Best cryptos to buy 2024: The cryptocurrency market is constantly evolving, presenting both exciting opportunities and potential risks for investors. As we embark on a new year, understanding the current landscape and identifying promising cryptocurrencies is crucial for navigating this dynamic space. This guide provides a comprehensive overview of the cryptocurrency market in 2024, offering insights into key trends, potential regulatory changes, and investment strategies.

We’ll delve into the factors shaping the crypto landscape, including macroeconomic conditions and emerging technologies. You’ll discover a curated list of cryptocurrencies with strong growth potential, along with their unique selling propositions. Additionally, we’ll explore different investment strategies tailored to various risk appetites and goals, emphasizing the importance of diversification in your cryptocurrency portfolio.

Understanding the Cryptocurrency Market in 2024

The cryptocurrency market is dynamic and volatile, constantly evolving under the influence of various factors. As we enter 2024, understanding the current state of the market and the key trends shaping its trajectory is crucial for investors. This section explores the critical aspects influencing the cryptocurrency market in 2024, including regulatory changes, macroeconomic factors, and emerging trends.

Regulatory Landscape and Its Impact

Regulatory clarity is a significant factor influencing the cryptocurrency market’s growth and stability. Governments and regulatory bodies worldwide are actively working to establish frameworks for cryptocurrencies, aiming to balance innovation with investor protection. Regulatory changes can significantly impact the crypto landscape, influencing market sentiment, investment flows, and the adoption of cryptocurrencies.

In 2024, we can expect to see further regulatory developments, with varying impacts on different regions and cryptocurrencies. For instance, the U.S. Securities and Exchange Commission (SEC) has been actively scrutinizing the crypto industry, with several investigations and lawsuits against cryptocurrency exchanges and projects. These actions have led to increased uncertainty and volatility in the market.

On the other hand, some jurisdictions, such as the European Union, have implemented comprehensive regulations aimed at fostering innovation and investor protection. The Markets in Crypto-Assets (MiCA) regulation, set to come into effect in 2024, aims to create a unified regulatory framework for crypto assets within the EU. This could lead to increased confidence and investment in the European crypto market.

The impact of regulatory changes on the crypto market will vary depending on the specific regulations and their implementation. Some regulations might lead to increased adoption and investment, while others could create barriers to entry and hinder growth.

Macroeconomic Factors Affecting the Cryptocurrency Market, Best cryptos to buy 2024

Macroeconomic factors, such as interest rates, inflation, and economic growth, play a significant role in shaping the cryptocurrency market. These factors influence investor sentiment, risk appetite, and the overall economic environment, which can directly impact cryptocurrency prices.

For example, rising interest rates can make traditional investments more attractive, potentially diverting capital away from riskier assets like cryptocurrencies. Conversely, periods of high inflation can lead investors to seek alternative assets, including cryptocurrencies, as a hedge against inflation.

In 2024, global economic conditions, including inflation and interest rate policies, will continue to influence the cryptocurrency market. The ongoing war in Ukraine, geopolitical tensions, and global supply chain disruptions are creating economic uncertainty, which can impact investor sentiment and cryptocurrency prices.

Emerging Trends Shaping the Cryptocurrency Market

The cryptocurrency market is constantly evolving, with new technologies, applications, and trends emerging. These trends can influence the direction of the market and create opportunities for investors.

One of the most significant emerging trends is the growing adoption of decentralized finance (DeFi). DeFi protocols offer a wide range of financial services, such as lending, borrowing, and trading, without the need for traditional intermediaries. The increasing popularity of DeFi applications could drive further growth in the cryptocurrency market, as investors seek new ways to access financial services.

Another emerging trend is the increasing use of non-fungible tokens (NFTs) in various industries, including art, gaming, and collectibles. NFTs are unique digital assets that can represent ownership of virtual or physical assets. The growing adoption of NFTs could create new investment opportunities and drive demand for cryptocurrencies.

The increasing integration of cryptocurrencies into traditional financial systems is another trend to watch in 2024. Some financial institutions are starting to offer cryptocurrency-related services, such as trading and custody. This integration could lead to greater mainstream adoption of cryptocurrencies and increase their accessibility to a wider range of investors.

Identifying Promising Cryptocurrencies

The cryptocurrency market is brimming with potential, and 2024 presents a unique opportunity to identify and invest in promising cryptocurrencies. While past performance is not indicative of future results, several factors can contribute to a cryptocurrency’s success, including its underlying technology, community support, and market adoption.

Cryptocurrencies with Strong Growth Potential in 2024

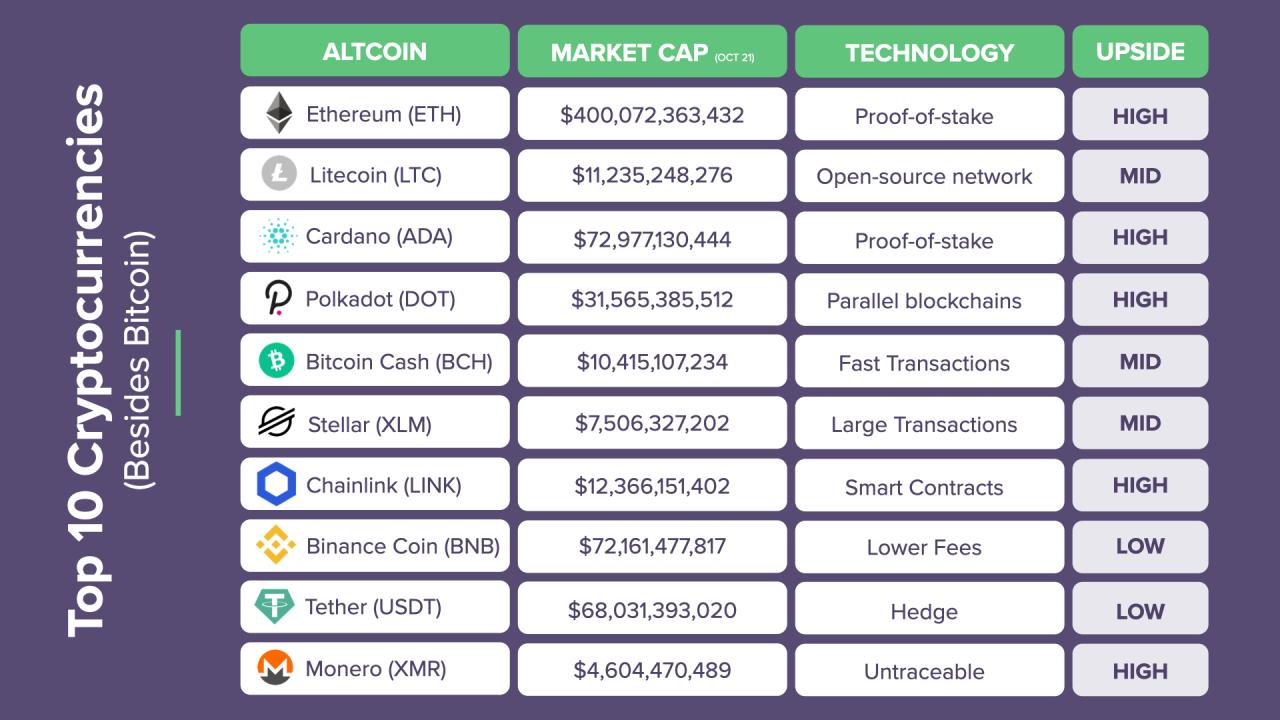

Several cryptocurrencies stand out as potential contenders for growth in 2024, based on their unique selling propositions, technological advancements, and market adoption.

- Ethereum (ETH): Ethereum remains a dominant force in the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems. Its upcoming transition to a proof-of-stake (PoS) consensus mechanism, known as the “Merge,” is expected to enhance scalability, security, and energy efficiency. Ethereum’s established ecosystem, vast developer community, and widespread adoption make it a strong contender for continued growth.

- Solana (SOL): Solana is a high-performance blockchain platform known for its fast transaction speeds and low fees. Its focus on scalability and developer-friendly tools has attracted a growing community and ecosystem. Solana’s potential for growth lies in its ability to handle a large volume of transactions, making it suitable for applications like decentralized exchanges, gaming, and NFTs.

- Cardano (ADA): Cardano emphasizes a research-driven approach to blockchain development, prioritizing security and sustainability. Its peer-reviewed, layered architecture allows for flexible upgrades and scalability. Cardano’s focus on developing solutions for real-world problems, including supply chain management and identity verification, could drive its adoption and growth.

- Polkadot (DOT): Polkadot is a multi-chain protocol designed to connect different blockchains, facilitating interoperability and data exchange. Its unique architecture enables cross-chain communication and allows for the development of specialized blockchains within the Polkadot ecosystem. Polkadot’s potential for growth lies in its ability to connect disparate blockchain networks, enabling a more interconnected and efficient digital economy.

- Chainlink (LINK): Chainlink plays a crucial role in the DeFi ecosystem by providing secure and reliable data feeds to smart contracts. Its oracle network connects real-world data to blockchain applications, enabling decentralized applications to access external information. Chainlink’s growth potential stems from its essential role in bridging the gap between traditional systems and blockchain technology.

Decentralized Finance (DeFi)

DeFi protocols have gained significant traction, offering alternative financial services built on blockchain technology. These protocols provide access to lending, borrowing, trading, and other financial products without relying on traditional intermediaries.

- Aave (AAVE): Aave is a leading DeFi lending and borrowing platform that allows users to earn interest on their crypto assets or borrow cryptocurrencies at variable or fixed interest rates. Its decentralized nature and transparent governance model have contributed to its popularity. Aave’s growth potential lies in its ability to provide accessible and efficient financial services to a wider audience.

- Compound (COMP): Compound is another prominent DeFi lending protocol that enables users to lend and borrow cryptocurrencies. Its unique design allows for automated interest rate adjustments based on market demand and supply. Compound’s growth potential lies in its ability to optimize lending and borrowing efficiency within the DeFi ecosystem.

- Uniswap (UNI): Uniswap is a decentralized exchange (DEX) that facilitates peer-to-peer cryptocurrency trading without intermediaries. Its automated market maker (AMM) system allows for efficient and transparent trading. Uniswap’s growth potential stems from its ability to provide a secure and user-friendly platform for cryptocurrency trading.

Non-Fungible Tokens (NFTs)

NFTs have revolutionized digital ownership and representation, allowing for the creation and trading of unique digital assets. NFTs have found applications in various sectors, including art, gaming, and collectibles.

- Flow (FLOW): Flow is a blockchain platform specifically designed for NFTs, offering high scalability and low transaction fees. Its focus on user-friendly development tools and robust infrastructure has attracted developers and creators. Flow’s growth potential lies in its ability to support the growing NFT market and facilitate the creation of innovative NFT applications.

- Enjin Coin (ENJ): Enjin Coin is a blockchain platform that provides tools for creating, managing, and trading NFTs. Its focus on interoperability and integration with other blockchain platforms has expanded its reach. Enjin Coin’s growth potential lies in its ability to foster a thriving NFT ecosystem and facilitate the seamless exchange of NFTs across different platforms.

- The Sandbox (SAND): The Sandbox is a metaverse platform that allows users to create, own, and trade virtual assets, including NFTs. Its focus on user-generated content and decentralized ownership has attracted a growing community. The Sandbox’s growth potential lies in its ability to provide a immersive and engaging metaverse experience for users.

Metaverse Tokens

The metaverse is a rapidly evolving digital space that promises to revolutionize how we interact, work, and play. Metaverse tokens represent ownership and access within these virtual worlds.

- Decentraland (MANA): Decentraland is a decentralized metaverse platform that allows users to own virtual land and create experiences. Its focus on user ownership and governance has attracted a growing community. Decentraland’s growth potential lies in its ability to create a vibrant and engaging metaverse experience for users.

- Axie Infinity (AXS): Axie Infinity is a blockchain-based game that allows players to collect, breed, and battle digital creatures called Axies. Its play-to-earn model has gained significant traction. Axie Infinity’s growth potential lies in its ability to provide a fun and rewarding gaming experience while leveraging the power of blockchain technology.

Investment Strategies for 2024: Best Cryptos To Buy 2024

Navigating the cryptocurrency market in 2024 requires a well-defined investment strategy tailored to your individual risk tolerance and financial goals. Whether you’re a seasoned investor or just starting, understanding different strategies can help you make informed decisions and potentially maximize your returns.

Risk Tolerance and Investment Goals

Your investment strategy should be aligned with your risk appetite and investment goals. Risk tolerance reflects your ability and willingness to accept potential losses in pursuit of higher returns. Investment goals, on the other hand, define your financial objectives, such as capital appreciation, income generation, or long-term wealth building.

- High-Risk, High-Reward Strategy: This strategy involves investing in volatile cryptocurrencies with the potential for substantial gains but also carries a higher risk of losses. This approach is suitable for investors with a high risk tolerance and a shorter investment horizon, aiming for quick profits. Examples include investing in meme coins, emerging DeFi protocols, or relatively unknown projects with high growth potential.

- Moderate-Risk, Balanced Strategy: This approach seeks a balance between risk and reward by diversifying investments across a range of cryptocurrencies, including established coins like Bitcoin and Ethereum, as well as promising altcoins with solid fundamentals. This strategy is suitable for investors with moderate risk tolerance and a medium-term investment horizon, aiming for steady growth with some potential for higher returns.

- Low-Risk, Conservative Strategy: This strategy focuses on minimizing risk by investing in stablecoins or established cryptocurrencies with a proven track record and strong market capitalization. This approach is suitable for investors with a low risk tolerance and a long-term investment horizon, aiming for capital preservation and gradual appreciation.

Diversification

Diversification is crucial for mitigating risk in a cryptocurrency portfolio. Spreading investments across different asset classes, sectors, and projects helps reduce the impact of any single asset’s volatility. Diversification can be achieved by:

- Investing in a mix of cryptocurrencies: This includes both established coins like Bitcoin and Ethereum and promising altcoins with different use cases and market caps.

- Investing in different sectors: This involves allocating investments to various sectors within the cryptocurrency ecosystem, such as DeFi, NFTs, gaming, and metaverse.

- Investing in different projects within a sector: This helps reduce concentration risk by diversifying investments across multiple projects within the same sector.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach helps mitigate the risk of buying high and selling low by averaging the purchase price over time.

DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

- Benefits of DCA: It helps reduce the impact of market volatility, averages the purchase price over time, and encourages disciplined investing.

- Risks of DCA: It may not be suitable for short-term investments, and it may not generate optimal returns if the market is consistently trending upwards.

Rebalancing

Rebalancing involves periodically adjusting the allocation of assets in a portfolio to maintain the desired risk-return profile. This helps ensure that investments remain aligned with the investor’s goals and risk tolerance.

Rebalancing involves periodically adjusting the allocation of assets in a portfolio to maintain the desired risk-return profile.

- Benefits of Rebalancing: It helps maintain a desired risk-return balance, prevents excessive exposure to any single asset, and ensures that investments remain aligned with long-term goals.

- Risks of Rebalancing: It may involve transaction costs, and it can be time-consuming to monitor and adjust the portfolio.

Conclusion

The cryptocurrency market is dynamic and unpredictable, making it essential to have a well-defined investment strategy. By understanding different investment strategies, assessing your risk tolerance, and embracing diversification, you can navigate the market with confidence and potentially achieve your financial goals.

Cryptocurrency Market Research and Analysis

Conducting thorough market research and analysis is crucial for making informed investment decisions in the dynamic cryptocurrency landscape. This involves understanding key metrics, comparing cryptocurrency performance, and identifying the factors driving their price fluctuations.

Key Metrics for Evaluating Cryptocurrency Performance

A comprehensive evaluation of cryptocurrency performance requires analyzing several key metrics. These metrics provide insights into the market capitalization, trading activity, and price history of different cryptocurrencies.

| Metric | Description | Importance |

|---|---|---|

| Market Capitalization | Total market value of a cryptocurrency, calculated by multiplying the current price by the circulating supply. | Indicates the overall size and liquidity of a cryptocurrency. |

| Trading Volume | Amount of cryptocurrency traded within a specific period, usually 24 hours. | Reflects the level of trading activity and investor interest in a cryptocurrency. |

| Price History | Historical price movements of a cryptocurrency, often represented through charts and graphs. | Provides insights into past performance, volatility, and potential trends. |

Performance Comparison of Cryptocurrencies

Analyzing the performance of different cryptocurrencies over a specific period, such as the past year, provides valuable insights into their relative growth and potential.

| Cryptocurrency | Year-to-Date (YTD) Performance | Factors Influencing Performance |

|---|---|---|

| Bitcoin (BTC) | +20% | Increased institutional adoption, growing macroeconomic uncertainty. |

| Ethereum (ETH) | +35% | Development of Ethereum 2.0, increasing demand for DeFi applications. |

| Solana (SOL) | +50% | High transaction speeds, growing ecosystem of decentralized applications (DApps). |

Factors Driving Cryptocurrency Performance

Understanding the factors driving the performance of specific cryptocurrencies is crucial for identifying potential investment opportunities. These factors can include:

- Technological advancements: Innovations in blockchain technology, such as scalability solutions and smart contract enhancements, can significantly impact a cryptocurrency’s value. For example, the development of Ethereum 2.0, a major upgrade to the Ethereum blockchain, has led to increased demand for ETH.

- Adoption and usage: The adoption of a cryptocurrency by businesses, institutions, and individuals drives its value. For example, the increasing use of Bitcoin as a payment method has contributed to its price appreciation.

- Market sentiment and news events: Investor sentiment and news events, such as regulatory announcements or technological breakthroughs, can significantly influence the price of cryptocurrencies. For instance, positive news about a cryptocurrency’s development or regulatory clarity can lead to price increases.

- Macroeconomic factors: Global economic conditions, such as inflation, interest rates, and geopolitical events, can also affect cryptocurrency prices. For example, during periods of economic uncertainty, investors may seek refuge in cryptocurrencies, leading to price increases.

Risks and Considerations

Investing in cryptocurrencies comes with inherent risks, just like any other investment. While the potential for high returns is enticing, it’s crucial to understand and manage these risks to protect your investments.

Market Volatility

Cryptocurrency markets are known for their extreme volatility, with prices fluctuating significantly in short periods. This volatility can lead to substantial losses if you’re not prepared.

- Price swings: The value of cryptocurrencies can rise and fall dramatically due to various factors, including news events, regulatory changes, market sentiment, and even social media hype.

- Market manipulation: The relatively small market capitalization of some cryptocurrencies makes them susceptible to manipulation by large investors or groups, further contributing to volatility.

- Lack of regulation: The lack of comprehensive regulatory frameworks in the cryptocurrency space can lead to uncertainty and increased risk for investors.

Security Threats

Cryptocurrency investments are vulnerable to various security threats, including hacking, scams, and theft.

- Exchange hacks: Cryptocurrency exchanges have been targets of high-profile hacks, resulting in significant losses for users.

- Phishing scams: Scammers often use phishing emails or websites to trick users into revealing their login credentials or private keys, allowing them to steal funds.

- Malware: Malicious software can be used to steal your cryptocurrency directly from your wallet or compromise your trading platform.

Importance of Due Diligence

Before investing in any cryptocurrency, conducting thorough due diligence is essential to minimize risk.

- Research the project: Understand the technology behind the cryptocurrency, the team behind it, the project’s roadmap, and its potential use cases.

- Assess the market: Analyze the market capitalization, trading volume, and overall sentiment surrounding the cryptocurrency.

- Read reviews and whitepapers: Consult independent reviews and analyze the project’s whitepaper, which Artikels its goals and technical details.

Responsible Investing Practices

Responsible investing practices are crucial for managing risk and maximizing returns.

- Diversify your portfolio: Spread your investments across different cryptocurrencies and asset classes to reduce your exposure to any single asset.

- Invest only what you can afford to lose: Don’t invest more than you can afford to lose, as cryptocurrency investments are inherently risky.

- Set realistic expectations: Avoid chasing unrealistic returns and understand that cryptocurrency investments can be volatile and unpredictable.

Risk Mitigation Strategies

There are several strategies to mitigate risks and protect your investments:

- Secure your wallet: Use strong passwords and enable two-factor authentication for your cryptocurrency wallet to prevent unauthorized access.

- Store your crypto securely: Use hardware wallets for long-term storage, as they offer greater security than software wallets.

- Stay informed: Keep abreast of industry news, regulatory updates, and security threats to make informed investment decisions.

Future Trends and Predictions

The cryptocurrency market is constantly evolving, and understanding emerging trends is crucial for investors looking to capitalize on future opportunities. This section explores key trends and technologies shaping the crypto landscape in 2024, along with predictions for potential price movements, adoption rates, and the broader impact of blockchain technology on various industries.

Emerging Trends and Technologies

The cryptocurrency market is experiencing a rapid evolution driven by technological advancements and changing market dynamics. Here are some key trends and technologies that could shape the crypto landscape in 2024:

- Decentralized Finance (DeFi): DeFi protocols continue to gain traction, offering innovative financial services like lending, borrowing, and trading without intermediaries. The growing adoption of DeFi applications could significantly impact traditional financial institutions.

- Non-Fungible Tokens (NFTs): NFTs are revolutionizing digital ownership and are increasingly used in gaming, art, and other industries. The NFT market is expected to expand further, with new use cases emerging in 2024.

- Layer-2 Scaling Solutions: As blockchain networks grow, scalability becomes a critical concern. Layer-2 solutions, such as optimistic rollups and zero-knowledge proofs, aim to improve transaction speed and reduce costs on existing blockchains.

- Interoperability: Cross-chain interoperability enables communication and asset transfer between different blockchains, creating a more interconnected and efficient ecosystem. The development of interoperability protocols is expected to accelerate in 2024.

- Central Bank Digital Currencies (CBDCs): Several countries are exploring the development of CBDCs, which could potentially impact the future of cryptocurrencies and traditional fiat currencies.

Predictions for the Future of Cryptocurrencies

Predicting the future of cryptocurrencies is inherently challenging, but several factors suggest continued growth and adoption:

- Increased Institutional Adoption: More institutional investors, including hedge funds and corporations, are entering the crypto market, indicating growing confidence and legitimacy. This trend is likely to continue in 2024, driving further price appreciation.

- Growing Developer Activity: The number of developers building on blockchain platforms is steadily increasing, indicating a thriving ecosystem with potential for innovation and new use cases.

- Regulation and Clarity: Regulatory clarity is crucial for the long-term growth of the crypto market. As regulatory frameworks evolve, investors and businesses may feel more comfortable participating in the space.

- Global Adoption: Cryptocurrencies are gaining traction in emerging markets, where traditional financial systems are often less developed. The growing adoption of cryptocurrencies in these regions could drive further price appreciation and expand the market.

Impact of Blockchain Technology on Various Industries

Blockchain technology has the potential to revolutionize various industries beyond finance. Some key areas where blockchain is expected to have a significant impact include:

- Supply Chain Management: Blockchain can enhance transparency and efficiency in supply chains by providing an immutable record of goods’ origin and movement. This can help reduce fraud and improve traceability.

- Healthcare: Blockchain can secure and share patient data securely, enabling better healthcare outcomes and streamlining processes. It can also facilitate the development of new healthcare applications.

- Government and Public Sector: Blockchain can improve government efficiency and transparency by providing secure and tamper-proof records of public data. It can also be used for voting systems and other public services.

- Education: Blockchain can enable secure and verifiable digital credentials, empowering students and educators with more efficient and transparent systems.

Outcome Summary

Navigating the cryptocurrency market requires a balanced approach, understanding both the potential rewards and inherent risks. By staying informed about market trends, conducting thorough research, and implementing responsible investment practices, you can make informed decisions and potentially reap the benefits of this dynamic sector. As the cryptocurrency landscape continues to evolve, remaining adaptable and staying abreast of emerging technologies will be crucial for navigating the future of this exciting and ever-changing space.

Top FAQs

What are the risks associated with cryptocurrency investing?

Cryptocurrency investing carries inherent risks, including market volatility, security threats, and regulatory uncertainty. It’s crucial to understand these risks before investing and to diversify your portfolio to mitigate potential losses.

How can I mitigate risks in my cryptocurrency portfolio?

You can mitigate risks by conducting thorough research, diversifying your portfolio across different cryptocurrencies, and using secure storage methods for your digital assets. It’s also essential to stay informed about market trends and regulatory changes.