The best crypto coin to buy is a question on the minds of many investors, especially with the recent volatility in the cryptocurrency market. While there’s no one-size-fits-all answer, understanding the factors that influence cryptocurrency prices and the diverse landscape of cryptocurrencies is crucial to making informed investment decisions.

From Bitcoin’s dominance to Ethereum’s smart contracts, the world of cryptocurrencies offers a range of possibilities. Understanding the various use cases, strengths, and risks associated with each coin is essential for navigating this dynamic market.

Understanding the Crypto Market

The cryptocurrency market is a dynamic and ever-evolving space, characterized by high volatility and significant potential for both gains and losses. It’s essential to understand the forces driving this market before considering any investment.

Recent Trends and Major Events

The cryptocurrency market has experienced a rollercoaster ride in recent years. Major events, such as regulatory changes, technological advancements, and global economic shifts, have significantly impacted prices. For example, the 2021 bull run saw Bitcoin reach an all-time high, driven by institutional adoption and increased mainstream interest. However, the market experienced a sharp correction in 2022, with prices falling significantly due to factors like rising inflation and interest rate hikes.

Factors Influencing Cryptocurrency Prices and Volatility, Best crypto coin to buy

Several factors contribute to the volatility of cryptocurrency prices. These include:

- Supply and Demand: Like any market, cryptocurrency prices are determined by the balance between supply and demand. Increased demand from investors drives prices up, while a decrease in demand can lead to price drops.

- Market Sentiment: News, social media trends, and general market sentiment play a significant role in shaping investor behavior and influencing price movements.

- Regulation: Government regulations, particularly those related to taxation and trading, can have a major impact on cryptocurrency markets. Clearer regulations can increase investor confidence, while uncertainty can lead to market volatility.

- Technological Advancements: Innovations in blockchain technology, such as the development of new protocols and applications, can impact the value of specific cryptocurrencies.

- Economic Factors: Global economic conditions, such as inflation, interest rates, and geopolitical events, can influence the overall investment landscape, including cryptocurrency markets.

Types of Cryptocurrencies and Their Use Cases

The cryptocurrency world encompasses a diverse range of digital assets, each with its unique characteristics and potential applications.

- Bitcoin (BTC): Often referred to as digital gold, Bitcoin is the first and most well-known cryptocurrency. It is primarily used as a decentralized digital currency and a store of value.

- Ethereum (ETH): Ethereum is a platform for decentralized applications (dApps) and smart contracts. Its native cryptocurrency, Ether, is used to pay for transaction fees and interact with the Ethereum network.

- Stablecoins: Stablecoins are cryptocurrencies designed to maintain a stable price, typically pegged to a fiat currency like the US dollar. They are often used for trading and as a means of reducing volatility in cryptocurrency portfolios.

- Decentralized Finance (DeFi): DeFi platforms offer decentralized financial services, such as lending, borrowing, and trading, without the need for intermediaries. Many DeFi projects have their own native tokens, which are used to access these services.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of specific items, such as digital art, collectibles, or in-game assets. They are gaining popularity as a new form of digital ownership and have created a vibrant marketplace.

Factors to Consider When Choosing a Crypto Coin

Before diving into the exciting world of cryptocurrency investment, it’s crucial to understand that investing in cryptocurrencies comes with inherent risks. It’s essential to conduct thorough research and due diligence before investing in any cryptocurrency, considering various factors that can influence its future performance and your potential returns.

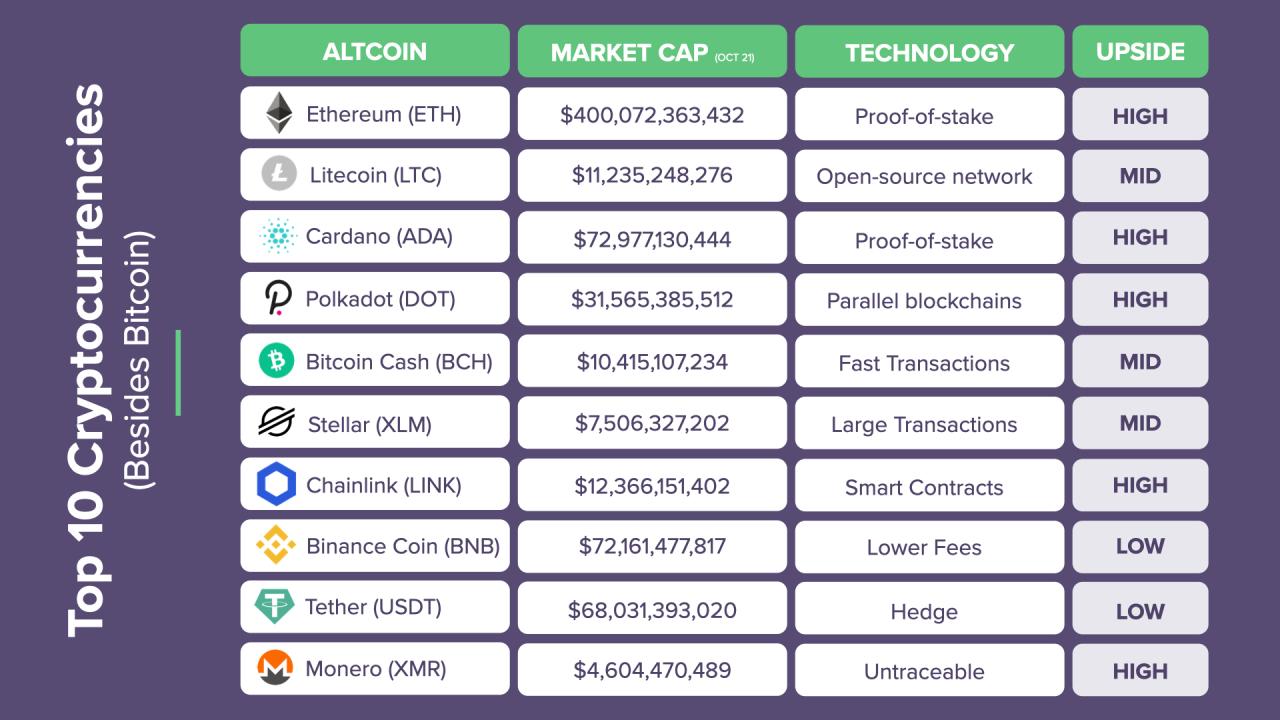

Market Capitalization

Market capitalization, often referred to as “market cap,” represents the total value of a cryptocurrency in circulation. It is calculated by multiplying the current price of the coin by the total number of coins in circulation. Market cap provides a valuable metric for gauging the overall size and popularity of a cryptocurrency. Larger market caps generally indicate greater adoption and stability, while smaller market caps may represent emerging projects with higher potential for growth but also higher risk.

Trading Volume

Trading volume refers to the amount of cryptocurrency traded within a specific period, typically measured in a 24-hour timeframe. Higher trading volume indicates strong interest and liquidity, making it easier to buy and sell the cryptocurrency without significantly impacting its price. Conversely, low trading volume can signal a lack of interest and potentially lead to price volatility.

Development Team

The development team behind a cryptocurrency plays a crucial role in its success. Investors should carefully evaluate the team’s experience, expertise, and track record in the blockchain and cryptocurrency space. A strong and experienced team with a clear vision and roadmap for the project’s development is a positive indicator of its potential for growth.

Community Engagement

A thriving and engaged community is a vital aspect of a cryptocurrency’s success. A strong community provides support, feedback, and advocacy for the project. Active social media presence, online forums, and regular communication from the development team are indicators of a healthy and engaged community.

Popular Cryptocurrencies to Consider

Choosing the right cryptocurrency to invest in can be a daunting task, given the vast and ever-evolving landscape of digital assets. Understanding the unique characteristics, strengths, and potential risks of each cryptocurrency is crucial for making informed investment decisions.

Popular Cryptocurrencies

To help you navigate this complex space, we’ve compiled a list of popular cryptocurrencies, highlighting their key features, strengths, and potential risks.

| Cryptocurrency | Symbol | Market Cap | Price | Use Case |

|---|---|---|---|---|

| Bitcoin | BTC | $470 Billion | $26,000 | Digital Gold, Store of Value |

| Ethereum | ETH | $190 Billion | $1,700 | Smart Contracts, Decentralized Applications |

| Binance Coin | BNB | $40 Billion | $250 | Trading Fees, Binance Ecosystem |

| Cardano | ADA | $12 Billion | $0.30 | Smart Contracts, Decentralized Finance |

| Solana | SOL | $10 Billion | $20 | High-Speed Transactions, Decentralized Applications |

| XRP | XRP | $15 Billion | $0.50 | Cross-Border Payments, Financial Services |

| Dogecoin | DOGE | $10 Billion | $0.07 | Meme Coin, Community-Driven |

Bitcoin is widely regarded as the first and most established cryptocurrency. Its decentralized nature, limited supply, and robust security make it a popular choice for investors seeking a store of value. However, its price volatility and slow transaction speeds can be drawbacks.

Ethereum, the second-largest cryptocurrency by market capitalization, is known for its smart contract functionality, enabling the development of decentralized applications (dApps). While Ethereum has gained popularity for its versatility, its high transaction fees and network congestion have been challenges.

Binance Coin is a native token of the Binance exchange, one of the largest cryptocurrency exchanges globally. BNB offers discounts on trading fees and access to various services within the Binance ecosystem. However, its reliance on the Binance platform and potential regulatory risks are factors to consider.

Cardano is a blockchain platform focused on scalability, sustainability, and security. It utilizes a proof-of-stake consensus mechanism, which is more energy-efficient than Bitcoin’s proof-of-work. While Cardano has a strong community and a well-defined roadmap, its development progress has been slower than anticipated.

Solana is a high-performance blockchain platform known for its fast transaction speeds and low fees. Its scalability and developer-friendly environment have attracted significant interest. However, its centralized nature and recent network outages have raised concerns.

XRP is a cryptocurrency designed for fast and efficient cross-border payments. Its low transaction fees and global reach have made it attractive for financial institutions. However, its regulatory uncertainties and ongoing legal battles have impacted its price and adoption.

Dogecoin is a meme coin that gained popularity due to its community-driven nature and its association with Elon Musk. While its price has fluctuated significantly, its loyal following and meme status have contributed to its popularity.

Remember, this is not an exhaustive list, and the cryptocurrency market is constantly evolving. It’s essential to conduct thorough research and consider your individual investment goals and risk tolerance before making any investment decisions.

Investment Strategies for Cryptocurrencies

Investing in cryptocurrencies can be a complex and risky endeavor, but with the right strategy, it can potentially lead to significant returns. Understanding different investment strategies and their associated risks is crucial for navigating the volatile world of cryptocurrencies.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money in a cryptocurrency at regular intervals, regardless of the price. This approach helps to mitigate risk by reducing the average purchase price over time.

For example, let’s say you invest $100 in Bitcoin every week. If the price of Bitcoin is $20,000 one week and $30,000 the next, you will buy more Bitcoin when the price is lower and less Bitcoin when the price is higher.

This strategy helps to smooth out price fluctuations and reduce the impact of market volatility.

- Advantages:

- Reduces the risk of buying high and selling low.

- Helps to average out the purchase price over time.

- Disciplined approach to investing.

- Disadvantages:

- May not yield the highest returns if the market experiences a sustained bull run.

- Requires a long-term investment horizon.

Hodling

Hodling is a strategy that involves buying and holding a cryptocurrency for an extended period, often years. Hodlers believe in the long-term potential of the cryptocurrency and are willing to ride out short-term price fluctuations.

The term “hodling” originated from a typo in a Bitcoin forum post, but it has since become a popular term in the crypto community.

- Advantages:

- Potential for high returns over the long term.

- Reduces the need for frequent trading and associated fees.

- Disadvantages:

- Requires a high tolerance for risk and market volatility.

- May result in losses if the cryptocurrency’s price declines significantly.

Trading

Trading involves buying and selling cryptocurrencies in an attempt to profit from short-term price fluctuations. Traders use technical analysis, fundamental analysis, and other strategies to identify trading opportunities.

Trading can be a high-risk, high-reward activity, and it requires a deep understanding of the cryptocurrency market and trading strategies.

- Advantages:

- Potential for high returns in a short period.

- Flexibility to adjust positions based on market conditions.

- Disadvantages:

- High risk of losses due to market volatility.

- Requires significant time and effort to research and execute trades.

- Can be emotionally draining due to constant market fluctuations.

Diversification

Diversifying your cryptocurrency investments across multiple coins is crucial for mitigating risk. This approach helps to reduce the impact of a single cryptocurrency’s price fluctuations on your overall portfolio.

For example, instead of investing all your money in Bitcoin, you could diversify your portfolio by investing in other cryptocurrencies like Ethereum, Solana, or Cardano.

- Advantages:

- Reduces the overall risk of your portfolio.

- Increases the potential for higher returns.

- Disadvantages:

- May require more research and due diligence to identify suitable cryptocurrencies.

Conclusion: Best Crypto Coin To Buy

Investing in cryptocurrencies can be a rewarding but risky endeavor. By understanding the market dynamics, conducting thorough research, and considering your investment goals, you can approach this space with confidence. Remember, diversification is key to mitigating risk, and staying informed about industry trends is crucial for making sound investment decisions.

Clarifying Questions

What are the biggest risks associated with investing in cryptocurrencies?

Investing in cryptocurrencies comes with several risks, including price volatility, security vulnerabilities, regulatory uncertainty, and the potential for scams.

How can I learn more about cryptocurrency investing?

There are numerous resources available to learn about cryptocurrency investing, including reputable websites, forums, social media communities, educational articles, videos, and white papers. Consulting with a financial professional is also recommended before making any investment decisions.

Is it too late to invest in cryptocurrencies?

The cryptocurrency market is constantly evolving, and it’s never too late to start learning and exploring potential investment opportunities. However, it’s important to remember that past performance is not indicative of future results.