Basic insurance terms, while often confusing, are the key to understanding how insurance protects you. This guide unravels the complexities of insurance, from defining core concepts to navigating the claims process. We’ll explore various insurance types, policy documents, and crucial financial aspects like premiums and deductibles, empowering you to make informed decisions about your financial well-being. Understanding these fundamental terms is the first step towards securing your future.

We’ll cover essential terminology, compare different insurance types (life, health, auto), and provide practical examples to illustrate how these concepts work in real-world scenarios. We will also discuss the importance of risk management and how insurance plays a vital role in mitigating financial uncertainties.

Defining Basic Insurance Terms

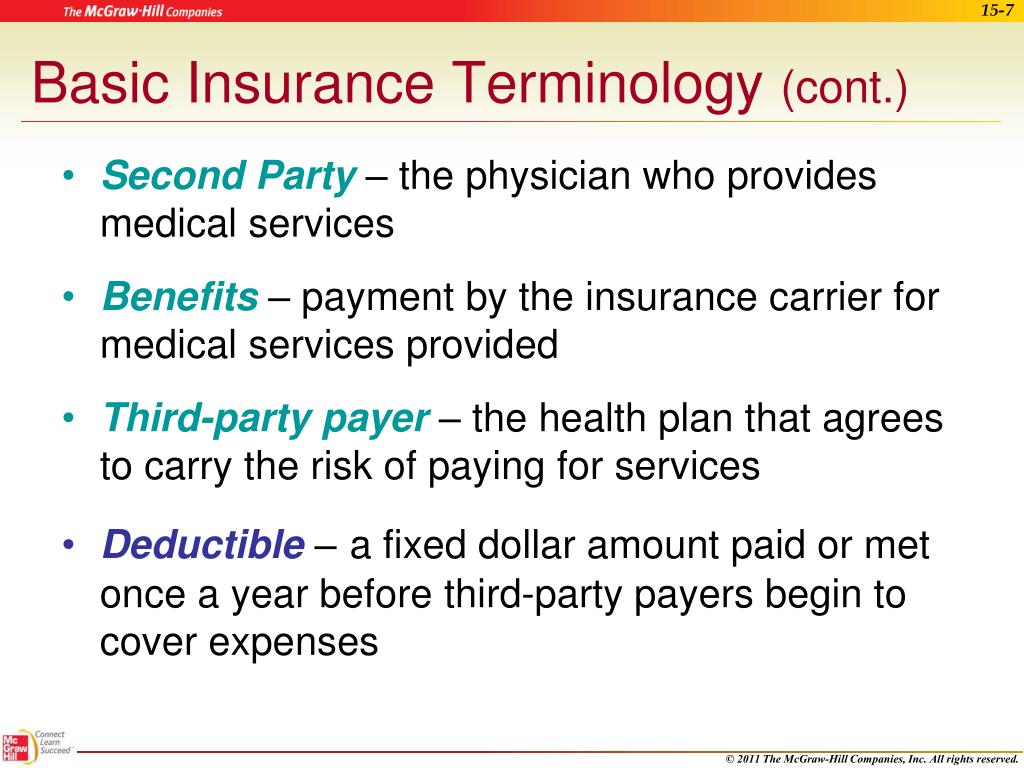

Insurance is a fundamental risk management tool. It’s a contract where an individual or entity (the insured) pays a fee (premium) to an insurance company (the insurer) in exchange for financial protection against potential losses. If an insured event occurs, the insurer compensates the insured for the covered losses, up to a pre-determined limit. This system allows individuals and businesses to transfer the financial burden of unexpected events to a larger pool of resources.

Essential Insurance Terms

Understanding key insurance terms is crucial for making informed decisions about your coverage. The following list provides concise definitions of ten essential terms commonly encountered in insurance policies.

| Term | Definition | Example | Related Concepts |

|---|---|---|---|

| Premium | The regular payment made by the insured to maintain insurance coverage. | A monthly payment of $100 for health insurance. | Policy, Deductible, Copay |

| Policy | The formal contract outlining the terms and conditions of insurance coverage. | A document detailing coverage for a car insurance policy. | Premium, Coverage, Claims |

| Coverage | The specific types of losses or events covered by an insurance policy. | Liability coverage in a car insurance policy covers damage caused to others. | Policy, Exclusions, Limits |

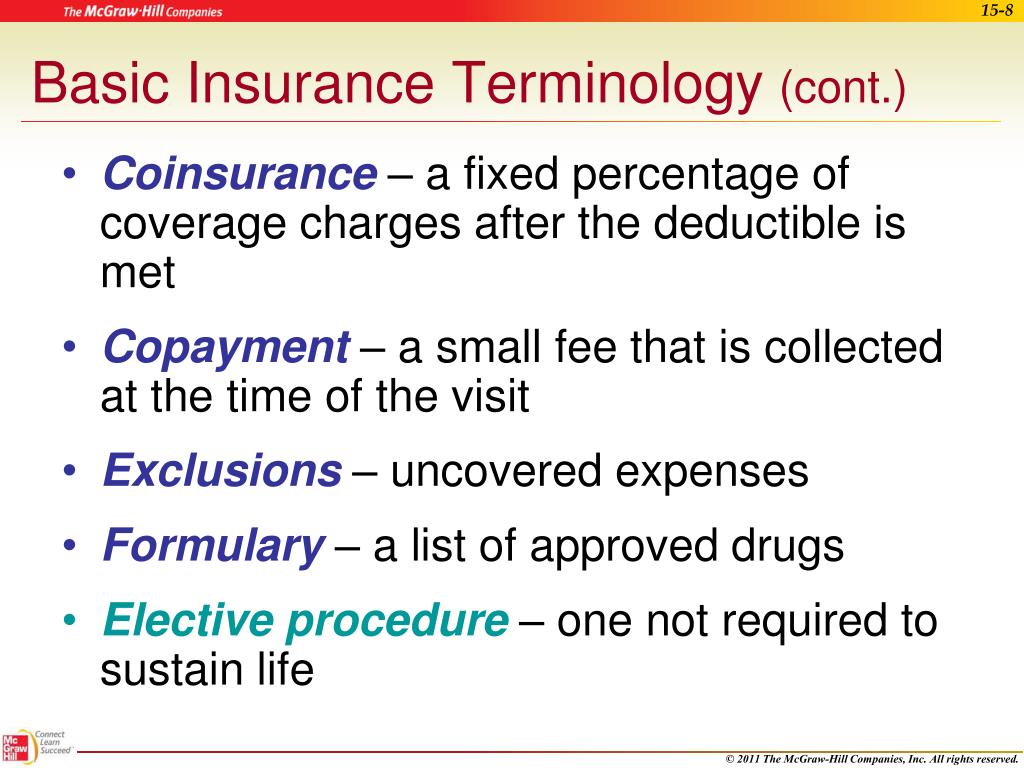

| Deductible | The amount the insured must pay out-of-pocket before the insurance company begins to cover expenses. | A $500 deductible on a health insurance policy means the insured pays the first $500 of medical bills. | Premium, Copay, Out-of-pocket maximum |

| Copay | A fixed amount the insured pays for a covered healthcare service. | A $25 copay for a doctor’s visit. | Deductible, Premium, Out-of-pocket maximum |

| Claim | A formal request for payment made to the insurer after an insured event occurs. | Filing a claim with your car insurance company after an accident. | Policy, Coverage, Benefits |

| Beneficiary | The person or entity designated to receive insurance benefits in the event of a covered loss. | Naming your spouse as the beneficiary of your life insurance policy. | Policy, Life Insurance, Death Benefit |

| Exclusions | Specific events or circumstances not covered by an insurance policy. | A car insurance policy may exclude coverage for damage caused by driving under the influence. | Coverage, Policy, Limitations |

| Liability | Legal responsibility for causing harm or damage to another person or property. | Liability insurance covers costs associated with lawsuits resulting from accidents. | Coverage, Premiums, Claims |

| Actuary | A professional who analyzes and assesses risk for insurance companies. | Actuaries determine insurance premiums based on statistical analysis of risk. | Risk Assessment, Premium Calculation, Statistical Modeling |

Types of Basic Insurance Coverage: Basic Insurance Terms

Understanding the different types of insurance is crucial for protecting yourself and your assets against unforeseen circumstances. This section will explore three fundamental types: life insurance, health insurance, and auto insurance, highlighting their key differences and common coverage options.

Life Insurance

Life insurance provides a financial safety net for your dependents in the event of your death. The policy pays out a death benefit, a predetermined sum of money, to your beneficiaries. This helps them cover expenses like funeral costs, outstanding debts, and ongoing living expenses.

Common coverage options within life insurance policies include term life insurance (coverage for a specific period), whole life insurance (permanent coverage with a cash value component), and universal life insurance (flexible premiums and death benefits). For example, a young family might opt for a term life insurance policy to cover their mortgage and children’s education until the mortgage is paid off, while an older individual with significant assets might choose whole life insurance for its long-term coverage and cash value accumulation.

Health Insurance

Health insurance helps cover the costs associated with medical care, including doctor visits, hospital stays, surgeries, and prescription medications. It protects you from potentially crippling medical bills, allowing you access to necessary healthcare services without financial ruin.

Common coverage options include hospitalization coverage, surgical coverage, medical coverage (covering doctor visits and other outpatient care), and prescription drug coverage. For instance, a comprehensive health insurance plan might cover a significant portion of the costs associated with a major surgery, while a more basic plan might only cover essential services. Different plans also offer varying levels of coverage and cost-sharing mechanisms like deductibles and co-pays.

Auto Insurance

Auto insurance protects you financially in the event of an accident involving your vehicle. It covers damages to your car, injuries to yourself or others, and legal liabilities arising from an accident. Having adequate auto insurance is typically legally mandated in most jurisdictions.

Common coverage options include liability coverage (protecting you against claims from others), collision coverage (covering damage to your car from accidents), comprehensive coverage (covering damage from events other than collisions, such as theft or vandalism), and uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with an uninsured or underinsured driver). For example, a driver with a new car might opt for comprehensive coverage to protect against theft or damage, while a driver with an older car might only carry the legally required liability coverage.

Comparison of Insurance Types

| Feature | Life Insurance | Health Insurance | Auto Insurance |

|---|---|---|---|

| Primary Purpose | Financial protection for dependents after death | Coverage for medical expenses | Financial protection in auto accidents |

| Beneficiary | Designated individuals | Policyholder | Policyholder and others potentially injured |

| Coverage Options | Term, whole, universal life | Hospitalization, surgical, medical, prescription | Liability, collision, comprehensive, uninsured/underinsured |

| Cost | Varies based on age, health, and coverage amount | Varies based on plan type and coverage | Varies based on driving record, location, and vehicle type |

Understanding Policy Documents

Insurance policies, while often dense, are crucial documents outlining the agreement between you and your insurer. Understanding their contents is vital for ensuring you receive the coverage you expect. This section will guide you through the typical components and interpretation of these important legal contracts.

Typical Sections in an Insurance Policy

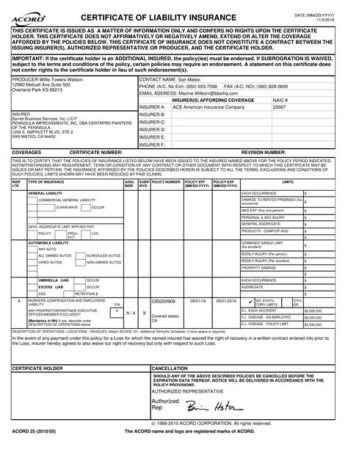

Insurance policies generally follow a standardized structure, although specific wording and section titles might vary slightly between insurers and policy types. Familiarizing yourself with the common sections will significantly aid in comprehension. A typical policy includes a declarations page, definitions, insuring agreement, exclusions, conditions, and endorsements.

Interpreting Key Policy Provisions

Navigating the complexities of policy language requires a systematic approach. Begin by carefully reading the declarations page, which summarizes key information like policyholder details, coverage amounts, and effective dates. Next, familiarize yourself with the definitions section, as it clarifies the specific meanings of terms used throughout the policy. The insuring agreement details the insurer’s promises to provide coverage under specific circumstances. Pay close attention to the conditions section, as it Artikels the obligations of both the policyholder and the insurer. For example, a condition might require prompt notification of a claim. Finally, review any endorsements, which are additions or modifications to the original policy.

Common Policy Exclusions and Limitations

Understanding what is *not* covered is as important as understanding what is covered. Insurance policies often exclude certain events or circumstances from coverage. These exclusions are typically listed explicitly within the policy document. For example, many homeowner’s insurance policies exclude damage caused by floods or earthquakes, requiring separate flood or earthquake insurance. Limitations refer to restrictions on the amount or scope of coverage. A common limitation is a deductible, which is the amount the policyholder must pay out-of-pocket before the insurance coverage begins. Another example might be a policy limit on liability coverage, restricting the maximum amount the insurer will pay for a specific type of claim. For instance, a car insurance policy might have a liability limit of $100,000 per accident. If an accident results in damages exceeding this amount, the policyholder would be responsible for the difference.

Premiums and Deductibles

Insurance premiums and deductibles are two key components of any insurance policy that significantly impact the overall cost and risk management strategy. Understanding how they work together is crucial for making informed decisions about your coverage. This section will clarify the calculation of premiums, the role of deductibles in cost management, and the various deductible options available.

Premium Calculation and Influencing Factors

Insurance premiums are essentially the price you pay for your insurance coverage. Actuaries, specialists in assessing and managing risk, utilize complex statistical models to determine these premiums. These models consider numerous factors to predict the likelihood of a claim and the potential cost of that claim. Key factors include the type of insurance (e.g., auto, home, health), the coverage level selected (higher coverage generally means higher premiums), the insured’s risk profile (age, driving history, health status, location), and the claims history of similar policyholders. For example, a young driver with a history of accidents will typically pay higher auto insurance premiums than an older driver with a clean driving record. Similarly, individuals living in high-crime areas might face higher home insurance premiums. The insurer also factors in administrative costs and profit margins into the premium calculation.

The Role of Deductibles in Managing Insurance Costs

A deductible is the amount of money you, the policyholder, must pay out-of-pocket before your insurance coverage kicks in. It acts as a cost-sharing mechanism, influencing both the premium and the out-of-pocket expenses. A higher deductible typically results in a lower premium, as the insurer’s financial risk is reduced. Conversely, a lower deductible means a higher premium because the insurer is assuming more of the financial burden upfront. The optimal deductible depends on individual risk tolerance and financial capabilities. Someone with a higher risk tolerance and a larger emergency fund might opt for a higher deductible to lower their premiums, while someone with a lower risk tolerance might prefer a lower deductible despite paying higher premiums.

Deductible Options and Their Impact on Out-of-Pocket Expenses, Basic insurance terms

Insurance companies offer a range of deductible options to cater to diverse needs and financial situations. For example, a health insurance policy might offer deductibles of $1,000, $2,500, or $5,000. Choosing a higher deductible ($5,000) will significantly lower the monthly premium, but you’ll need to pay $5,000 out-of-pocket before your insurance coverage begins to pay for medical expenses. Conversely, a lower deductible ($1,000) results in a higher monthly premium, but you’ll only have to pay $1,000 out-of-pocket before insurance coverage begins. It’s crucial to consider your expected healthcare costs and financial capacity when selecting a deductible. A similar principle applies to other types of insurance, such as auto or home insurance, where deductible options influence the premium and the amount you pay in the event of a claim. The best option depends on individual circumstances and risk assessment.

Claims Process and Procedures

Filing an insurance claim can seem daunting, but understanding the process can significantly ease the experience. This section Artikels the typical steps involved, necessary documentation, and the appeals process for denied claims. Remember that specific procedures may vary slightly depending on your insurance provider and the type of claim.

The claims process generally begins with reporting the incident to your insurance company. This is usually done via phone or online through their designated portal. Prompt reporting is crucial to initiate the claims process efficiently. Following the initial report, you will need to gather and submit the required documentation to support your claim. The insurer will then review your claim, investigate the incident if necessary, and determine the coverage and payout amount. Finally, you will receive a settlement or a denial, with the option to appeal a denial if you disagree with the decision.

Required Documentation for Different Claim Types

The necessary documentation varies depending on the type of claim. For example, a car accident claim would require a police report, photos of the damage, and medical records if injuries occurred. A homeowner’s insurance claim for a damaged roof might involve photos of the damage, a contractor’s estimate for repairs, and proof of ownership. A health insurance claim would typically require the medical bills, a completed claim form, and potentially supporting medical documentation from your physician.

It’s advisable to maintain meticulous records throughout the entire process. This includes keeping copies of all correspondence with the insurance company, documentation submitted, and any payment received. This organized record-keeping will be invaluable if any issues arise or if an appeal is necessary.

Appealing a Denied Claim

If your claim is denied, you have the right to appeal the decision. Most insurance companies have a formal appeals process Artikeld in their policy documents. This typically involves submitting a written appeal letter, along with any additional supporting documentation that was not previously considered or new evidence that strengthens your case. The appeal letter should clearly state the reasons why you believe the claim should be reconsidered and cite specific points of disagreement with the initial denial. For example, if a claim was denied due to a perceived lack of evidence, you might provide additional photos, witness statements, or expert opinions.

The insurance company will review your appeal and provide a final decision. If the appeal is still unsuccessful, you may need to seek legal counsel to further pursue the matter. Understanding your policy and rights is critical to navigating the appeals process successfully. It is often helpful to keep a record of all communications and dates during the appeal process.

Insurance and Risk Management

Insurance and risk management are intrinsically linked. Insurance is a crucial tool for managing and mitigating the financial consequences of unforeseen events. Understanding how risk assessment informs insurance decisions is fundamental to effective risk management.

Risk assessment, in the context of insurance, involves identifying, analyzing, and evaluating potential risks. This process helps determine the likelihood and potential severity of various events that could lead to financial loss. Insurers use this information to calculate premiums and determine the level of coverage they are willing to offer. Individuals and businesses also benefit from performing their own risk assessments to understand their vulnerabilities and make informed decisions about the types and levels of insurance they need.

Risk Assessment and Insurance Premiums

The outcome of a risk assessment directly influences the premiums charged by insurance companies. A higher likelihood of an event occurring, or a greater potential for significant financial loss, will generally result in higher premiums. For example, a young driver with a history of accidents will likely pay higher car insurance premiums than an older driver with a clean driving record. This is because the insurer assesses a higher risk of accidents and associated claims for the younger driver. Conversely, individuals or businesses with lower risk profiles may qualify for discounts or lower premiums. The process involves a detailed analysis of various factors, which can vary depending on the type of insurance. For example, in health insurance, pre-existing conditions may influence premiums, while in property insurance, location and building features play a significant role.

Insurance as a Financial Risk Mitigation Tool

Insurance acts as a financial safety net, protecting individuals and businesses from the potentially devastating financial consequences of unexpected events. By transferring the risk of financial loss to an insurance company, policyholders gain peace of mind and financial stability. This transfer of risk allows individuals and businesses to focus on their core activities without the constant worry of catastrophic financial setbacks. The cost of insurance premiums is generally far less than the potential cost of dealing with a major loss without insurance. Consider, for example, a small business owner whose building is destroyed by a fire. Without adequate insurance, the owner could face bankruptcy. With insurance, the business can rebuild and recover more quickly.

Examples of Risk Management through Insurance

Individuals and businesses utilize insurance to manage risk in numerous ways. Individuals might purchase health insurance to protect against high medical costs, auto insurance to cover accidents, and homeowners insurance to protect their property. Businesses might utilize commercial property insurance, liability insurance to protect against lawsuits, and workers’ compensation insurance to cover employee injuries. A large corporation might even use specialized insurance policies to mitigate risks associated with cyberattacks or supply chain disruptions. Effective risk management involves carefully assessing the potential risks faced, selecting appropriate insurance coverage, and regularly reviewing the insurance portfolio to ensure it aligns with changing circumstances and evolving risks. For instance, a business expanding its operations into a new market might need to adjust its liability insurance coverage accordingly.

Illustrative Scenarios

Understanding insurance concepts is easier with real-world examples. The following scenarios illustrate how different types of insurance policies work in practice.

Car Accident and Auto Insurance Coverage

Imagine Sarah is involved in a car accident. Another driver runs a red light and hits her car. Sarah’s car sustains significant damage, and she suffers minor injuries. Her auto insurance policy includes liability, collision, and comprehensive coverage. The liability portion covers the damages to the other driver’s vehicle and any medical expenses they incur as a result of the accident, assuming Sarah is found at fault. Her collision coverage pays for the repairs to her own car, regardless of who caused the accident. If the accident had occurred due to something other than a collision (e.g., a tree falling on her car), her comprehensive coverage would have addressed those damages. The extent of coverage would depend on her specific policy limits and deductible.

Hospital Stay and Health Insurance Coverage

John experiences a sudden heart attack and requires a hospital stay. He has a PPO (Preferred Provider Organization) health insurance plan. His plan has a $5,000 deductible, a $50 co-pay for doctor visits, and a 20% co-insurance after the deductible is met. His hospital stay costs $20,000. First, he pays his $5,000 deductible. Then, his insurance company pays 80% of the remaining $15,000 ($12,000), and John pays the remaining 20% ($3,000) as co-insurance. He also pays his co-pays for doctor visits during his stay. If John had a different plan, such as an HMO (Health Maintenance Organization) or a high-deductible health plan (HDHP) with a health savings account (HSA), the cost-sharing responsibilities would be different, with potentially higher deductibles or out-of-pocket maximums. The specific cost-sharing details are defined in his policy documents.

Life Insurance Payout after Unexpected Death

Mark, a 40-year-old father of two, unexpectedly passes away. He had a $500,000 term life insurance policy with his wife, Lisa, and his children as beneficiaries. Upon his death, the insurance company pays out the $500,000 death benefit to Lisa, who can use this money to cover funeral expenses, outstanding debts, and to support her children’s education and future needs. The payout amount is determined by the policy’s face value and any applicable riders. Had Mark had a whole life insurance policy, the death benefit would be paid upon his death, and there would also be a cash value component that could be accessed during his lifetime.

Outcome Summary

Mastering basic insurance terms is crucial for navigating the world of personal finance and risk management. By understanding premiums, deductibles, policy provisions, and the claims process, you can confidently choose the right coverage and protect yourself and your assets from unforeseen events. This guide serves as a foundation for making informed decisions about your insurance needs, empowering you to secure a more financially stable future. Remember to always review your policy documents and consult with an insurance professional for personalized advice.

Popular Questions

What is a beneficiary?

A beneficiary is the person or entity designated to receive the benefits of an insurance policy, such as a life insurance payout, upon the insured’s death or other specified event.

What is an actuary?

An actuary is a professional who assesses and manages financial risks, often within the insurance industry. They use statistical methods to predict future events and determine appropriate insurance premiums.

What is subrogation?

Subrogation is the process by which an insurance company, after paying a claim to its insured, seeks recovery from a third party who caused the loss. For example, if your car is damaged in an accident caused by another driver, your insurance company might pursue reimbursement from the at-fault driver’s insurance company.

What is a rider?

A rider is an add-on to an existing insurance policy that modifies or extends its coverage. For example, a life insurance policy might include a rider that provides additional benefits for specific situations, like accidental death.