- Introduction to Online Accounting Degrees

- Curriculum and Coursework

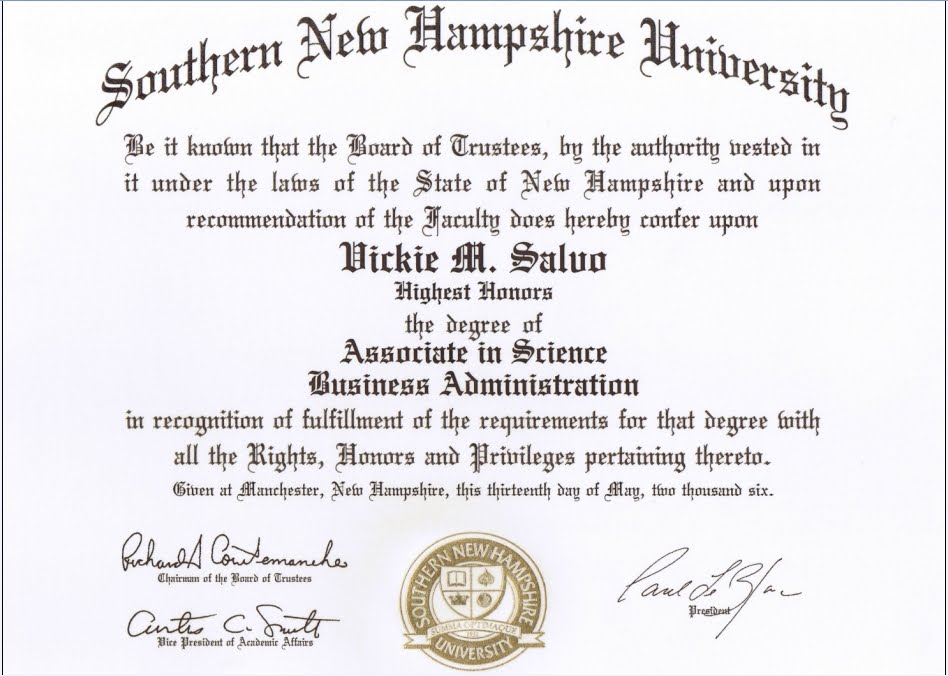

- Accreditation and Program Quality

- Admission Requirements and Application Process

- Learning Environment and Technology

- Career Outlook and Job Market

- Financial Considerations

- Tips for Success in Online Accounting Programs

- Final Summary: Bachelors Degree In Accounting Online

- Answers to Common Questions

Bachelors degree in accounting online – A Bachelor’s Degree in Accounting Online opens doors to a rewarding career in a field that is always in demand. The flexibility of online learning allows individuals to pursue their education while balancing work and personal commitments. This degree provides a comprehensive understanding of accounting principles, financial reporting, and tax regulations, preparing graduates for a wide range of roles in various industries.

From financial analysts to auditors and tax accountants, an online accounting degree can equip you with the skills and knowledge necessary to excel in the competitive job market. The curriculum often includes courses in financial accounting, managerial accounting, auditing, tax, and business law, providing a strong foundation for a successful career in accounting.

Introduction to Online Accounting Degrees

The accounting profession is a cornerstone of the global economy, playing a crucial role in ensuring financial transparency, accountability, and informed decision-making. As businesses and organizations become increasingly complex, the demand for skilled accounting professionals continues to grow, making an accounting degree a valuable asset in today’s job market.

Pursuing an online accounting degree offers a flexible and convenient pathway to a rewarding career in this in-demand field.

Advantages of Online Accounting Degrees

Online accounting degrees offer a number of advantages that make them an attractive option for individuals seeking a career in accounting.

- Flexibility and Convenience: Online programs allow students to learn at their own pace and on their own schedule, making it easier to balance their studies with work, family, and other commitments.

- Accessibility: Online accounting programs are available to students from all over the world, regardless of their location or prior commitments.

- Affordability: Online programs can often be more affordable than traditional on-campus programs, as they eliminate the costs associated with commuting, housing, and other expenses.

- Technology-Focused Learning: Online accounting programs often incorporate the latest technology and software, preparing students for the demands of the modern accounting workplace.

Career Paths Available with an Accounting Degree

An accounting degree opens doors to a wide range of career paths, both within and outside of traditional accounting roles. Here are some examples of career paths available with an accounting degree:

- Accountant: Accountants are responsible for recording, classifying, and summarizing financial transactions, preparing financial statements, and providing financial advice to businesses and organizations.

- Auditor: Auditors examine and evaluate financial records to ensure accuracy and compliance with accounting standards and regulations. They often work for accounting firms, government agencies, or internal audit departments of companies.

- Tax Accountant: Tax accountants specialize in preparing tax returns for individuals and businesses, advising on tax planning strategies, and ensuring compliance with tax laws.

- Financial Analyst: Financial analysts collect, analyze, and interpret financial data to make recommendations on investment decisions, assess the financial health of companies, and evaluate potential risks and opportunities.

- Management Accountant: Management accountants provide financial information and analysis to internal stakeholders, such as managers and executives, to support decision-making and improve organizational performance.

- Controller: Controllers are responsible for overseeing all aspects of an organization’s accounting function, including financial reporting, budgeting, and internal controls.

- Chief Financial Officer (CFO): CFOs are the top financial executives in organizations, responsible for managing the organization’s financial resources, developing financial strategies, and providing financial guidance to the board of directors.

Curriculum and Coursework

An online accounting degree program equips students with the essential knowledge and skills required for a successful career in accounting. The curriculum typically includes a comprehensive range of core courses and elective options, providing students with a solid foundation in accounting principles and practices.

The curriculum is designed to provide students with a thorough understanding of accounting principles, financial reporting, and taxation. Students will also learn about the various accounting software programs used in the industry.

Core Courses

Core courses are fundamental to an accounting degree and provide a comprehensive foundation in accounting principles and practices. These courses are typically required for all accounting majors and cover a wide range of topics, including:

- Financial Accounting: This course focuses on the principles and practices of recording, classifying, and summarizing financial transactions. It covers topics such as the accounting cycle, balance sheet, income statement, and statement of cash flows.

- Managerial Accounting: This course focuses on providing financial information to internal users, such as managers, for decision-making purposes. It covers topics such as cost accounting, budgeting, and performance analysis.

- Taxation: This course covers the principles and practices of federal, state, and local taxation. It includes topics such as income tax, sales tax, and property tax.

- Auditing: This course covers the principles and practices of auditing financial statements. It includes topics such as audit planning, internal control, and audit procedures.

- Accounting Information Systems: This course focuses on the design, implementation, and maintenance of accounting information systems. It covers topics such as data processing, database management, and cybersecurity.

Elective Courses

Elective courses allow students to specialize in areas of accounting that interest them. These courses provide students with the opportunity to develop advanced skills and knowledge in specific areas of accounting. Here are some examples of elective courses that are commonly offered in online accounting programs:

- Forensic Accounting: This course covers the principles and practices of investigating financial crimes. It includes topics such as fraud detection, financial statement analysis, and legal procedures.

- International Accounting: This course focuses on the accounting principles and practices used in different countries. It covers topics such as international financial reporting standards (IFRS), cross-border transactions, and global taxation.

- Government and Not-for-Profit Accounting: This course covers the accounting principles and practices used by government agencies and not-for-profit organizations. It includes topics such as grant accounting, fund accounting, and performance measurement.

Practical Experience and Internships

Practical experience is essential for success in the accounting field. Many online accounting programs offer opportunities for students to gain practical experience through internships. Internships allow students to apply their classroom knowledge in a real-world setting and develop valuable skills such as communication, problem-solving, and teamwork.

“Internships provide students with the opportunity to network with professionals in the accounting field and gain valuable experience that can help them secure a job after graduation.”

Accreditation and Program Quality

Earning an accounting degree from an accredited program is crucial for aspiring accountants. Accreditation signifies that a program meets specific standards and prepares graduates for successful careers.

Accreditation is a process that evaluates educational institutions and programs against a set of criteria. It ensures that students receive a high-quality education and that graduates are qualified for their chosen profession.

Accreditation Bodies for Accounting Programs

Several organizations accredit accounting programs in the United States.

- Accreditation Council for Business Schools and Programs (ACBSP): ACBSP is a specialized accreditation body for business schools and programs, including accounting. It focuses on the quality of instruction, curriculum, and faculty qualifications.

- Association to Advance Collegiate Schools of Business (AACSB): AACSB is a global accreditation body for business schools. It is considered the most prestigious accreditation for business programs, including accounting. AACSB accreditation emphasizes rigorous academic standards, faculty expertise, and program innovation.

- International Accreditation Council for Business Education (IACBE): IACBE is an international accreditation body that focuses on quality assurance in business education. It accredits a wide range of business programs, including accounting. IACBE accreditation emphasizes student learning outcomes, program effectiveness, and continuous improvement.

Criteria for Evaluating Online Accounting Program Quality

When choosing an online accounting program, it is essential to evaluate the program’s quality. Here are some criteria to consider:

- Accreditation: Ensure the program is accredited by a reputable organization, such as AACSB, ACBSP, or IACBE. Accreditation indicates that the program meets specific quality standards.

- Faculty Qualifications: Look for a program with experienced and qualified faculty members who have industry experience and academic credentials.

- Curriculum: The curriculum should be comprehensive and aligned with the latest industry standards. Look for programs that offer courses in accounting principles, financial reporting, auditing, taxation, and other relevant areas.

- Technology and Resources: The program should utilize technology effectively to deliver high-quality online learning experiences. This includes access to online learning platforms, interactive simulations, and other resources.

- Career Services: A strong career services department can provide valuable assistance with job searching, resume writing, and interview preparation.

- Student Support: Look for programs that offer robust student support services, such as academic advising, tutoring, and technical assistance.

- Reputation: Research the program’s reputation among employers and alumni. Look for programs with a strong track record of placing graduates in successful accounting careers.

Admission Requirements and Application Process

Earning a bachelor’s degree in accounting online requires meeting specific admission requirements and navigating the application process. This section will provide an overview of the typical admission requirements for online accounting programs, offer tips for crafting a compelling application, and discuss the importance of a strong resume and letters of recommendation.

Admission Requirements

The admission requirements for online accounting programs vary depending on the institution. However, some common requirements include:

- A high school diploma or equivalent

- A minimum GPA, typically a 2.5 or higher

- Official transcripts from all previously attended colleges or universities

- Standardized test scores, such as the GMAT or GRE, may be required for some programs

- A personal statement or essay

- Letters of recommendation

- A resume or curriculum vitae (CV)

- Proof of English proficiency for international students

Some programs may also require specific prerequisite courses, such as college algebra, statistics, or introductory accounting. It is important to research the specific requirements of each program you are interested in.

Crafting a Compelling Application

When applying to an online accounting program, it is crucial to present a strong application that highlights your qualifications and commitment to the field. Here are some tips for crafting a compelling application:

- Start early: Begin the application process well in advance of the deadline to allow ample time for research, preparation, and submission.

- Thoroughly research programs: Explore different online accounting programs and identify those that align with your academic and career goals.

- Craft a compelling personal statement: In your personal statement, clearly articulate your reasons for pursuing an online accounting degree, your career aspirations, and how the program aligns with your goals.

- Showcase your academic achievements: Highlight your strong academic record and any relevant coursework, such as accounting, finance, or business courses.

- Demonstrate relevant experience: If you have any work experience, volunteer experience, or extracurricular activities related to accounting, be sure to highlight them in your application.

- Obtain strong letters of recommendation: Seek letters of recommendation from individuals who can speak to your academic abilities, work ethic, and potential for success in an accounting program.

Resume and Letters of Recommendation

A strong resume and letters of recommendation are essential components of a successful application.

- Resume: Your resume should showcase your relevant skills, experience, and accomplishments. It should be tailored to the specific program you are applying to and highlight any experience or skills that demonstrate your passion for accounting.

- Letters of Recommendation: Letters of recommendation should provide detailed insights into your academic abilities, work ethic, and potential for success in the program. They should be written by individuals who can speak to your qualifications and character.

Learning Environment and Technology

Online accounting degree programs are designed to provide a flexible and accessible learning experience. These programs utilize a variety of technologies and platforms to deliver course content, facilitate student-faculty interactions, and foster a collaborative learning environment.

Technology Utilized in Online Accounting Degree Programs

Technology plays a crucial role in online accounting degree programs. The following are some key ways technology is used to enhance the learning experience:

- Learning Management Systems (LMS): These platforms serve as the central hub for course materials, assignments, announcements, and communication. Popular LMS platforms include Blackboard, Canvas, and Moodle.

- Video Conferencing: Live lectures, office hours, and group discussions are often conducted using video conferencing tools like Zoom, WebEx, or Microsoft Teams. This allows for real-time interaction between students and instructors.

- Interactive Learning Modules: Online programs utilize interactive learning modules, simulations, and case studies to provide engaging and hands-on learning experiences. These modules often incorporate multimedia elements such as videos, animations, and interactive quizzes.

- Collaboration Tools: Online programs often incorporate collaboration tools like discussion forums, group projects, and online whiteboards to encourage student interaction and teamwork.

Faculty Support and Student Resources

Online programs provide a variety of support resources to help students succeed:

- Faculty Support: Online instructors are readily available to answer questions, provide guidance, and offer feedback. They may offer office hours via video conferencing or email, and some programs even provide dedicated online tutoring services.

- Technical Support: Most online programs have dedicated technical support teams available to assist students with any technical issues they may encounter with the LMS or other online tools.

- Student Success Centers: Many universities offer online student success centers that provide resources such as academic advising, career counseling, and financial aid assistance.

- Online Libraries: Students have access to a wealth of online resources through university libraries, including e-books, journals, and databases.

Career Outlook and Job Market

An accounting degree opens doors to a wide range of career paths and offers a stable and rewarding future. The demand for skilled accounting professionals remains consistently high across various industries, making it a promising field for those seeking a fulfilling career.

Current Job Market for Accounting Professionals, Bachelors degree in accounting online

The job market for accounting professionals is robust and expected to continue growing in the coming years. According to the U.S. Bureau of Labor Statistics, employment of accountants and auditors is projected to grow 7% from 2021 to 2031, faster than the average for all occupations. This growth is driven by several factors, including the increasing complexity of business operations, the need for compliance with regulations, and the growing demand for financial analysis and reporting.

Emerging Trends and Opportunities in Accounting

The accounting profession is constantly evolving, with new technologies and trends shaping the landscape. Some of the emerging trends and opportunities in accounting include:

- Data Analytics and Big Data: Accounting professionals are increasingly using data analytics tools to gain insights from large datasets, identify patterns, and make better business decisions. This includes using data to improve financial forecasting, risk management, and fraud detection.

- Cloud Computing: Cloud-based accounting software is becoming increasingly popular, allowing businesses to access their financial data from anywhere, anytime. This has created new opportunities for accountants who are skilled in using cloud-based accounting software and managing data security.

- Artificial Intelligence (AI): AI is being used to automate tasks, such as data entry and reconciliation, freeing up accountants to focus on more strategic tasks. AI is also being used to improve fraud detection and risk management.

- Cybersecurity: As businesses become increasingly reliant on technology, cybersecurity has become a critical concern. Accountants are playing a key role in ensuring the security of financial data and systems.

Industries Where Accounting Skills are Highly Sought After

Accounting skills are highly sought after across a wide range of industries, including:

- Finance and Banking: These industries require accountants to manage financial transactions, prepare financial statements, and analyze financial data to make informed decisions.

- Technology: As the technology sector continues to grow, there is a high demand for accountants who can understand the unique financial challenges of technology companies, such as intellectual property valuation and stock option accounting.

- Healthcare: The healthcare industry is complex and highly regulated, requiring accountants with specialized knowledge of healthcare accounting and compliance requirements.

- Retail: Retail companies need accountants to manage inventory, track sales, and analyze financial performance to optimize operations and profitability.

- Manufacturing: Manufacturing companies require accountants to manage costs, track production, and analyze financial data to improve efficiency and profitability.

Financial Considerations

Pursuing an online accounting degree is a significant investment, but the potential career benefits make it worthwhile. Understanding the financial aspects of online education is crucial to making an informed decision.

The cost of an online accounting degree can vary greatly depending on the institution, program length, and location. It’s important to research and compare different programs to find the best value for your investment. Online programs may offer lower tuition rates compared to traditional on-campus programs. However, additional expenses like technology fees, software subscriptions, and books should be factored in.

Financial Aid and Scholarships

Numerous financial aid options and scholarships are available to help offset the cost of an online accounting degree. These resources can make pursuing higher education more affordable and accessible.

- Federal Student Loans: These loans are available to students who meet specific eligibility requirements and are often the most affordable option. Federal loans typically have lower interest rates and flexible repayment options compared to private loans.

- State Grants: Many states offer grants to residents pursuing higher education. These grants may not need to be repaid, making them a valuable resource for students.

- Institutional Scholarships: Many colleges and universities offer scholarships based on academic merit, financial need, or other criteria. These scholarships can significantly reduce the overall cost of your degree.

- Private Scholarships: Numerous private organizations and foundations offer scholarships to students pursuing accounting degrees. These scholarships often have specific eligibility requirements, so it’s important to research and apply to those that align with your background and interests.

Managing the Financial Aspects of Online Education

Managing the financial aspects of online education requires careful planning and budgeting. Consider the following strategies to ensure you stay on track financially.

- Create a Budget: Develop a realistic budget that accounts for tuition, fees, technology costs, living expenses, and other potential expenses. This will help you track your spending and ensure you stay within your financial means.

- Explore Part-Time Work: Consider part-time work opportunities to supplement your income and help cover the cost of your education. Many online accounting programs offer flexible scheduling options, making it easier to balance work and studies.

- Seek Financial Counseling: If you need assistance with financial planning or budgeting, consult with a financial advisor or counselor. They can provide personalized guidance and help you develop a financial plan that meets your specific needs.

Tips for Success in Online Accounting Programs

Earning an online accounting degree can be challenging, but with the right approach, you can set yourself up for success. This section provides essential tips for navigating the online learning environment, maximizing your time, and achieving your academic and career goals.

Effective Time Management and Study Habits

Effective time management is crucial for online students. It’s important to create a consistent study schedule and stick to it. This can help you stay organized and avoid falling behind. Here are some practical tips for effective time management:

- Set aside dedicated study time: Treat your online courses like in-person classes. Schedule specific blocks of time each week for studying, attending live sessions, and completing assignments.

- Break down tasks: Large projects can seem overwhelming. Break them down into smaller, manageable steps. This will make them feel less daunting and easier to accomplish.

- Minimize distractions: Find a quiet place to study where you can focus without interruptions. Turn off your phone, close unnecessary tabs on your computer, and let others know you need uninterrupted time.

- Use a planner or calendar: Track deadlines, assignments, and important events. This will help you stay organized and avoid missing anything.

- Prioritize tasks: Focus on the most important tasks first. This will ensure that you complete your most critical work and avoid falling behind.

Active Participation and Engagement

While online learning provides flexibility, it’s important to actively participate and engage with the course material and your instructors. This can help you stay motivated and learn more effectively.

- Attend live sessions: If your program offers live sessions, make an effort to attend as many as possible. This will allow you to interact with your instructors and classmates in real-time.

- Ask questions: Don’t be afraid to ask questions if you don’t understand something. Your instructors are there to help you succeed. Utilize online forums or discussion boards to connect with classmates and ask questions.

- Contribute to discussions: Participate in online discussions and forums. Share your insights and perspectives, and engage with your classmates’ contributions.

- Seek feedback: Ask your instructors for feedback on your work. This can help you identify areas where you can improve.

Building a Professional Network and Seeking Career Opportunities

Networking is crucial for success in any field, especially in accounting. Use your online program as an opportunity to build relationships with fellow students, instructors, and professionals in the field.

- Connect with classmates: Engage in online forums and discussions, and consider reaching out to classmates to collaborate on projects or study groups.

- Attend virtual events: Many professional organizations host virtual events, such as webinars and conferences. These events provide excellent opportunities to network and learn about current industry trends.

- Reach out to instructors: Your instructors can be valuable mentors and sources of career advice. Don’t hesitate to ask them for guidance on your career goals.

- Join professional organizations: Membership in professional organizations, such as the American Institute of Certified Public Accountants (AICPA) or the Institute of Management Accountants (IMA), can provide access to networking events, resources, and job boards.

Final Summary: Bachelors Degree In Accounting Online

Pursuing a Bachelor’s Degree in Accounting Online is a strategic investment in your future. By choosing a reputable program and dedicating yourself to your studies, you can acquire the skills and credentials necessary to thrive in the dynamic world of accounting. Whether you are seeking a career change or looking to advance your existing career, an online accounting degree can be a valuable asset, opening up new opportunities and possibilities for professional growth.

Answers to Common Questions

What are the job prospects after completing an online accounting degree?

Graduates with an online accounting degree can pursue various roles, including financial analysts, auditors, tax accountants, budget analysts, and cost accountants, in diverse industries such as finance, healthcare, manufacturing, and technology.

How long does it take to complete an online accounting degree?

The duration of an online accounting degree program can vary depending on the institution and the number of courses taken per semester. Most programs can be completed in 4 years, but some may offer accelerated options for those who want to graduate faster.

Are online accounting degrees recognized by employers?

Yes, online accounting degrees from reputable institutions are widely recognized by employers. It is important to choose an accredited program to ensure its credibility and value in the job market.

What are the admission requirements for online accounting programs?

Typical admission requirements include a high school diploma or equivalent, a minimum GPA, and standardized test scores (such as the SAT or ACT). Some programs may also require prior coursework in accounting or business.