- Introduction

- Understanding AMS Insurance: A Maritime Safety Net

- Types of AMS Insurance Coverage

- Importance of AMS Insurance

- AMS Insurance: A Detailed Breakdown

- Conclusion

-

FAQ about AMS Insurance

- What is AMS Insurance?

- What types of insurance does AMS Insurance offer?

- Who is AMS Insurance for?

- How do I get a quote from AMS Insurance?

- How do I file a claim with AMS Insurance?

- What is the claims process like with AMS Insurance?

- What are the benefits of using AMS Insurance?

- How can I learn more about AMS Insurance?

- What is AMS Insurance’s financial strength rating?

Introduction

Hey there, readers! Welcome aboard our comprehensive guide to AMS insurance. Whether you’re a seasoned seafarer or just dipping your toes into the world of maritime adventures, this article will provide you with an insider’s perspective on this crucial protection for your vessels and operations.

Understanding AMS Insurance: A Maritime Safety Net

AMS insurance, short for Authorized Marine Surveyor, is an indispensable insurance coverage designed specifically for maritime professionals. It provides a comprehensive safety net against potential accidents, damages, and liabilities that arise during the surveying process of vessels and marine structures.

AMS Insurance in Action

Authorized marine surveyors are experts in assessing the seaworthiness and structural integrity of vessels. They play a vital role in ensuring the safety of boats, ships, and other marine assets. AMS insurance offers financial protection to these professionals in case they face legal or financial claims resulting from their surveying activities.

Types of AMS Insurance Coverage

AMS insurance policies come in various forms, each tailored to the specific needs of maritime surveyors. The most common types include:

Liability Insurance

This coverage protects Authorized Marine Surveyors against legal liability for bodily injury, property damage, or financial loss resulting from their surveying activities.

Errors and Omissions Insurance

This policy safeguards marine surveyors against negligence or errors in their professional services, leading to financial losses for their clients.

Marine Pollution Insurance

In the unfortunate event of an oil spill or other marine pollution incident, this insurance provides coverage for the costs of cleanup and environmental damage.

Importance of AMS Insurance

Obtaining AMS insurance is not merely a wise decision but an essential step for any Authorized Marine Surveyor. It provides peace of mind and protection against unexpected liabilities, ensuring that you can focus on your work with confidence.

AMS Insurance: A Detailed Breakdown

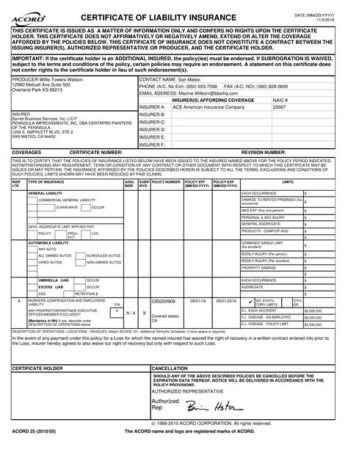

To help you better understand the scope of AMS insurance, here’s a detailed table outlining the key aspects of coverage:

| Coverage Type | Description |

|---|---|

| Liability Insurance | Protection against claims of bodily injury, property damage, or financial loss resulting from surveying activities. |

| Errors and Omissions Insurance | Coverage for negligence or errors in professional services leading to client financial losses. |

| Marine Pollution Insurance | Payment for cleanup and environmental damage costs in case of an oil spill or marine pollution incident. |

| Third-Party Claims | Coverage for legal expenses and damages arising from claims made by third parties. |

| Legal Defense Costs | Payment for attorney fees, court costs, and other expenses incurred in defending against lawsuits. |

Conclusion

AMS insurance is an indispensable tool for Authorized Marine Surveyors, providing protection against potential liabilities and ensuring peace of mind. As you navigate the complexities of maritime surveying, we encourage you to explore and consider the various AMS insurance options available.

For further insights and valuable resources, be sure to check out our other articles on maritime insurance and best practices for Authorized Marine Surveyors. Stay safe and sail smoothly with the protection of AMS insurance!

FAQ about AMS Insurance

What is AMS Insurance?

AMS Insurance is a provider of specialty insurance products and services.

What types of insurance does AMS Insurance offer?

AMS Insurance offers a wide range of insurance products, including:

- Commercial auto insurance

- Commercial property insurance

- General liability insurance

- Professional liability insurance

- Workers’ compensation insurance

Who is AMS Insurance for?

AMS Insurance provides insurance to businesses of all sizes, from small businesses to large corporations.

How do I get a quote from AMS Insurance?

You can get a quote from AMS Insurance by visiting their website or calling their toll-free number.

How do I file a claim with AMS Insurance?

You can file a claim with AMS Insurance online, by phone, or by mail.

What is the claims process like with AMS Insurance?

The claims process with AMS Insurance is straightforward and efficient. You will be assigned a claims adjuster who will help you through the process.

What are the benefits of using AMS Insurance?

There are many benefits to using AMS Insurance, including:

- Competitive rates

- Excellent customer service

- Comprehensive coverage options

- Fast and efficient claims processing

How can I learn more about AMS Insurance?

You can learn more about AMS Insurance by visiting their website or calling their toll-free number.

What is AMS Insurance’s financial strength rating?

AMS Insurance has a financial strength rating of A+ (Superior) from AM Best. This rating indicates that AMS Insurance is a financially sound company.