- Broadform Insurance: What It Is, When You Need It, and How to Get It

-

FAQ about Broadform Insurance

- What is broadform insurance?

- What does broadform insurance cover?

- What is the difference between broadform insurance and standard homeowners insurance?

- How much does broadform insurance cost?

- What are the benefits of broadform insurance?

- What are the drawbacks of broadform insurance?

- How can I get broadform insurance?

- What should I look for when shopping for broadform insurance?

- What are some tips for getting the most out of your broadform insurance?

- Is broadform insurance right for me?

Broadform Insurance: What It Is, When You Need It, and How to Get It

Introduction

Readers,

Are you looking for an insurance policy that covers you against a wide range of risks? If so, you should consider broadform insurance. This type of insurance provides comprehensive protection against a variety of perils, including fire, theft, and vandalism. In this article, we will discuss what broadform insurance is, when you need it, and how to get it.

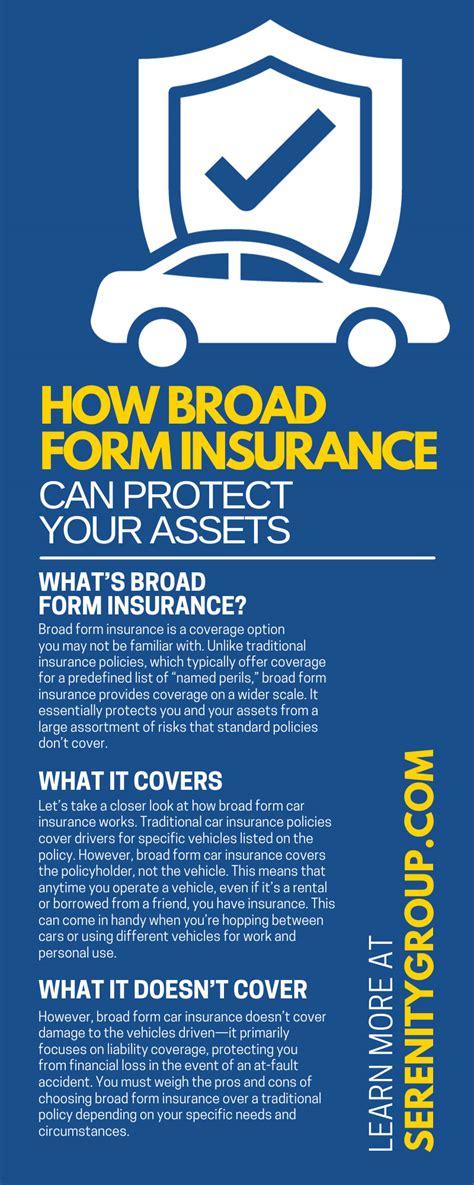

What Is Broadform Insurance?

Broadform insurance is a type of insurance policy that provides coverage for a wide range of perils. These perils typically include fire, theft, vandalism, and other covered causes of loss. Broadform insurance policies are typically more comprehensive than basic insurance policies, which only provide coverage for a limited number of perils.

When Do You Need Broadform Insurance?

You should consider purchasing broadform insurance if you own a home or business that is at risk of being damaged or destroyed by a covered peril. For example, if you live in an area that is prone to wildfires, you may want to purchase broadform insurance to protect your home from damage caused by fire.

How to Get Broadform Insurance

You can purchase broadform insurance from most insurance companies. When shopping for a broadform insurance policy, be sure to compare the coverage and rates offered by different companies. You should also make sure that you understand the policy’s terms and conditions before you purchase it.

Table: Broadform Insurance Coverage

| Peril | Coverage |

|---|---|

| Fire | Damage to your home or business caused by fire |

| Theft | Theft of your personal property |

| Vandalism | Damage to your home or business caused by vandalism |

| Other covered causes of loss | Other perils that are covered by your policy |

Benefits of Broadform Insurance

There are many benefits to purchasing broadform insurance. These benefits include:

- Comprehensive coverage: Broadform insurance policies provide coverage for a wide range of perils, which can give you peace of mind knowing that your home or business is protected.

- Flexibility: You can customize your broadform insurance policy to meet your specific needs. For example, you can choose to add riders that provide additional coverage for specific perils.

- Affordability: Broadform insurance policies are typically affordable, making them a great value for your money.

Conclusion

Broadform insurance is a valuable type of insurance that can protect your home or business from a wide range of risks. If you are looking for comprehensive insurance coverage, you should consider purchasing a broadform insurance policy.

Readers, if you found this article helpful, be sure to check out our other articles on insurance. We have a variety of articles that can help you learn more about different types of insurance, how to choose the right insurance policy, and how to get the most out of your insurance coverage.

FAQ about Broadform Insurance

What is broadform insurance?

- Broadform insurance is a type of property insurance that provides comprehensive coverage for your home and belongings against a wide range of risks.

What does broadform insurance cover?

- Broadform insurance typically covers your home and belongings against damage or loss from fire, lightning, windstorms, hail, vandalism, theft, and other covered perils.

What is the difference between broadform insurance and standard homeowners insurance?

- Broadform insurance provides more comprehensive coverage than standard homeowners insurance, which typically only covers damage or loss from a specific list of perils.

How much does broadform insurance cost?

- The cost of broadform insurance will vary depending on factors such as the size and value of your home, the location of your home, and the amount of coverage you choose.

What are the benefits of broadform insurance?

- Broadform insurance provides peace of mind knowing that your home and belongings are protected against a wide range of risks. It can also help you to save money on your homeowners insurance premiums by bundling it with other types of insurance, such as auto insurance.

What are the drawbacks of broadform insurance?

- Broadform insurance can be more expensive than standard homeowners insurance. It may also have higher deductibles and lower coverage limits than other types of insurance.

How can I get broadform insurance?

- You can get broadform insurance through an insurance agent or by contacting your current homeowners insurance provider.

What should I look for when shopping for broadform insurance?

- When shopping for broadform insurance, you should compare quotes from different insurance companies to find the best coverage and price. You should also read the policy carefully to understand what is covered and what is not.

What are some tips for getting the most out of your broadform insurance?

- To get the most out of your broadform insurance, you should keep your policy up to date and make sure that your coverage limits are adequate. You should also file claims promptly and keep accurate records of your belongings.

Is broadform insurance right for me?

- Broadform insurance may be right for you if you want comprehensive coverage for your home and belongings. However, it is important to weigh the costs and benefits of broadform insurance before making a decision.