The best alt crypto to buy can be a challenging question to answer. With thousands of altcoins vying for attention, finding the gems among the duds requires a careful analysis of market trends, project fundamentals, and risk tolerance. This guide delves into the world of altcoins, exploring the factors that influence their value, offering insights on investment strategies, and outlining essential risk management practices.

From understanding the concept of altcoins and their role in the broader cryptocurrency ecosystem to navigating the complexities of market analysis, we’ll equip you with the knowledge needed to make informed decisions in the exciting yet volatile world of altcoin investing.

Evaluating Altcoins

Navigating the vast and volatile world of altcoins requires a discerning eye and a structured approach. While the potential for significant returns is alluring, it’s crucial to evaluate altcoin investment opportunities with a critical lens. This section delves into key metrics and insights for assessing the potential of altcoins.

Key Metrics for Evaluating Altcoin Investment Potential

Understanding the key metrics that underpin the value proposition of an altcoin is essential for making informed investment decisions. These metrics provide insights into the project’s technical soundness, market traction, and overall viability.

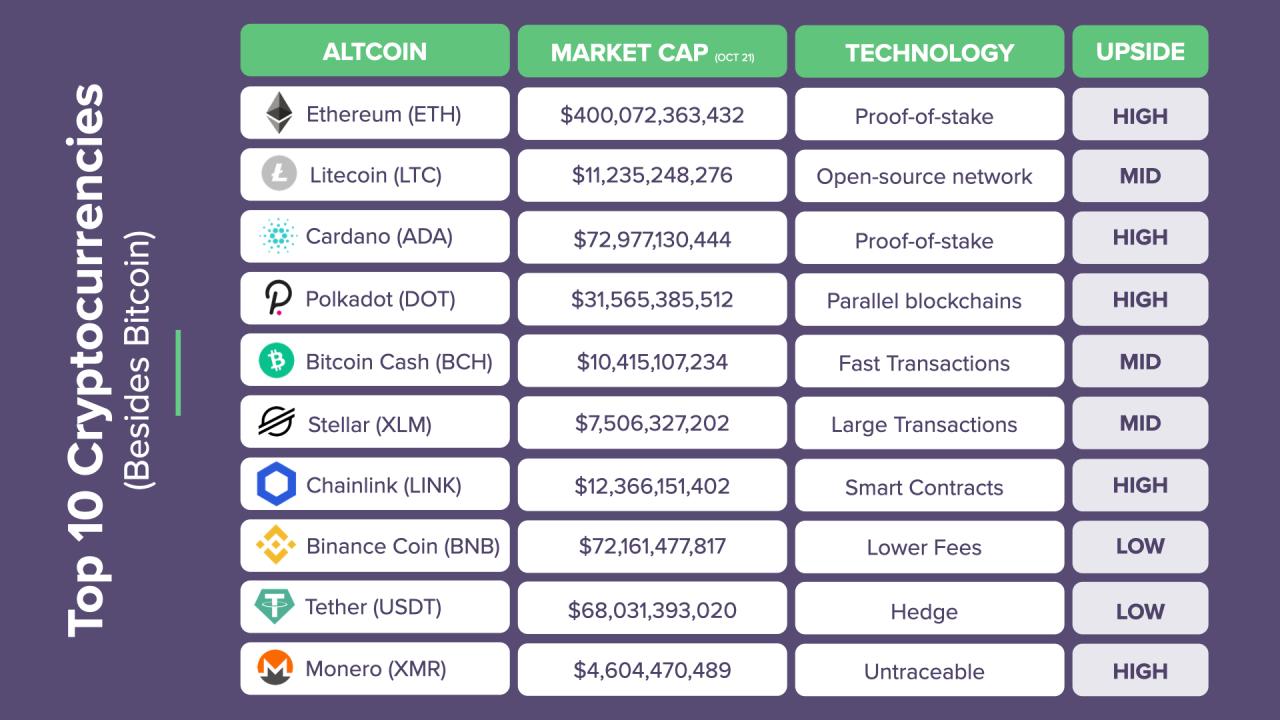

- Market Capitalization: Represents the total value of all outstanding coins. It provides a measure of the project’s size and market influence.

- Trading Volume: Indicates the level of activity in the altcoin’s market. High trading volume often suggests strong investor interest and liquidity.

- Price Volatility: Measures the degree of price fluctuations. High volatility can present both opportunities and risks for investors.

- Circulating Supply: Refers to the number of coins currently in circulation. A lower circulating supply can lead to higher price appreciation due to scarcity.

- Total Supply: Represents the maximum number of coins that will ever be created. A fixed total supply can limit inflation and enhance the value of existing coins.

- Network Activity: Reflects the usage and adoption of the altcoin’s underlying blockchain network. High network activity signifies real-world utility and demand.

Analyzing the Team, Technology, and Market Adoption of Altcoins

Beyond financial metrics, evaluating the team, technology, and market adoption of an altcoin is crucial for understanding its long-term potential.

- Team: Assessing the experience, expertise, and track record of the team behind the project is essential. A strong team with a proven history of success in the blockchain space can instill confidence in the project’s execution and development.

- Technology: Understanding the underlying technology and its innovation is crucial. Evaluating the project’s whitepaper, technical documentation, and codebase can shed light on its technical soundness and potential for disruption.

“A strong whitepaper that Artikels the project’s goals, technology, and roadmap is a critical indicator of a well-structured project.”

- Market Adoption: Analyzing the project’s user base, partnerships, and integration into existing ecosystems provides insights into its real-world utility and potential for growth.

“A project with a growing user base, strategic partnerships, and integration into existing ecosystems is likely to gain traction and value.”

Examples of Successful and Unsuccessful Altcoin Projects

Examining the characteristics of successful and unsuccessful altcoin projects can provide valuable lessons for investors.

- Successful Altcoin Projects:

- Ethereum (ETH): A decentralized platform that enables smart contracts and decentralized applications (dApps). Its robust technology, strong community, and widespread adoption have made it a leading cryptocurrency.

- Chainlink (LINK): A decentralized oracle network that connects blockchains to real-world data. Its ability to bridge the gap between on-chain and off-chain data has fueled its growth.

- Unsuccessful Altcoin Projects:

- Dogecoin (DOGE): Initially a meme coin, its value skyrocketed due to hype and speculation but lacked a solid foundation. It eventually experienced a significant decline in value.

- BitConnect (BCC): A Ponzi scheme that promised high returns through a lending platform. It ultimately collapsed, resulting in significant losses for investors.

Investment Strategies: Best Alt Crypto To Buy

Investing in altcoins presents various approaches, each with its own risk profile and potential rewards. Understanding these strategies is crucial for making informed decisions and maximizing returns.

Long-Term Holding

Long-term holding, or “hodling,” involves buying and holding altcoins for an extended period, typically years, with the expectation that their value will appreciate over time. This strategy relies on the belief in the underlying technology or project’s long-term potential.

Risks and Rewards

- Risk: Volatility and market fluctuations can lead to significant losses in the short term, especially during market downturns. The long-term success of a project is uncertain, and there is always a risk of it failing or becoming obsolete.

- Reward: Potential for substantial gains if the altcoin’s value increases over time. Long-term holders can benefit from compounding returns and the potential for significant price appreciation.

Day Trading

Day trading involves buying and selling altcoins within a single trading day, aiming to profit from short-term price fluctuations. This strategy requires a high level of technical analysis skills, market knowledge, and risk tolerance.

Risks and Rewards

- Risk: High volatility and rapid price movements can lead to significant losses. Day trading requires constant monitoring and quick decision-making, which can be stressful and time-consuming.

- Reward: Potential for significant gains if market movements are correctly predicted. Day traders can profit from small price fluctuations by executing multiple trades throughout the day.

Arbitrage

Arbitrage involves exploiting price differences between different cryptocurrency exchanges. This strategy involves buying an altcoin on one exchange where it is priced lower and selling it on another exchange where it is priced higher, profiting from the difference.

Risks and Rewards

- Risk: Price differences can be small and may not always be profitable after accounting for transaction fees and slippage. Arbitrage opportunities can disappear quickly due to market fluctuations.

- Reward: Potential for consistent profits by exploiting price discrepancies. Arbitrage can be automated using software bots, allowing for continuous monitoring and execution of trades.

Hypothetical Portfolio

The following table presents a hypothetical portfolio of altcoins based on various risk tolerance levels:

| Risk Tolerance | Portfolio Allocation |

|---|---|

| Low | Bitcoin (BTC) 70%, Ethereum (ETH) 20%, Stablecoins (USDT, USDC) 10% |

| Medium | Bitcoin (BTC) 50%, Ethereum (ETH) 25%, Altcoins (e.g., Solana, Cardano) 25% |

| High | Ethereum (ETH) 40%, Altcoins (e.g., Polkadot, Chainlink) 40%, DeFi tokens (e.g., Uniswap, Aave) 20% |

Note: This is a hypothetical example and should not be considered investment advice. The specific allocation of assets should be tailored to individual circumstances, risk tolerance, and investment goals.

Market Trends and Predictions

The altcoin market is constantly evolving, with new trends and technologies emerging regularly. Understanding these trends is crucial for investors looking to capitalize on potential opportunities. In addition to analyzing current trends, it is essential to consider expert opinions and predictions on the future of altcoins, as well as the potential impact of regulatory changes on the market.

Emerging Sectors and Technologies

Emerging sectors and technologies are driving innovation and growth in the altcoin market. Some of the most prominent trends include:

- Decentralized Finance (DeFi): DeFi applications are revolutionizing traditional financial services by offering decentralized alternatives for lending, borrowing, trading, and more. Platforms like Aave, Compound, and MakerDAO are leading the charge in this sector.

- Non-Fungible Tokens (NFTs): NFTs are unique digital assets that represent ownership of digital or physical items. They have gained immense popularity in areas like art, gaming, and collectibles, with platforms like OpenSea and Rarible facilitating NFT trading.

- Metaverse and Gaming: The metaverse, a collective virtual world, is gaining traction, with altcoins like Decentraland and Sandbox enabling users to create, own, and trade virtual assets. Gaming platforms are also incorporating blockchain technology, offering players ownership of in-game items and rewards.

- Layer-2 Scaling Solutions: As blockchain networks like Ethereum face scalability challenges, layer-2 solutions are emerging to improve transaction speed and reduce costs. Platforms like Polygon, Optimism, and Arbitrum are providing efficient scaling solutions.

Expert Opinions and Predictions

Experts in the cryptocurrency industry offer valuable insights and predictions on the future of altcoins. Some key perspectives include:

- Increased Adoption: Many experts believe that the adoption of altcoins will continue to grow, driven by factors like increasing awareness, regulatory clarity, and the development of user-friendly applications.

- Focus on Utility: The focus is shifting from speculative trading to altcoins with real-world utility and use cases. Projects that solve real problems and offer tangible benefits are expected to thrive.

- Consolidation and Diversification: The altcoin market is likely to see consolidation, with strong projects gaining prominence. However, diversification within the altcoin space is still crucial for managing risk.

Regulatory Impact

Regulatory changes have a significant impact on the altcoin market. While some regulations aim to protect investors and promote responsible innovation, others can stifle growth and innovation.

- Increased Scrutiny: Regulators worldwide are increasingly scrutinizing the cryptocurrency industry, including altcoins. This scrutiny is likely to continue, with a focus on areas like anti-money laundering (AML) and know-your-customer (KYC) regulations.

- Impact on Trading and Investment: Regulatory changes can affect the trading and investment landscape for altcoins. For example, new regulations may require exchanges to comply with stricter KYC/AML requirements or limit access to certain investors.

- Potential for Innovation: While regulations can pose challenges, they can also create opportunities for innovation. For example, regulations may incentivize the development of more compliant and secure blockchain platforms.

Resources and Tools

Navigating the world of altcoins requires access to reliable information and tools to help you make informed decisions. This section explores valuable resources and tools for researching, tracking, and analyzing altcoins.

Reputable Resources for Altcoin Research

- CoinMarketCap: This website provides comprehensive data on cryptocurrency prices, market capitalization, trading volume, and more. It allows you to filter and sort altcoins based on various criteria, such as market cap, trading volume, and price change.

- CoinGecko: Another popular platform similar to CoinMarketCap, offering detailed information on altcoins, including their historical price data, market cap, and developer activity.

- Messari: A comprehensive platform that provides in-depth research reports, data analysis, and insights on various cryptocurrencies and blockchain projects.

- CryptoCompare: This platform offers real-time cryptocurrency data, historical price charts, exchange comparisons, and market analysis tools.

- CryptoSlate: A news and information website that provides up-to-date coverage of the cryptocurrency market, including altcoin news, analysis, and reviews.

Cryptocurrency Exchange Comparison

Choosing the right cryptocurrency exchange is crucial for trading altcoins. Here’s a comparison of some popular exchanges based on their features:

| Exchange | Supported Altcoins | Fees | Security | Features |

|---|---|---|---|---|

| Binance | Wide range of altcoins | Low trading fees | High security measures | Spot trading, margin trading, futures trading, staking |

| Coinbase | Limited selection of altcoins | Higher trading fees | Strong security features | User-friendly interface, easy onboarding |

| Kraken | Extensive altcoin selection | Competitive fees | Excellent security reputation | Advanced trading tools, margin trading |

| KuCoin | Wide range of altcoins | Low trading fees | Robust security measures | Spot trading, margin trading, futures trading, lending |

| Bitfinex | Extensive altcoin selection | Competitive fees | High security standards | Advanced trading tools, margin trading, futures trading |

Technical Analysis Tools for Altcoin Trading Opportunities

Technical analysis involves using historical price data and charts to identify patterns and trends that can predict future price movements. Various tools can assist in technical analysis, including:

- TradingView: This platform provides real-time charts, technical indicators, and drawing tools for analyzing price movements. It also offers community-generated ideas and strategies.

- TradingView: A platform that offers real-time charts, technical indicators, and drawing tools for analyzing price movements. It also offers community-generated ideas and strategies.

- Cryptocurrency Exchanges: Many cryptocurrency exchanges provide built-in charting tools and technical indicators that you can use to analyze altcoin prices.

Moving Averages are popular technical indicators that smooth out price fluctuations and help identify trends.

A simple moving average (SMA) calculates the average price over a specific period. A longer SMA represents a long-term trend, while a shorter SMA reflects short-term price fluctuations.

Relative Strength Index (RSI) is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

An RSI value above 70 suggests an overbought condition, while a value below 30 indicates an oversold condition.

Risk Management

Investing in altcoins comes with inherent risks, just like any other investment. It’s crucial to understand these risks and implement strategies to mitigate them. This section delves into the potential pitfalls and explores practical risk management approaches to navigate the volatile world of altcoins.

Risk Factors Associated with Altcoins

The volatile nature of the cryptocurrency market, particularly for altcoins, poses significant risks. Here are some key risk factors to consider:

- Market Volatility: Altcoins are known for their extreme price fluctuations, often exceeding those of Bitcoin. This volatility can lead to substantial losses in a short period.

- Lack of Regulation: The cryptocurrency market is largely unregulated, which can expose investors to fraud, scams, and manipulation.

- Technological Risk: Altcoins rely on underlying technology, which can be prone to vulnerabilities, bugs, and security breaches.

- Competition: The cryptocurrency landscape is highly competitive, with new altcoins emerging constantly. This competition can make it difficult for existing altcoins to maintain value.

- Liquidity Risk: Some altcoins may have low trading volume, making it challenging to buy or sell them quickly at a desired price.

- Project Failure: Altcoins are often backed by projects that may not succeed or fail to deliver on their promises.

Strategies for Managing Risk

While altcoins present risks, effective risk management strategies can help mitigate potential losses. Here are some approaches:

- Diversification: Spreading investments across multiple altcoins and other asset classes reduces exposure to the risks associated with any single coin.

- Stop-Loss Orders: Setting stop-loss orders automatically sells an altcoin if its price falls below a predetermined threshold, limiting potential losses.

- Proper Portfolio Allocation: Allocating a specific portion of your portfolio to altcoins, based on your risk tolerance and investment goals, helps prevent overexposure.

- Thorough Research: Before investing in any altcoin, conduct in-depth research on the project, its team, its technology, and its market potential.

- Due Diligence: Verify the legitimacy of the project, its development progress, and the reputation of its developers.

- Risk Tolerance Assessment: Understand your own risk appetite and invest accordingly.

Real-World Examples of Risk Management

- Diversification: Imagine an investor who invests in Bitcoin, Ethereum, and a few other promising altcoins. If one altcoin experiences a sharp decline, the losses are mitigated by the gains from other assets in the portfolio.

- Stop-Loss Orders: Consider an investor who buys an altcoin at $100. They set a stop-loss order at $80, meaning the coin will automatically be sold if its price drops to $80, preventing further losses.

- Portfolio Allocation: An investor may allocate 10% of their portfolio to altcoins, with the remaining 90% invested in other assets. This limits the potential impact of altcoin losses on the overall portfolio.

Ethical Considerations

Investing in altcoins, like any other financial venture, comes with ethical implications. It’s crucial to consider the potential environmental impact, the risk of scams, and the broader social and economic consequences of your investment decisions.

Environmental Impact of Altcoin Mining

The energy consumption associated with cryptocurrency mining, particularly for proof-of-work (PoW) consensus mechanisms like Bitcoin, is a significant ethical concern. The process of mining involves using powerful computers to solve complex mathematical problems, which requires substantial energy resources. This can contribute to greenhouse gas emissions and strain local power grids.

Potential for Scams and Fraud

The decentralized nature of the cryptocurrency market makes it susceptible to scams and fraud. While blockchain technology provides transparency, the anonymity it offers can be exploited by malicious actors.

Responsible and Ethical Altcoin Investing, Best alt crypto to buy

To mitigate the ethical risks associated with altcoin investing, consider these best practices:

- Invest responsibly: Conduct thorough research on the projects you’re considering, evaluating their team, technology, and use cases.

- Diversify your portfolio: Spreading your investments across various altcoins can reduce the risk of losing your entire investment in a single project.

- Be cautious of hype and FOMO: Avoid investing based solely on hype or fear of missing out. Make informed decisions based on fundamental analysis.

- Understand the environmental impact: Consider the environmental footprint of the coins you’re investing in and choose those that prioritize sustainability.

- Support ethical projects: Invest in projects that align with your values, such as those promoting social good or addressing environmental issues.

Key Ethical Considerations for Altcoin Investors

| Ethical Consideration | Description | Example |

|---|---|---|

| Environmental Impact | The energy consumption associated with cryptocurrency mining, particularly for proof-of-work (PoW) consensus mechanisms like Bitcoin, is a significant ethical concern. The process of mining involves using powerful computers to solve complex mathematical problems, which requires substantial energy resources. This can contribute to greenhouse gas emissions and strain local power grids. | The Bitcoin network’s energy consumption is estimated to be equivalent to the annual energy consumption of a small country. |

| Potential for Scams and Fraud | The decentralized nature of the cryptocurrency market makes it susceptible to scams and fraud. While blockchain technology provides transparency, the anonymity it offers can be exploited by malicious actors. | The rise of rug pulls, where developers abandon projects after raising funds from investors, is a growing concern in the altcoin space. |

| Social and Economic Impact | The rapid growth of the cryptocurrency market has raised concerns about its social and economic impact, including potential for wealth inequality, financial instability, and regulatory challenges. | The volatility of the cryptocurrency market can create significant economic risks for individuals and businesses. |

Last Point

The journey to finding the best alt crypto to buy is an ongoing one, requiring constant research, adaptation, and a healthy dose of risk management. By understanding the fundamentals of altcoins, analyzing market trends, and employing strategic investment approaches, you can navigate the dynamic landscape of the cryptocurrency market and potentially unlock the rewards of investing in this innovative sector.

User Queries

What is the best altcoin to buy right now?

There is no one-size-fits-all answer to this question. The best altcoin for you will depend on your individual investment goals, risk tolerance, and research. It’s crucial to conduct thorough due diligence before investing in any altcoin.

What are the risks of investing in altcoins?

Investing in altcoins carries inherent risks, including volatility, market manipulation, and the possibility of scams. It’s essential to understand these risks and implement appropriate risk management strategies.

How can I learn more about altcoins?

There are numerous resources available to help you learn more about altcoins, including online articles, educational platforms, and cryptocurrency communities. You can also consult with financial advisors who specialize in digital assets.