- Introduction

- Understanding Car Insurance Quotes

- Getting Car Insurance Quotes

- Types of Car Insurance Coverage

- Comparing Car Insurance Quotes

- Understanding the Coverage Table

- Conclusion

-

FAQ about Car Insurance Quotes

- 1. What is a car insurance quote?

- 2. How do I get a car insurance quote?

- 3. What information do I need to get a car insurance quote?

- 4. How long does it take to get a car insurance quote?

- 5. How do I compare car insurance quotes?

- 6. What is the best way to save money on car insurance?

- 7. What happens if I don’t have car insurance?

- 8. What is liability insurance?

- 9. What is collision insurance?

- 10. What is comprehensive insurance?

Introduction

Greetings, readers! Are you looking to secure the best car insurance coverage for your vehicle? Navigating the world of insurance can be a daunting task, but we’ve got you covered. In this comprehensive guide, we’ll delve into every aspect of car insurance quotes, empowering you to make an informed decision that protects you and your precious ride.

So, buckle up and let’s embark on this journey to uncover the secrets of finding the perfect car insurance quote.

Understanding Car Insurance Quotes

What is a Car Insurance Quote?

A car insurance quote is an estimate of the cost of your insurance coverage. It provides you with a breakdown of the premiums and deductibles associated with different levels of coverage. By comparing quotes from multiple insurers, you can determine the most suitable and affordable plan for your needs.

Factors Affecting Car Insurance Quotes

Numerous factors influence your car insurance quote, including:

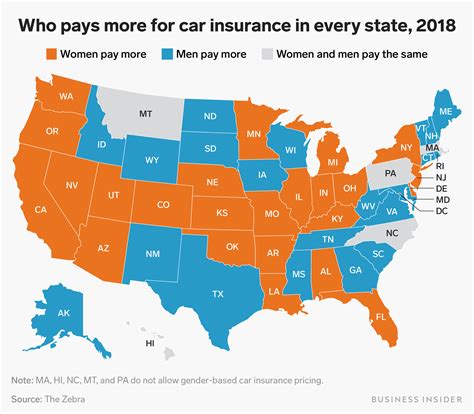

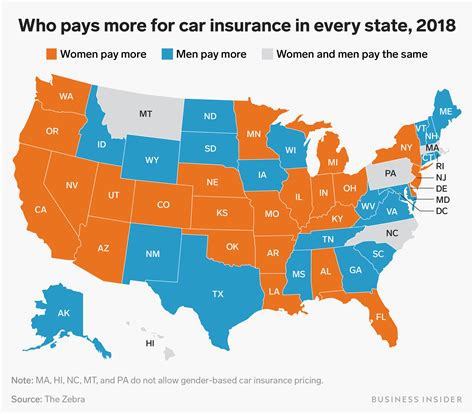

- Your age, gender, and driving history

- The make, model, and year of your car

- Your location and ZIP code

- The amount of coverage you need

- Your driving habits, such as frequency and distance

Getting Car Insurance Quotes

Online Quote Tools

Many insurance companies offer online quote tools that allow you to instantly compare rates. These tools are often user-friendly and provide you with a range of options to choose from.

Independent Insurance Agents

Independent insurance agents represent multiple insurance carriers, offering you a wider selection of quotes. They can also provide personalized guidance based on your specific situation.

Direct from Insurance Companies

You can also request quotes directly from insurance companies by visiting their websites or contacting their customer service numbers.

Types of Car Insurance Coverage

Liability Coverage

Liability coverage is required by law in most states. It protects you if you are found legally responsible for causing damage or injury to others or their property in a car accident.

Collision and Comprehensive Coverage

Collision coverage pays for damage to your own vehicle caused by a collision with another object. Comprehensive coverage, on the other hand, covers non-collision-related damages, such as theft, vandalism, or weather-related incidents.

Additional Coverage Options

- Uninsured/Underinsured Motorist Coverage: Protects you if you are involved in an accident with a driver who does not have insurance or has inadequate coverage.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of who is at fault.

- Rental Reimbursement Coverage: Pays for a rental car if your vehicle is being repaired or replaced.

Comparing Car Insurance Quotes

Compare Coverage Levels

Make sure to compare quotes that provide the same coverage. Different companies may offer varying levels of coverage within each category.

Check for Discounts

Many insurance companies offer discounts for factors such as good driving history, multi-vehicle policies, and safety features in your vehicle.

Pay Attention to Deductibles

Deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, so consider your financial situation.

Understanding the Coverage Table

| Coverage Type | Minimum Coverage | Maximum Coverage |

|---|---|---|

| Liability | Bodily injury: $25,000 per person, $50,000 per accident | Bodily injury: $100,000 per person, $300,000 per accident |

| Collision | Actual cash value of the vehicle | Replacement cost of the vehicle |

| Comprehensive | Actual cash value of the vehicle | Replacement cost of the vehicle |

| Uninsured/Underinsured Motorist | $25,000 per person, $50,000 per accident | $100,000 per person, $300,000 per accident |

| Personal Injury Protection | Up to $10,000 per person | Up to $50,000 per person |

| Rental Reimbursement | Up to $30 per day, maximum $500 | Up to $60 per day, maximum $1,500 |

Conclusion

Finding the right car insurance quote car insurance doesn’t have to be a headache. By understanding the different coverage options, comparing quotes from multiple insurers, and considering your individual needs, you can secure the best protection for your car and yourself.

Don’t hesitate to explore our other articles for more insights into insurance-related topics. Stay informed, stay protected, and enjoy the peace of mind that comes with knowing you’re covered.

FAQ about Car Insurance Quotes

1. What is a car insurance quote?

- A car insurance quote is an estimate of the cost of your car insurance policy. It is based on factors such as your age, driving history, and the type of car you drive.

2. How do I get a car insurance quote?

- You can get a car insurance quote online, over the phone, or through a local insurance agent.

3. What information do I need to get a car insurance quote?

- You will need to provide information such as your name, address, date of birth, driving history, and the type of car you drive.

4. How long does it take to get a car insurance quote?

- It typically takes a few minutes to get a car insurance quote online. If you get a quote over the phone or through an agent, it may take a little longer.

5. How do I compare car insurance quotes?

- When comparing car insurance quotes, it is important to compare the coverage, the cost, and the financial stability of the insurance company.

6. What is the best way to save money on car insurance?

- There are several ways to save money on car insurance, such as bundling your policies, increasing your deductible, and taking a defensive driving course.

7. What happens if I don’t have car insurance?

- If you are caught driving without car insurance, you could face fines, penalties, and even jail time.

8. What is liability insurance?

- Liability insurance covers you if you are found liable for damages or injuries caused to other people or their property in an accident.

9. What is collision insurance?

- Collision insurance covers damage to your own car in an accident, regardless of who is at fault.

10. What is comprehensive insurance?

- Comprehensive insurance covers damage to your car from events other than accidents, such as theft, vandalism, and fire.