- A Comprehensive Guide to Affordable Car Insurance

-

What is Affordable Car Insurance?

- How to Find Affordable Car Insurance

- 1. Compare Quotes from Multiple Insurers

- 2. Bundle Your Insurance Policies

- 3. Increase Your Deductible

- 4. Improve Your Credit Score

- 5. Take Advantage of Discounts

- Coverage Options for Affordable Car Insurance

- 1. Liability Coverage

- 2. Collision Coverage

- 3. Comprehensive Coverage

- Table of Insurance Coverage Costs

- Conclusion

-

FAQ about Affordable Car Insurance

- 1. What are the factors that affect car insurance rates?

- 2. How can I find the cheapest car insurance?

- 3. What is the minimum car insurance coverage I need?

- 4. What is a deductible?

- 5. What is liability insurance?

- 6. What is collision insurance?

- 7. What is comprehensive coverage?

- 8. What are the best companies for affordable car insurance?

- 9. Can I get car insurance without a driver’s license?

- 10. What should I do if I can’t afford car insurance?

A Comprehensive Guide to Affordable Car Insurance

Introduction

Hey there, readers! Are you looking for ways to get affordable car insurance without sacrificing coverage? You’re in the right place. In this extensive guide, we’ll delve into everything you need to know about securing a cost-effective car insurance policy. Whether you’re a first-time driver or a long-time insured, we’ve got you covered.

What is Affordable Car Insurance?

Affordable car insurance refers to insurance policies that provide adequate coverage at a price that’s within your budget. It’s not about getting the bare minimum coverage; it’s about finding a balance between affordability and protection.

How to Find Affordable Car Insurance

1. Compare Quotes from Multiple Insurers

Don’t settle for the first quote you come across. Take the time to compare prices and coverage options from different insurance companies. Use online comparison tools or consult with an insurance broker to get a comprehensive overview of the market.

2. Bundle Your Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in significant discounts. Insurers offer bundled packages to encourage customer loyalty and provide convenience.

3. Increase Your Deductible

Raising your deductible is a quick way to lower your insurance premiums. However, it’s important to choose a deductible that you’re comfortable paying in case of an accident.

4. Improve Your Credit Score

Your credit score can impact your car insurance rates. Good credit often translates to lower premiums, while poor credit can lead to higher costs. Focus on paying your bills on time, reducing debt, and maintaining a healthy credit profile.

5. Take Advantage of Discounts

Many insurance companies offer discounts for things like safe driving habits, owning multiple vehicles, and having a clean driving record. Be sure to ask your insurance agent about any discounts you may be eligible for.

Coverage Options for Affordable Car Insurance

1. Liability Coverage

Liability coverage protects you from financial liability if you cause an accident that results in bodily injury or property damage to others. It’s a legal requirement in most states.

2. Collision Coverage

Collision coverage pays for repairs to your vehicle if you’re involved in an accident with another vehicle or object. It’s optional, but recommended if you have a financed or leased vehicle.

3. Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision events, such as theft, vandalism, fire, and storms. It’s a good choice if you live in an area with a high risk of these types of events.

Table of Insurance Coverage Costs

| Coverage Type | Average Annual Cost |

|---|---|

| Liability Only | $500 – $1,000 |

| Liability + Collision | $1,000 – $1,500 |

| Liability + Comprehensive | $1,200 – $1,800 |

Note: These costs are approximate and may vary depending on your driving history, location, and vehicle.

Conclusion

Finding affordable car insurance is possible with a little effort and research. By following the tips outlined in this guide, you can secure the coverage you need at a price that fits your budget. Remember to compare quotes, bundle your policies, and take advantage of discounts. And don’t forget to check out our other articles for more tips on saving money on car insurance and related topics.

FAQ about Affordable Car Insurance

1. What are the factors that affect car insurance rates?

- Age, gender, driving history, location, coverage level, type of vehicle, and insurance company.

2. How can I find the cheapest car insurance?

- Compare quotes from multiple insurance companies, consider raising your deductible, and taking advantage of discounts.

3. What is the minimum car insurance coverage I need?

- This varies by state, but typically includes liability insurance to cover damages caused to others.

4. What is a deductible?

- The amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible can lower your premiums.

5. What is liability insurance?

- Coverage that pays for damages you cause to others in an accident.

6. What is collision insurance?

- Coverage that pays for damages to your own vehicle in an accident, regardless of fault.

7. What is comprehensive coverage?

- Coverage that pays for damages to your own vehicle caused by events other than accidents, such as theft or vandalism.

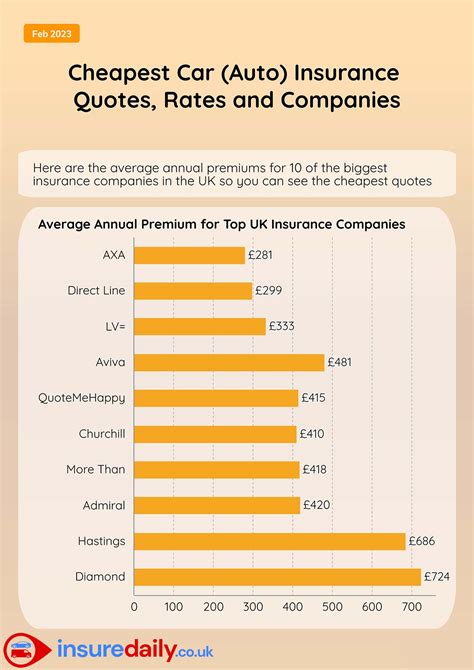

8. What are the best companies for affordable car insurance?

- This can vary depending on your individual circumstances, but some recommended companies include Geico, State Farm, and Progressive.

9. Can I get car insurance without a driver’s license?

- In most cases, no. You typically need a valid driver’s license to be eligible for car insurance.

10. What should I do if I can’t afford car insurance?

- Consider state-run insurance programs, public transportation, or carpooling. You may also be able to negotiate a payment plan with your insurance company.