- Apartment Insurance Cost: A Comprehensive Guide for Renters

- Factors that Affect Apartment Insurance Cost

- Types of Apartment Insurance Coverage

- How to Get Affordable Apartment Insurance

- Table: Average Apartment Insurance Costs

- Conclusion

-

FAQ about Apartment Insurance Cost

- How much does apartment insurance cost?

- What does apartment insurance cover?

- What is a deductible?

- How can I save money on apartment insurance?

- What are the different types of apartment insurance coverage?

- Which type of apartment insurance coverage is right for me?

- How can I get apartment insurance?

- What should I look for when choosing an apartment insurance company?

- What should I do if I have a claim?

Apartment Insurance Cost: A Comprehensive Guide for Renters

Introduction

Hey readers,

Are you looking for a foolproof way to protect your belongings and safeguard your financial well-being as a renter? Apartment insurance, also known as renters insurance, is your answer. In this comprehensive guide, we’ll delve into the intricacies of apartment insurance costs and provide you with all the information you need to make an informed decision.

Apartment insurance is not just a legal requirement in many places; it’s an essential investment that can save you thousands of dollars in the event of an unexpected loss. By understanding the factors that influence apartment insurance costs and getting the right coverage, you can protect your belongings, your financial future, and your peace of mind.

Factors that Affect Apartment Insurance Cost

Understanding the factors that influence apartment insurance costs is crucial for budgeting and getting the best value for your money. Here are some key considerations:

1. Coverage Limits and Deductibles

The amount of coverage you choose and the deductibles you select will significantly impact your insurance premiums. Higher coverage limits and lower deductibles mean higher premiums, while lower coverage limits and higher deductibles lead to lower premiums.

2. Location and Crime Rate

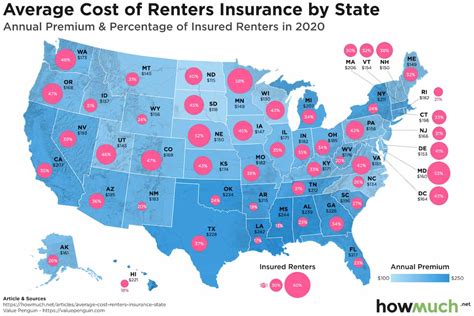

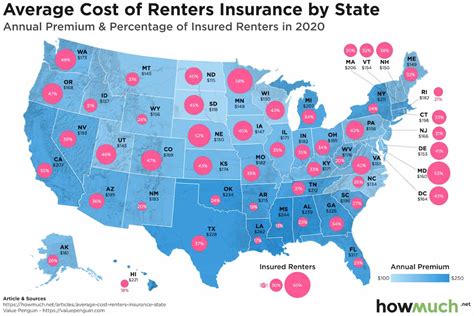

The location of your apartment plays a significant role in determining your insurance costs. Apartments in areas with a higher crime rate or natural disaster risk will typically have higher insurance premiums.

3. Type of Apartment and Building

The size, age, and type of construction of your apartment building can also affect your insurance costs. Newer, more secure buildings with fire safety features and security systems may have lower premiums.

4. Renters History and Credit Score

Your renters history and credit score can also be taken into consideration when determining your insurance costs. A good renters history and a high credit score can lead to lower premiums.

5. Personal Belongings

The value of your personal belongings can also influence your insurance costs. If you have high-value items, such as jewelry, electronics, or artwork, you may need to purchase additional coverage.

Types of Apartment Insurance Coverage

Apartment insurance policies typically offer a range of coverage options to meet your specific needs. Some of the most common types of coverage include:

1. Personal Property Coverage

This coverage protects your personal belongings, such as furniture, clothing, and electronics, in the event of theft, fire, or other covered perils.

2. Liability Coverage

Liability coverage protects you from financial responsibility if someone is injured or their property is damaged while on your premises.

3. Additional Living Expenses Coverage

This coverage reimburses you for additional living expenses, such as hotel costs or meals, if you are unable to live in your apartment due to a covered peril.

How to Get Affordable Apartment Insurance

Finding affordable apartment insurance is possible with a bit of research and comparison shopping. Here are a few tips to help you save money:

1. Compare Quotes from Multiple Insurers

Getting quotes from different insurers is the best way to find the best deal on apartment insurance. Take the time to compare coverage options and premiums before making a decision.

2. Increase Your Deductible

Raising your deductible can significantly reduce your insurance premiums. However, make sure you select a deductible that you can afford to pay in the event of a claim.

3. Bundle Your Insurance

If you have other insurance policies, such as auto or homeowners insurance, bundling them with your apartment insurance can often save you money.

4. Ask for Discounts

Many insurers offer discounts for certain factors, such as good renters history, home security systems, or paperless billing. Be sure to ask your insurer about any discounts you may be eligible for.

Table: Average Apartment Insurance Costs

The following table provides an overview of average apartment insurance costs based on coverage limits:

| Coverage Limit | Average Annual Premium |

|---|---|

| $10,000 | $150 – $250 |

| $20,000 | $200 – $300 |

| $30,000 | $250 – $350 |

| $40,000 | $300 – $400 |

| $50,000 | $350 – $450 |

Note: These are just estimates, and actual costs may vary depending on your specific circumstances.

Conclusion

Apartment insurance is an essential investment for renters. By understanding the factors that affect apartment insurance costs and getting the right coverage, you can protect your belongings, your financial future, and your peace of mind.

If you’re looking for additional information on apartment insurance or other related topics, be sure to check out our other articles. We’re committed to providing you with the information you need to make informed decisions about your insurance coverage.

FAQ about Apartment Insurance Cost

How much does apartment insurance cost?

The average cost of apartment insurance in the US is $15-$30 per month. The exact cost will vary depending on a number of factors, including the size and location of your apartment, the amount of coverage you need, and your deductible.

What does apartment insurance cover?

Apartment insurance typically covers your personal belongings, such as furniture, clothing, and electronics, in the event of a covered loss, such as fire, theft, or vandalism. It can also provide liability coverage in case someone is injured in your apartment.

What is a deductible?

A deductible is the amount of money you have to pay out of pocket before your insurance coverage kicks in. A higher deductible will typically result in a lower monthly premium.

How can I save money on apartment insurance?

There are a number of ways to save money on apartment insurance, including:

- Bundle your insurance: If you have multiple insurance policies, such as car insurance and renters insurance, you may be able to get a discount on your premiums by bundling them together.

- Get a higher deductible: As mentioned above, a higher deductible will typically result in a lower monthly premium.

- Install security features: Installing security features, such as a deadbolt or alarm system, can help to reduce your risk of theft, which can in turn lead to lower insurance premiums.

What are the different types of apartment insurance coverage?

There are two main types of apartment insurance coverage:

- Actual cash value: This type of coverage pays you the actual cash value of your belongings at the time of the loss.

- Replacement cost: This type of coverage pays you the cost to replace your belongings with new ones of similar quality.

Which type of apartment insurance coverage is right for me?

The type of apartment insurance coverage that is right for you will depend on your individual needs and budget. If you have a lot of valuable belongings, you may want to consider replacement cost coverage. If you are on a budget, actual cash value coverage may be a more affordable option.

How can I get apartment insurance?

You can get apartment insurance from a variety of insurance companies. You can compare quotes from different companies to find the best deal. You can also purchase apartment insurance online.

What should I look for when choosing an apartment insurance company?

When choosing an apartment insurance company, you should consider the following factors:

- Financial strength: Make sure the insurance company is financially strong and has a good reputation.

- Coverage: Make sure the insurance company offers the coverage you need at a price you can afford.

- Customer service: Make sure the insurance company has a good customer service record.

What should I do if I have a claim?

If you have a claim, you should contact your insurance company as soon as possible. The insurance company will investigate your claim and determine whether it is covered. If the claim is covered, the insurance company will pay you the benefits that you are entitled to.