Best crypto to buy 2024 – Best Crypto to Buy in 2024: A Comprehensive Guide takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original. As the cryptocurrency market continues to evolve, the question of which digital assets to invest in remains a crucial one. This guide provides a comprehensive overview of the crypto market in 2024, examining factors to consider when choosing cryptocurrencies, highlighting promising candidates, and exploring emerging trends that are shaping the future of the space.

From understanding the impact of macroeconomic factors and regulatory trends to evaluating key metrics and fundamental analysis, we delve into the intricacies of selecting cryptocurrencies that align with your investment goals and risk tolerance. We also explore innovative technologies like DeFi, NFTs, and Web3, highlighting their potential to revolutionize the way we interact with the digital world.

Understanding the Crypto Market in 2024

Navigating the crypto market in 2024 requires a keen understanding of the forces shaping its trajectory. Macroeconomic factors, regulatory landscapes, and evolving adoption trends will significantly influence the performance of cryptocurrencies.

Macroeconomic Factors

Macroeconomic factors play a crucial role in shaping the crypto market. Inflation, interest rates, and global economic conditions can impact investor sentiment and asset allocation decisions. For instance, during periods of high inflation, investors may seek refuge in assets perceived as hedges against inflation, such as gold and cryptocurrencies. However, rising interest rates can make borrowing more expensive, potentially dampening investment in riskier assets like crypto.

Regulatory Trends

Regulatory clarity is essential for the long-term growth and stability of the crypto market. Governments around the world are actively developing frameworks to regulate cryptocurrencies, ranging from outright bans to more permissive approaches. Regulatory trends can influence investor confidence, access to capital, and the overall adoption of cryptocurrencies. For example, the implementation of clear regulatory guidelines for crypto exchanges and stablecoins can foster greater trust and transparency in the market.

Adoption and Mainstream Interest

The adoption of cryptocurrencies continues to grow, with increasing mainstream interest. More businesses and individuals are exploring the use of cryptocurrencies for payments, investments, and other purposes. This growing adoption can create demand for cryptocurrencies, driving price appreciation. For instance, the increasing popularity of decentralized finance (DeFi) applications, which allow users to borrow, lend, and trade cryptocurrencies without intermediaries, has contributed to the growing adoption of cryptocurrencies.

Factors to Consider When Choosing Cryptocurrencies

Navigating the world of cryptocurrencies can be daunting, especially with the sheer number of options available. To make informed decisions, it’s crucial to consider several factors beyond just price fluctuations. This section delves into key metrics, fundamental analysis, and personal considerations that can help you choose the right cryptocurrencies for your portfolio.

Market Capitalization and Trading Volume

Market capitalization, often referred to as “market cap,” represents the total value of a cryptocurrency in circulation. It’s calculated by multiplying the current price of a coin or token by the total number of coins or tokens in circulation. A higher market cap generally indicates a larger and more established cryptocurrency.

Trading volume reflects the amount of cryptocurrency traded within a specific timeframe. High trading volume suggests significant interest and liquidity, making it easier to buy and sell the asset.

Market cap and trading volume are important indicators of a cryptocurrency’s overall popularity and liquidity. However, it’s essential to remember that these metrics can be manipulated and should be considered alongside other factors.

Developer Activity

Developer activity refers to the ongoing development and maintenance of a cryptocurrency’s underlying technology. Active development is a positive sign, indicating that the project is being actively improved and supported.

You can gauge developer activity by looking at:

- GitHub repositories: These repositories host the codebase of the cryptocurrency, and regular updates and commits are indicative of active development.

- Community forums and discussions: Active discussions and contributions from developers and community members are a good sign of ongoing development and engagement.

- Roadmaps and white papers: These documents Artikel the project’s goals, timelines, and future development plans. Regularly updated roadmaps and white papers demonstrate a commitment to progress.

Fundamental Analysis

Fundamental analysis involves evaluating the underlying technology, team, and use cases of a cryptocurrency. This analysis helps you understand the project’s potential for growth and sustainability.

- Technology: Examine the technology behind the cryptocurrency, including its consensus mechanism, scalability, and security features. For example, a cryptocurrency that uses a proven and secure consensus mechanism like Proof-of-Work (PoW) or Proof-of-Stake (PoS) is generally considered more robust.

- Team: Research the team behind the project, including their experience, expertise, and track record. A strong and experienced team can increase the credibility and success of a project.

- Use Cases: Evaluate the real-world applications of the cryptocurrency. A cryptocurrency with clear and compelling use cases is more likely to gain adoption and value.

Risk Tolerance and Investment Goals

Your risk tolerance and investment goals are crucial factors to consider when choosing cryptocurrencies.

- Risk tolerance: If you’re risk-averse, you might prefer established and stable cryptocurrencies with lower volatility. On the other hand, if you’re willing to take on more risk, you might consider investing in emerging cryptocurrencies with higher growth potential.

- Investment goals: Your investment goals will influence the type of cryptocurrencies you choose. For example, if you’re looking for long-term growth, you might invest in cryptocurrencies with strong fundamentals and a clear roadmap. If you’re looking for short-term gains, you might consider trading more volatile cryptocurrencies.

Promising Cryptocurrencies for 2024

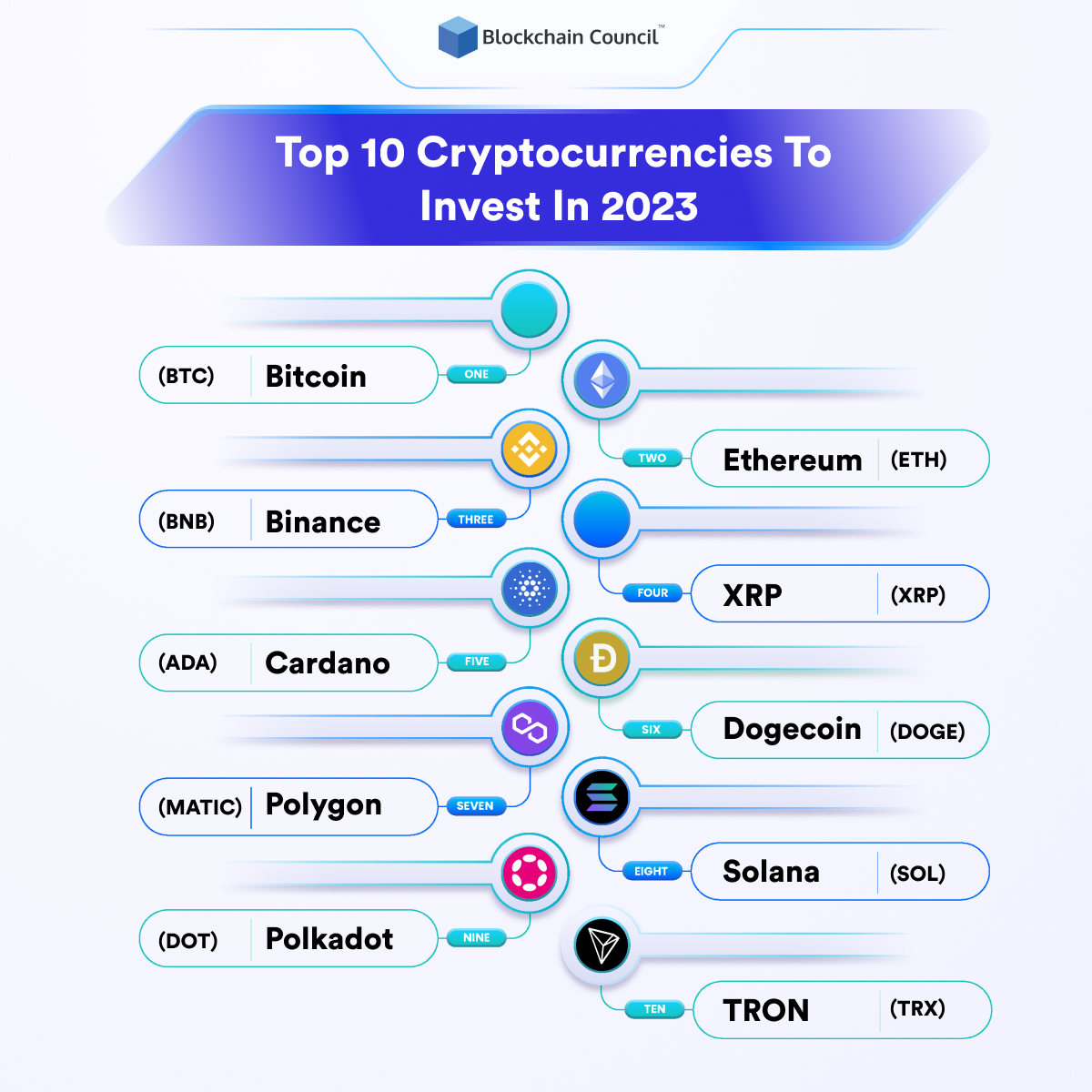

The cryptocurrency market is constantly evolving, with new projects emerging and existing ones developing at a rapid pace. While past performance is not indicative of future results, certain cryptocurrencies have the potential to stand out in 2024 based on their technology, team, and community. We’ll delve into some of these promising projects and explore their potential for growth.

Promising Cryptocurrencies

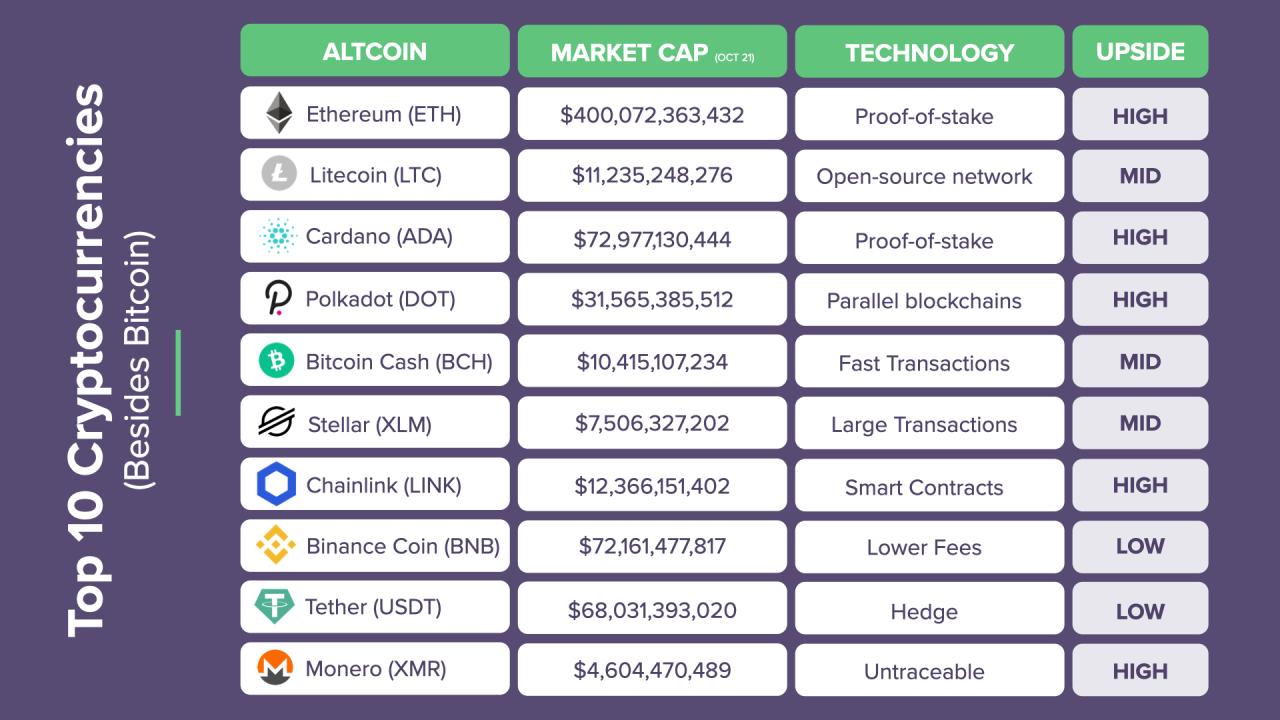

Here are some of the most promising cryptocurrencies that could see significant growth in 2024, along with their key features and potential use cases:

| Cryptocurrency Name | Project Description | Key Features | Potential Use Cases |

|---|---|---|---|

| Ethereum (ETH) | Ethereum is a decentralized, open-source blockchain platform that enables smart contracts and decentralized applications (dApps). | Scalability through layer-2 solutions, improved security, and a robust developer community. | Decentralized finance (DeFi), non-fungible tokens (NFTs), gaming, and supply chain management. |

| Cardano (ADA) | Cardano is a proof-of-stake blockchain platform that focuses on scalability, security, and sustainability. | Peer-reviewed development process, smart contracts, and a commitment to academic rigor. | Decentralized applications, supply chain tracking, and identity management. |

| Solana (SOL) | Solana is a high-performance blockchain platform that utilizes a unique Proof-of-History consensus mechanism. | Fast transaction speeds, low transaction fees, and a growing ecosystem of dApps. | Decentralized finance, NFTs, gaming, and decentralized exchanges. |

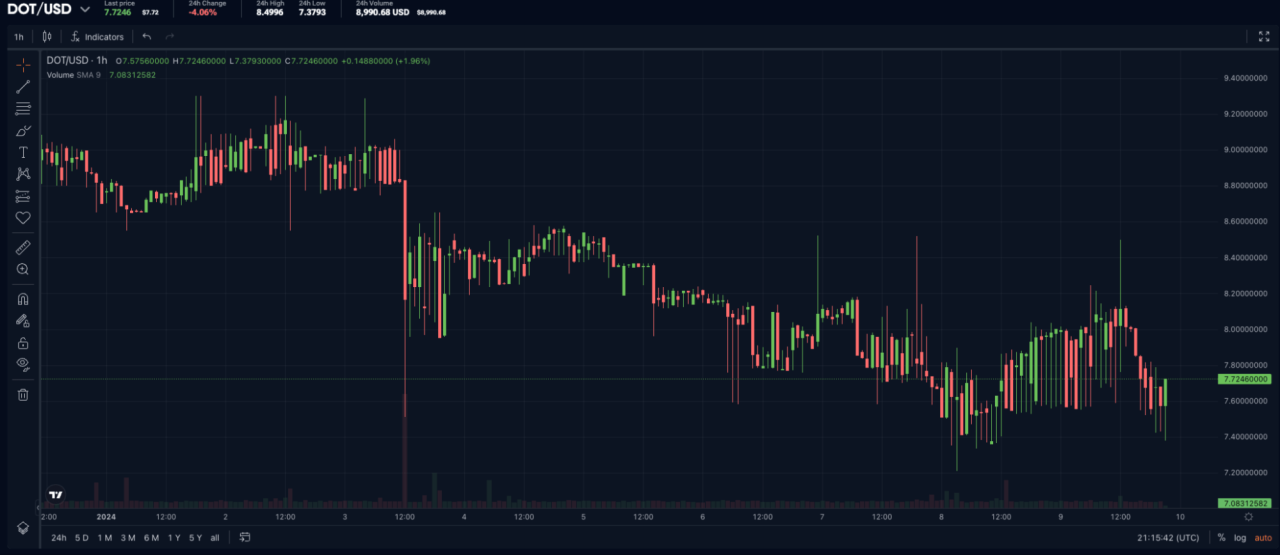

| Polkadot (DOT) | Polkadot is a multi-chain protocol that enables interoperability between different blockchains. | Cross-chain communication, scalability, and a focus on security. | Connecting different blockchains, creating a decentralized internet, and facilitating cross-chain transactions. |

Ethereum, the second-largest cryptocurrency by market capitalization, has been a pioneer in the decentralized finance (DeFi) and non-fungible token (NFT) spaces. Its upcoming upgrades, such as the transition to proof-of-stake (PoS) and the implementation of sharding, are expected to significantly enhance its scalability and performance.

Cardano’s focus on academic rigor and peer-reviewed development has resulted in a highly secure and robust platform. Its native token, ADA, has been steadily gaining traction in the market, and its commitment to sustainability could attract environmentally conscious investors.

Solana’s high-performance capabilities have made it a popular choice for developers building decentralized applications. Its unique Proof-of-History consensus mechanism allows for fast transaction speeds and low fees, making it a viable alternative to Ethereum.

Polkadot’s interoperability features have the potential to revolutionize the blockchain landscape. Its ability to connect different blockchains could facilitate cross-chain transactions and create a more interconnected and decentralized internet.

Investment Strategies for Cryptocurrencies

Investing in cryptocurrencies can be a thrilling and potentially lucrative endeavor, but it’s crucial to approach it with a well-defined strategy. Navigating the volatile nature of the crypto market requires careful planning and a solid understanding of different investment approaches.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of the current market price. This approach helps mitigate the risk of buying high and selling low, as you purchase more cryptocurrency when prices are low and less when they are high. By averaging your purchase price over time, you can potentially reduce the overall impact of market fluctuations on your investment.

Diversification

Diversification is a fundamental principle of investing that involves spreading your investments across different assets to reduce overall risk. In the context of cryptocurrencies, diversification means investing in a range of different cryptocurrencies with varying market capitalizations, use cases, and underlying technologies. This approach helps mitigate the risk of losing your entire investment if one particular cryptocurrency experiences a sharp decline.

Long-Term Holding

Long-term holding, often referred to as “hodling” in the crypto community, involves buying and holding cryptocurrencies for an extended period, typically years. This strategy is based on the belief that the value of cryptocurrencies will appreciate over time, particularly as the underlying technology and adoption continue to grow. While long-term holding can potentially yield significant returns, it also requires patience and the ability to withstand market volatility.

Managing Risk and Setting Realistic Expectations, Best crypto to buy 2024

Managing risk is crucial for any investment, but it’s particularly important in the volatile world of cryptocurrencies. It’s essential to understand the inherent risks associated with crypto investing, including price volatility, regulatory uncertainty, and the potential for scams. Setting realistic expectations is also vital. While the potential for high returns is a significant draw for many investors, it’s important to remember that cryptocurrencies are still a relatively new and unproven asset class.

Crypto Investment Platforms

Numerous platforms cater to cryptocurrency investors, each with its own strengths and weaknesses.

- Centralized Exchanges (CEXs): Platforms like Binance, Coinbase, and Kraken offer a wide range of cryptocurrencies, advanced trading features, and high liquidity. However, they require users to relinquish control of their private keys, which can be a security concern.

- Decentralized Exchanges (DEXs): Platforms like Uniswap and PancakeSwap operate on blockchain technology, allowing users to trade cryptocurrencies directly with each other without intermediaries. This approach offers greater privacy and security but may have lower liquidity and higher transaction fees.

- Hardware Wallets: Hardware wallets, such as Ledger Nano S and Trezor, provide the highest level of security by storing your private keys offline. They are generally considered the safest way to store cryptocurrencies but can be more expensive and require a higher level of technical expertise.

Emerging Trends in the Crypto Space: Best Crypto To Buy 2024

The cryptocurrency landscape is constantly evolving, with new trends emerging and reshaping the industry. Understanding these trends is crucial for navigating the crypto market and identifying potential investment opportunities. Some of the most significant trends include DeFi, NFTs, and Web3, which are transforming how we interact with finance, art, and the internet.

Decentralized Finance (DeFi)

DeFi is a rapidly growing sector of the crypto market that aims to create a more accessible and transparent financial system. DeFi applications allow users to borrow, lend, trade, and earn interest on their crypto assets without relying on traditional financial institutions.

- Decentralized Exchanges (DEXs): DEXs like Uniswap and PancakeSwap allow users to trade cryptocurrencies directly with each other, eliminating the need for intermediaries. This enhances privacy and security, as users do not have to disclose their personal information.

- Lending and Borrowing: DeFi platforms like Aave and Compound allow users to lend their crypto assets to earn interest or borrow crypto assets for various purposes. This provides alternative financing options to traditional loans.

- Stablecoins: Stablecoins are cryptocurrencies pegged to a stable asset like the US dollar, reducing volatility and making them suitable for everyday transactions.

Non-Fungible Tokens (NFTs)

NFTs are unique digital assets that represent ownership of real-world or digital items. NFTs are gaining popularity in various sectors, including art, gaming, and collectibles.

- Digital Art: NFTs have revolutionized the art world, allowing artists to sell their work directly to collectors without intermediaries, bypassing traditional galleries and auction houses. Examples include Beeple’s “Everydays: The First 5000 Days,” which sold for $69.3 million in 2021.

- Gaming: NFTs are being used to create in-game assets, such as characters, weapons, and virtual land, which can be traded on marketplaces. This allows players to own and monetize their in-game assets.

- Collectibles: NFTs are being used to create digital versions of physical collectibles, such as trading cards, sports memorabilia, and stamps. This allows collectors to buy, sell, and trade these items in a secure and verifiable manner.

Web3

Web3 is a vision of a decentralized internet that leverages blockchain technology to create a more open, secure, and user-controlled online experience. Web3 applications aim to give users more control over their data and provide a more equitable and transparent online ecosystem.

- Decentralized Social Media: Web3 platforms like Minds and Diaspora aim to provide alternatives to centralized social media giants like Facebook and Twitter, giving users more control over their content and data.

- Decentralized Storage: Web3 platforms like IPFS (InterPlanetary File System) provide decentralized storage solutions, allowing users to store their data on a network of computers rather than relying on centralized servers.

- Decentralized Identity: Web3 solutions like SelfKey and Civic aim to provide decentralized identity management systems, giving users more control over their personal data and online identities.

Decentralized Autonomous Organizations (DAOs)

DAOs are organizations governed by a set of rules encoded in smart contracts on a blockchain. DAOs are becoming increasingly popular as they offer a more transparent and democratic way of managing organizations.

- Community Governance: DAOs allow members to vote on proposals and decisions, giving everyone an equal voice in the organization’s direction.

- Transparency and Accountability: All DAO transactions and activities are recorded on a public blockchain, ensuring transparency and accountability.

- Global Participation: DAOs can operate without geographical boundaries, allowing people from all over the world to participate.

Epilogue

As we conclude our exploration of the best cryptocurrencies to buy in 2024, it’s important to remember that investing in crypto carries inherent risks. While this guide provides valuable insights and potential opportunities, it’s crucial to conduct thorough research, diversify your portfolio, and invest responsibly. The future of the crypto market is brimming with potential, and by staying informed and navigating the space with prudence, you can position yourself to capitalize on the exciting developments to come.

FAQ Insights

What are some of the key risks associated with investing in cryptocurrencies?

Cryptocurrencies are known for their volatility, meaning their prices can fluctuate significantly in short periods. Other risks include security breaches, regulatory uncertainty, and the potential for scams. It’s crucial to understand and manage these risks before investing in any cryptocurrency.

Is it too late to invest in cryptocurrencies?

It’s never too late to start investing in cryptocurrencies. While the market has experienced significant growth, there are still opportunities for investors who conduct thorough research and make informed decisions. The key is to adopt a long-term perspective and be prepared for market fluctuations.

How can I learn more about cryptocurrencies and investing in them?

There are numerous resources available to learn about cryptocurrencies, including online courses, articles, books, and communities. It’s essential to stay informed about the latest developments in the crypto space and consult with financial advisors if needed.