App Forex sets the stage for this enthralling narrative, offering readers a glimpse into a world where the financial markets are accessible from the palm of your hand. This guide explores the exciting landscape of Forex apps, providing a comprehensive overview of their functionalities, benefits, and risks.

The world of Forex trading has evolved dramatically, with mobile apps becoming integral to the trading experience. These apps empower individuals to participate in the global currency market with unprecedented ease and flexibility, allowing them to monitor market trends, execute trades, and manage their portfolios anytime, anywhere.

Introduction to Forex Apps

Forex, short for foreign exchange, is the global marketplace where currencies are traded. It is the largest and most liquid financial market in the world, with trillions of dollars changing hands every day. Forex trading involves buying and selling currencies in the hope of profiting from fluctuations in their exchange rates.

Forex apps have become increasingly popular among traders, offering a convenient and accessible way to participate in the forex market. These apps provide a platform for traders to execute trades, access real-time market data, and manage their accounts.

Benefits of Using Forex Apps

Forex apps offer several advantages for traders, including:

- Accessibility: Forex apps allow traders to access the market from anywhere with an internet connection, making it possible to trade on the go.

- Convenience: Apps provide a user-friendly interface that simplifies the trading process, allowing traders to execute trades quickly and easily.

- Real-time Data: Most forex apps offer real-time market data, including currency quotes, charts, and news feeds, enabling traders to make informed decisions.

- Trading Tools: Forex apps often include advanced trading tools, such as technical indicators, charting tools, and order types, to help traders analyze the market and execute trades more effectively.

- Educational Resources: Some apps provide educational resources, such as articles, tutorials, and webinars, to help traders learn about forex trading and improve their skills.

Challenges of Using Forex Apps

While forex apps offer numerous benefits, they also present some challenges:

- Security Risks: Trading on a mobile device can expose traders to security risks, such as data breaches and unauthorized access to accounts. It is crucial to choose a reputable and secure app from a trusted provider.

- Limited Functionality: Some forex apps may have limited functionality compared to desktop trading platforms, particularly in terms of advanced charting and analysis tools.

- Market Volatility: The forex market is highly volatile, and quick price movements can be challenging to manage on a mobile device. Traders need to be aware of the risks and have a robust trading strategy in place.

- Emotional Trading: The convenience of mobile trading can lead to impulsive decision-making, which can negatively impact trading results. Traders need to exercise discipline and avoid emotional trading.

Types of Forex Apps

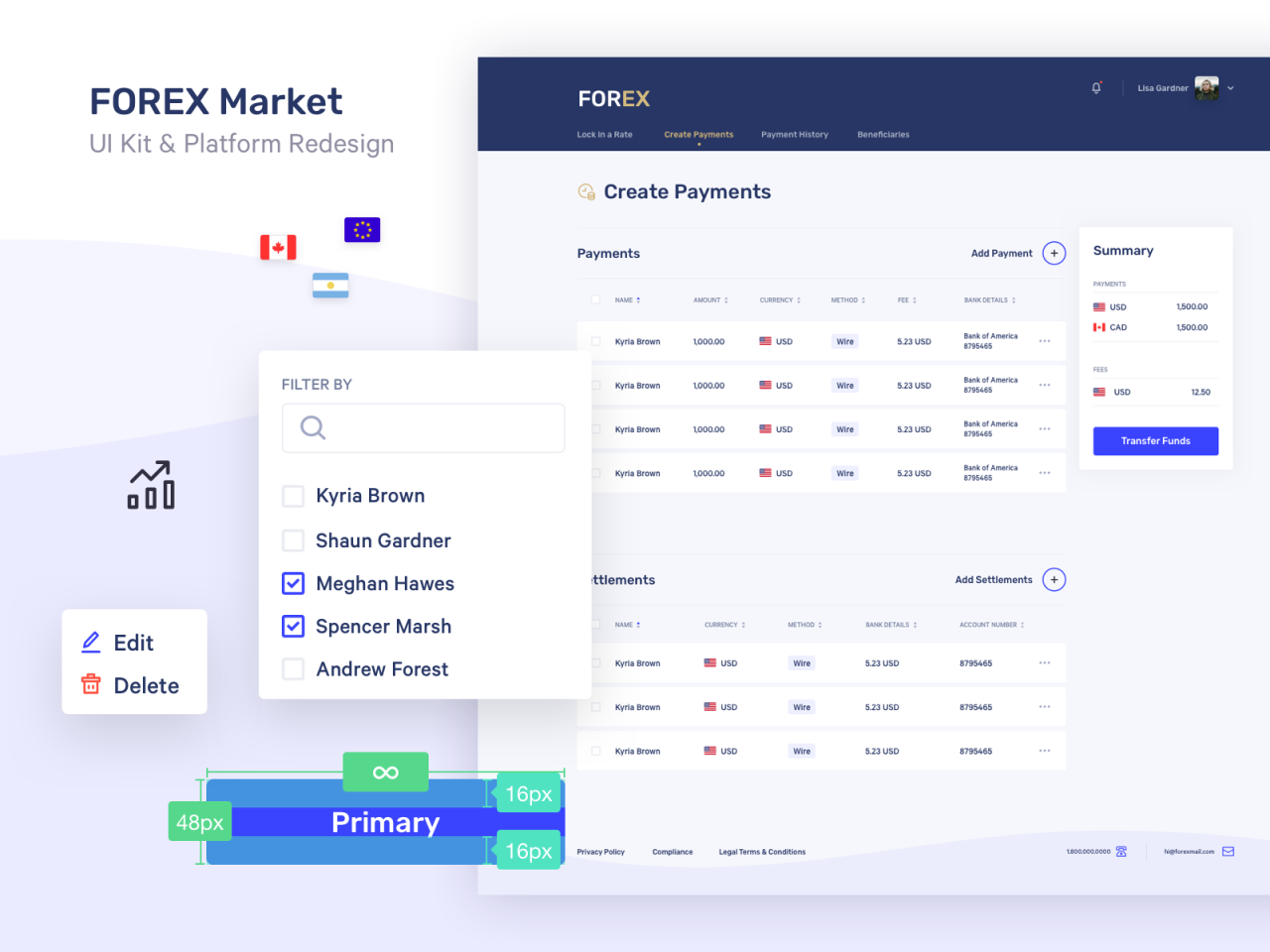

Forex apps offer a diverse range of features and functionalities to cater to different trading needs. Understanding the various types of forex apps available is crucial for choosing the right tool for your trading strategy.

Trading Platforms

Trading platforms are the core of any forex trading experience, providing the interface to execute trades and manage your positions. These apps typically offer:

- Real-time market data, including charts, quotes, and indicators.

- Order execution capabilities, allowing you to buy or sell currencies at the desired price.

- Account management features for monitoring balances, transaction history, and open positions.

Popular trading platforms include:

- MetaTrader 4 (MT4): A widely used platform known for its extensive charting capabilities, customizable indicators, and expert advisor (EA) support.

- MetaTrader 5 (MT5): An advanced platform offering more sophisticated trading features, including multi-asset trading and enhanced charting tools.

- cTrader: A platform designed for experienced traders, emphasizing speed, depth of market data, and advanced order types.

Trading platforms differ in their user interfaces, order execution speeds, charting capabilities, and available tools. Choosing the right platform depends on your individual trading style and needs.

Analysis Tools

Analysis tools are essential for understanding market trends and making informed trading decisions. These apps provide various analytical capabilities, including:

- Technical analysis tools: Analyze price charts to identify patterns and trends using indicators like moving averages, MACD, and Bollinger Bands.

- Fundamental analysis tools: Provide economic data, news updates, and reports to assess the underlying factors influencing currency values.

- Sentiment analysis tools: Gauge market sentiment and identify potential trading opportunities based on market mood.

Popular analysis tools include:

- TradingView: A comprehensive platform offering advanced charting, technical indicators, and social trading features.

- Myfxbook: A platform that tracks and analyzes trading performance, allowing you to benchmark your results against other traders.

- FXStreet: A news and analysis portal providing economic calendars, market commentary, and technical analysis insights.

Analysis tools can be standalone apps or integrated into trading platforms, providing traders with a comprehensive suite of tools for making informed decisions.

News Providers

Staying up-to-date with global events and economic news is crucial for forex trading. News providers deliver real-time updates and analysis on events that can impact currency values.

- Reuters: A leading financial news provider offering breaking news, market commentary, and economic data.

- Bloomberg: A global financial news and information provider offering comprehensive market coverage and in-depth analysis.

- Investing.com: A website and app providing financial news, market data, and technical analysis tools.

News providers can be standalone apps or integrated into other platforms, offering traders access to critical information.

Other Forex Apps

Besides the core categories, other forex apps cater to specific needs:

- Forex calculators: Help calculate potential profits and losses based on trade size, currency pairs, and exchange rates.

- Forex signal providers: Generate trading signals based on technical or fundamental analysis, providing buy or sell recommendations.

- Forex education apps: Offer courses, tutorials, and resources to help traders learn about forex trading and develop their skills.

These apps supplement core trading platforms and analysis tools, offering specialized features and functionalities to enhance the forex trading experience.

Key Features of Forex Apps

A Forex app is only as good as its features. The right app will give you the tools you need to trade confidently and effectively. Here are some key features to look for when choosing a Forex app:

Security and Reliability

Security is paramount in any financial application, especially one that handles your money. Look for apps that have robust security measures in place to protect your personal and financial information. These measures include:

- Two-factor authentication (2FA): This adds an extra layer of security by requiring you to enter a code from your phone or email in addition to your password.

- Encryption: Your data should be encrypted both in transit and at rest to prevent unauthorized access.

- Regulation: Ensure the app provider is regulated by a reputable financial authority. This indicates that they are subject to strict standards and oversight.

Reliability is also crucial. A Forex app should be stable and accessible when you need it. Look for apps with a proven track record of uptime and responsiveness.

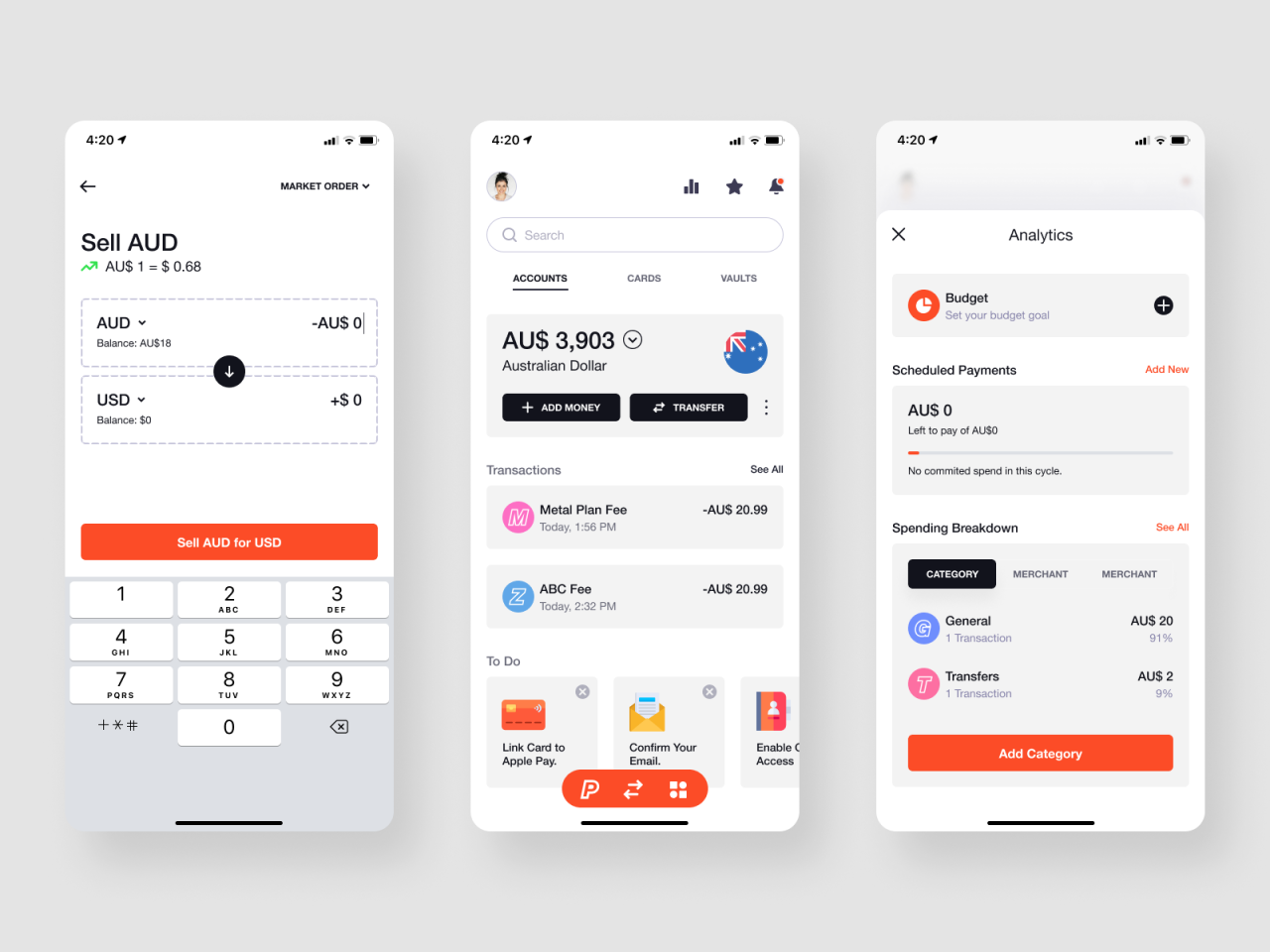

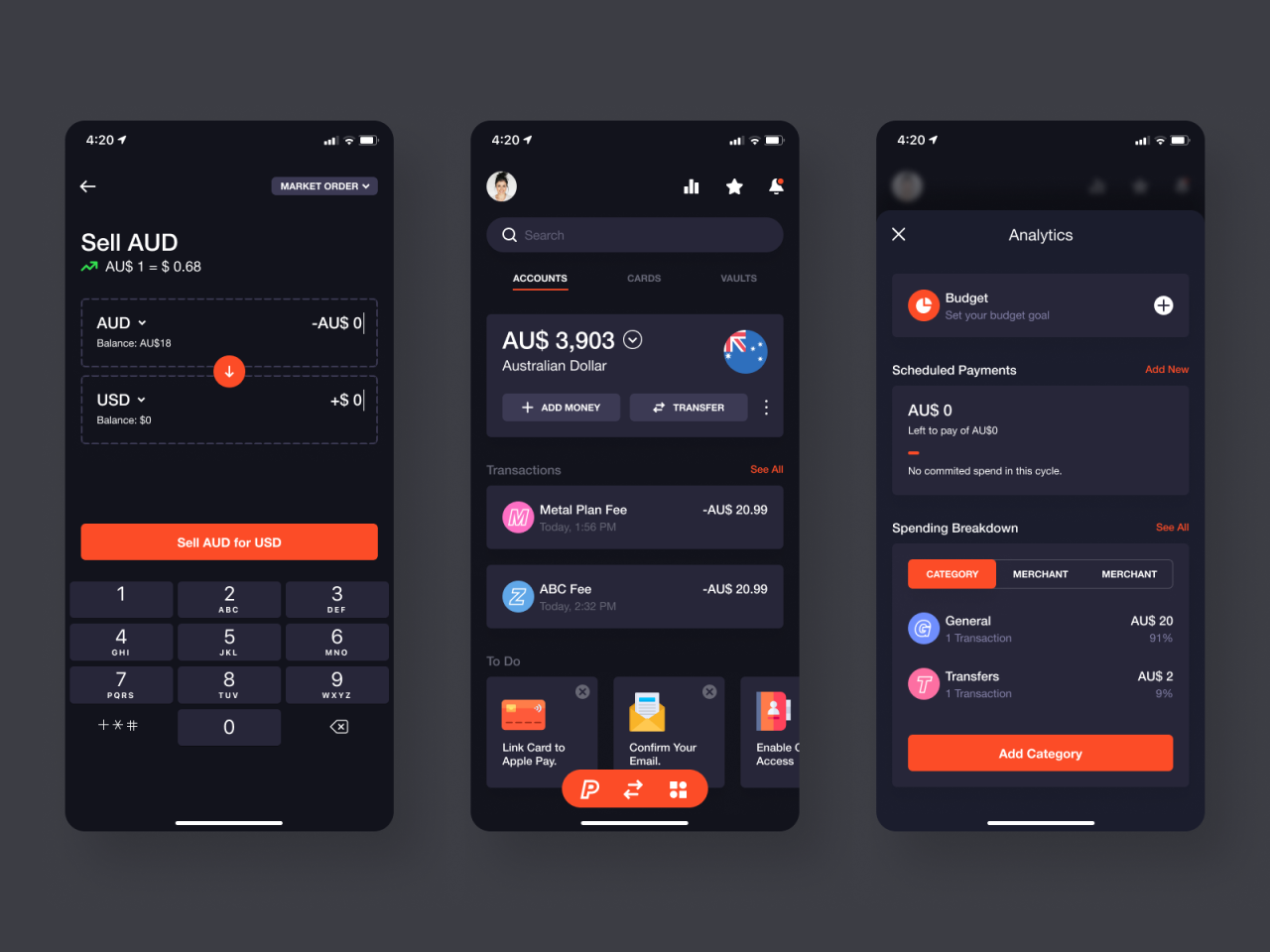

User Interface

A Forex app’s user interface (UI) should be intuitive and easy to use. You should be able to find the information you need quickly and easily. Consider these factors:

- Simplicity: The UI should be clear and uncluttered, allowing you to focus on your trading. Avoid apps with overly complex interfaces.

- Customization: A good Forex app will let you customize the UI to suit your preferences. This could include things like changing the color scheme, font size, and layout.

- Mobile responsiveness: The app should be designed to work well on both smartphones and tablets.

Real-Time Quotes

Accurate and up-to-the-minute market data is essential for making informed trading decisions. Look for an app that provides real-time quotes for the currency pairs you trade. These quotes should be sourced from reliable providers and updated frequently.

Charting Tools

Charts are an indispensable tool for analyzing market trends and identifying trading opportunities. Look for an app with a range of charting tools, including:

- Technical indicators: These tools help you identify patterns and trends in price movements. Examples include moving averages, Bollinger Bands, and MACD.

- Drawing tools: These allow you to draw lines, shapes, and other objects on charts to help you visualize trends and support/resistance levels.

- Multiple timeframes: The ability to view charts on different timeframes (e.g., daily, weekly, monthly) helps you understand the bigger picture.

Order Execution

A Forex app’s order execution system is critical. Look for an app that offers:

- Speed: Orders should be executed quickly and efficiently to minimize slippage.

- Transparency: You should be able to see the order confirmation and details of the execution.

- Variety of order types: Different order types allow you to manage your risk and trade more strategically. Examples include market orders, limit orders, and stop-loss orders.

Alerts

Alerts can keep you informed of important market movements and trading opportunities. Look for an app that allows you to set alerts for:

- Price changes: Alerts can be triggered when a currency pair reaches a specific price level.

- News events: Alerts can notify you about major economic releases that could impact market prices.

- Trading signals: Some apps provide alerts based on technical analysis indicators or other trading strategies.

Choosing the Right Forex App

Selecting the right Forex app is crucial for a successful trading journey. It’s like choosing the right tool for a specific task; the wrong app can lead to frustration, inefficiency, and even financial losses.

Factors to Consider When Choosing a Forex App

Choosing the right Forex app involves considering various factors that align with your individual trading needs and preferences.

- Trading Experience: If you are a beginner, a user-friendly app with educational resources and simplified features would be ideal. Experienced traders might prefer apps with advanced charting tools, technical indicators, and customizable trading strategies.

- Investment Goals: Your investment goals, such as short-term profits or long-term wealth building, should guide your app selection. Consider apps that offer features relevant to your goals, such as scalping tools for short-term trades or fundamental analysis tools for long-term investments.

- Device Compatibility: Ensure the app is compatible with your preferred devices, whether it’s a smartphone, tablet, or desktop computer. Some apps offer seamless integration across multiple devices, allowing you to manage your trades from anywhere.

- Trading Platform Features: The features offered by the app play a crucial role in your trading experience. Look for essential features like order types, real-time market data, charting tools, technical indicators, and news feeds.

- Security and Regulation: Security is paramount in Forex trading. Choose apps that employ robust security measures, such as encryption and two-factor authentication. Additionally, ensure the app is regulated by reputable financial authorities.

- Customer Support: Responsive and reliable customer support is essential, especially when encountering technical issues or having questions about the platform. Look for apps that offer multiple channels of support, such as email, phone, or live chat.

- Fees and Commissions: Understand the fee structure of the app, including trading commissions, spreads, and inactivity fees. Compare fees across different apps to find the most cost-effective option.

Evaluating and Comparing Different Forex Apps

Evaluating and comparing different Forex apps involves a systematic approach to ensure you choose the best fit for your trading style and needs.

- Research and List: Begin by researching and creating a list of potential Forex apps based on your initial criteria, such as device compatibility, features, and reputation.

- Demo Accounts: Most Forex apps offer demo accounts, which allow you to test the platform and its features without risking real money. Utilize demo accounts to familiarize yourself with the app’s interface, order execution, and trading tools.

- Read Reviews: Read reviews from other traders to gain insights into the app’s user experience, reliability, and customer support. Pay attention to both positive and negative reviews to get a balanced perspective.

- Compare Features: Compare the features of different apps side-by-side to identify which offers the most relevant and valuable tools for your trading style. Consider features like charting tools, technical indicators, order types, and real-time data.

- Consider Fees: Compare the fee structure of different apps, including trading commissions, spreads, and inactivity fees. Choose an app with transparent and competitive fees that align with your budget.

- Test Customer Support: Contact the app’s customer support team with a simple question or request to assess their responsiveness and helpfulness. This will give you an idea of the level of support you can expect when needed.

Tips for Finding a Forex App That Meets Individual Needs

Finding a Forex app that meets your individual needs requires careful consideration and a personalized approach.

- Define Your Trading Style: Identify your preferred trading style, such as scalping, day trading, or swing trading. This will help you narrow down your app choices to those that offer features relevant to your approach.

- Prioritize Features: Determine the most important features for you, such as advanced charting tools, technical indicators, or news feeds. This will guide your app selection and ensure you prioritize apps that offer the features you need.

- Consider Your Budget: Set a budget for your Forex trading activities and choose an app with a fee structure that aligns with your financial constraints. Consider factors like trading commissions, spreads, and inactivity fees.

- Read the Fine Print: Before committing to an app, carefully review the terms and conditions, including fees, security measures, and risk disclosures. Understand the app’s policies and procedures to avoid any surprises later.

- Start Small: If you are new to Forex trading, consider starting with a small account and a basic app. As you gain experience, you can gradually upgrade to a more advanced app with more features.

Using Forex Apps for Trading: App Forex

Forex trading apps offer a convenient and accessible way to engage in the foreign exchange market. They provide a platform for placing orders, managing trades, and analyzing market data, all from the comfort of your mobile device or computer.

Setting Up and Using a Forex App

Before you can start trading, you need to set up your Forex app. This typically involves creating an account with a Forex broker, verifying your identity, and funding your account. Once your account is set up, you can start exploring the app’s features and functionalities.

- Choose a Forex Broker: The first step is to select a reputable Forex broker that offers a trading app compatible with your device. Consider factors like the broker’s regulation, trading fees, and customer support.

- Download and Install the App: Once you’ve chosen a broker, download and install their trading app from your device’s app store. Most Forex brokers offer apps for both Android and iOS devices.

- Create an Account: Open a trading account with the broker through the app. This usually involves providing personal information and verifying your identity.

- Fund Your Account: Deposit funds into your trading account using the app’s deposit methods. You can typically use bank transfers, credit cards, or e-wallets.

Placing Orders

Once your account is funded, you can start placing orders. Forex apps provide a user-friendly interface for placing buy and sell orders.

- Choose a Currency Pair: Select the currency pair you want to trade. For example, EUR/USD represents the Euro against the US Dollar.

- Set the Order Type: You can choose from various order types, including market orders, limit orders, and stop-loss orders. Market orders execute immediately at the current market price, while limit orders are placed at a specific price or better. Stop-loss orders are used to limit potential losses.

- Specify the Order Size: Enter the amount of currency you want to trade. This is typically expressed in units or lots.

- Confirm the Order: Review your order details and confirm the trade. Once confirmed, the order will be sent to the market for execution.

Managing Trades, App forex

Forex apps allow you to monitor your open trades and manage them effectively.

- Trade Monitoring: The app displays real-time information about your open trades, including the entry price, current price, profit/loss, and trade duration.

- Trade Modification: You can adjust your trades by changing the stop-loss or take-profit levels, or by adding or removing orders.

- Trade Closure: You can close your trades manually or set up automated closing conditions, such as stop-loss or take-profit orders.

Analyzing Market Data

Forex apps provide various tools for analyzing market data and making informed trading decisions.

- Charts and Indicators: Most apps offer a range of charting tools, including candlestick charts, line charts, and bar charts. They also provide access to technical indicators, such as moving averages, MACD, and RSI.

- Economic Calendar: This feature displays upcoming economic events that can impact currency prices. By understanding these events, you can anticipate potential market movements.

- News Feed: Many apps provide real-time news updates related to the Forex market, allowing you to stay informed about current events that might affect your trades.

Best Practices for Using Forex Apps

Here are some best practices for using Forex apps effectively:

- Start with a Demo Account: Practice trading with a demo account before using real money. This allows you to familiarize yourself with the app’s features and test your trading strategies without risking capital.

- Develop a Trading Plan: Before you start trading, create a trading plan that Artikels your goals, risk tolerance, and trading strategy. This will help you stay disciplined and avoid emotional trading.

- Manage Your Risk: Always use stop-loss orders to limit potential losses. Never risk more than you can afford to lose.

- Stay Informed: Keep up with market news and events that can impact currency prices. Use the app’s economic calendar and news feed to stay informed.

- Seek Professional Advice: If you’re new to Forex trading, consider seeking guidance from a professional financial advisor or Forex trader.

Risks and Considerations

Forex trading, even when using apps, involves inherent risks. It’s crucial to understand these risks and implement responsible trading practices to protect your investments.

Risk Management Strategies

Risk management is an essential part of Forex trading. It involves taking steps to minimize potential losses while maximizing potential profits. Here are some key strategies:

- Set Stop-Loss Orders: These orders automatically close your position when the price reaches a predetermined level, limiting your potential losses.

- Use Take-Profit Orders: These orders automatically close your position when the price reaches a predetermined level, locking in your profits.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Invest in a variety of currency pairs to spread your risk.

- Manage Your Leverage: Leverage can amplify both profits and losses. Use it cautiously and responsibly.

- Trade Within Your Risk Tolerance: Only invest an amount you’re comfortable losing. Don’t chase losses or trade impulsively.

Understanding Market Volatility

Forex markets are highly volatile, meaning prices can fluctuate rapidly and unpredictably. This volatility can lead to sudden and significant losses if you’re not prepared.

“Market volatility is a double-edged sword. It can lead to quick profits, but also to sudden losses.”

The Importance of Education

Before you start trading Forex, it’s essential to educate yourself about the markets, trading strategies, and risk management techniques. Many resources are available online and through reputable brokers.

Beware of Scams

The Forex market is unfortunately susceptible to scams. Be wary of any promises of guaranteed returns or unrealistic profits. Stick to reputable brokers and apps with a proven track record.

Future Trends in Forex Apps

The Forex app industry is constantly evolving, driven by advancements in technology and the growing popularity of mobile trading. As a result, we can expect to see several exciting trends shaping the future of Forex apps. These trends will not only enhance the user experience but also redefine the way Forex trading is conducted.

Integration of Artificial Intelligence

Artificial intelligence (AI) is poised to revolutionize the Forex app landscape. AI algorithms can analyze vast amounts of market data, identify patterns, and generate trading signals with remarkable accuracy. This can help traders make more informed decisions and potentially improve their trading outcomes. Forex apps incorporating AI features can provide personalized insights, risk management tools, and even automated trading strategies.

Blockchain Technology and Decentralized Finance

Blockchain technology, known for its secure and transparent nature, is also making its way into the Forex app industry. Decentralized finance (DeFi) platforms built on blockchain can offer alternative ways to access Forex markets. These platforms can potentially reduce reliance on traditional financial institutions and provide greater transparency and control to traders.

Enhanced User Experience and Mobile-First Design

Forex apps are increasingly focusing on providing a seamless and user-friendly experience. This includes intuitive interfaces, personalized dashboards, and real-time market data. Mobile-first design is becoming crucial, ensuring that apps are optimized for both smartphones and tablets. This focus on user experience aims to attract a wider audience, including novice traders who are comfortable with mobile technology.

Increased Security and Regulation

As Forex trading becomes more accessible through mobile apps, security and regulatory compliance are paramount. Forex apps will likely incorporate advanced security features, such as multi-factor authentication and encryption, to protect user data and prevent unauthorized access. Regulatory bodies are also likely to play a more active role in overseeing the Forex app industry, ensuring fair and transparent practices.

Closure

As the Forex app landscape continues to evolve, it’s clear that these powerful tools will play an increasingly significant role in shaping the future of trading. Whether you’re a seasoned trader or just starting out, understanding the nuances of Forex apps is crucial for navigating this dynamic and exciting market.

FAQ

What are the risks associated with using Forex apps?

While Forex apps offer convenience, they also come with inherent risks. These include market volatility, leverage, and potential security breaches. It’s crucial to understand and manage these risks to protect your investments.

Are Forex apps safe to use?

The safety of Forex apps depends on the provider. Look for reputable brokers with robust security measures, including encryption and two-factor authentication. It’s also important to conduct thorough research and read user reviews before choosing an app.

Do I need any prior experience to use Forex apps?

While prior experience can be helpful, many Forex apps cater to beginners. Some offer educational resources, tutorials, and demo accounts to help you learn the ropes before investing real money.