Can you buy crypto on Robinhood? The answer is a resounding yes! Robinhood, the popular trading platform known for its user-friendly interface, has expanded its offerings to include a selection of cryptocurrencies. This has opened up the world of digital assets to a broader audience, making it easier for individuals to invest in cryptocurrencies like Bitcoin, Ethereum, and Dogecoin.

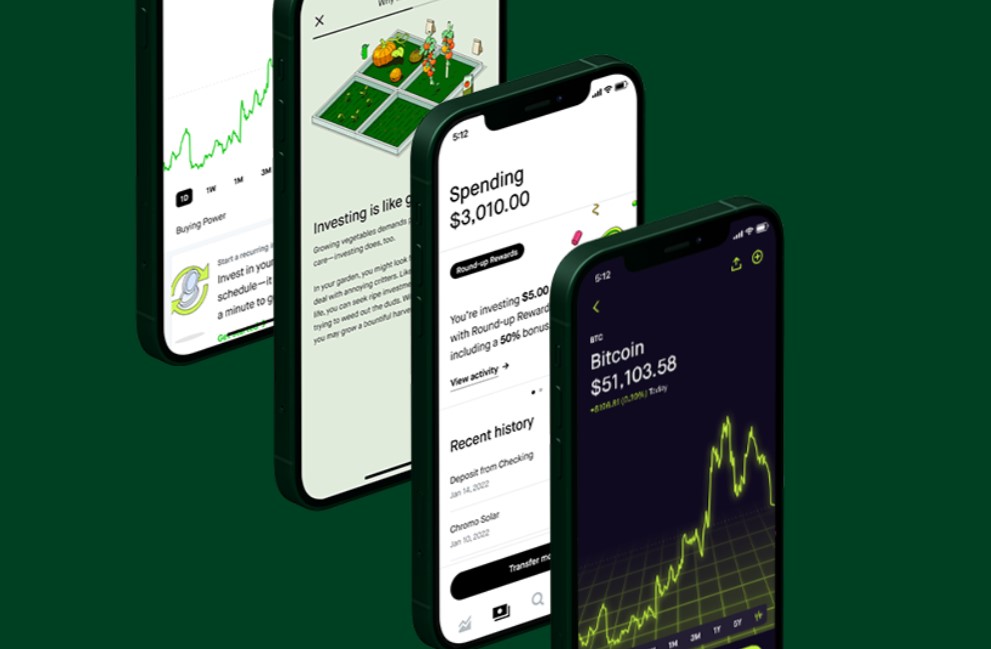

Robinhood’s crypto trading platform provides a streamlined and accessible way to buy, sell, and manage crypto investments. However, it’s crucial to understand the platform’s features, fees, and limitations before diving into the world of crypto trading.

Robinhood’s Crypto Offerings

Robinhood, the popular trading platform known for its user-friendly interface and commission-free stock trading, has expanded its services to include cryptocurrency trading. While not offering the same breadth of cryptocurrencies as some dedicated exchanges, Robinhood provides a streamlined and accessible gateway for beginners and experienced investors alike to enter the world of digital assets.

Cryptocurrency Selection

Robinhood’s cryptocurrency selection is limited compared to other platforms, but it includes some of the most popular and widely traded cryptocurrencies. Currently, Robinhood users can trade the following cryptocurrencies:

- Bitcoin (BTC)

- Ethereum (ETH)

- Dogecoin (DOGE)

- Bitcoin Cash (BCH)

- Litecoin (LTC)

- Ethereum Classic (ETC)

This selection covers a range of cryptocurrencies, including the leading cryptocurrencies like Bitcoin and Ethereum, along with meme coins like Dogecoin, and altcoins like Litecoin and Bitcoin Cash. While Robinhood doesn’t offer obscure or less established cryptocurrencies, its selection provides a good starting point for those new to crypto investing.

Trading Fees and Commission Structure

Robinhood’s crypto trading fees are structured differently from its stock trading. While Robinhood doesn’t charge commissions on stock trades, it does charge a spread on cryptocurrency transactions. This spread is the difference between the bid and ask price, which represents the price at which Robinhood is willing to buy and sell the cryptocurrency.

- Bid Price: The price at which Robinhood will buy a cryptocurrency from you.

- Ask Price: The price at which Robinhood will sell a cryptocurrency to you.

The spread is typically a small percentage of the cryptocurrency’s price, but it can vary depending on the cryptocurrency and market conditions. Robinhood doesn’t disclose the exact spread for each cryptocurrency, but it’s generally comparable to other platforms.

Advantages and Disadvantages of Robinhood for Crypto Trading

Robinhood’s simplicity and user-friendly interface make it an attractive platform for beginners. Its commission-free stock trading model has made it popular, and the extension of this model to crypto trading has attracted many new users. However, there are also disadvantages to consider.

Advantages

- User-Friendly Interface: Robinhood’s interface is known for its simplicity and ease of use, making it a good choice for beginners.

- Commission-Free Trading: While Robinhood charges a spread on cryptocurrency transactions, it doesn’t charge commissions, making it a cost-effective option for frequent traders.

- Secure Platform: Robinhood has a good track record of security and has implemented measures to protect user accounts and funds.

Disadvantages

- Limited Cryptocurrency Selection: Robinhood offers a limited selection of cryptocurrencies compared to other platforms, which may not suit experienced traders or those seeking more niche or obscure cryptocurrencies.

- No Advanced Trading Features: Robinhood doesn’t offer advanced trading features such as margin trading, futures, or options, which may limit the trading strategies available to experienced traders.

- Spread Charges: While Robinhood doesn’t charge commissions, it does charge a spread on cryptocurrency transactions, which can eat into profits, especially for small trades.

Buying Crypto on Robinhood

Robinhood offers a user-friendly platform for buying and selling cryptocurrencies, making it an attractive option for both beginners and experienced traders. The process is straightforward and involves several steps, from setting up an account to executing trades.

Account Setup and Funding

To begin buying crypto on Robinhood, you need to create an account and fund it. This process is similar to setting up an account for traditional stock trading.

- Download the Robinhood app or visit the website. Robinhood is available on both iOS and Android devices, as well as on the web.

- Provide your personal information. This includes your name, address, date of birth, and Social Security number for verification purposes.

- Link a bank account or debit card. Robinhood allows you to fund your account through various methods, including bank transfers and debit card deposits.

- Complete the identity verification process. Robinhood requires you to verify your identity by uploading a government-issued ID, such as a driver’s license or passport.

Once your account is set up and funded, you’re ready to start trading crypto.

Order Execution

Buying crypto on Robinhood is similar to buying stocks. You can place market orders or limit orders, depending on your trading strategy.

- Market orders execute at the current market price, ensuring immediate execution but potentially resulting in a less favorable price.

- Limit orders allow you to set a specific price you’re willing to buy or sell at. This gives you more control over the price but may not execute if the market price doesn’t reach your desired level.

Security Measures

Robinhood takes security seriously and employs various measures to protect user funds and transactions.

- Two-factor authentication (2FA) adds an extra layer of security by requiring a unique code from your phone or email in addition to your password when logging in.

- Encryption safeguards your data during transmission and storage, making it difficult for unauthorized individuals to access it.

- Cold storage keeps a significant portion of Robinhood’s cryptocurrency holdings offline, reducing the risk of theft through hacking or cyberattacks.

Crypto Features on Robinhood

Robinhood offers a range of features designed to help users manage their crypto investments effectively. These features cater to different levels of experience and risk tolerance, providing tools for portfolio tracking, price alerts, and research.

Portfolio Tracking

Robinhood’s portfolio tracking feature allows users to monitor the performance of their crypto investments. This feature provides a comprehensive overview of their portfolio, including the value of their holdings, the percentage allocation to each asset, and the overall return on investment. Users can view their portfolio performance over different time periods, such as daily, weekly, or monthly, to track their progress and make informed decisions.

Price Alerts

Price alerts are a crucial tool for traders who want to stay informed about price movements in the crypto market. Robinhood’s price alert feature allows users to set custom alerts for specific cryptocurrencies, triggered when the price reaches a predetermined level. This feature can help users buy or sell cryptocurrencies at their desired price points, ensuring they don’t miss out on potential opportunities or avoid unnecessary losses.

Research Tools

Robinhood offers limited research tools for cryptocurrencies, providing basic information such as price charts, trading volume, and market capitalization. While this information can be useful for beginners, more experienced traders may find it insufficient for in-depth analysis. The platform’s research tools are not as extensive as those offered by other platforms, such as CoinMarketCap or TradingView, which provide more detailed technical analysis tools, news feeds, and community discussions.

Comparison with Other Platforms

Compared to other platforms, Robinhood’s crypto features are relatively basic. While it provides essential tools for portfolio tracking and price alerts, it lacks advanced research tools and trading features. For example, platforms like Coinbase Pro offer more sophisticated charting tools, order types, and access to institutional-grade research.

Implications for Investors

Robinhood’s crypto features are suitable for investors who are new to the crypto market or have a low risk tolerance. The platform’s user-friendly interface and limited trading options make it an accessible entry point for beginners. However, experienced traders or those seeking more advanced features may find Robinhood’s offerings lacking.

Considerations for Buying Crypto on Robinhood

Before diving into the world of cryptocurrency trading on Robinhood, it’s essential to understand the potential risks and limitations associated with this platform. It’s crucial to consider the regulatory landscape surrounding crypto trading on Robinhood and the importance of conducting thorough research and due diligence before investing in any cryptocurrency.

Risks and Limitations of Buying Crypto on Robinhood

Robinhood offers a user-friendly platform for buying and selling cryptocurrencies, but it’s essential to be aware of the potential risks and limitations associated with this platform.

- Limited Cryptocurrency Selection: Robinhood currently offers a limited selection of cryptocurrencies compared to other exchanges. This could limit your investment options and potentially hinder your ability to diversify your portfolio.

- Limited Trading Features: Robinhood’s platform lacks advanced trading features such as margin trading, short selling, and limit orders. These features can be valuable for experienced traders looking for more sophisticated trading strategies.

- Security Risks: Like any online platform, Robinhood is susceptible to security risks. While the platform has implemented security measures, it’s crucial to protect your account information and use strong passwords.

- Custody of Crypto: Robinhood holds the private keys to your cryptocurrencies, meaning you don’t have direct control over your assets. This can raise concerns about security and potential loss of access to your funds.

- Potential for Market Volatility: The cryptocurrency market is known for its volatility, and prices can fluctuate significantly in short periods. This volatility can lead to substantial losses, particularly for inexperienced investors.

Regulatory Environment of Crypto Trading on Robinhood

The regulatory environment surrounding cryptocurrency trading is constantly evolving.

- U.S. Securities and Exchange Commission (SEC): The SEC has been actively investigating and regulating cryptocurrency exchanges, including Robinhood. The SEC has expressed concerns about the lack of transparency and potential for fraud in the cryptocurrency market.

- Financial Crimes Enforcement Network (FinCEN): FinCEN regulates financial institutions, including cryptocurrency exchanges, to prevent money laundering and other financial crimes. Robinhood is subject to FinCEN’s regulations, which require the platform to implement anti-money laundering (AML) and know-your-customer (KYC) procedures.

- State Regulations: Some states have implemented their own regulations regarding cryptocurrency trading. Robinhood must comply with these state-level regulations, which can vary in their scope and requirements.

Importance of Research and Due Diligence

Before investing in any cryptocurrency, it’s essential to conduct thorough research and due diligence.

- Understand the Technology: Familiarize yourself with the underlying technology behind the cryptocurrency you’re considering, such as blockchain technology. Understanding the technology can help you assess the potential risks and benefits of investing.

- Evaluate the Project’s Team: Research the team behind the cryptocurrency project, including their experience, expertise, and track record. A strong team can increase the project’s credibility and potential for success.

- Assess the Project’s Use Cases: Evaluate the potential use cases for the cryptocurrency. A cryptocurrency with real-world applications and a strong community is likely to have a higher chance of success.

- Read White Papers: Cryptocurrency projects typically publish white papers that Artikel their goals, technology, and roadmap. Read the white paper carefully to understand the project’s details and potential risks.

- Consider Investment Risks: Cryptocurrency investments are inherently risky. Be aware of the potential for market volatility, security breaches, and regulatory changes that could impact your investment.

Alternatives to Robinhood for Crypto Trading

While Robinhood offers a user-friendly platform for crypto trading, it’s not the only option available. Numerous other platforms cater to different needs and preferences, each with its unique set of features, fees, and advantages. Exploring these alternatives can help you find the best fit for your crypto trading journey.

Comparison of Crypto Trading Platforms

Understanding the differences between Robinhood and other popular crypto trading platforms is crucial for making an informed decision. The table below highlights key features, fees, and pros and cons of each platform:

| Platform Name | Key Features | Fees | Pros | Cons |

|---|---|---|---|---|

| Robinhood | User-friendly interface, commission-free trading, limited crypto selection | No trading fees, but spreads can be wider than other platforms | Easy to use, no trading fees, good for beginners | Limited crypto selection, wider spreads, no advanced trading features |

| Coinbase | Large selection of cryptocurrencies, user-friendly interface, educational resources | Trading fees vary based on volume and payment method | Wide range of cryptocurrencies, strong security, good educational resources | Higher fees than some platforms, limited advanced trading features |

| Binance | Extensive crypto selection, low fees, advanced trading features | Low trading fees, wide range of trading pairs | Low fees, extensive crypto selection, advanced trading features | Steeper learning curve, complex interface, potential security concerns |

| Kraken | Advanced trading features, institutional-grade security, wide range of cryptocurrencies | Competitive trading fees, advanced charting tools | Strong security, advanced trading features, good for experienced traders | Steeper learning curve, more complex interface |

Advantages and Disadvantages of Alternative Platforms, Can you buy crypto on robinhood

Choosing an alternative platform to Robinhood for crypto trading can offer several benefits. These platforms often provide:

- Wider selection of cryptocurrencies: Platforms like Coinbase and Binance offer a significantly larger selection of cryptocurrencies compared to Robinhood, allowing you to diversify your portfolio and access emerging markets.

- Lower trading fees: Some platforms, like Binance, offer lower trading fees compared to Robinhood, which can save you money in the long run.

- Advanced trading features: Platforms like Kraken and Binance provide advanced trading features like margin trading, futures contracts, and technical analysis tools, catering to experienced traders seeking greater control and flexibility.

- More robust security: Platforms like Kraken and Coinbase prioritize security and offer advanced measures like two-factor authentication and cold storage to protect your assets.

However, switching to alternative platforms also comes with potential drawbacks:

- Steeper learning curve: Some platforms, like Binance and Kraken, have a steeper learning curve due to their advanced features and complex interfaces. This can be challenging for beginners.

- More complex interfaces: Platforms with advanced features often have more complex interfaces, which can be overwhelming for new users.

- Potential security concerns: While reputable platforms prioritize security, they can still be vulnerable to hacking and other threats. It’s crucial to conduct thorough research and choose platforms with a proven track record of security.

Summary

In conclusion, Robinhood offers a convenient and user-friendly platform for buying and selling cryptocurrencies. While it may not be the most comprehensive or feature-rich platform for experienced traders, it provides a good starting point for beginners looking to explore the world of digital assets. However, it’s essential to conduct thorough research, understand the associated risks, and carefully consider your investment goals before making any trading decisions.

Answers to Common Questions: Can You Buy Crypto On Robinhood

Is Robinhood safe for crypto trading?

Robinhood employs robust security measures to protect user funds and transactions, including two-factor authentication and encryption. However, no platform is completely immune to security risks, so it’s essential to practice good security habits and be aware of potential threats.

What are the fees for buying crypto on Robinhood?

Robinhood does not charge commission fees for buying or selling cryptocurrencies. However, they may charge a spread, which is the difference between the buy and sell prices of a cryptocurrency. This spread can vary depending on the cryptocurrency and market conditions.

Can I withdraw my crypto from Robinhood?

While you can’t withdraw your crypto from Robinhood directly, you can sell your crypto holdings and withdraw the proceeds to your linked bank account.

What are the minimum and maximum investment amounts for crypto on Robinhood?

Robinhood does not have a minimum investment amount for cryptocurrencies. The maximum investment amount will depend on your account balance and the availability of funds.