- Introduction

- Types of Car Auto Insurance

- Factors to Consider

- Car Auto Insurance Comparison Tools

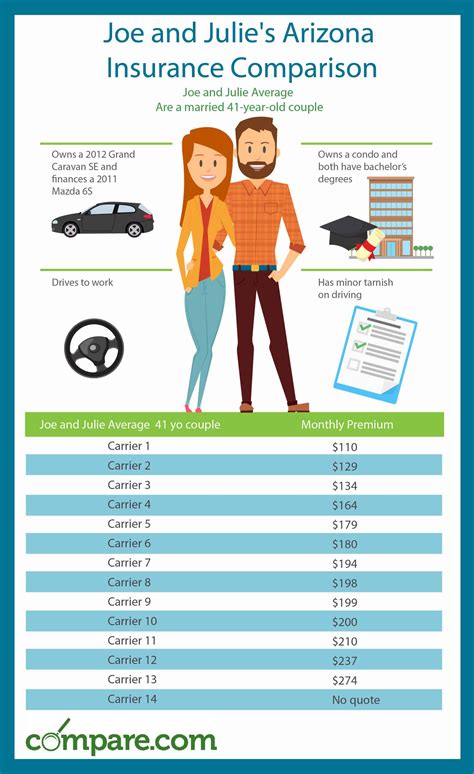

- Detailed Table Breakdown

- Conclusion

-

FAQ about Car Auto Insurance Comparison

- What is auto insurance comparison?

- Why should I compare auto insurance?

- What factors should I consider when comparing auto insurance?

- How can I compare auto insurance?

- What are the benefits of using an insurance agent?

- Are the quotes I get from online comparison websites accurate?

- How often should I compare auto insurance?

- What are some tips for getting the best auto insurance rates?

- What is the difference between liability coverage and collision coverage?

- What does comprehensive coverage cover?

Introduction

Greetings, readers! Welcome to our in-depth guide on car auto insurance comparison. In today’s complex insurance landscape, navigating the options and making an informed choice can be daunting. This article aims to simplify the process by providing you with comprehensive information to help you find the perfect policy for your needs.

As the saying goes, knowledge is power. By arming yourself with the necessary insights, you can avoid costly mistakes, protect your assets, and ensure peace of mind on the road. So, let’s dive into the intricate world of car auto insurance comparison.

Types of Car Auto Insurance

Liability Coverage

Liability insurance is the cornerstone of any car auto insurance policy. It protects you financially in the event that you cause bodily injury or property damage to others. Liability coverage comes in two forms:

- Bodily injury liability covers medical expenses, lost wages, and pain and suffering of individuals injured in an accident you cause.

- Property damage liability covers damage to property, such as vehicles, structures, or personal belongings, caused by your actions.

Comprehensive Coverage

Comprehensive coverage, also known as "other than collision," provides protection against incidents that are not collisions with other vehicles or objects. Common covered events include:

- Theft and vandalism

- Fire and natural disasters

- Glass breakage

- Animal collisions

Collision Coverage

Collision coverage protects your vehicle from damage sustained in an accident, regardless of fault. It is more expensive than comprehensive coverage but offers more comprehensive protection.

Factors to Consider

Age, Location, and Driving History

Your age, location, and driving history significantly impact your car auto insurance rates. Young drivers, drivers living in high-crime areas, and drivers with poor driving records typically face higher premiums.

Vehicle Make and Model

Insurance companies consider the safety features, repair costs, and theft rate of your vehicle when determining your rates. Vehicles with strong safety ratings and low repair costs generally qualify for lower premiums.

Coverage Limits

Coverage limits determine the maximum amount your insurance company will pay for each type of coverage. Higher coverage limits provide greater financial protection but also increase your premiums.

Deductible

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible lowers your premiums, but you will have to pay more if you file a claim.

Car Auto Insurance Comparison Tools

Online Comparison Websites

Numerous websites allow you to compare quotes from multiple insurance companies simultaneously. These websites make it easy to find affordable coverage that meets your specific needs.

Insurance Agents

Insurance agents represent specific insurance companies and can provide personalized quotes based on your individual circumstances. They may offer professional advice and assist you with filing claims.

Detailed Table Breakdown

| Coverage Type | Benefits | Cost |

|---|---|---|

| Liability Coverage | Protects against financial liability for bodily injury and property damage | Low to moderate |

| Comprehensive Coverage | Covers non-collision incidents, such as theft and vandalism | Moderate |

| Collision Coverage | Protects your vehicle from damage in accidents | High |

Conclusion

Understanding the nuances of car auto insurance comparison is essential for making informed decisions. By carefully considering the factors discussed in this guide, utilizing comparison tools, and seeking professional advice if needed, you can find the perfect policy that meets your individual needs and provides comprehensive protection.

We appreciate you taking the time to explore our article. If you’re interested in delving deeper into other automotive topics, be sure to check out our latest articles on car maintenance, road safety, and industry trends.

FAQ about Car Auto Insurance Comparison

What is auto insurance comparison?

Auto insurance comparison is the process of comparing different insurance policies from multiple insurance companies to find the best coverage and rates for your specific needs.

Why should I compare auto insurance?

Comparing auto insurance can help you save money, find better coverage, and make sure you have the right protection for your vehicle and driving habits.

What factors should I consider when comparing auto insurance?

Some factors to consider include: coverage limits, deductibles, discounts, customer service ratings, and policy terms.

How can I compare auto insurance?

You can compare auto insurance online using comparison websites, through insurance agents, or by contacting insurance companies directly.

What are the benefits of using an insurance agent?

Insurance agents can provide personalized advice, help you understand your coverage options, and advocate for you if you have a claim.

Are the quotes I get from online comparison websites accurate?

Online comparison website quotes provide general estimates, but the actual rates may vary depending on your specific circumstances.

How often should I compare auto insurance?

It’s a good idea to compare auto insurance every few years or whenever you experience significant life changes, such as buying a new car or moving to a different state.

What are some tips for getting the best auto insurance rates?

Some tips include: maintaining a good driving record, shopping around for discounts, bundling your insurance policies, and increasing your deductibles.

What is the difference between liability coverage and collision coverage?

Liability coverage pays for damages and injuries to others if you cause an accident. Collision coverage pays for damages to your own vehicle if you are involved in an accident.

What does comprehensive coverage cover?

Comprehensive coverage provides protection for your vehicle against non-collision events, such as theft, vandalism, and natural disasters.