Can I switch electric companies if I owe money sets the stage for this exploration, offering readers a glimpse into a common consumer dilemma. Navigating the complexities of switching providers while managing an outstanding balance can be daunting, but understanding the terms of your contract, communicating with your current provider, and exploring alternative options can pave the way for a smoother transition.

This article delves into the intricacies of switching electric companies while owing money, providing a comprehensive guide to help you make informed decisions and navigate the process with confidence. From understanding your contract obligations to exploring potential solutions and considering the legal aspects, this guide equips you with the knowledge to navigate this common consumer challenge.

Understanding Your Contract: Can I Switch Electric Companies If I Owe Money

Before you can switch electric companies, it’s essential to understand the terms and conditions of your current contract. This includes the clauses that pertain to switching providers while you still have an outstanding balance.

Your contract Artikels the agreement between you and your current electric company, defining the services provided, the rates charged, and the obligations of both parties. It’s important to familiarize yourself with these terms to avoid any unexpected consequences or fees.

Consequences of Switching While Owing Money

Switching electric companies while owing money can lead to several consequences. These can range from a simple service interruption to more serious financial repercussions.

- Service Disconnection: Your current electric company may disconnect your service if you have an outstanding balance. This can leave you without electricity, potentially causing inconvenience and disruption to your daily life.

- Penalties and Fees: Some electric companies may impose penalties or fees for switching while owing money. These charges can add to your overall debt and increase your financial burden.

- Credit Score Impact: A late payment or unpaid balance on your electric bill can negatively affect your credit score. This can make it harder to obtain loans, credit cards, or even rent an apartment in the future.

Different Contract Types and Switching Policies

Electric companies offer different types of contracts, each with its own set of rules and policies regarding switching.

- Fixed-Rate Contracts: These contracts lock in a specific price for a set period, often 12 or 24 months. Switching providers during this period might involve penalties or early termination fees.

- Variable-Rate Contracts: These contracts allow the price of electricity to fluctuate based on market conditions. Switching providers under a variable-rate contract is generally easier, as there are often no penalties for early termination.

- Month-to-Month Contracts: These contracts offer flexibility, allowing you to switch providers at any time without penalties. However, the rates may be higher than those offered under fixed-rate contracts.

It’s essential to carefully review the terms and conditions of your current contract, particularly the clauses related to switching providers while owing money. This will help you understand the potential consequences and make an informed decision about whether switching is the right option for you.

Communication with Your Current Provider

It’s important to communicate with your current electric provider before switching. This will help you understand your outstanding balance, explore payment options, and ensure a smooth transition.

Contacting Your Provider

To initiate the process, contact your current electric company directly. You can usually do this through their website, phone number, or by visiting a local office.

- Website: Most electric companies have a dedicated section on their website for customer service, where you can find contact information and submit inquiries.

- Phone: Call the customer service number listed on your bill or on the company’s website.

- Local Office: If you prefer in-person communication, visit your local electric company office.

Asking the Right Questions, Can i switch electric companies if i owe money

When you contact your provider, ask about your outstanding balance and explore potential solutions for switching.

- Outstanding Balance: Inquire about the total amount you owe, the breakdown of charges, and any late fees.

- Payment Plans: Ask if your provider offers payment plans or any other financial assistance options to help you manage your outstanding balance.

- Switching Policy: Find out if your provider has a specific policy for switching with an outstanding balance. For instance, they might require you to pay a certain amount before switching or allow you to transfer your balance to your new provider.

Documenting Conversations

It’s essential to keep a record of all your conversations and agreements with your current provider.

- Notes: Take detailed notes during your phone calls or in-person meetings, including the date, time, name of the representative you spoke to, and the key points discussed.

- Emails: If you communicate via email, save all correspondence, including the subject line and the content of the messages.

- Written Agreements: If you reach an agreement with your provider, ensure it’s documented in writing and signed by both parties. This could include a payment plan or a formal agreement about the switching process.

Exploring Alternative Options

You might be wondering if there are other ways to resolve the outstanding balance before switching electric companies. There are several options available, each with its own set of pros and cons. Let’s explore them in detail.

Negotiating a Payment Plan

Negotiating a payment plan with your current provider can be a viable solution if you’re unable to pay the entire outstanding balance upfront. This allows you to break down the debt into smaller, more manageable installments.

Contact your provider and explain your financial situation. They may be willing to work with you and create a payment plan that fits your budget.

Setting Up a Budget

Setting up a budget is essential for managing your finances effectively, especially when dealing with debt. It helps you prioritize your expenses and allocate funds towards paying off the outstanding balance.

Use budgeting tools or apps to track your income and expenses. Identify areas where you can cut back and allocate those savings towards paying off your debt.

Transferring the Outstanding Balance

Some electric companies may allow you to transfer your outstanding balance to a new provider. This means that the new provider would assume responsibility for the debt, allowing you to switch without having to pay it off first. However, this option is not always available, and it may come with specific terms and conditions.

Contact both your current and potential new providers to inquire about the possibility of transferring the outstanding balance.

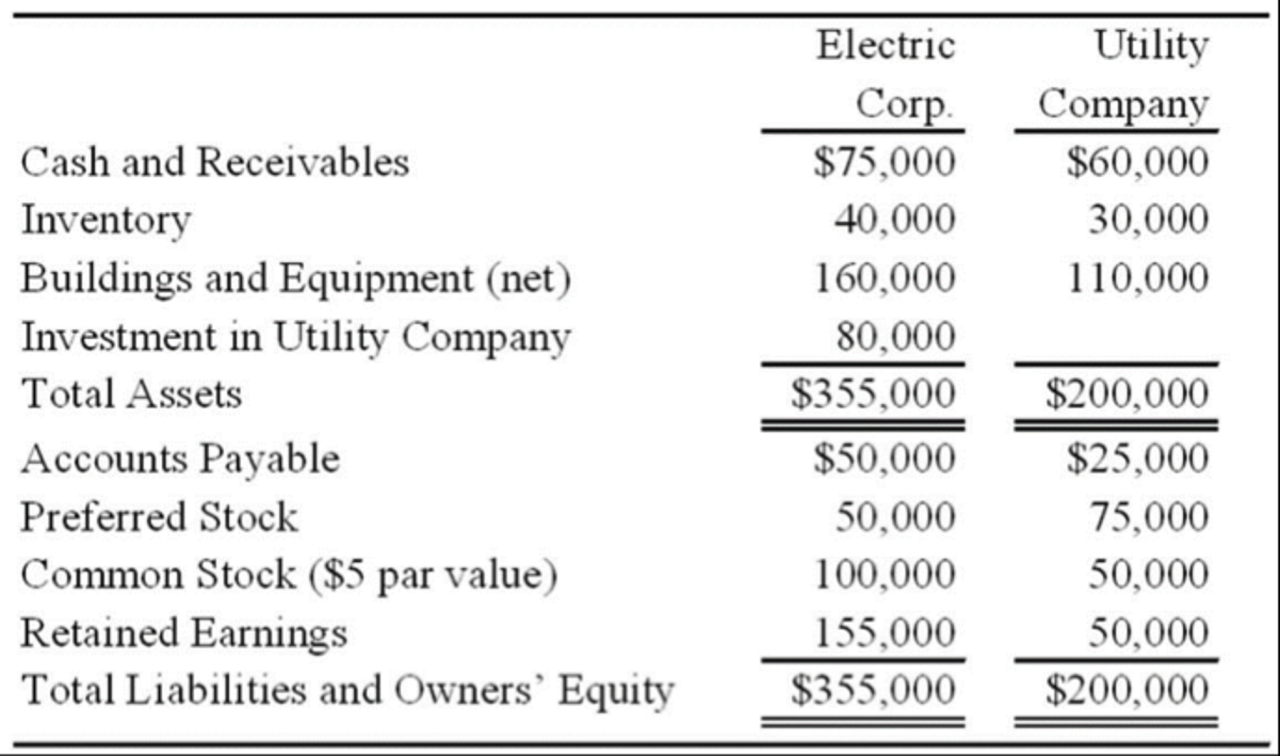

Comparing Different Options

| Option | Pros | Cons |

|—|—|—|

| Switching with Outstanding Balance | No need to pay off the debt immediately. | May face penalties or higher rates from the new provider. |

| Paying Off the Debt First | Avoids potential penalties or higher rates from the new provider. | Requires a significant upfront payment. |

| Transferring the Outstanding Balance | May be possible to switch without paying off the debt upfront. | Not all providers offer this option. May have specific terms and conditions. |

The New Provider’s Perspective

Switching electric companies while owing money to your previous provider can be a complex situation, and it’s essential to understand the perspective of the new provider. While they might be willing to take on a customer with an outstanding balance, there are several factors they consider before making a decision.

Factors Influencing Acceptance

The decision of a new provider to accept a customer with an outstanding balance is influenced by various factors. These include:

- Credit History: A new provider will likely review your credit history to assess your overall financial responsibility. A good credit history demonstrates a track record of paying bills on time, which increases the likelihood of them accepting you as a customer.

- Amount Owed: The amount of money you owe to your previous provider is a significant factor. A large outstanding balance could be a red flag for the new provider, indicating a potential risk of non-payment.

- Reason for Outstanding Balance: Understanding the reason behind the outstanding balance is crucial. If it’s due to a temporary financial hardship or a billing dispute, the new provider might be more lenient. However, if it’s due to negligence or a history of non-payment, they might be hesitant to accept you.

Hypothetical Scenario

Let’s consider a hypothetical scenario where a new provider might accept a customer with an outstanding balance. Imagine a customer who has a good credit history but has a small outstanding balance with their previous provider due to a billing error. The new provider might be willing to accept them under the following conditions:

- Payment Plan: The customer agrees to a payment plan to settle the outstanding balance with their previous provider. This demonstrates their commitment to resolving the issue and maintaining financial responsibility.

- Security Deposit: The new provider might require a security deposit to mitigate the risk of non-payment. This deposit would be refunded upon completion of the agreed-upon payment plan.

- Conditional Service: The new provider might initially offer a conditional service agreement. This means the customer’s service could be subject to review and potential termination if they fail to meet the terms of the payment plan.

It’s important to note that these are just hypothetical scenarios. The specific conditions and consequences will vary depending on the individual circumstances and the policies of the new provider.

Legal Considerations

Switching electric companies while owing money to your current provider can involve legal complexities. Understanding the legal framework surrounding this process is crucial to ensure a smooth transition and avoid potential legal issues.

Consumer Protection Laws

Consumer protection laws play a significant role in regulating the relationship between consumers and electric companies. These laws aim to protect consumers from unfair or deceptive practices, including:

- Unfair billing practices: Laws often restrict companies from charging excessive fees or imposing unreasonable penalties for late payments.

- Misleading advertising: Electric companies must provide accurate information about their rates and services, and cannot mislead consumers about their offers.

- Discrimination: Companies cannot discriminate against customers based on factors like race, religion, or disability.

Contract Regulations

Your contract with your current electric company Artikels the terms of your service, including payment obligations and termination procedures. It’s essential to understand the following:

- Early termination fees: Some contracts may include fees for breaking your contract before the agreed-upon term ends.

- Payment terms: Your contract specifies the due date for your bill and the consequences of late payments, such as late fees or service disconnection.

- Notice period: Contracts may require you to provide a certain amount of notice before switching to a new provider.

Potential Legal Issues

Switching electric companies while owing money can potentially lead to legal issues, such as:

- Breach of contract: Failing to fulfill your payment obligations under your existing contract could be considered a breach of contract, potentially leading to legal action.

- Debt collection practices: If you fail to pay your outstanding balance, your current provider may pursue debt collection measures, which could involve legal proceedings or credit reporting.

- Credit reporting: Unpaid bills can negatively impact your credit score, potentially affecting your ability to secure loans or other financial services.

Resources and Organizations

If you’re facing legal issues related to switching electric companies, several resources can provide guidance and assistance:

- State Public Utilities Commission: Your state’s Public Utilities Commission regulates electric companies and can help resolve disputes.

- Consumer Protection Agency: Your state’s consumer protection agency can provide information about your rights and help address unfair or deceptive practices.

- Legal Aid Society: If you qualify financially, a legal aid society can offer free or low-cost legal advice and representation.

Epilogue

Switching electric companies while owing money requires careful consideration and proactive communication. Understanding your contract, exploring alternative options, and seeking guidance from relevant resources can empower you to make informed decisions and ensure a smooth transition. Remember, staying organized, communicating clearly, and prioritizing your financial well-being are key to navigating this process successfully.

Question & Answer Hub

What if I can’t afford to pay off the balance before switching?

You may be able to negotiate a payment plan with your current provider, or explore options like transferring the balance to the new provider if allowed.

Can I switch if I’m in a contract?

Your contract may have early termination fees. Check your contract terms for details.

What if the new provider refuses to accept me?

If a new provider is unwilling to accept you due to an outstanding balance, you may need to find alternative solutions, such as negotiating a payment plan with your current provider or exploring other options.

Will my credit score be affected?

An unpaid balance could potentially negatively impact your credit score. However, if you communicate with your provider and work towards a resolution, it may not have a significant impact.