Bachelors degree accounting – A Bachelor’s degree in Accounting is a stepping stone to a fulfilling and rewarding career in the world of finance. It opens doors to diverse roles in various industries, offering a blend of analytical skills, problem-solving abilities, and a deep understanding of financial principles.

This degree equips individuals with the knowledge and expertise to manage financial records, analyze financial data, and provide strategic financial advice to businesses. From auditing and taxation to financial analysis and management accounting, a Bachelor’s in Accounting provides a solid foundation for a successful career.

Introduction to Accounting

Accounting is the language of business. It is a system for recording, classifying, summarizing, and reporting financial transactions. Accounting provides information that is essential for decision-making by both internal and external stakeholders.

Accounting plays a crucial role in business decision-making. It provides financial information that helps managers make informed decisions about pricing, production, investment, and financing. For example, a manager might use accounting information to determine whether to invest in a new piece of equipment, to decide on the optimal pricing strategy for a product, or to assess the financial health of the company.

Types of Accounting

Accounting can be broadly classified into three main types: financial accounting, managerial accounting, and cost accounting.

- Financial accounting focuses on providing financial information to external stakeholders, such as investors, creditors, and regulatory agencies. It follows a set of generally accepted accounting principles (GAAP) to ensure consistency and comparability across different companies.

- Managerial accounting provides financial information to internal stakeholders, such as managers and employees. It is not bound by GAAP and can be tailored to the specific needs of the company. For example, a manager might use managerial accounting information to track the costs of producing a product, to evaluate the performance of different departments, or to make decisions about pricing and production.

- Cost accounting focuses on the measurement and analysis of costs. It is used to determine the cost of producing goods or services, to track the efficiency of production processes, and to make decisions about pricing and product mix.

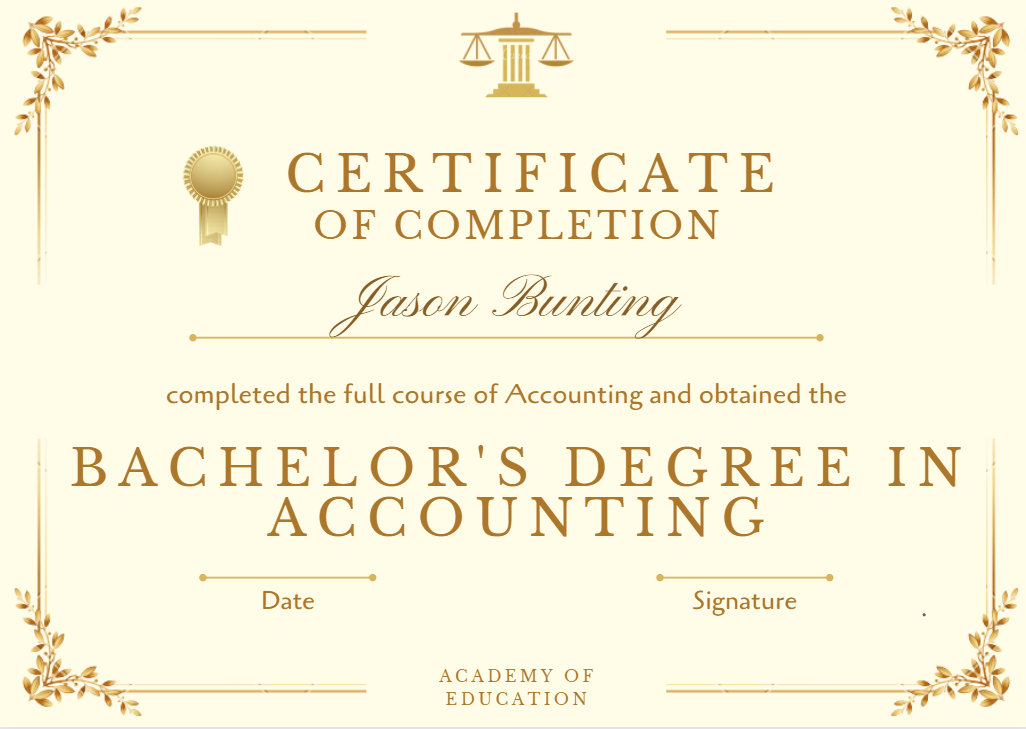

Bachelor’s Degree in Accounting

A Bachelor’s Degree in Accounting is a popular choice for students seeking a career in finance, business, or government. This degree provides a comprehensive understanding of accounting principles, practices, and applications.

Curriculum of a Bachelor’s Degree in Accounting

A typical bachelor’s degree in accounting curriculum encompasses a broad range of subjects designed to equip students with the necessary knowledge and skills for a successful career in the field. The curriculum often includes core courses that cover fundamental accounting principles, as well as elective courses that allow students to specialize in specific areas of accounting.

Core Courses in Accounting

The core courses in an accounting curriculum provide a solid foundation in the fundamental principles and practices of accounting. These courses are essential for understanding the financial reporting process, analyzing financial statements, and making informed business decisions. Some of the most common core courses include:

- Financial Accounting: This course focuses on the principles and practices of recording, classifying, and summarizing financial transactions. Students learn how to prepare financial statements, including the balance sheet, income statement, and statement of cash flows.

- Managerial Accounting: This course explores the use of accounting information for internal decision-making. Students learn how to analyze costs, prepare budgets, and evaluate performance.

- Auditing: This course examines the process of auditing financial statements to ensure their accuracy and compliance with accounting standards. Students learn about different types of audits, auditing procedures, and the role of the auditor.

- Taxation: This course covers the principles and practices of federal, state, and local taxation. Students learn how to prepare tax returns, understand tax laws, and advise clients on tax planning strategies.

- Ethics: This course explores the ethical considerations and professional responsibilities of accountants. Students learn about the AICPA Code of Professional Conduct and other ethical guidelines that govern the accounting profession.

Career Paths with a Bachelor’s Degree in Accounting

A bachelor’s degree in accounting opens doors to a wide range of career opportunities in various sectors, including:

- Public Accounting: Public accountants work for independent accounting firms that provide auditing, tax, and consulting services to businesses and individuals. This career path often involves working with clients in a variety of industries and providing expert advice on financial matters.

- Corporate Accounting: Corporate accountants work for businesses and organizations to manage their financial records, prepare financial statements, and analyze financial performance. They may specialize in specific areas such as cost accounting, budgeting, or financial reporting.

- Government Accounting: Government accountants work for federal, state, and local governments to manage public funds, prepare budgets, and ensure compliance with financial regulations. They may work in areas such as tax collection, auditing, or financial reporting.

- Forensic Accounting: Forensic accountants investigate financial crimes, such as fraud and embezzlement. They use their accounting expertise to identify financial irregularities, gather evidence, and assist in legal proceedings.

- Financial Analysis: Financial analysts use their accounting knowledge to evaluate the financial health of businesses and make investment recommendations. They may work for investment banks, hedge funds, or other financial institutions.

Career Opportunities for Accounting Graduates

An accounting degree opens doors to a wide range of career paths, offering diverse opportunities in various industries. Accounting graduates are highly sought after by employers due to their analytical skills, attention to detail, and understanding of financial principles.

Job Roles for Accounting Graduates

Accounting graduates can pursue various roles, each requiring specific skills and knowledge.

- Staff Accountant: Staff accountants are responsible for recording financial transactions, preparing financial statements, and assisting with the day-to-day operations of the accounting department. They typically work under the supervision of a senior accountant or controller.

- Financial Analyst: Financial analysts evaluate financial data, prepare reports, and provide insights to help businesses make informed financial decisions. They may analyze investments, assess risk, and develop financial models.

- Auditor: Auditors examine financial records and statements to ensure their accuracy and compliance with accounting standards and regulations. They may work for accounting firms, government agencies, or corporations.

- Tax Accountant: Tax accountants specialize in tax preparation, planning, and compliance. They advise clients on tax strategies, prepare tax returns, and represent clients in tax audits.

- Management Accountant: Management accountants provide financial information and analysis to internal stakeholders, such as managers and executives. They help organizations make strategic decisions, improve efficiency, and control costs.

Job Market for Accounting Professionals

The job market for accounting professionals is generally strong, with a steady demand for skilled graduates. The Bureau of Labor Statistics projects a 7% growth in employment for accountants and auditors from 2020 to 2030, which is faster than the average for all occupations. This growth is driven by factors such as the increasing complexity of business operations, the need for compliance with regulations, and the growing use of technology in accounting.

Industries Employing Accounting Graduates

Accounting graduates are employed in a wide range of industries, including:

- Finance: This industry offers roles in investment banking, asset management, and financial planning.

- Healthcare: Hospitals, clinics, and insurance companies employ accountants to manage financial records, track costs, and ensure compliance with regulations.

- Manufacturing: Manufacturing companies require accountants to manage costs, track inventory, and analyze production data.

- Technology: Technology companies, particularly those involved in software development and data analytics, are increasingly hiring accounting professionals.

- Nonprofit: Nonprofit organizations, such as charities and educational institutions, need accountants to manage their finances and ensure transparency and accountability.

Skills and Qualities for Accounting Professionals

The accounting profession demands a unique blend of technical expertise and personal qualities. To excel in this field, aspiring accountants must possess a comprehensive skillset that encompasses analytical thinking, problem-solving, attention to detail, communication, and technology proficiency. Furthermore, ethical conduct and professional judgment are paramount in maintaining the integrity of the profession.

Essential Skills for Accounting Professionals

The foundation of a successful accounting career lies in a strong understanding of core accounting principles and a mastery of essential skills.

- Analytical Thinking: Accountants analyze financial data to identify trends, patterns, and potential issues. They use their analytical skills to interpret financial statements, evaluate business performance, and make informed decisions.

- Problem-Solving: Accounting professionals often face complex financial challenges that require creative solutions. They must be able to identify problems, gather relevant information, develop alternative solutions, and implement the most effective approach.

- Attention to Detail: Accuracy is crucial in accounting. Accountants must be meticulous in their work, ensuring that all transactions are recorded correctly and that financial statements are free from errors.

- Communication: Accountants communicate financial information to a wide range of stakeholders, including management, investors, and regulators. They must be able to convey complex financial concepts clearly and concisely, both orally and in writing.

- Technology Proficiency: The accounting profession is increasingly reliant on technology. Accountants must be proficient in using accounting software, spreadsheets, and other financial tools to streamline their work and enhance their efficiency.

Ethical Conduct and Professional Judgment

The accounting profession is built on a foundation of trust. Accountants are entrusted with handling sensitive financial information and making judgments that can impact businesses and individuals. Therefore, ethical conduct and professional judgment are paramount.

“Ethical conduct is a fundamental principle in accounting. Accountants are expected to act with integrity, objectivity, and professional competence. They must avoid conflicts of interest, maintain confidentiality, and uphold the highest standards of professional ethics.”

Accountants must exercise sound judgment in their decision-making, considering the ethical implications of their actions. They must be able to identify and evaluate potential conflicts of interest, ensure the accuracy and completeness of financial information, and make decisions that are in the best interests of their clients and stakeholders.

Soft Skills for Career Advancement

While technical skills are essential, soft skills can significantly enhance an accountant’s career prospects.

- Teamwork: Accountants often work in teams, collaborating with colleagues, clients, and other professionals. Effective teamwork requires strong communication, interpersonal skills, and the ability to work effectively in a collaborative environment.

- Leadership: As accountants progress in their careers, they may assume leadership roles, managing teams and projects. Strong leadership skills, including the ability to motivate, inspire, and delegate effectively, are essential for success in these positions.

- Adaptability: The accounting profession is constantly evolving, with new technologies, regulations, and business practices emerging regularly. Accountants must be adaptable and willing to learn new skills and adapt to changing circumstances.

Professional Certifications in Accounting: Bachelors Degree Accounting

Earning professional certifications in accounting can significantly enhance your career prospects and earning potential. These certifications demonstrate your expertise, credibility, and commitment to the field.

Benefits of Professional Certifications

The benefits of obtaining professional certifications in accounting include:

- Increased earning potential: Certified accountants typically earn higher salaries than their non-certified counterparts. According to the U.S. Bureau of Labor Statistics, the median annual salary for certified public accountants was $73,560 in 2021, while the median annual salary for all accountants and auditors was $77,250.

- Enhanced career opportunities: Many employers prefer to hire certified accountants, as they possess the knowledge, skills, and ethical standards required for success in the profession. Certifications can open doors to leadership roles, specialized positions, and higher-paying jobs.

- Improved credibility and reputation: Holding a professional certification demonstrates your commitment to the accounting profession and your dedication to staying up-to-date on industry standards and best practices. It enhances your credibility among clients, employers, and peers.

- Increased job security: In a competitive job market, having a professional certification can give you a significant advantage. Employers are more likely to retain certified accountants, as they are valuable assets to the organization.

Requirements for Obtaining Professional Certifications

To obtain professional certifications, such as the CPA or CMA, candidates must meet specific requirements, which may vary depending on the certification and jurisdiction. These requirements typically include:

- Education: Most certifications require a bachelor’s degree in accounting or a related field. Some certifications may also require a master’s degree or specific coursework.

- Experience: Many certifications require a certain amount of work experience in accounting, typically in a public accounting firm or a corporate setting. This experience helps candidates gain practical knowledge and apply their theoretical understanding to real-world situations.

- Exams: Candidates must pass a rigorous exam to demonstrate their knowledge and competency in accounting principles, practices, and ethics. These exams are typically multiple-choice and cover a wide range of topics.

- Continuing education: To maintain their certifications, professionals must participate in ongoing education and training to stay up-to-date on industry changes and regulations. This may involve attending conferences, workshops, or taking online courses.

Certified Public Accountant (CPA)

The Certified Public Accountant (CPA) is a highly respected professional certification in accounting. CPAs are qualified to provide a wide range of accounting services, including auditing, tax preparation, and financial consulting.

Requirements for the CPA

To become a CPA, candidates must typically meet the following requirements:

- Education: A bachelor’s degree in accounting or a related field is required. Some states may require 150 semester hours of coursework.

- Experience: Most states require 1-2 years of work experience in accounting under the supervision of a licensed CPA. This experience can be gained in public accounting, corporate accounting, or government accounting.

- Exams: Candidates must pass the Uniform CPA Examination, which is a four-part exam covering auditing and attestation, business environment and concepts, financial accounting and reporting, and regulation. The exam is administered by the AICPA (American Institute of Certified Public Accountants) and is graded by the AICPA.

- Ethics: CPAs must adhere to a strict code of ethics, which emphasizes integrity, objectivity, and professional competence.

Certified Management Accountant (CMA)

The Certified Management Accountant (CMA) is a professional certification for accountants who work in management and financial accounting roles. CMAs are experts in cost accounting, budgeting, financial analysis, and strategic decision-making.

Requirements for the CMA

To become a CMA, candidates must typically meet the following requirements:

- Education: A bachelor’s degree in accounting or a related field is required. Candidates must also have two years of relevant work experience in management accounting or a related field. This experience can be gained in a variety of industries, including manufacturing, retail, and healthcare.

- Exams: Candidates must pass two exams, each covering a different aspect of management accounting. The exams are administered by the IMA (Institute of Management Accountants) and are graded by the IMA.

- Ethics: CMAs must adhere to the IMA’s Code of Ethics, which emphasizes honesty, fairness, and objectivity in professional practice.

Career Paths and Earning Potential for Certified Accountants

Certified accountants have a wide range of career opportunities, including:

- Public accounting: CPAs can work in public accounting firms, providing audit, tax, and consulting services to businesses and individuals.

- Corporate accounting: Certified accountants can work in corporate accounting departments, managing financial records, preparing financial statements, and analyzing financial performance.

- Government accounting: Certified accountants can work for government agencies, managing public funds and ensuring compliance with regulations.

- Financial planning and analysis: Certified accountants can specialize in financial planning and analysis, providing insights and recommendations to businesses on financial strategy and decision-making.

- Forensic accounting: Certified accountants can work in forensic accounting, investigating financial crimes and fraud.

Certified accountants typically earn higher salaries than their non-certified counterparts. According to a 2022 survey by the AICPA, the median salary for CPAs was $80,000, while the median salary for all accountants and auditors was $77,250. The earning potential for certified accountants can vary depending on factors such as experience, industry, and location.

The Future of Accounting

The accounting profession is rapidly evolving, driven by technological advancements, changing business landscapes, and a growing demand for data-driven insights. The traditional role of an accountant is shifting from a purely transactional function to one that is more analytical, strategic, and focused on providing valuable business intelligence.

Impact of Technology on Accounting, Bachelors degree accounting

Technology is transforming the accounting profession, automating repetitive tasks, enhancing data analysis capabilities, and creating new opportunities for accountants.

- Automation: Automation tools, such as robotic process automation (RPA) and artificial intelligence (AI), are automating routine tasks like data entry, invoice processing, and bank reconciliation. This frees up accountants to focus on higher-value activities, such as financial analysis, strategic planning, and risk management.

- Data Analytics: The rise of big data and advanced analytics is enabling accountants to extract insights from vast amounts of data, providing a deeper understanding of business performance and identifying potential risks and opportunities. This includes using data visualization tools to create interactive dashboards and reports that provide real-time insights into key financial metrics.

- Cloud Computing: Cloud-based accounting software provides access to real-time financial data from anywhere, anytime. This eliminates the need for expensive on-premises servers and allows for seamless collaboration among team members.

Emerging Trends in Accounting

The accounting profession is continuously evolving to address the needs of businesses and stakeholders. Here are some key emerging trends:

- Sustainability Reporting: With increasing awareness of environmental, social, and governance (ESG) factors, sustainability reporting is becoming increasingly important. Accountants are playing a crucial role in developing and implementing frameworks for reporting on a company’s sustainability performance, including its impact on the environment, society, and its governance practices.

- Forensic Accounting: Forensic accounting involves investigating financial crimes, such as fraud, embezzlement, and money laundering. As businesses become more complex and interconnected, the need for forensic accountants is growing. Forensic accountants use their expertise in financial analysis, auditing, and investigation to uncover financial irregularities and provide evidence for legal proceedings.

- Data Visualization: Data visualization tools are transforming how accountants communicate financial information. By using charts, graphs, and interactive dashboards, accountants can present complex data in a clear and engaging way, making it easier for stakeholders to understand financial performance and trends.

Future Skills and Qualifications

To thrive in the evolving accounting profession, professionals will need to develop a diverse set of skills and qualifications.

- Technical Skills: Accountants will need to be proficient in using accounting software, data analytics tools, and cloud computing platforms. They will also need to stay abreast of emerging technologies and their impact on the accounting profession.

- Analytical Skills: The ability to analyze complex financial data, identify trends, and draw meaningful insights is essential. Accountants will need to be able to think critically and solve problems using data-driven approaches.

- Communication Skills: Effective communication is crucial for accountants to convey complex financial information to a variety of stakeholders, including management, investors, and regulators. This includes both written and verbal communication skills.

- Business Acumen: Accountants need to understand the broader business context in which they operate. This includes understanding business strategies, industry trends, and the competitive landscape.

Ending Remarks

In conclusion, a Bachelor’s degree in Accounting is a valuable investment in your future. It offers a dynamic and challenging career path with excellent earning potential. By developing strong analytical skills, ethical principles, and a commitment to continuous learning, accounting graduates can make a significant impact in the financial world.

FAQ Guide

What are the salary expectations for accounting graduates?

Starting salaries for accounting graduates vary depending on factors such as location, experience, and industry. However, the average starting salary is typically competitive and offers excellent earning potential for those with strong skills and qualifications.

Is a Bachelor’s degree in Accounting enough for a successful career?

While a Bachelor’s degree in Accounting is a great foundation, pursuing professional certifications like the CPA or CMA can significantly enhance career prospects and earning potential.

What are some of the most in-demand accounting roles?

Some of the most sought-after accounting roles include financial analysts, auditors, tax accountants, and management accountants. The demand for these professionals is consistently high across various industries.