Best hours to trade forex sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The global Forex market, operating 24/5, presents a unique opportunity for traders to capitalize on currency fluctuations across different time zones. Understanding the optimal hours for trading is crucial to maximizing profits and minimizing risks.

This exploration delves into the intricate world of Forex trading, dissecting the factors that influence market activity and highlighting the best times to engage in trading. By analyzing historical data, identifying key trading sessions, and understanding the impact of economic events, we can uncover the secrets to successful Forex trading.

Tools and Resources for Forex Trading

Successful forex trading relies on having the right tools and resources to make informed decisions. Accessing reliable information, analyzing market trends, and executing trades efficiently are crucial elements of a profitable trading strategy. This section will explore some of the essential tools and resources available to forex traders.

Trading Platforms

Trading platforms are the software applications that connect traders to the forex market. They provide tools for placing orders, managing trades, and accessing market data. Popular trading platforms offer a wide range of features to cater to different trading styles and experience levels.

- MetaTrader 4 (MT4): MT4 is a widely used platform known for its user-friendly interface, extensive charting capabilities, and a vast library of technical indicators. It also supports automated trading through expert advisors (EAs).

- MetaTrader 5 (MT5): MT5 is the successor to MT4, offering enhanced features like more advanced charting tools, a wider range of order types, and support for multiple asset classes.

- cTrader: cTrader is a platform designed for professional traders, featuring advanced order execution, customizable charting, and a comprehensive suite of analytical tools.

- TradingView: TradingView is a web-based platform that provides real-time market data, charting tools, and social trading features. It allows traders to share their analysis and interact with other traders.

Economic Calendars and News Sources

Staying informed about global economic events is essential for forex traders. Economic calendars provide a schedule of upcoming economic releases, such as inflation data, interest rate decisions, and employment reports. These events can significantly impact currency movements.

- Investing.com: Investing.com offers a comprehensive economic calendar with a wide range of economic indicators and news releases.

- FXStreet: FXStreet provides an economic calendar, news analysis, and market commentary.

- DailyFX: DailyFX offers a combination of economic calendar, news articles, and educational resources.

Technical Analysis Tools, Best hours to trade forex

Technical analysis is a method of analyzing market data to identify trading opportunities. It involves studying price charts, patterns, and indicators to predict future price movements. Technical analysis tools help traders to identify trends, support and resistance levels, and potential entry and exit points.

- Moving Averages: Moving averages are indicators that smooth out price fluctuations and help to identify trends.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

- MACD: The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages.

- Fibonacci Retracement: Fibonacci retracement is a technical analysis tool that uses Fibonacci numbers to identify potential support and resistance levels.

Concluding Remarks: Best Hours To Trade Forex

Ultimately, choosing the best hours to trade Forex involves a combination of market analysis, personal preferences, and risk tolerance. By carefully considering the factors Artikeld in this guide, traders can optimize their trading strategies and increase their chances of success in this dynamic and ever-evolving market.

Top FAQs

What are the most volatile trading hours in Forex?

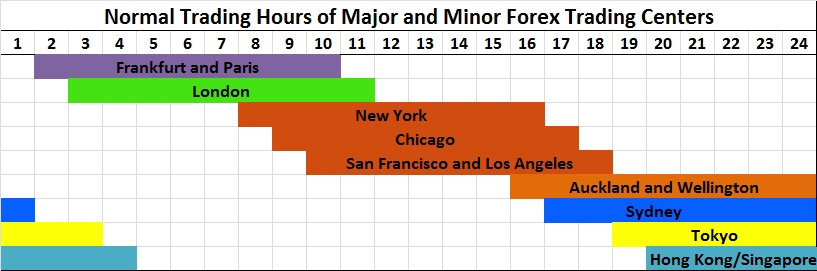

The most volatile trading hours are typically during the overlaps of major trading sessions, such as the London and New York overlap or the Tokyo and London overlap.

How do I find the best trading hours for a specific currency pair?

Analyze historical data and trading volume for the currency pair you are interested in. Identify the sessions with the highest activity and volatility for that pair.

What are the risks of trading during peak hours?

Trading during peak hours can lead to increased volatility, rapid price fluctuations, and potentially higher slippage. However, it also presents opportunities for larger profits.

Are there any specific tools for identifying the best trading hours?

Yes, there are several tools available, such as economic calendars, trading platforms with session indicators, and historical data analysis software.