Buy crypto with debit card – Buying crypto with a debit card has become increasingly popular, offering a convenient way to access the world of digital assets. This method allows users to purchase cryptocurrencies directly from their bank accounts, eliminating the need for traditional exchange accounts. However, it’s crucial to understand the advantages, disadvantages, and security considerations involved before diving in.

This guide delves into the process of buying crypto with a debit card, exploring the various platforms and services available, the associated fees, and essential security measures. We’ll also discuss the future of this method and its potential impact on the crypto landscape.

Fees and Charges Associated with Debit Card Purchases

When buying crypto with a debit card, it’s crucial to understand the various fees involved, as they can significantly impact your overall costs. These fees can come from different sources, including the cryptocurrency exchange or platform you use, your bank, and potentially your card issuer.

Debit Card Processing Fees

Debit card processing fees are charged by the payment processor and your bank for facilitating the transaction. These fees typically range from 1% to 3% of the transaction amount, but they can vary depending on the platform, your bank, and the specific card you’re using.

Cryptocurrency Exchange Fees

Cryptocurrency exchanges often charge fees for buying and selling cryptocurrencies. These fees can be flat fees, percentage-based fees, or a combination of both. The fees can vary widely depending on the exchange, the cryptocurrency you’re buying, and the transaction size. Some exchanges offer lower fees for high-volume traders or those who use their native tokens for trading.

Other Fees

In addition to processing and exchange fees, you may encounter other fees, such as:

- Network Fees: Some blockchains, like Ethereum, require network fees (also known as gas fees) to process transactions. These fees are paid to miners to verify and add transactions to the blockchain.

- Withdrawal Fees: Some exchanges charge fees for withdrawing cryptocurrencies to external wallets. These fees are typically based on the cryptocurrency being withdrawn.

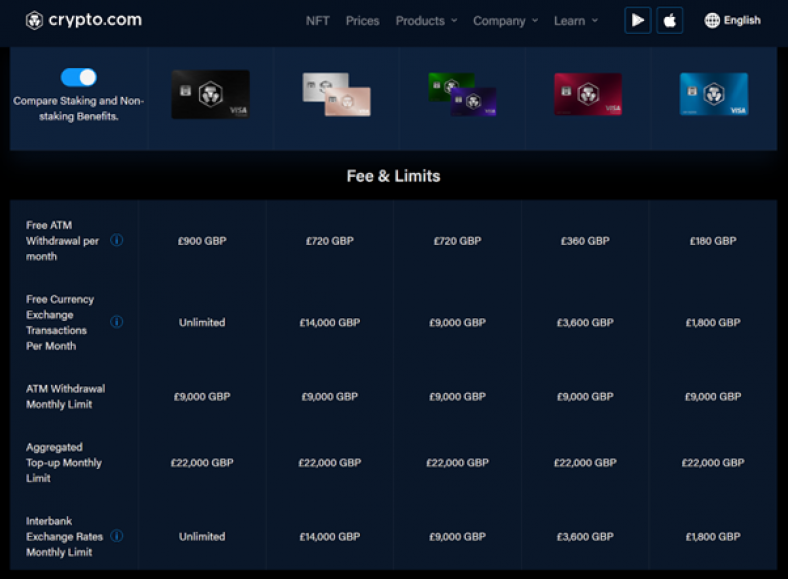

Comparing Fees Across Platforms

It’s essential to compare fees across different platforms before choosing one to buy crypto with your debit card. Some platforms offer lower fees than others, and some may have specific promotions or discounts.

Tips for Minimizing Transaction Costs

- Choose Exchanges with Low Fees: Research and compare fees across different exchanges to find those with the lowest transaction costs.

- Use Debit Cards with No Foreign Transaction Fees: If you’re buying crypto from an exchange based in a different country, consider using a debit card that doesn’t charge foreign transaction fees.

- Buy in Larger Amounts: Some exchanges offer lower percentage-based fees for larger transactions. Buying crypto in bulk can help reduce the overall cost.

- Utilize Free Promotions: Some exchanges offer free or discounted transactions during specific periods or for new users. Keep an eye out for these opportunities.

- Consider Using a Cryptocurrency Wallet: Once you’ve purchased crypto, you can transfer it to a cryptocurrency wallet to avoid storage fees and potentially lower transaction costs for future trades.

Security Considerations

When buying crypto with a debit card, security is paramount. It’s essential to choose reputable platforms with robust security measures to protect your funds and personal information. While convenient, debit card purchases come with inherent risks, making it crucial to understand and mitigate them.

Risks Associated with Debit Card Purchases

Using a debit card for crypto purchases introduces specific security risks. Understanding these risks allows you to take proactive measures to safeguard your funds.

- Data Breaches: Platforms storing your debit card information could be vulnerable to data breaches, exposing your financial details to unauthorized access.

- Phishing Scams: Phishing attacks aim to trick you into revealing your debit card details. Scammers often impersonate legitimate platforms or send fraudulent emails and messages to steal your information.

- Chargebacks: While not a security risk per se, chargebacks can be challenging with crypto purchases. If you dispute a transaction, it might be difficult to get your money back, especially if the platform is unreliable or operates in a gray area.

Best Practices for Securing Your Account

Taking steps to secure your account and protect your funds is crucial.

- Choose Reputable Platforms: Opt for platforms with a proven track record of security and compliance, such as those licensed and regulated by reputable financial authorities.

- Enable Two-Factor Authentication (2FA): 2FA adds an extra layer of security by requiring you to enter a code sent to your phone or email in addition to your password when logging in.

- Use Strong Passwords: Create strong, unique passwords for each platform you use and avoid using the same password for multiple accounts. Consider using a password manager to help you generate and store strong passwords securely.

- Regularly Monitor Your Account: Check your account activity regularly for any suspicious transactions or unauthorized access. Most platforms provide transaction history and alerts to help you monitor your account.

- Be Wary of Phishing Attempts: Be cautious of suspicious emails, messages, or phone calls requesting your debit card details. Never click on links or open attachments from unknown senders.

Tips for Choosing the Right Platform

Selecting the right platform to buy crypto with a debit card is crucial, as it impacts your security, fees, and overall experience. This decision should be based on a thorough evaluation of your needs and the features offered by each platform.

Factors to Consider When Choosing a Platform

The platform you choose should align with your needs and preferences. Here’s a checklist of factors to consider:

- Supported Cryptocurrencies: Ensure the platform offers the cryptocurrencies you want to buy. Some platforms have a limited selection, while others offer a wider range.

- Fees: Compare the fees associated with debit card purchases, including transaction fees, deposit fees, and withdrawal fees. Lower fees generally translate to greater savings.

- Security Features: Prioritize platforms with robust security measures, such as two-factor authentication, cold storage for crypto assets, and encryption protocols.

- User Interface and Experience: Choose a platform with a user-friendly interface that is easy to navigate, especially if you are new to crypto.

- Customer Support: Evaluate the quality and responsiveness of customer support. Reliable customer support can be invaluable in resolving issues or answering questions.

- Reputation and Trustworthiness: Research the platform’s reputation and track record. Look for platforms with positive reviews and a history of secure operations.

- Regulatory Compliance: Ensure the platform is compliant with relevant regulations in your jurisdiction. This helps protect your investments and ensures the platform operates within legal boundaries.

Recommendations for Different Types of Users, Buy crypto with debit card

Different users have different needs and preferences when it comes to buying crypto. Here are some recommendations based on common user profiles:

- Beginners: For those new to crypto, platforms with a user-friendly interface, clear explanations, and good customer support are recommended. Platforms like Coinbase and Binance.US are popular choices for beginners due to their ease of use and educational resources.

- Experienced Traders: Experienced traders may prefer platforms with advanced features, such as charting tools, order types, and access to a wider range of cryptocurrencies. Platforms like Kraken and Bitfinex cater to the needs of experienced traders.

- Security-Conscious Users: For users prioritizing security, platforms with robust security features, such as cold storage and two-factor authentication, are essential. Platforms like Ledger and Trezor offer hardware wallets that provide an extra layer of security.

- Low-Fee Seekers: If minimizing fees is a priority, compare platforms based on their fee structure and choose the one with the lowest fees for debit card purchases. Some platforms, like Crypto.com, offer lower fees for specific cryptocurrencies or during certain periods.

The Future of Buying Crypto with Debit Cards: Buy Crypto With Debit Card

The way we buy cryptocurrency is constantly evolving, and debit cards are playing an increasingly significant role in this transformation. The ease and convenience of using debit cards to purchase crypto have made it a popular choice for both seasoned investors and newcomers to the space. As the cryptocurrency market matures, we can expect to see even more exciting developments in this area.

Regulatory Impact on Debit Card Purchases

The regulatory landscape surrounding cryptocurrency is constantly evolving, and this has a direct impact on the use of debit cards for crypto purchases.

- Regulations aim to protect consumers from fraud and money laundering while also promoting responsible innovation. As regulations become more defined, we can expect to see more mainstream adoption of debit card purchases for crypto.

- Regulatory clarity will likely lead to increased competition among cryptocurrency exchanges and payment processors, driving down fees and improving user experience.

Emerging Trends in Debit Card Crypto Purchases

Several emerging trends are shaping the future of buying crypto with debit cards.

- Increased Integration with Traditional Financial Systems: As cryptocurrency becomes more mainstream, we can expect to see greater integration between crypto exchanges and traditional financial institutions. This could involve partnerships between banks and crypto platforms, allowing users to buy crypto directly from their bank accounts using debit cards.

- Growth of Decentralized Finance (DeFi): The rise of DeFi is expected to provide more options for buying crypto with debit cards. DeFi platforms offer decentralized alternatives to traditional financial institutions, allowing users to buy crypto directly from their wallets.

- Enhanced Security Features: As the value of cryptocurrencies continues to rise, security is a paramount concern. We can expect to see more robust security features implemented on platforms that allow debit card purchases, such as two-factor authentication and biometrics.

Closing Notes

Buying crypto with a debit card presents a straightforward and accessible gateway to the world of digital assets. While it offers convenience and ease of use, it’s essential to approach this method with caution, prioritizing security and understanding the potential risks involved. By choosing reputable platforms, implementing strong security measures, and staying informed about the evolving landscape, individuals can navigate the world of crypto purchases with confidence.

FAQ Compilation

What are the advantages of buying crypto with a debit card?

Convenience, ease of use, direct purchase from bank accounts, and faster transaction times are some of the key advantages.

Are there any risks associated with buying crypto with a debit card?

Potential risks include fraud, security breaches, and volatility in cryptocurrency prices.

How can I minimize fees when buying crypto with a debit card?

Compare fees across different platforms, look for platforms with lower transaction fees, and avoid unnecessary conversions.

What are some tips for choosing a reputable platform?

Check for security measures, user reviews, and regulatory compliance.