Accounting bachelor degree salary is a topic of great interest to aspiring professionals in the field. It’s a rewarding career path that offers a solid foundation for a successful future. The demand for skilled accountants remains strong, and with a bachelor’s degree in accounting, you can open doors to a wide range of opportunities in various industries.

The salary potential for accounting graduates is influenced by several factors, including the industry, location, experience level, and certifications. For example, a Certified Public Accountant (CPA) can command a higher salary than an entry-level accountant with no certifications. Location also plays a role, with metropolitan areas typically offering higher salaries than rural areas.

Introduction

Accounting is a vital profession that plays a crucial role in the smooth functioning of businesses and organizations across the globe. It involves recording, classifying, summarizing, and analyzing financial transactions to provide insights into an entity’s financial health and performance. In the modern business world, where competition is fierce and financial transparency is paramount, the role of accountants has become increasingly significant.

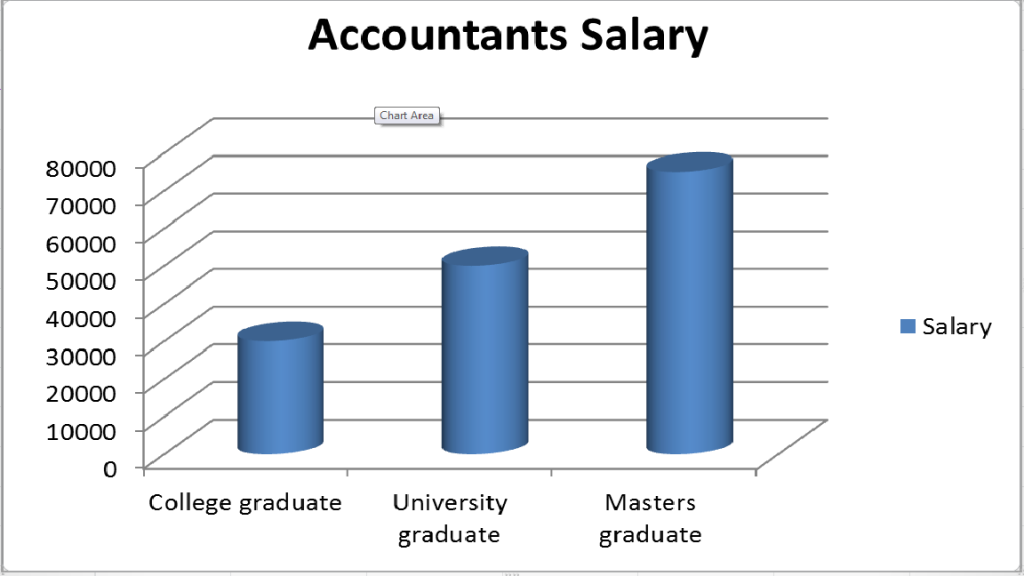

A bachelor’s degree in accounting serves as a fundamental qualification for aspiring professionals in this field. It equips individuals with the necessary knowledge and skills to understand accounting principles, financial reporting standards, and the intricacies of financial analysis. This degree program lays a strong foundation for a successful career in accounting, opening doors to various opportunities in diverse industries.

Salary Expectations for Accounting Graduates

A bachelor’s degree in accounting can lead to a rewarding career path with competitive salaries. The starting salary for accounting graduates can vary depending on factors such as location, industry, employer, and the specific skills and experience acquired.

Factors Influencing Salary

Several factors influence the salary levels for accounting graduates with a bachelor’s degree. These factors can significantly impact earning potential and career trajectory. Understanding these factors can help graduates make informed decisions about their career paths and negotiate competitive salaries.

Industry

The industry in which an accounting graduate works plays a crucial role in determining their salary. Different industries have varying compensation structures and demand for accounting professionals. Here are some examples of how industry can affect salary:

- Public Accounting: Public accounting firms, such as the Big Four (Deloitte, PwC, EY, and KPMG), typically offer higher starting salaries and faster career progression opportunities compared to other industries. However, the work can be demanding and require long hours.

- Corporate Accounting: Companies in various industries, such as manufacturing, technology, and finance, employ accountants for internal financial reporting, budgeting, and analysis. Salaries in corporate accounting can vary depending on the company’s size, industry, and location.

- Government: Government agencies at the federal, state, and local levels employ accountants to manage public funds and ensure financial accountability. Salaries in government accounting are generally lower than those in the private sector but offer job security and benefits.

Location

The geographic location where an accountant works can also impact their salary. Metropolitan areas typically have higher costs of living and higher demand for skilled professionals, leading to higher salaries. Conversely, salaries in rural areas may be lower due to lower costs of living and less competition for jobs.

- Metropolitan Areas: Major cities like New York, Los Angeles, and San Francisco offer higher salaries for accounting professionals due to the concentration of businesses and financial institutions.

- Rural Areas: Salaries in rural areas tend to be lower due to lower demand and cost of living. However, the cost of living in rural areas is also lower, which can offset the lower salary.

Experience Level

Experience is a key factor that influences salary in accounting. Entry-level positions typically offer lower salaries, while more experienced professionals command higher salaries. As accountants gain experience, they develop specialized skills and knowledge, which makes them more valuable to employers.

- Entry-Level Positions: Entry-level accountants typically start with lower salaries, but they have the opportunity to learn and grow their skills quickly.

- Senior Positions: Senior accountants with extensive experience and expertise in specific areas, such as financial reporting or auditing, can earn significantly higher salaries.

Certifications

Professional certifications, such as the Certified Public Accountant (CPA) and Certified Management Accountant (CMA), can significantly enhance an accountant’s earning potential. These certifications demonstrate a high level of competence and knowledge, making certified accountants more desirable to employers.

- CPA: The CPA certification is a highly respected credential in the accounting profession. CPAs are qualified to perform audits, provide tax advice, and offer other accounting services. Having a CPA designation can lead to higher salaries and career advancement opportunities.

- CMA: The CMA certification focuses on management accounting and financial planning. CMAs are skilled in cost accounting, budgeting, and financial analysis, making them valuable assets to organizations.

Skills and Qualifications, Accounting bachelor degree salary

In addition to certifications, specific skills and qualifications can also influence an accountant’s salary. Employers seek accountants with specialized skills and knowledge in areas such as data analytics, financial modeling, and audit experience.

- Data Analytics: With the increasing use of data in business, accountants with data analytics skills are in high demand. These skills allow accountants to analyze large datasets and identify trends, which can help organizations make better business decisions.

- Financial Modeling: Financial modeling skills are essential for accountants who work in corporate finance or investment banking. These skills allow accountants to create financial projections and evaluate investment opportunities.

- Audit Experience: Accountants with audit experience are highly sought after by public accounting firms. Audit experience provides accountants with a deep understanding of financial reporting and internal controls.

Salary Trends and Projections

The accounting profession offers a stable and rewarding career path with promising salary prospects. Understanding current salary trends and future projections is crucial for aspiring accounting professionals to make informed decisions about their career paths.

Salary data from reputable sources like the Bureau of Labor Statistics (BLS) and industry associations provide valuable insights into the earning potential of accounting graduates. These sources track salary trends, analyze factors influencing compensation, and project future salary growth based on economic indicators and industry demand.

Current Salary Trends

The median annual salary for accountants and auditors in the United States was $77,250 in May 2022, according to the BLS. This figure reflects the overall earning potential of accounting professionals with a bachelor’s degree and several years of experience. However, salaries can vary significantly based on factors such as location, industry, experience level, and specialization.

- Location: Salaries tend to be higher in major metropolitan areas like New York City, San Francisco, and Chicago, where the cost of living is higher and demand for accounting professionals is strong.

- Industry: Accounting professionals working in industries like finance, insurance, and real estate often command higher salaries compared to those in industries like manufacturing or retail.

- Experience Level: Entry-level accountants typically earn lower salaries than experienced professionals with advanced certifications or specialized skills.

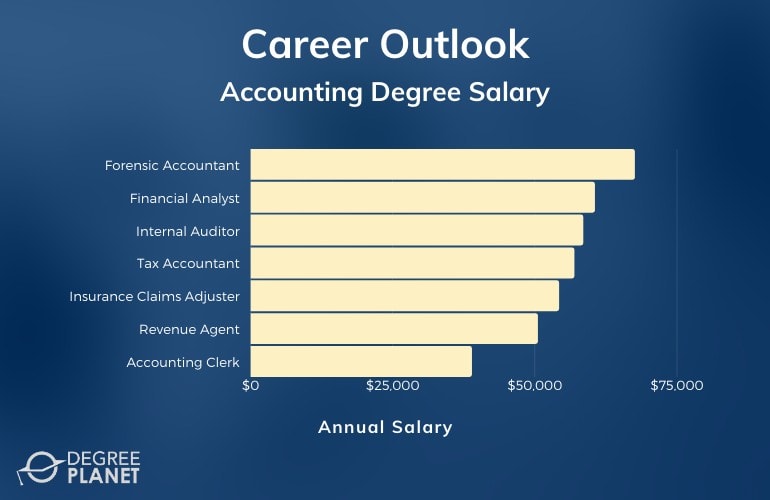

- Specialization: Accountants specializing in areas like forensic accounting, tax consulting, or management accounting may earn higher salaries due to the specialized knowledge and skills required.

Projected Salary Growth

The BLS projects a 7% growth in employment for accountants and auditors from 2020 to 2030, which is faster than the average for all occupations. This growth is driven by the increasing complexity of business operations, the need for financial transparency, and the growing demand for accounting professionals with specialized skills.

Based on historical trends and projected job growth, it is reasonable to expect continued salary growth for accounting professionals in the coming years. The BLS projects that the median annual salary for accountants and auditors will reach $86,540 by 2030. This projection suggests that the accounting profession will continue to offer competitive salaries and attractive career opportunities for qualified individuals.

Future Employment Opportunities

The accounting profession is expected to experience significant growth in the coming years, driven by factors such as globalization, technological advancements, and the increasing need for financial expertise. This growth will create numerous employment opportunities for accounting graduates with a bachelor’s degree.

- Technological Advancements: The rise of big data, artificial intelligence, and cloud computing is transforming the accounting profession, creating new opportunities for professionals with expertise in data analytics, cybersecurity, and technology-enabled accounting solutions.

- Globalization: The increasing interconnectedness of global economies is driving demand for accountants with international business experience and knowledge of global accounting standards.

- Financial Expertise: The growing complexity of business operations and regulations is creating a demand for accountants with expertise in areas like financial reporting, tax compliance, and risk management.

Job Roles and Responsibilities: Accounting Bachelor Degree Salary

A bachelor’s degree in accounting opens doors to a wide array of career paths, each offering unique responsibilities and challenges. Accounting graduates can find themselves working in various industries, from finance and banking to healthcare and manufacturing. The specific roles and responsibilities often depend on the size and type of organization, as well as the individual’s experience and specialization.

Entry-Level Accounting Roles

For those fresh out of college, several entry-level positions provide valuable experience and a foundation for career growth. These roles typically involve a combination of routine tasks and analysis, allowing new graduates to learn the fundamentals of accounting and gain practical skills.

Staff Accountant

Staff accountants are responsible for a wide range of tasks, including:

- Recording financial transactions in accounting software

- Preparing and analyzing financial statements

- Reconciling bank statements and accounts

- Assisting with budgeting and forecasting

- Preparing tax returns for individuals or businesses

Accounts Payable/Receivable Clerk

These roles focus on managing a company’s financial obligations and receivables. Responsibilities include:

- Processing invoices and payments

- Maintaining accurate records of accounts payable and receivable

- Reconciling vendor statements

- Collecting overdue payments

- Communicating with vendors and customers

Tax Preparer

Tax preparers specialize in assisting individuals and businesses with their tax obligations. Their responsibilities include:

- Gathering and analyzing financial documents

- Preparing and filing tax returns

- Staying up-to-date on tax laws and regulations

- Providing tax advice and planning services

Career Paths and Advancement

A bachelor’s degree in accounting opens doors to a wide range of career paths, offering opportunities for growth and advancement within the field. Accounting professionals can progress through various roles, gaining experience, certifications, and specialized skills to climb the career ladder and earn higher salaries.

Career Progression and Advancement Opportunities

Gaining experience is crucial for career advancement in accounting. Starting with entry-level positions like staff accountant or accounts payable clerk allows individuals to build a foundation of practical skills and knowledge. As they gain experience, they can progress to more senior roles, such as senior accountant, cost accountant, or financial analyst.

- Gaining Experience: Entry-level positions like staff accountant or accounts payable clerk provide a foundation for building practical skills and knowledge. As experience is gained, individuals can progress to more senior roles, such as senior accountant, cost accountant, or financial analyst.

- Obtaining Certifications: Professional certifications, such as the Certified Public Accountant (CPA), Certified Management Accountant (CMA), or Certified Internal Auditor (CIA), demonstrate expertise and can lead to higher salaries and greater job opportunities.

- Developing Specialized Skills: Specializing in areas like tax accounting, forensic accounting, or financial planning can open up niche opportunities and enhance earning potential.

- Networking and Professional Development: Attending industry conferences, joining professional organizations, and actively engaging in networking activities can help build relationships and gain valuable insights.

Senior Accounting Roles

Senior accounting roles offer greater responsibility, leadership opportunities, and higher salaries. Examples of such roles include:

- Controller: A controller oversees all aspects of a company’s financial reporting and accounting operations. They are responsible for ensuring accurate financial statements, managing internal controls, and providing financial guidance to management.

- Chief Financial Officer (CFO): The CFO is the highest-ranking financial executive in a company, responsible for overall financial planning, strategy, and risk management. They play a key role in making strategic decisions and ensuring the financial health of the organization.

- Financial Analyst: Financial analysts provide insights into financial performance, conduct market research, and develop financial models. They support investment decisions, identify trends, and advise management on financial strategies.

Education and Training

A bachelor’s degree in accounting is the foundation for a successful career in the field. This degree equips individuals with the necessary knowledge, skills, and credentials to excel in various accounting roles.

Accounting Curriculum and Core Courses

The curriculum of an accounting bachelor’s program is designed to provide a comprehensive understanding of accounting principles, practices, and applications. Core courses typically cover a wide range of topics, including:

- Financial Accounting: This course covers the principles and methods used to record, classify, and summarize financial transactions. It emphasizes the preparation of financial statements, such as the balance sheet, income statement, and statement of cash flows.

- Managerial Accounting: This course focuses on providing financial information to managers for internal decision-making. It covers topics such as cost accounting, budgeting, and performance analysis.

- Auditing: This course explores the process of examining and evaluating financial records to ensure accuracy and compliance with accounting standards. It covers audit procedures, risk assessment, and reporting.

- Taxation: This course delves into the principles and procedures of federal, state, and local taxation. It covers income tax, sales tax, and property tax, as well as tax planning and compliance.

- Information Systems: This course introduces students to the use of technology in accounting, including accounting software, databases, and data analytics.

Benefits of Additional Certifications

While a bachelor’s degree in accounting is a valuable asset, pursuing additional certifications can enhance career prospects and increase earning potential. Two prominent certifications in the accounting field are the Certified Public Accountant (CPA) and the Certified Management Accountant (CMA).

The CPA license is a highly respected credential that allows individuals to provide audit, tax, and advisory services to clients.

The CMA certification focuses on management accounting and financial management skills, making it highly sought after by companies seeking individuals with expertise in strategic financial planning, cost analysis, and performance management.

Job Market and Industry Outlook

The job market for accounting professionals with a bachelor’s degree is robust and offers diverse opportunities across various industries. The demand for accounting skills remains consistently high, driven by the critical role accounting plays in businesses and organizations.

Demand for Accounting Skills in Various Industries

The demand for accounting skills is widespread, spanning various industries and sectors. Accounting professionals are sought after in:

- Financial Services: This industry encompasses banking, investment management, insurance, and real estate, where accounting expertise is essential for financial analysis, risk management, and regulatory compliance.

- Manufacturing and Production: Accounting professionals play a vital role in managing costs, inventory, and production processes, ensuring efficient operations and profitability.

- Healthcare: As the healthcare sector continues to grow, the need for skilled accountants to manage complex financial operations, including billing and reimbursement, is rising.

- Technology: The technology industry, characterized by rapid growth and innovation, requires accounting professionals with specialized skills in areas such as software development, data analytics, and cybersecurity.

- Government and Non-profit Organizations: These organizations rely on accountants to ensure financial transparency, accountability, and compliance with regulations.

Future Outlook for the Accounting Profession

The accounting profession is expected to experience continued growth in the coming years, driven by several factors:

- Technological Advancements: The increasing adoption of automation and artificial intelligence (AI) in accounting tasks is creating new opportunities for professionals with expertise in data analysis, financial modeling, and technology integration.

- Globalization and International Trade: Businesses are expanding their operations globally, requiring accountants with knowledge of international accounting standards and regulations.

- Increased Regulatory Scrutiny: As regulations become more complex, the demand for accounting professionals with expertise in compliance and risk management is increasing.

- Focus on Sustainability and Corporate Social Responsibility: Businesses are increasingly focused on sustainability and social responsibility, leading to a growing demand for accountants with expertise in environmental, social, and governance (ESG) reporting.

Potential Growth Areas

- Forensic Accounting: This specialized field involves investigating financial crimes and fraud, offering significant growth opportunities as businesses become more sophisticated and vulnerable to financial misconduct.

- Data Analytics and Business Intelligence: Accounting professionals with data analysis skills are in high demand to interpret financial data, identify trends, and provide insights for decision-making.

- Cybersecurity: As cyber threats continue to escalate, accountants with cybersecurity expertise are needed to protect sensitive financial data and ensure compliance with cybersecurity regulations.

- Tax Planning and Advisory: The complexity of tax laws and regulations is creating a growing demand for accountants with expertise in tax planning, compliance, and advisory services.

Ending Remarks

In conclusion, an accounting bachelor’s degree can be a valuable investment in your future. With the right skills and experience, you can build a successful career in this dynamic field. By understanding the factors that influence salary and exploring the various career paths available, you can make informed decisions and set yourself up for success.

FAQ Explained

What is the average starting salary for an accounting graduate with a bachelor’s degree?

The average starting salary for an accounting graduate with a bachelor’s degree varies depending on factors such as location, industry, and experience level. However, it is typically in the range of $50,000 to $65,000 per year.

What are the best industries for accounting graduates to work in?

Some of the best industries for accounting graduates include public accounting, corporate accounting, government, and financial services. These industries offer a wide range of opportunities and potential for career growth.

Is it worth getting a CPA certification?

Yes, obtaining a CPA certification can significantly increase your earning potential and open up more career opportunities. CPAs are highly sought-after professionals, and they often command higher salaries than non-certified accountants.