- Prices vary depending on factors such as age, driving history, and type of vehicle. On average, expect to pay around $1,200 per year.

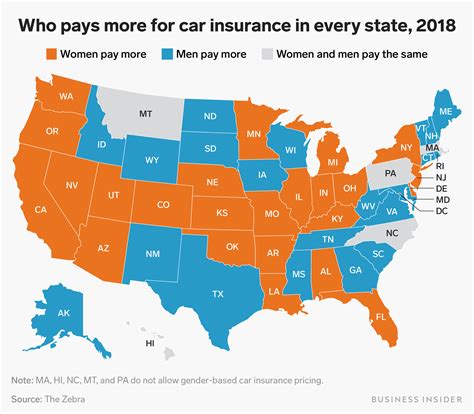

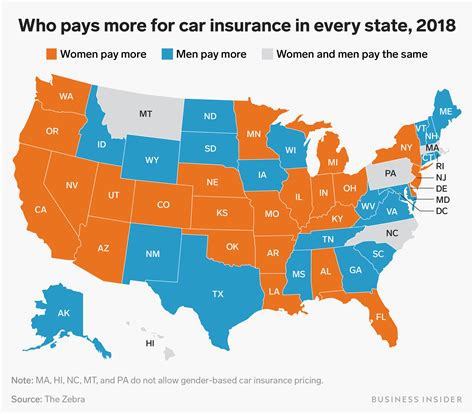

What factors affect my car insurance rates?

- Age, driving record, credit score, vehicle make/model, and coverage limits

What is uninsured/underinsured motorist coverage?

- Coverage that helps pay for your injuries or property damage if the at-fault driver is uninsured or underinsured.

What is collision and comprehensive coverage?

- Collision: Covers damage to your own vehicle from a collision with another object or vehicle.

- Comprehensive: Covers damage to your vehicle from non-collision events such as theft, vandalism, or weather-related incidents.

Do I need gap insurance?

- Only if you finance or lease your vehicle and the value of your car is less than the amount you owe.

What is an SR-22?

- A document that proves you have the minimum required insurance coverage, often required if your license was suspended or revoked.

How can I find affordable car insurance in Wichita, KS?

- Compare quotes from multiple insurance companies

- Increase your deductible

- Take advantage of discounts (e.g., safe driver, good student, multi-car)

What if I can’t afford car insurance?

- Contact the Kansas Department of Motor Vehicles to see if you qualify for the Kansas Automobile Insurance Plan (KAIP).

How do I file a car insurance claim in Wichita, KS?

- Contact your insurance company and provide details of the accident and any injuries or damage.