- Introduction to Forex Trading

- Key Factors to Consider When Choosing a Forex Platform

- Popular Forex Trading Platforms

- Essential Features of a Forex Trading Platform

- Security and Reliability Considerations

- Tips for Choosing the Best Forex Trading Platform: Best Platform For Forex Trading

- Concluding Remarks

- Answers to Common Questions

Finding the best platform for forex trading is crucial for success in this dynamic and global market. Forex trading, short for foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their exchange rates. This guide will delve into the key factors to consider when choosing a platform, explore popular options, and provide tips for making an informed decision.

The world of forex trading is vast and complex, but with the right platform, you can navigate its intricacies and potentially unlock significant returns. This guide will equip you with the knowledge and insights you need to make a confident choice, allowing you to embark on your forex trading journey with a solid foundation.

Introduction to Forex Trading

Forex trading, short for foreign exchange trading, is the simultaneous buying of one currency and selling of another. It is the largest and most liquid financial market globally, with trillions of dollars exchanged daily. This market’s significance lies in its ability to facilitate international trade, investment, and tourism.

Forex trading involves the exchange of currencies based on their relative values. The value of one currency against another is constantly fluctuating, creating opportunities for traders to profit from these fluctuations.

Currency Pairs

Currency pairs represent the relationship between two currencies. For example, the EUR/USD pair indicates the exchange rate between the Euro and the US Dollar. The first currency in the pair is known as the base currency, and the second is the quote currency.

The exchange rate reflects how much of the quote currency is required to buy one unit of the base currency. For example, if the EUR/USD exchange rate is 1.1000, it means one Euro can be exchanged for 1.1000 US Dollars.

History of Forex Trading

The history of forex trading dates back to the 19th century, when the gold standard was in place. However, it was not until the 1970s, when the Bretton Woods system collapsed, that forex trading truly took off. The introduction of electronic trading platforms in the 1990s further revolutionized the market, making it accessible to a wider audience.

The global nature of forex trading has led to its growth and popularity. The market is open 24 hours a day, five days a week, providing traders with ample opportunities to participate. The continuous trading allows for constant fluctuations in currency values, creating opportunities for both profit and loss.

Key Factors to Consider When Choosing a Forex Platform

Choosing the right forex trading platform is crucial for success in the market. It’s not just about finding a platform that offers a wide range of features, but also one that aligns with your trading style and risk tolerance. Several key factors need to be considered when making this important decision.

Regulation and Licensing

Regulation and licensing are crucial for ensuring the safety and security of your funds. A regulated forex broker operates under strict guidelines, ensuring transparency, fair practices, and client protection.

- Reputable Regulatory Bodies: Look for brokers regulated by reputable authorities like the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC) in Australia, or the Commodity Futures Trading Commission (CFTC) in the United States. These regulators impose stringent requirements on brokers, including capital adequacy, risk management, and client funds segregation.

- Financial Security: A regulated broker is more likely to have robust financial security measures in place, such as segregated client accounts, which separate your funds from the broker’s own operating capital. This protects your funds even if the broker faces financial difficulties.

- Dispute Resolution: Regulated brokers are subject to dispute resolution mechanisms, providing a fair and impartial process for resolving any disagreements between the broker and the client.

Types of Trading Accounts

Forex platforms offer various trading account types, each catering to different trading needs and risk appetites. Understanding the differences between these account types can help you choose the one that best suits your trading goals.

- Demo Accounts: Demo accounts are risk-free practice environments that allow you to test trading strategies, familiarize yourself with the platform’s interface, and gain experience without risking real money. These accounts are typically funded with virtual currency and provide a realistic trading environment.

- Standard Accounts: Standard accounts are the most common type, offering access to the full range of trading instruments and features. These accounts typically have fixed spreads, which are the difference between the bid and ask prices of a currency pair.

- ECN (Electronic Communication Network) Accounts: ECN accounts offer direct access to the interbank market, allowing traders to execute trades at the best available prices. These accounts typically have variable spreads, which fluctuate based on market liquidity and volatility.

- Micro Accounts: Micro accounts allow traders to start trading with smaller deposit amounts and trade smaller lot sizes. These accounts are ideal for beginners who want to test the waters with minimal risk.

Trading Platforms

Forex platforms vary significantly in terms of their user interface, features, and tools. Choosing a platform that suits your trading style and needs is essential.

- User Interface: A user-friendly interface is essential for a seamless trading experience. Look for a platform with a clean layout, intuitive navigation, and customizable settings. Some platforms offer multiple trading interfaces, allowing you to choose the one that best suits your preferences.

- Features and Tools: Different platforms offer a wide range of features and tools, including advanced charting, technical indicators, real-time market data, and order types. Consider your trading style and the features that are most important to you when choosing a platform.

- Mobile App: Mobile trading is becoming increasingly popular, so consider a platform that offers a robust mobile app with all the essential features and functionality. Look for a platform with a user-friendly app that allows you to trade on the go.

- Customer Support: Reliable customer support is crucial for any trading platform. Look for a broker that offers 24/5 support through various channels, such as live chat, email, and phone.

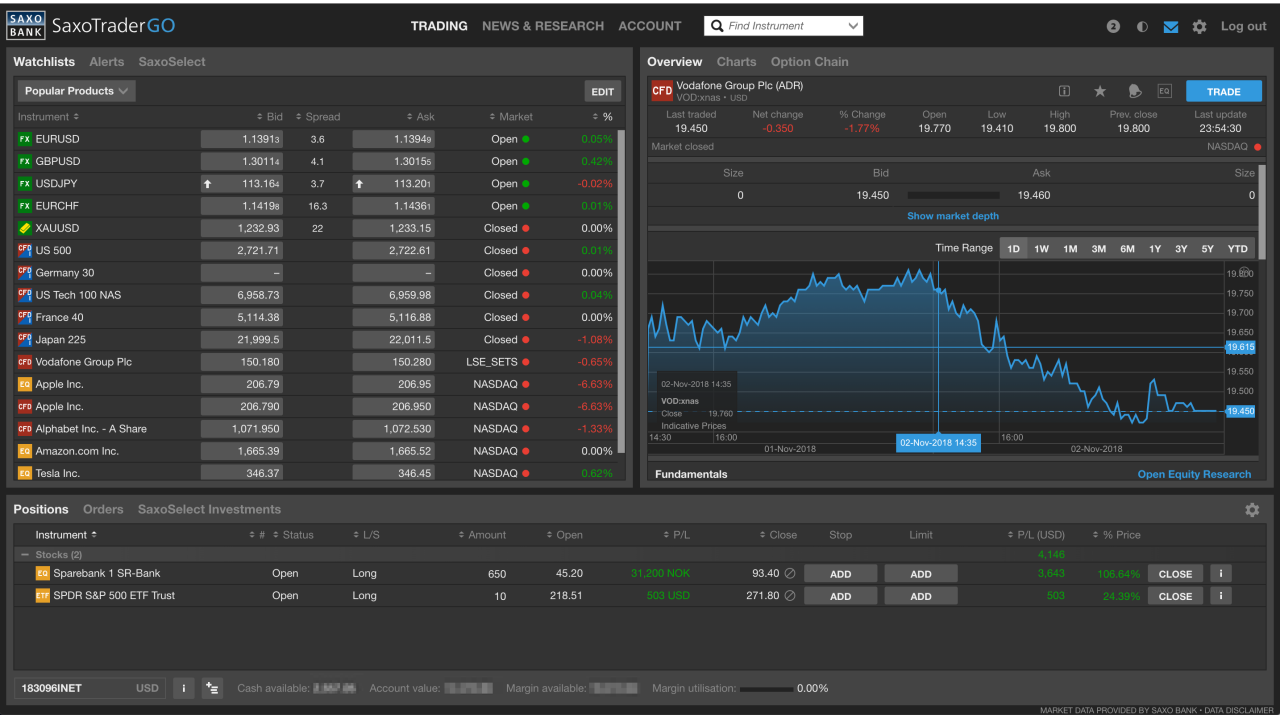

Popular Forex Trading Platforms

Choosing the right forex trading platform is crucial for success in the forex market. A good platform should provide a user-friendly interface, advanced trading tools, and reliable customer support. Here, we will delve into the top forex trading platforms, examining their strengths and weaknesses, trading fees, spreads, and other costs associated with trading.

Popular Forex Trading Platforms

Here’s an overview of some of the most popular forex trading platforms:

- MetaTrader 4 (MT4): One of the most widely used forex trading platforms globally, MT4 is renowned for its versatility, user-friendliness, and robust trading tools. It offers a wide range of features, including expert advisors (EAs), custom indicators, and a vast library of trading strategies. However, MT4 can be challenging for beginners due to its advanced features and complex interface.

- MetaTrader 5 (MT5): The successor to MT4, MT5 offers a more advanced trading experience with expanded features, including a wider range of order types, enhanced charting capabilities, and improved backtesting tools. While it is more complex than MT4, MT5 is highly regarded for its comprehensive functionality and advanced trading features.

- cTrader: Developed by Spotware Systems, cTrader is a modern and sophisticated platform that is gaining popularity among professional traders. It features a high-performance trading engine, advanced charting tools, and a user-friendly interface. cTrader is known for its low spreads and fast order execution, making it an attractive option for scalpers and high-frequency traders.

- TradingView: A popular online charting platform, TradingView is known for its intuitive interface and extensive charting tools. It offers a wide range of technical indicators, drawing tools, and real-time data feeds. While TradingView is not a full-fledged trading platform, it provides a comprehensive charting experience and can be integrated with various brokers.

- NinjaTrader: A powerful platform designed for both beginners and experienced traders, NinjaTrader offers a wide range of features, including advanced charting tools, backtesting capabilities, and automated trading strategies. It is known for its customizable interface and extensive educational resources, making it a good choice for traders of all levels.

Trading Fees and Spreads

Trading fees and spreads are crucial factors to consider when choosing a forex trading platform. Spreads are the difference between the bid and ask prices, while trading fees are charged for executing trades.

- Spreads: Platforms typically offer variable spreads that fluctuate based on market volatility and liquidity. It is important to choose a platform with competitive spreads to minimize trading costs.

- Commissions: Some platforms charge commissions on trades, while others offer commission-free trading. It is essential to understand the fee structure of a platform before opening an account.

- Other Costs: Other costs associated with trading may include inactivity fees, withdrawal fees, and overnight financing charges.

Customer Support, Educational Resources, and Research Tools

Excellent customer support, comprehensive educational resources, and robust research tools are essential for a forex trading platform.

- Customer Support: A reliable customer support team can assist traders with account setup, technical issues, and trading-related inquiries. Look for platforms that offer multiple channels of support, such as phone, email, and live chat.

- Educational Resources: Educational resources, such as tutorials, webinars, and trading guides, can help traders learn about forex trading and develop their trading skills.

- Research Tools: Research tools, such as economic calendars, market analysis reports, and technical indicators, can provide traders with valuable insights and help them make informed trading decisions.

Essential Features of a Forex Trading Platform

A Forex trading platform is your window to the global currency market, providing the tools and resources you need to execute trades, analyze market trends, and manage your risk. Choosing a platform with the right features can significantly impact your trading success.

Order Execution Speed and Slippage

Order execution speed refers to how quickly your buy or sell orders are filled after you place them. In the fast-paced Forex market, even a fraction of a second can make a difference. Slippage occurs when your order is filled at a price that is different from the price you initially intended to trade at. This can happen due to market volatility or a lack of liquidity.

- Importance of Speed: Faster execution speeds are crucial for minimizing slippage and ensuring your orders are filled at the desired price.

- Minimizing Slippage: Slippage can be minimized by choosing a platform with a strong infrastructure and robust order execution technology.

Charting Tools, Indicators, and Technical Analysis Features

Technical analysis is a fundamental aspect of Forex trading, allowing you to identify patterns and trends in price movements. Charting tools and indicators provide the visual representations and data points needed to make informed trading decisions.

- Types of Charts: Platforms offer a variety of chart types, including line charts, candlestick charts, and bar charts, each providing different perspectives on price movements.

- Technical Indicators: Technical indicators are mathematical calculations based on historical price data, providing insights into market momentum, volatility, and potential trend reversals. Examples include moving averages, MACD, RSI, and Bollinger Bands.

- Drawing Tools: Charting tools such as trend lines, Fibonacci retracements, and support and resistance levels help traders identify potential entry and exit points for trades.

Real-Time Market Data and News Feeds

Access to real-time market data and news feeds is essential for staying ahead of the curve in Forex trading. These resources provide crucial insights into market sentiment, economic events, and global news that can influence currency prices.

- Market Data: Real-time market data includes live quotes, bid/ask spreads, and trading volume, providing a snapshot of the current market conditions.

- Economic Calendars: Economic calendars list upcoming economic events, such as interest rate announcements and inflation reports, which can significantly impact currency valuations.

- News Feeds: News feeds provide real-time updates on global events, political developments, and economic reports that can influence market sentiment and currency prices.

Security and Reliability Considerations

In the world of forex trading, choosing a secure and reliable platform is paramount. Your hard-earned money and sensitive data are at stake, so you need to be confident in the platform’s ability to protect them.

This section will delve into the crucial security and reliability features that you should look for in a forex trading platform.

Data Security and Encryption

Data security is a critical aspect of any online trading platform. Forex platforms handle sensitive financial information, including account details, trading history, and personal data.

A robust security system is essential to safeguard this information from unauthorized access.

Here are some key security measures that reputable forex platforms implement:

- Encryption: All data transmitted between your computer and the platform should be encrypted using industry-standard protocols like SSL/TLS. This ensures that even if someone intercepts the data, they won’t be able to read it.

- Firewalls: Forex platforms use firewalls to block unauthorized access to their servers. Firewalls act as a barrier, preventing malicious actors from penetrating the platform’s network.

- Two-factor Authentication (2FA): 2FA adds an extra layer of security by requiring you to provide two forms of authentication, such as a password and a code sent to your phone. This makes it much harder for unauthorized users to access your account.

- Regular Security Audits: Reputable platforms conduct regular security audits to identify and address any vulnerabilities in their systems. This helps ensure that the platform is constantly protected against evolving cyber threats.

Financial Security and Regulation

Financial security is just as important as data security. You need to be confident that your funds are safe and secure with the forex platform you choose.

- Regulation: Choose a platform that is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. Regulation ensures that the platform adheres to certain standards and practices to protect its clients.

- Segregation of Funds: Reputable platforms segregate client funds from their own operating funds. This means that your money is held in separate accounts and is not used for the platform’s business operations. In the event of financial difficulties, your funds are protected.

- Insurance: Some platforms offer insurance policies to protect client funds in case of unforeseen events like fraud or insolvency.

Platform Reliability and Uptime

A reliable forex trading platform is crucial for successful trading. You need to be able to access the platform and execute trades without interruption.

- Uptime: Look for platforms with a high uptime record, ideally 99.9% or higher. This indicates that the platform is available almost all the time.

- Server Infrastructure: Reputable platforms invest in robust server infrastructure to ensure stability and speed. They use high-performance servers and redundancy measures to minimize downtime.

- Customer Support: Reliable platforms provide responsive and helpful customer support, available 24/5 or even 24/7. This is important for resolving issues quickly and efficiently.

Platform Reputation and Track Record

Before choosing a forex trading platform, it’s essential to research its reputation and track record within the industry.

- Reviews and Testimonials: Read reviews and testimonials from other traders to get a sense of the platform’s reliability and customer service. Look for platforms with positive reviews and a track record of providing a positive trading experience.

- Industry Awards: Check if the platform has won any industry awards or recognition. This can be a good indicator of its quality and reputation.

- News and Articles: Look for news articles and blog posts about the platform. This can provide insights into its performance, features, and overall reputation.

Tips for Choosing the Best Forex Trading Platform: Best Platform For Forex Trading

Finding the right forex trading platform is crucial for success in the market. With numerous platforms available, choosing the best one for your needs can seem daunting. This section will provide you with essential tips to help you navigate this process and make an informed decision.

Factors to Consider When Choosing a Forex Platform, Best platform for forex trading

When choosing a forex trading platform, consider these key factors:

- Trading Instruments: Ensure the platform offers a wide range of currency pairs, commodities, indices, and other assets that align with your trading strategy.

- Trading Features: Look for features like advanced charting tools, technical indicators, order types (market, limit, stop-loss), and real-time market data to enhance your trading experience.

- Fees and Commissions: Compare different platforms’ fee structures, including spreads, commissions, and inactivity fees, to determine the most cost-effective option.

- Trading Platform Interface: Choose a platform with a user-friendly interface that is easy to navigate, understand, and use, regardless of your experience level.

- Customer Support: Reliable customer support is essential for resolving issues, accessing assistance, and ensuring a smooth trading experience.

- Security and Regulation: Prioritize platforms regulated by reputable financial authorities to ensure the safety of your funds and personal information.

- Mobile Trading: A mobile trading app is convenient for monitoring markets and executing trades from your smartphone or tablet.

Research and Compare Forex Trading Platforms

Once you have identified key factors, research and compare different platforms to find the best fit for your trading style.

- Read Reviews: Explore online reviews from other traders to gain insights into the platform’s performance, reliability, and user experience.

- Visit Platform Websites: Visit the websites of potential platforms to learn about their features, pricing, and customer support options.

- Compare Features and Fees: Create a spreadsheet or table to compare different platforms based on your preferred criteria. This will help you identify the most competitive options.

- Consider Your Trading Style: Think about your trading frequency, risk tolerance, and preferred trading instruments. This will help you narrow down your search and choose a platform that aligns with your approach.

Test Forex Trading Platforms with Demo Accounts

Before committing to live trading, leverage demo accounts offered by many platforms.

- Familiarize Yourself with the Platform: Demo accounts allow you to practice trading in a risk-free environment and familiarize yourself with the platform’s features and interface.

- Test Trading Strategies: Experiment with different trading strategies and techniques to identify what works best for you without risking real capital.

- Evaluate Platform Performance: Assess the platform’s speed, reliability, and responsiveness during demo trading to ensure it meets your expectations.

Concluding Remarks

Choosing the right forex trading platform is an essential step in your journey to success. By considering factors like regulation, trading features, and user experience, you can find a platform that aligns with your trading style and goals. Remember to do your research, test platforms through demo accounts, and prioritize security and reliability. With the right platform by your side, you can confidently navigate the exciting world of forex trading and explore the vast opportunities it offers.

Answers to Common Questions

What is the minimum deposit required for forex trading?

The minimum deposit required for forex trading varies significantly between brokers. Some platforms may offer accounts with as little as $10, while others require a few hundred dollars. It’s essential to check the specific requirements of the platform you’re interested in.

How can I learn more about forex trading?

Many resources are available to help you learn about forex trading, including online courses, webinars, books, and articles. Reputable forex brokers often provide educational materials and tutorials for their clients.

Are there any risks associated with forex trading?

Yes, forex trading involves inherent risks, including market volatility, leverage, and the potential for losses. It’s crucial to understand these risks before investing and to manage your trades responsibly.