Best crypto stocks to buy now? The cryptocurrency market is a volatile beast, but for those willing to ride the waves, there are potential rewards to be reaped. This guide explores the landscape of publicly traded companies involved in the crypto industry, helping you understand the risks and rewards of investing in this exciting, yet unpredictable, sector.

We’ll delve into the key players, their business models, and the factors that drive their performance. We’ll also discuss different investment strategies, key financial metrics, and the regulatory landscape that shapes this rapidly evolving industry.

Understanding the Crypto Market

The cryptocurrency market has experienced remarkable growth in recent years, attracting investors seeking high returns and technological innovation. However, this volatile market presents both opportunities and risks.

The Current State of the Cryptocurrency Market

The cryptocurrency market is characterized by its high volatility, driven by a confluence of factors, including investor sentiment, regulatory developments, and technological advancements. Recent trends include:

* Increased Institutional Adoption: Major financial institutions are increasingly investing in cryptocurrencies, providing legitimacy and stability to the market. For example, BlackRock, the world’s largest asset manager, launched a Bitcoin private trust for institutional clients in 2021.

* Decentralized Finance (DeFi): DeFi protocols allow users to access financial services, such as lending and borrowing, without intermediaries. The rise of DeFi has created new opportunities for investors and developers.

* Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of digital or physical items. The NFT market has exploded in popularity, with applications ranging from art and collectibles to gaming and virtual real estate.

Risks and Rewards of Investing in Cryptocurrencies

Investing in cryptocurrencies involves inherent risks, but also offers potential rewards.

* Volatility: The value of cryptocurrencies can fluctuate significantly in a short period, leading to potential losses.

* Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving, which can create uncertainty for investors.

* Security Risks: Cryptocurrencies are susceptible to hacking and theft, requiring investors to take appropriate security measures.

* High Potential Returns: The value of some cryptocurrencies has increased significantly over time, offering the potential for high returns.

* Innovation: The blockchain technology underlying cryptocurrencies has the potential to revolutionize various industries.

* Decentralization: Cryptocurrencies operate outside traditional financial systems, providing a degree of freedom and autonomy.

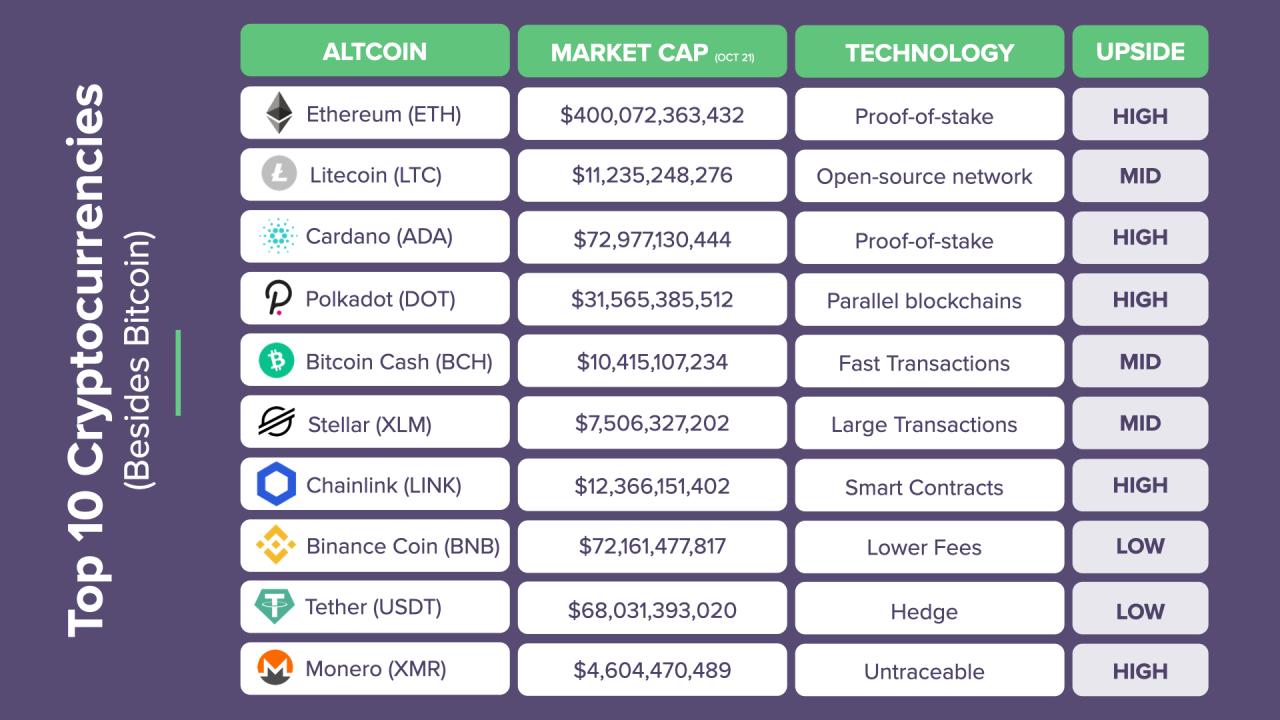

Types of Cryptocurrencies and Their Use Cases

The cryptocurrency market encompasses a wide range of digital assets with diverse use cases.

* Bitcoin (BTC): The first and most well-known cryptocurrency, Bitcoin is often used as a store of value and a means of payment.

* Ethereum (ETH): Ethereum is a platform for decentralized applications (dApps) and smart contracts.

* Stablecoins: Stablecoins are cryptocurrencies designed to maintain a stable value, often pegged to a fiat currency like the US dollar. They are used to reduce volatility in crypto transactions.

* Meme Coins: Meme coins are cryptocurrencies that gain popularity through online communities and social media hype.

Identifying Crypto Stocks

Investing in crypto stocks offers a way to participate in the cryptocurrency market without directly buying and holding digital assets. These stocks represent companies that are actively involved in various aspects of the crypto ecosystem, providing opportunities for both growth and diversification within your investment portfolio.

Crypto Mining Companies

Crypto mining companies are essential for the operation of blockchain networks, as they validate transactions and add new blocks to the blockchain.

- Marathon Digital Holdings (MARA): One of the largest publicly traded Bitcoin miners, Marathon Digital Holdings operates large-scale mining facilities in the United States. Their business model relies on acquiring and deploying mining hardware to generate Bitcoin, which they then hold or sell to generate revenue.

- Riot Blockchain (RIOT): Another major Bitcoin miner, Riot Blockchain focuses on utilizing sustainable energy sources for its mining operations. Their revenue is primarily generated from the mining and sale of Bitcoin, with a focus on building a vertically integrated mining ecosystem.

- CleanSpark (CLSK): CleanSpark is a Bitcoin mining company that emphasizes environmentally friendly mining practices. They have been actively expanding their mining operations and exploring new technologies to optimize their energy efficiency.

Crypto Exchange Platforms

Crypto exchange platforms facilitate the buying, selling, and trading of cryptocurrencies. These companies typically generate revenue through trading fees, as well as other services such as custody and lending.

- Coinbase Global (COIN): One of the largest cryptocurrency exchanges in the world, Coinbase offers a wide range of services, including trading, custody, and institutional solutions. Their platform is accessible to both retail and institutional investors.

- Robinhood Markets (HOOD): Robinhood, known for its commission-free stock trading platform, has expanded into the cryptocurrency market, offering trading in various digital assets. Their user-friendly interface and commission-free model have attracted a large user base.

- Kraken (private): Kraken is a well-established cryptocurrency exchange that caters to both retail and institutional investors. They offer a wide range of trading pairs and advanced trading tools, making them popular among experienced traders.

Blockchain Developers

Blockchain developers create and maintain the underlying technology that powers cryptocurrencies. These companies often develop software solutions for various industries, leveraging the benefits of blockchain technology.

- MicroStrategy Incorporated (MSTR): MicroStrategy is a business intelligence company that has become a significant Bitcoin holder. Their strategy involves accumulating Bitcoin as a long-term investment, highlighting the potential of blockchain technology.

- Block, Inc. (SQ): Formerly known as Square, Block is a financial technology company that has embraced the cryptocurrency space. They offer various services related to Bitcoin, including payments, custody, and investment products.

- Galaxy Digital Holdings (GLXY): Galaxy Digital is a financial services company that specializes in the digital asset market. They provide a range of services, including trading, investment banking, and asset management, focused on the cryptocurrency industry.

Evaluating Crypto Stocks

Evaluating crypto stocks requires a comprehensive approach that considers both traditional financial metrics and the unique characteristics of the cryptocurrency industry. This includes understanding the underlying technology, market trends, and regulatory landscape.

Key Financial Metrics

Investors should consider several key financial metrics to assess the financial health and growth potential of crypto stocks. These metrics provide insights into a company’s revenue generation, profitability, and market position.

- Revenue Growth: This metric measures the rate at which a company’s revenue is increasing over time. For crypto companies, revenue growth can be driven by factors such as increased user adoption, new product launches, and expansion into new markets.

- Profitability: Profitability measures a company’s ability to generate profits from its operations. Key metrics include gross profit margin, operating profit margin, and net profit margin. Crypto companies often face challenges in achieving profitability due to high operating costs and volatile market conditions.

- Market Capitalization: Market capitalization represents the total value of a company’s outstanding shares. This metric is a useful indicator of a company’s size and market influence. However, market capitalization can be volatile in the crypto industry due to rapid price fluctuations.

Competitive Landscape

The crypto industry is highly competitive, with numerous players vying for market share. Understanding the competitive landscape is crucial for evaluating crypto stocks.

- Market Share: Assess the market share held by each company in its respective segment of the crypto industry. Companies with a larger market share often have a competitive advantage in terms of revenue, brand recognition, and network effects.

- Innovation: Evaluate the level of innovation and technological advancements within each company. Companies that are at the forefront of innovation may have a significant advantage in the rapidly evolving crypto space.

- Partnerships and Collaborations: Analyze the partnerships and collaborations that each company has formed. Strategic alliances can provide access to new markets, technologies, and resources, enhancing a company’s competitive position.

Regulatory Risks and Opportunities

The regulatory landscape for cryptocurrencies is constantly evolving. Understanding the potential regulatory risks and opportunities is crucial for evaluating crypto stocks.

- Regulatory Clarity: Crypto companies operate in a relatively unregulated environment, which can create uncertainty and volatility. Clearer regulatory frameworks could provide stability and attract more institutional investors.

- Compliance Costs: Compliance with regulatory requirements can be costly for crypto companies. These costs can impact profitability and hinder growth.

- Regulatory Advantage: Companies that are early adopters of regulatory compliance may gain a competitive advantage by demonstrating their commitment to responsible practices. This can enhance their reputation and attract investors.

Investing Strategies for Crypto Stocks

Investing in crypto stocks involves navigating the volatile and dynamic world of digital assets. A comprehensive approach that blends risk management with strategic decision-making is crucial. There are various investment strategies that cater to different risk appetites and financial goals.

Long-Term Holding

Long-term holding, also known as buy-and-hold, is a strategy where investors purchase crypto stocks and hold them for an extended period, often years. This approach is based on the belief that the long-term value of the underlying crypto assets will appreciate over time.

“Long-term investing is the only way to achieve substantial wealth.” – Warren Buffett

Long-term holding can be a suitable strategy for investors with a high risk tolerance and a long-term investment horizon. It allows investors to ride out market fluctuations and benefit from potential long-term growth.

Short-Term Trading, Best crypto stocks to buy now

Short-term trading, also known as day trading, involves buying and selling crypto stocks within a short period, often within the same day. This strategy aims to profit from short-term price fluctuations and requires a high level of market knowledge and technical analysis skills.

Short-term trading can be a high-risk strategy, as rapid price movements can lead to significant losses. However, it can also be potentially profitable for experienced traders who can accurately predict market trends.

Diversification

Diversification is a key principle of investing, and it applies to crypto stocks as well. Diversifying your portfolio by investing in a range of crypto stocks across different sectors and market capitalizations can help mitigate risk.

“Don’t put all your eggs in one basket.” – Old Proverb

Diversification can help reduce the impact of any single investment’s underperformance on your overall portfolio.

Research and Due Diligence

Before investing in any crypto stock, it is crucial to conduct thorough research and due diligence. This involves:

- Understanding the underlying technology and business model of the company.

- Analyzing the company’s financial performance and future prospects.

- Evaluating the team behind the company and their experience in the crypto industry.

- Reading industry reports and news articles to stay informed about market trends and regulatory developments.

Risk Management

Managing risk is an essential part of investing in crypto stocks. Investors should:

- Only invest what they can afford to lose.

- Set realistic investment goals and avoid chasing quick profits.

- Use stop-loss orders to limit potential losses.

- Stay informed about market developments and adjust their investment strategy accordingly.

Setting Realistic Investment Goals

Setting realistic investment goals is crucial for success in the crypto market. Investors should:

- Consider their risk tolerance and investment horizon.

- Set specific, measurable, achievable, relevant, and time-bound (SMART) goals.

- Avoid unrealistic expectations of quick riches.

- Focus on long-term growth and value creation.

Examples of Crypto Stocks to Consider

Now that you have a grasp of the crypto market, let’s delve into some specific crypto stocks that might be worth adding to your portfolio. This list is not exhaustive, and it’s crucial to remember that past performance is not indicative of future results.

Examples of Crypto Stocks

Here are a few examples of crypto stocks to consider, along with their ticker symbols, market capitalization, and recent performance. Keep in mind that this information is subject to change, and it’s always advisable to conduct your own thorough research before making any investment decisions.

| Company Name | Ticker Symbol | Market Capitalization (USD) | Recent Performance (%) |

|---|---|---|---|

| Coinbase Global, Inc. | COIN | $10.5 billion | -50% in the last year |

| MicroStrategy Incorporated | MSTR | $2.5 billion | -60% in the last year |

| Marathon Digital Holdings, Inc. | MARA | $1.5 billion | -70% in the last year |

| Riot Blockchain, Inc. | RIOT | $1 billion | -80% in the last year |

Remember, this table is for illustrative purposes only. It’s crucial to conduct thorough research before investing in any of these stocks, considering factors like their business models, market trends, and risk tolerance.

Concluding Remarks: Best Crypto Stocks To Buy Now

Investing in crypto stocks is a journey of careful research, risk management, and understanding the underlying technologies that drive this sector. By navigating the complexities of the crypto market, you can potentially position yourself for growth and profit. However, remember that past performance is not indicative of future results, and all investments carry inherent risks.

Quick FAQs

What are the risks associated with investing in crypto stocks?

Cryptocurrency markets are highly volatile and subject to rapid price fluctuations. Regulatory uncertainty, market manipulation, and technological risks can all impact the value of crypto stocks.

How can I find reliable information about crypto stocks?

Consult reputable financial news sources, industry publications, and research reports from established investment firms. Always verify information from multiple sources and consider the source’s potential biases.

Is it better to invest in crypto stocks or directly in cryptocurrencies?

The best approach depends on your risk tolerance, investment goals, and understanding of the crypto market. Crypto stocks offer exposure to the industry through established companies, while direct cryptocurrency investments provide exposure to the underlying digital assets.