Best cryptos to buy right now? It’s a question on every investor’s mind, especially with the cryptocurrency market constantly fluctuating. Understanding the market’s nuances, identifying promising projects, and managing risk are crucial for making informed investment decisions. This guide explores the top-performing cryptocurrencies, emerging projects with potential, and various investment strategies to help you navigate the exciting, yet volatile, world of crypto.

From understanding the key factors influencing cryptocurrency prices to exploring the ethical implications of mining, this guide provides a comprehensive overview of the cryptocurrency landscape. We’ll also delve into technical analysis, fundamental analysis, and the importance of diversification and risk management, equipping you with the knowledge and tools to make informed decisions.

Diversification and Risk Management

Diversification is a crucial aspect of any investment strategy, especially in the volatile cryptocurrency market. By spreading your investments across various cryptocurrencies, you can mitigate potential losses and enhance your overall portfolio performance.

Diversification Strategies

Diversifying your cryptocurrency portfolio involves investing in a range of assets with different characteristics, aiming to reduce risk and enhance potential returns.

- By Market Capitalization: Invest in both large-cap (established) and small-cap (emerging) cryptocurrencies. Large-cap cryptocurrencies like Bitcoin and Ethereum tend to be more stable, while small-cap cryptocurrencies may offer higher growth potential but come with greater risk.

- By Technology: Include cryptocurrencies representing various technologies, such as blockchain platforms, decentralized finance (DeFi), non-fungible tokens (NFTs), and privacy coins. This approach diversifies your portfolio across different sectors within the crypto ecosystem.

- By Geographic Location: Consider investing in cryptocurrencies developed in different regions, including Asia, Europe, and North America. This strategy mitigates risks associated with specific geographic areas and exposes you to various market dynamics.

Risk Management Strategies

Managing risk in the cryptocurrency market is crucial for preserving capital and maximizing potential returns.

- Dollar-Cost Averaging (DCA): This strategy involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of market fluctuations. DCA helps mitigate the risk of buying high and selling low by averaging your purchase price over time.

- Stop-Loss Orders: Setting stop-loss orders automatically sells your cryptocurrency holdings if the price drops below a predetermined threshold. This helps limit potential losses by automatically exiting a position when the market moves against you.

- Risk Tolerance: Assess your risk tolerance before investing in cryptocurrencies. Consider how much volatility you can handle and choose investments accordingly. High-risk investments may offer higher potential returns but also carry a greater risk of losing capital.

Portfolio Rebalancing

Regularly reviewing and rebalancing your cryptocurrency portfolio is essential for maintaining your desired risk and return profile. As the market evolves, the relative performance of different cryptocurrencies may change. Rebalancing involves adjusting your portfolio allocations to ensure they align with your investment goals and risk tolerance.

Technical Analysis and Market Trends

Technical analysis is a valuable tool for understanding and predicting price movements in the cryptocurrency market. It involves analyzing historical price data, trading volume, and other market indicators to identify patterns and trends that can be used to make informed trading decisions.

Technical Analysis Tools

Technical analysis tools provide a visual representation of price movements and market sentiment, allowing traders to identify potential buy and sell opportunities. These tools are widely available on trading platforms and websites.

- Candlestick Charts: Candlestick charts display price data for specific time periods, providing information about the opening, closing, high, and low prices. Different candlestick patterns, such as the “hammer” or “shooting star,” can signal potential reversals or continuations of price trends.

- Moving Averages: Moving averages smooth out price fluctuations, providing a clearer picture of long-term trends. Traders often use multiple moving averages to identify support and resistance levels, as well as potential buy and sell signals.

- Technical Indicators: Technical indicators are mathematical calculations based on price data and trading volume. Examples include the Relative Strength Index (RSI), which measures the magnitude of recent price changes to evaluate overbought or oversold conditions, and the Moving Average Convergence Divergence (MACD), which identifies trend changes and potential buy or sell signals.

Key Indicators and Patterns

Traders use technical indicators and patterns to identify potential price movements. Some key indicators and patterns to watch for include:

- Support and Resistance Levels: Support levels represent price points where buying pressure is strong enough to prevent further declines, while resistance levels represent price points where selling pressure is strong enough to prevent further gains. These levels can act as potential buy or sell signals.

- Trend Lines: Trend lines are lines drawn on charts to connect price highs or lows, indicating the overall direction of price movement. Uptrends are characterized by rising trend lines, while downtrends are characterized by falling trend lines.

- Volume: Trading volume can indicate the strength of price movements. High volume during a price increase suggests strong buying pressure, while high volume during a price decline suggests strong selling pressure.

- Bullish and Bearish Patterns: Bullish patterns, such as the “head and shoulders” pattern, suggest potential price increases, while bearish patterns, such as the “double top” pattern, suggest potential price declines.

Interpreting Technical Analysis Charts and Data, Best cryptos to buy right now

Interpreting technical analysis charts and data requires practice and experience. Traders must learn to recognize key indicators and patterns and understand how they relate to market conditions. It’s important to consider multiple indicators and patterns, as well as other market factors, before making trading decisions.

“Technical analysis is not a perfect science, and there is no guarantee that any particular indicator or pattern will predict future price movements. However, it can provide valuable insights into market sentiment and help traders make more informed decisions.”

Fundamental Analysis of Cryptocurrencies

Fundamental analysis is a crucial aspect of cryptocurrency investing, as it helps investors assess the intrinsic value of a cryptocurrency and its potential for future growth. Unlike technical analysis, which focuses on price charts and trading patterns, fundamental analysis delves into the underlying factors that drive the value of a cryptocurrency.

Key Metrics for Fundamental Analysis

To evaluate the fundamentals of a cryptocurrency, investors consider various key metrics, providing insights into its long-term prospects.

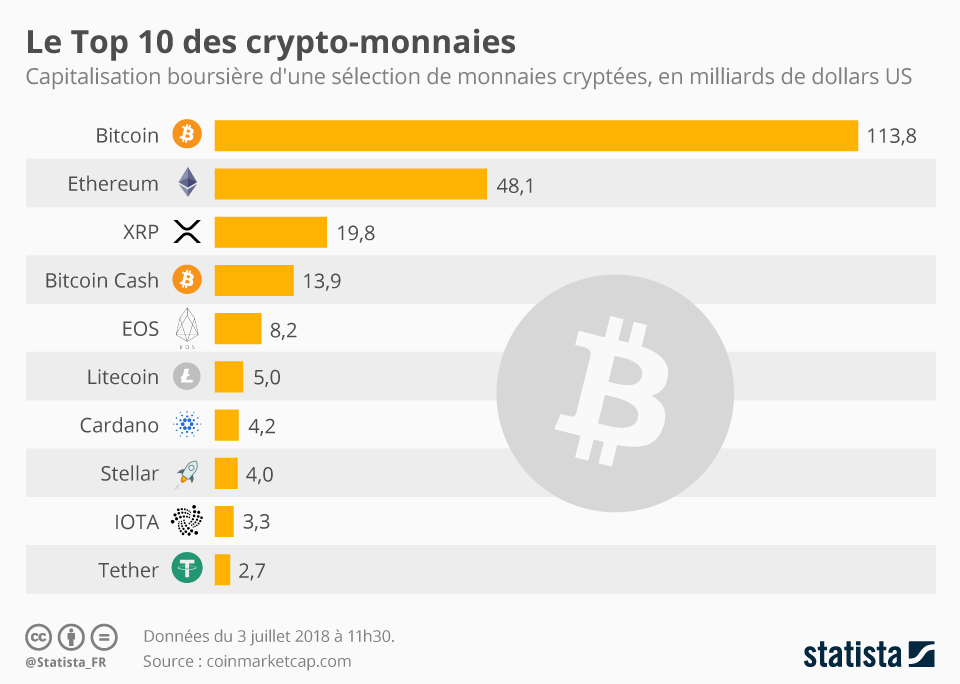

- Market Capitalization: This metric reflects the total value of a cryptocurrency in circulation, calculated by multiplying the current price by the circulating supply. It provides a measure of the cryptocurrency’s overall size and market dominance. For example, Bitcoin’s market capitalization is significantly larger than most other cryptocurrencies, indicating its dominance in the market.

- Trading Volume: Trading volume represents the amount of cryptocurrency traded within a specific timeframe. High trading volume suggests strong interest and liquidity, which can contribute to price volatility. Conversely, low trading volume may indicate limited interest and potential price stagnation.

- Team and Development: The team behind a cryptocurrency plays a crucial role in its success. Investors evaluate the team’s experience, expertise, and track record in blockchain development. A strong and experienced team inspires confidence in the project’s long-term viability.

- Technology and Innovation: The underlying technology and innovation behind a cryptocurrency are essential for its success. Investors assess the project’s technical capabilities, scalability, and potential for real-world applications.

- Community and Adoption: A strong and active community is vital for the success of a cryptocurrency. A large and engaged community provides support, promotes adoption, and contributes to the project’s development.

- Use Cases and Applications: Cryptocurrencies with clear use cases and real-world applications are more likely to gain traction and attract investors. For example, Ethereum’s smart contract capabilities have enabled the development of decentralized applications (DApps), contributing to its adoption and value.

- Regulatory Landscape: Regulatory changes can significantly impact cryptocurrency prices. Positive regulatory developments, such as clear guidelines and legal frameworks, can foster investor confidence and promote adoption. Conversely, negative regulatory actions, such as bans or restrictions, can lead to price declines.

Impact of Regulatory Changes on Cryptocurrency Prices

Regulatory changes can have a significant impact on cryptocurrency prices. Positive regulatory developments, such as clear guidelines and legal frameworks, can foster investor confidence and promote adoption, leading to price increases. Conversely, negative regulatory actions, such as bans or restrictions, can lead to price declines as investors become wary of the cryptocurrency’s future.

Cryptocurrency Regulations and Compliance: Best Cryptos To Buy Right Now

The global landscape of cryptocurrency regulations is constantly evolving, presenting both challenges and opportunities for investors, businesses, and governments alike. Understanding the regulatory framework is crucial for navigating the crypto market and ensuring compliance.

Current Cryptocurrency Regulations Worldwide

Cryptocurrency regulations vary significantly across jurisdictions. Some countries have embraced cryptocurrencies and implemented clear regulatory frameworks, while others have taken a more cautious approach.

- United States: The U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are the primary regulators of cryptocurrencies. The SEC has classified many cryptocurrencies as securities, subjecting them to stringent regulations. The CFTC has focused on regulating cryptocurrency derivatives.

- European Union: The EU has adopted a comprehensive regulatory framework for cryptocurrencies through the Markets in Crypto-Assets (MiCA) regulation. MiCA aims to provide legal certainty, investor protection, and market integrity.

- China: China has taken a restrictive approach to cryptocurrencies, banning cryptocurrency trading and mining activities.

- Japan: Japan has established a regulatory framework for cryptocurrency exchanges, requiring them to register with the Financial Services Agency (FSA).

- Singapore: Singapore has adopted a pragmatic approach to crypto regulation, focusing on promoting innovation while ensuring consumer protection.

Potential Impact of Regulatory Changes on the Market

Regulatory changes can have a significant impact on the cryptocurrency market.

- Increased Clarity and Certainty: Clear regulations can provide legal certainty for investors and businesses, fostering confidence and attracting more participants to the market.

- Investor Protection: Regulations aimed at protecting investors from fraud and manipulation can enhance market stability and reduce volatility.

- Market Growth: Regulatory frameworks can create a more favorable environment for cryptocurrency adoption and growth, as businesses can operate with greater certainty and investors can participate with greater confidence.

- Innovation and Competition: While some regulations may restrict innovation, others can foster competition by creating a level playing field for businesses.

Importance of Compliance with Regulatory Requirements

Compliance with regulatory requirements is crucial for all participants in the cryptocurrency market.

- Avoiding Legal Penalties: Non-compliance with regulations can lead to significant fines, penalties, and even criminal charges.

- Maintaining Reputation: Failure to comply with regulations can damage the reputation of individuals and businesses, making it difficult to operate in the market.

- Ensuring Investor Protection: Compliance with regulations helps to protect investors from fraud and manipulation, fostering trust and confidence in the market.

- Promoting Market Integrity: Regulatory compliance contributes to a more stable and transparent cryptocurrency market, attracting more participants and promoting sustainable growth.

Security and Privacy Considerations

In the world of cryptocurrency, security and privacy are paramount. The decentralized nature of blockchain technology, while offering benefits like transparency and immutability, also introduces new security challenges. It’s crucial to understand the potential risks and implement robust measures to safeguard your digital assets.

Securing Cryptocurrency Wallets and Accounts

Protecting your cryptocurrency wallets and accounts is essential to prevent unauthorized access and potential losses. Here are some key tips:

- Choose a strong password and enable two-factor authentication (2FA): A strong password, ideally a combination of uppercase and lowercase letters, numbers, and symbols, makes it difficult for hackers to guess. Two-factor authentication adds an extra layer of security by requiring a second verification step, such as a code sent to your phone or email, before you can access your account.

- Store your private keys securely: Private keys are the passwords to your cryptocurrency wallets. Never share them with anyone and keep them in a safe and secure location. Consider using a hardware wallet, which stores your private keys offline, for added protection.

- Be cautious of phishing scams: Phishing attacks aim to trick you into revealing your private keys or other sensitive information. Be wary of suspicious emails, websites, or messages asking for your login details. Always verify the legitimacy of any request before providing information.

- Use reputable cryptocurrency exchanges: Choose a reputable and secure cryptocurrency exchange to buy, sell, and store your digital assets. Research the exchange’s security measures and track record before making a decision.

Risks Associated with Scams and Phishing Attacks

Cryptocurrency scams and phishing attacks are common threats in the digital world. Scammers often target unsuspecting investors with promises of high returns or free cryptocurrency, only to steal their funds. It’s crucial to be aware of these risks and take steps to protect yourself.

- Beware of unsolicited offers: If you receive an unexpected offer for cryptocurrency investment, be cautious. Legitimate investment opportunities are rarely unsolicited.

- Verify the legitimacy of websites and platforms: Before investing in any cryptocurrency, ensure that the website or platform you’re using is legitimate. Check for reviews and feedback from other users.

- Don’t click on suspicious links: Be wary of emails, messages, or links that seem too good to be true. They may lead to malicious websites that can steal your personal information or cryptocurrency.

- Report suspicious activity: If you encounter a scam or phishing attempt, report it to the relevant authorities or the cryptocurrency exchange where the incident occurred.

“Always remember that if something sounds too good to be true, it probably is.”

Ethical Considerations in Cryptocurrency Investing

Investing in cryptocurrencies, like any other investment, carries ethical implications. It’s crucial to consider the potential impact of your investment decisions on various stakeholders, including the environment, society, and future generations.

Environmental Impact of Cryptocurrency Mining

Cryptocurrency mining, the process of verifying and adding transactions to the blockchain, consumes significant energy. This is because miners use powerful computers to solve complex mathematical problems, which requires substantial electricity. The energy consumption associated with mining can contribute to greenhouse gas emissions and environmental degradation.

- Energy Consumption: Bitcoin mining alone consumes more energy than some countries. The electricity used for mining can strain power grids and increase reliance on fossil fuels, leading to higher carbon emissions.

- Environmental Impact: The mining process generates heat, which can contribute to climate change. Additionally, the disposal of electronic waste from mining equipment poses environmental challenges.

Cryptocurrency and Financial Inclusion

Cryptocurrencies have the potential to promote financial inclusion by providing access to financial services for individuals who are unbanked or underserved by traditional financial institutions.

- Accessibility: Cryptocurrencies can be used to send and receive money across borders without relying on traditional banking systems, which can be expensive and time-consuming.

- Transparency: Blockchain technology provides transparency and immutability, which can enhance trust in financial transactions.

Charitable Use of Cryptocurrencies

Cryptocurrencies can be used to support charitable causes. The decentralized nature of cryptocurrencies can facilitate donations to organizations operating in remote or conflict-affected areas where traditional financial systems are limited.

- Transparency and Accountability: Blockchain technology allows for transparent tracking of donations, reducing the risk of fraud and misappropriation.

- Global Reach: Cryptocurrencies can be used to make donations to organizations anywhere in the world.

Epilogue

Investing in cryptocurrencies requires a careful balance of research, analysis, and risk management. This guide has provided a foundation for understanding the market, identifying potential opportunities, and navigating the complexities of the cryptocurrency landscape. Remember, thorough research, a well-defined investment strategy, and a commitment to continuous learning are essential for success in this dynamic and evolving space.

Essential FAQs

What are the risks associated with investing in cryptocurrencies?

Cryptocurrency investments are highly volatile and subject to significant price fluctuations. Other risks include security breaches, regulatory uncertainty, and market manipulation.

How do I choose a cryptocurrency exchange?

Consider factors like security measures, fees, supported cryptocurrencies, user interface, and customer support when choosing an exchange.

Is it better to buy Bitcoin or Ethereum?

The choice depends on your investment goals and risk tolerance. Bitcoin is known for its security and established market position, while Ethereum offers a wider range of applications and potential for growth.

How can I learn more about cryptocurrency?

There are many resources available, including online courses, books, articles, and communities. Stay informed about the latest trends and developments in the cryptocurrency space.