The best forex app can be your gateway to the exciting world of currency trading. It offers you access to real-time market data, advanced charting tools, and the ability to execute trades quickly and efficiently. But with so many options available, choosing the right app can be daunting. This guide will help you navigate the forex app landscape, discovering the key features to consider and identifying apps that best suit your trading style and experience level.

Whether you’re a seasoned trader or just starting your forex journey, a well-chosen app can empower you to make informed decisions and potentially maximize your profits. We’ll explore the essential features, compare popular apps, and provide insights to help you select the best platform for your forex trading needs.

Introduction to Forex Trading

Forex trading, short for foreign exchange trading, involves buying and selling currencies to profit from their fluctuating exchange rates. It’s a global market operating 24 hours a day, five days a week, making it accessible to traders worldwide. While it might seem complex, the underlying principle is simple: you buy a currency you believe will appreciate in value against another currency and sell it when it does, making a profit on the difference.

Relevance to Everyday Life

Forex trading plays a significant role in everyday life, affecting various aspects of our economy and personal finances. For instance, when you travel abroad, you exchange your local currency for the currency of the country you’re visiting. The exchange rate you get is determined by the forex market. Similarly, businesses engaged in international trade rely on forex trading to manage their currency risk.

Benefits and Risks of Forex Trading

Benefits

- High Liquidity: Forex is the most liquid market globally, meaning you can easily buy or sell currencies without significantly impacting their prices. This ensures quick and efficient trades.

- 24/5 Trading: The forex market operates around the clock, allowing you to trade anytime, even during non-business hours. This provides flexibility and potential for round-the-clock trading opportunities.

- Leverage: Forex brokers offer leverage, enabling traders to control larger positions with a smaller investment. This can amplify potential profits but also losses. It’s crucial to use leverage responsibly and manage risk effectively.

- Potential for High Returns: The volatile nature of the forex market presents opportunities for significant returns. However, it’s important to remember that high returns come with higher risks.

Risks

- Market Volatility: Forex markets are known for their volatility, meaning prices can fluctuate rapidly and unpredictably. This can lead to sudden and substantial losses if not managed properly.

- Leverage: While leverage can amplify profits, it can also magnify losses. It’s essential to understand the risks associated with leverage and use it cautiously.

- Geopolitical Events: Global events, such as political instability, economic crises, and natural disasters, can significantly impact currency values. These events can be unpredictable and create sudden market shifts.

- Counterparty Risk: When trading with a broker, there’s a risk that the broker might become insolvent or unable to fulfill its obligations. Choosing a reputable and regulated broker is crucial to mitigate this risk.

Forex Trading Strategies and Techniques

Forex trading involves various strategies and techniques to capitalize on market movements. Some popular strategies include:

- Trend Trading: This strategy involves identifying and trading with the prevailing trend of a currency pair. Trend traders use technical indicators to identify trends and enter trades accordingly.

- Scalping: This strategy involves taking advantage of small price fluctuations by entering and exiting trades quickly. Scalpers aim to profit from small price movements, often using high leverage.

- News Trading: This strategy involves analyzing and reacting to economic news releases that can impact currency values. News traders often use technical analysis and fundamental analysis to identify potential trading opportunities.

- Arbitrage: This strategy involves taking advantage of price discrepancies between different markets. Arbitrageurs simultaneously buy and sell a currency pair in different markets, profiting from the price difference.

Features of Forex Apps

Navigating the Forex market can be a complex and fast-paced experience. Forex apps offer a crucial advantage for traders by providing access to real-time market data, powerful analysis tools, and convenient trading capabilities all within a user-friendly interface. These features empower traders to make informed decisions and execute trades efficiently, enhancing their overall trading experience.

Charting Tools

Charting tools are essential for visualizing price movements and identifying trends in the Forex market. Forex apps typically offer a range of charting features, including:

- Multiple Chart Types: Forex apps provide various chart types, such as line charts, bar charts, candlestick charts, and Heikin-Ashi charts, allowing traders to choose the most suitable visualization for their analysis. These different chart types can highlight different aspects of price movements, such as price action and volume, and provide insights that may not be apparent in other chart types.

- Technical Indicators: These indicators, such as moving averages, MACD, RSI, and Bollinger Bands, are mathematical formulas that help traders analyze price trends and identify potential buy or sell signals. They can be overlaid on charts to provide visual cues and confirm trading decisions.

- Drawing Tools: Forex apps allow traders to draw various technical patterns, such as trend lines, support and resistance levels, and Fibonacci retracements, on charts. These tools can help traders identify potential price reversals, breakout points, and other significant price movements.

Real-Time Quotes

Real-time quotes are essential for staying up-to-date with the latest market movements. Forex apps provide access to real-time quotes for various currency pairs, enabling traders to make informed decisions based on the latest market data.

- Quote Accuracy: The accuracy of real-time quotes is crucial for traders. Reputable Forex apps source their quotes from reliable data providers, ensuring that the information is accurate and up-to-date. This accuracy is paramount in the fast-paced Forex market, where even small delays can impact trading decisions.

- Quote Updates: Forex apps constantly update quotes, reflecting the latest market fluctuations. This ensures that traders have access to the most current information, enabling them to react quickly to market changes and capitalize on opportunities.

- Multiple Currency Pairs: Forex apps provide real-time quotes for a wide range of currency pairs, allowing traders to monitor the movements of different markets simultaneously. This feature is crucial for traders who engage in multiple currency pairs or those who want to diversify their portfolios.

Order Execution

Order execution is the process of placing and filling orders in the Forex market. Forex apps offer various order types, including:

- Market Orders: Market orders are executed immediately at the best available price. They are suitable for traders who want to enter or exit a trade quickly, but they may not always get the desired price, especially during volatile market conditions.

- Limit Orders: Limit orders are executed only when the price reaches a specified level. They allow traders to buy or sell at a specific price or better, but they may not be filled if the price does not reach the specified level.

- Stop Orders: Stop orders are triggered when the price reaches a specified level. They are used to limit potential losses or lock in profits. Stop orders can be placed above or below the current market price, depending on the trader’s strategy.

Security and Reliability

Security and reliability are paramount when choosing a Forex app. A secure and reliable app protects traders’ funds and ensures that orders are executed correctly. Here are some key factors to consider:

- Data Encryption: Reputable Forex apps use robust encryption protocols, such as SSL, to protect sensitive user data, including login credentials, trading history, and account balances, from unauthorized access. This encryption ensures that data transmitted between the app and the server is secure and cannot be intercepted by third parties.

- Two-Factor Authentication: Two-factor authentication adds an extra layer of security by requiring users to provide two different forms of identification before accessing their accounts. This significantly reduces the risk of unauthorized access, even if someone steals a user’s password. This additional authentication step significantly enhances account security and protects users from unauthorized access, even if their password is compromised.

- Regulation and Compliance: Forex apps should be regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the US. Regulation ensures that apps adhere to industry standards and provide a secure and transparent trading environment. Regulatory oversight provides assurance that the app operates within a legal and ethical framework, protecting users’ interests and fostering trust.

Top Forex Apps for Beginners

Starting your forex trading journey can be overwhelming, but with the right tools and guidance, it can be a rewarding experience. Forex apps designed for beginners offer a user-friendly interface, educational resources, and features that make learning the ropes easier. These apps are a great way to gain confidence and build a solid foundation in forex trading.

Beginner-Friendly Forex Apps

These apps are designed to make forex trading accessible to new traders. They offer intuitive interfaces, educational resources, and features that help beginners understand the basics of forex trading.

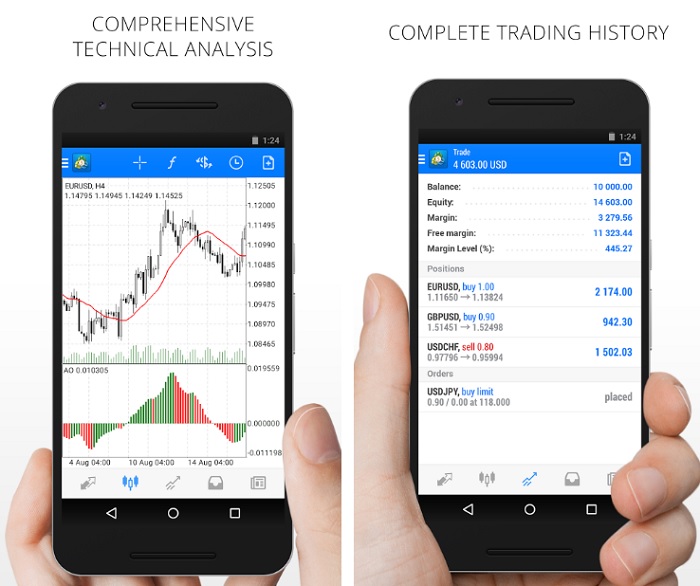

- MetaTrader 4 (MT4): MT4 is a popular forex trading platform known for its robust charting capabilities, technical indicators, and expert advisors (EAs). While it has a steeper learning curve, its extensive features make it a good choice for traders who want to advance their skills. MT4 offers a wide range of educational resources, including tutorials, webinars, and articles, to help beginners get started. The platform is available as a desktop application, web-based platform, and mobile app. It provides a comprehensive range of trading tools and analysis features, enabling users to analyze market trends and make informed trading decisions.

- MetaTrader 5 (MT5): MT5 is an advanced platform that builds on the functionality of MT4. It offers more advanced charting tools, a wider range of technical indicators, and a more sophisticated order execution system. It also features a built-in economic calendar and news feed, providing traders with valuable market insights. While it is more complex than MT4, MT5 is a powerful platform for traders who want to access a wider range of trading tools and features. It offers a variety of educational resources, including tutorials, webinars, and articles, to help traders understand the platform and its capabilities.

- eToro: eToro is a social trading platform that allows users to copy the trades of experienced traders. This feature can be helpful for beginners who are not yet confident in their own trading decisions. eToro also offers a wide range of educational resources, including articles, videos, and webinars, to help new traders learn the basics of forex trading. The platform is user-friendly and intuitive, making it a good choice for beginners. It provides a comprehensive range of trading tools and features, including charting capabilities, technical indicators, and market analysis tools.

- TradingView: TradingView is a popular charting platform that offers a wide range of technical indicators, drawing tools, and real-time market data. It is a great platform for learning about technical analysis and developing your trading skills. While it is not a forex trading platform, it can be used to analyze forex charts and identify potential trading opportunities. TradingView offers a variety of educational resources, including articles, videos, and webinars, to help traders learn about technical analysis and charting techniques.

Comparing Features and Pricing

| App | Features | Pricing |

|---|---|---|

| MetaTrader 4 (MT4) | Robust charting capabilities, technical indicators, expert advisors (EAs), educational resources, desktop, web, and mobile platforms | Free platform with commissions on trades |

| MetaTrader 5 (MT5) | Advanced charting tools, wider range of technical indicators, sophisticated order execution system, built-in economic calendar and news feed, educational resources, desktop, web, and mobile platforms | Free platform with commissions on trades |

| eToro | Social trading, copy trading, educational resources, user-friendly interface, desktop and mobile platforms | Spread-based pricing with minimum deposit requirements |

| TradingView | Charting platform with technical indicators, drawing tools, real-time market data, educational resources, web and mobile platforms | Free basic plan with paid premium plans for advanced features |

Forex Apps for Experienced Traders

Experienced traders demand more than just basic trading tools. They need sophisticated platforms with advanced features that empower them to execute complex strategies and optimize their trading outcomes. Forex apps designed for seasoned traders offer a comprehensive suite of tools, including technical analysis indicators, automated trading systems, and real-time market data.

Advanced Features for Experienced Traders

Advanced Forex apps cater to the specific needs of experienced traders by offering a range of powerful features. These features empower traders to make informed decisions, execute complex strategies, and manage risk effectively.

Technical Analysis Tools

Technical analysis is a crucial aspect of forex trading, and advanced apps provide a wide range of tools to assist traders in identifying trends, patterns, and potential trading opportunities.

- Technical Indicators: These indicators are mathematical formulas that analyze price movements and other market data to generate signals. Popular indicators include moving averages, MACD, RSI, and Bollinger Bands.

- Charting Tools: Advanced apps offer a variety of charting tools, including candlestick patterns, line charts, and bar charts. These tools allow traders to visualize price movements and identify patterns.

- Drawing Tools: Traders can use drawing tools to mark support and resistance levels, trend lines, and other key price points on charts.

Automated Trading Systems

Automated trading systems, also known as robots or expert advisors (EAs), execute trades automatically based on predefined rules and parameters. These systems can help traders:

- Execute Trades 24/5: Automated trading systems can operate around the clock, capturing trading opportunities even when traders are not actively monitoring the market.

- Reduce Emotional Bias: By automating trades, traders can eliminate the influence of emotions like fear and greed, which can lead to poor trading decisions.

- Test Strategies: EAs can be backtested on historical data to evaluate their performance and identify potential weaknesses.

Real-Time Market Data

Real-time market data is crucial for making informed trading decisions. Advanced Forex apps provide access to:

- Live Quotes: Up-to-the-minute price quotes for currency pairs and other financial instruments.

- News Feeds: Real-time news updates that can impact market sentiment and price movements.

- Economic Calendars: Schedules of upcoming economic events that can influence currency valuations.

Benefits of Advanced Features for Experienced Traders

Experienced traders can benefit significantly from the advanced features offered by specialized Forex apps.

- Improved Trading Efficiency: Automated trading systems and technical analysis tools can save time and effort, allowing traders to focus on other aspects of their trading strategy.

- Enhanced Accuracy: Technical analysis tools and real-time market data provide valuable insights that can help traders make more informed trading decisions.

- Reduced Risk: Automated trading systems can help traders manage risk effectively by executing trades based on predefined rules and parameters.

Drawbacks of Advanced Features

While advanced features offer numerous benefits, there are also potential drawbacks:

- Complexity: Advanced apps can be complex to use, requiring traders to invest time and effort in learning the features.

- Cost: Advanced apps often come with higher subscription fees compared to basic trading platforms.

- Risk of Malfunction: Automated trading systems can malfunction, leading to unintended consequences and financial losses.

Top Forex Apps for Experienced Traders

The following table showcases some of the top Forex apps designed for experienced traders, highlighting their key features and pricing:

| App Name | Key Features | Pricing |

|---|---|---|

| MetaTrader 4 (MT4) | Advanced charting tools, technical indicators, automated trading systems, real-time market data, customizable trading platform. | Free for download, broker fees may apply. |

| MetaTrader 5 (MT5) | Similar features to MT4, with additional features such as hedging, netting, and a wider range of trading instruments. | Free for download, broker fees may apply. |

| TradingView | Comprehensive charting platform with advanced technical analysis tools, real-time market data, social trading features, and backtesting capabilities. | Free plan available, paid plans offer additional features and data. |

| NinjaTrader | Advanced charting platform with customizable trading strategies, automated trading systems, real-time market data, and backtesting capabilities. | Free trial available, paid plans offer advanced features and data. |

Choosing the Right Forex App

Choosing the right forex app is crucial for success in the forex market. With a plethora of apps available, finding the one that best suits your trading needs and experience level can be challenging.

Factors to Consider When Choosing a Forex App

It is essential to consider several factors when selecting a forex app. These factors can help you narrow down your choices and find an app that aligns with your trading style and goals.

Trading Platform

The trading platform is the foundation of any forex app. It’s the interface where you’ll place orders, manage your trades, and access market data. Different platforms offer various features, functionalities, and user experiences. Consider the following aspects:

- User Interface (UI): Look for a platform with a user-friendly interface that is intuitive and easy to navigate, regardless of your experience level.

- Order Execution Speed: Fast and reliable order execution is critical in the fast-paced forex market. Choose a platform with a proven track record of swift order execution.

- Charting Tools: Robust charting tools are essential for technical analysis. Ensure the platform provides various charting types, indicators, and drawing tools to analyze market trends and identify trading opportunities.

- Market Data and Analysis: Access to real-time market data, including price quotes, news feeds, and economic indicators, is crucial for informed decision-making. The platform should provide comprehensive and up-to-date market information.

Trading Instruments

Not all forex apps offer the same range of trading instruments. Some apps may specialize in forex pairs, while others may offer a broader selection, including commodities, indices, and cryptocurrencies. Ensure the app offers the instruments you want to trade.

Customer Support

Reliable customer support is essential, especially for beginners. Look for an app with responsive customer support available through various channels, such as email, phone, and live chat.

Checklist of Essential Features

A comprehensive forex app should include several essential features to enhance your trading experience:

- Security: The app should prioritize security measures, including encryption, two-factor authentication, and secure data storage, to protect your account and personal information.

- Educational Resources: Look for an app that provides educational resources, such as tutorials, articles, and webinars, to help you learn about forex trading and improve your skills.

- Mobile Compatibility: A mobile-friendly app allows you to trade on the go, access market data, and manage your account from anywhere with an internet connection.

- Demo Account: A demo account lets you practice trading in a risk-free environment with virtual funds. This is particularly helpful for beginners to familiarize themselves with the platform and trading strategies before risking real money.

- Account Management: The app should allow you to easily manage your account, including depositing and withdrawing funds, viewing your trading history, and adjusting your account settings.

Importance of Considering Your Individual Trading Needs and Experience Level

Choosing a forex app should be tailored to your individual needs and experience level. Beginners may prefer an app with a user-friendly interface, comprehensive educational resources, and a demo account to practice. Experienced traders may prioritize advanced charting tools, real-time market data, and faster order execution.

Forex App Security and Regulation: Best Forex App

When venturing into the world of forex trading, it’s crucial to prioritize the security of your forex app and your personal information. This is where regulatory bodies play a vital role in ensuring a safe and transparent trading environment.

Importance of Forex App Security

Protecting your trading account and personal information is paramount in the forex market. Forex apps store sensitive data, including login credentials, trading history, and financial details. A secure app safeguards this information from unauthorized access and potential cyber threats.

Regulatory Bodies and Forex Apps

Regulatory bodies play a crucial role in overseeing forex apps and ensuring they adhere to strict security standards. These organizations set rules and regulations that aim to protect traders and maintain the integrity of the forex market.

- Financial Conduct Authority (FCA): The FCA is the UK’s financial regulator and oversees forex brokers and apps operating within the UK. They require regulated firms to meet specific security and financial requirements, including safeguarding client funds and ensuring data protection.

- National Futures Association (NFA): The NFA is a self-regulatory organization in the US that oversees futures and forex brokers. They enforce rules and regulations to protect traders and ensure market integrity.

- Australian Securities and Investments Commission (ASIC): ASIC is the Australian government’s corporate, markets, and financial services regulator. They oversee forex brokers and apps operating in Australia, requiring them to meet specific security and financial requirements.

Security Features of Reputable Forex Apps

Reputable forex apps prioritize security and employ various measures to protect user data. These features contribute to a secure trading environment.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring users to enter a unique code generated by their phone or email in addition to their password when logging in.

- Encryption: Sensitive data is encrypted, making it unreadable to unauthorized individuals. This ensures that even if someone gains access to your data, they won’t be able to understand or use it.

- Secure Socket Layer (SSL): SSL certificates are used to encrypt communication between your device and the forex app server, protecting your data during transmission. This is indicated by a padlock icon in the address bar of your web browser.

- Regular Security Updates: Reputable forex apps regularly update their security measures to address emerging threats and vulnerabilities.

Examples of Reputable Forex Apps with Strong Security Measures

Several reputable forex apps prioritize security and have earned a strong reputation in the industry. Here are some examples:

- MetaTrader 4 (MT4): MT4 is a widely used forex trading platform with a strong reputation for security. It offers 2FA, encryption, and SSL protection, along with regular security updates.

- MetaTrader 5 (MT5): MT5 is the newer version of MT4, offering enhanced features and security measures. It includes 2FA, encryption, SSL, and advanced security protocols.

- cTrader: cTrader is another popular forex trading platform known for its robust security features. It provides 2FA, encryption, and advanced security measures to protect user data.

Forex App Reviews and Ratings

Choosing the right Forex app is a crucial step in your trading journey. It’s essential to make an informed decision, and reading reviews and comparing ratings can provide valuable insights into the strengths and weaknesses of different apps.

Importance of Forex App Reviews and Ratings

Reviews and ratings offer a glimpse into the real-world experiences of other traders. They can help you understand the user-friendliness, features, reliability, and customer support of different Forex apps. By reading reviews, you can gain valuable insights that can inform your decision-making process.

Reputable Forex App Review Websites and Platforms

Several reputable websites and platforms provide unbiased and comprehensive reviews of Forex apps. These platforms typically employ a team of experts who test and evaluate apps based on various criteria, including:

- User Interface and Navigation: How easy is it to use the app and find the features you need?

- Trading Features: What types of orders, charts, and indicators are available?

- Research and Analysis Tools: Does the app offer market news, economic calendars, or technical analysis tools?

- Security and Regulation: Is the app secure and regulated by a reputable financial authority?

- Customer Support: How responsive and helpful is the app’s customer support team?

Here are some of the most reputable Forex app review websites and platforms:

- Investopedia: Investopedia is a well-known financial website that provides comprehensive reviews of Forex apps, covering features, pros, cons, and user feedback.

- The Forex Guy: The Forex Guy offers detailed reviews of Forex apps, focusing on their suitability for different trading styles and experience levels.

- ForexFactory: ForexFactory is a popular forum where traders can share their experiences with Forex apps and provide reviews.

- Trustpilot: Trustpilot is a platform where users can share their experiences with various products and services, including Forex apps.

Tips for Interpreting Forex App Reviews and Ratings, Best forex app

When reading Forex app reviews, it’s important to consider the following tips:

- Look for reviews from verified users: Some websites and platforms allow users to verify their accounts, which can help ensure the authenticity of reviews.

- Read a variety of reviews: Don’t rely on just one or two reviews. Read a diverse range of opinions to get a balanced perspective.

- Pay attention to the reviewer’s experience level: Reviews from experienced traders may offer different insights than reviews from beginners.

- Consider the date of the review: Older reviews may not reflect the latest app updates or changes.

- Be wary of overly positive or negative reviews: Some reviews may be biased or written by people with a vested interest in promoting or discrediting a particular app.

Identifying Reliable Sources of Information

It’s crucial to identify reliable sources of Forex app reviews. Look for websites and platforms that:

- Are reputable and well-established: Websites like Investopedia and The Forex Guy have a proven track record of providing accurate and unbiased information.

- Employ experts in the field: The reviewers should have a deep understanding of Forex trading and the app market.

- Use a transparent rating system: The rating system should be clear and easy to understand.

- Allow users to share their experiences: User reviews can provide valuable insights into the real-world performance of Forex apps.

Closure

In the ever-evolving world of forex trading, the right app can be your trusted companion. By understanding your needs, researching options, and considering security measures, you can find the best forex app to support your trading journey. Remember, a well-informed choice can make a significant difference in your forex trading success.

FAQ Overview

What is forex trading?

Forex trading involves buying and selling currencies to profit from exchange rate fluctuations. It’s a global market open 24/5, offering opportunities for both short-term and long-term trading.

How do forex apps work?

Forex apps provide a platform for accessing real-time market data, placing orders, and managing your trades. They often include charting tools, technical analysis indicators, and news feeds to help you make informed decisions.

Are forex apps safe?

Reputable forex apps prioritize security and use encryption to protect your personal information and trading activity. However, it’s crucial to choose regulated brokers and apps with a proven track record.

What are some good forex apps for beginners?

Beginner-friendly forex apps typically offer user-friendly interfaces, educational resources, and demo accounts to practice trading without risking real money. Look for apps with clear explanations and tutorials to help you learn the basics.