Demo trading forex provides a risk-free environment to hone your trading skills before venturing into the live market. This simulated trading experience allows you to experiment with different strategies, learn from mistakes, and gain confidence without risking real money.

By using a demo account, you can familiarize yourself with the trading platform, understand how forex works, and explore various trading techniques. You can test your strategies, analyze market trends, and refine your trading approach without any financial repercussions.

What is Demo Trading Forex?

Demo trading forex, also known as paper trading, is a simulated trading environment that allows individuals to practice forex trading without risking real money. It provides a safe and risk-free space for beginners to learn the fundamentals of forex trading, develop their trading strategies, and gain experience before venturing into live trading.

Benefits of Demo Trading for Beginners

Demo trading offers several benefits for individuals new to the forex market:

- Risk-Free Learning: Demo accounts allow traders to experiment with different trading strategies and techniques without risking their own capital. This is especially valuable for beginners who are still learning the intricacies of the forex market.

- Developing Trading Skills: Demo trading provides a platform for traders to develop their trading skills, such as analyzing charts, identifying trading opportunities, and managing risk. This practice helps them build confidence and become more proficient in their trading decisions.

- Familiarization with Trading Platforms: Demo accounts allow traders to familiarize themselves with the features and functionalities of different trading platforms. This helps them understand how to navigate the platform, place orders, manage their positions, and access various analytical tools.

- Testing Trading Strategies: Demo trading provides a controlled environment for traders to test their trading strategies and refine their approach. They can analyze the performance of their strategies, identify areas for improvement, and adjust their tactics based on the results.

How Demo Trading Works

Demo trading works by providing a simulated trading environment that replicates real-time market conditions. Here’s a step-by-step guide:

- Open a Demo Account: Most forex brokers offer free demo accounts that can be opened quickly and easily. Traders typically need to provide basic information such as their name, email address, and phone number.

- Fund Your Demo Account: Demo accounts are usually funded with virtual currency, which allows traders to execute trades without using real money. The amount of virtual funds is typically set by the broker, and traders can use it to practice trading.

- Access Real-Time Market Data: Demo accounts provide access to real-time market data, including price quotes, charts, and economic indicators. This data is identical to the information available to live traders, allowing for accurate practice.

- Place Trades and Manage Positions: Traders can place trades and manage their positions in the same way they would in a live account. They can open and close trades, set stop-loss orders, and adjust their position sizes. The trading platform will track their trades and provide them with performance statistics.

- Review Performance and Analyze Results: Demo trading platforms allow traders to review their trading history and analyze their performance. They can identify areas where they performed well and areas where they need improvement. This analysis helps them refine their strategies and become more effective traders.

Examples of Demo Trading Platforms

Here are some popular demo trading platforms offered by forex brokers:

- MetaTrader 4 (MT4): MT4 is a widely used forex trading platform known for its advanced charting capabilities, technical indicators, and automated trading features. Many brokers offer demo accounts for MT4, allowing traders to practice using this popular platform.

- MetaTrader 5 (MT5): MT5 is the successor to MT4 and offers even more advanced features, including a wider range of trading instruments, improved charting tools, and a more robust backtesting engine. Brokers that offer MT5 typically provide demo accounts for traders to familiarize themselves with its capabilities.

- cTrader: cTrader is a sophisticated trading platform designed for experienced traders. It offers advanced order types, real-time market depth, and customizable charting tools. Brokers that offer cTrader often provide demo accounts for traders to explore its advanced features.

Why Use Demo Trading Forex?

Demo trading is a valuable tool for aspiring and experienced forex traders alike. It provides a risk-free environment to practice trading strategies, learn about the market, and hone your skills before committing real capital.

Advantages of Demo Trading

Demo trading offers numerous advantages that can significantly enhance your forex trading journey. Here are some key benefits:

- Risk-free Trading: The most significant advantage of demo trading is that you can trade without risking any real money. This allows you to experiment with different strategies, learn from mistakes, and gain confidence without financial consequences.

- Learning and Experimentation: Demo accounts provide a safe space to learn the intricacies of forex trading. You can test various trading strategies, explore different indicators, and understand market dynamics without the pressure of real-time market fluctuations.

- Developing Trading Skills: Demo trading helps you develop essential trading skills such as risk management, order execution, and trade analysis. You can practice managing your trades, setting stop-loss orders, and analyzing market trends in a simulated environment.

- Understanding Market Dynamics: Demo trading exposes you to the dynamic nature of the forex market. You can observe how different factors, such as economic news, geopolitical events, and market sentiment, influence currency prices. This understanding is crucial for making informed trading decisions.

- Evaluating Trading Platforms: Demo accounts allow you to test different trading platforms and their features. You can compare user interfaces, charting tools, and order execution speeds before choosing a platform for live trading.

Comparing Demo Trading with Live Trading

While demo trading offers numerous benefits, it’s essential to understand its limitations and how it differs from live trading.

- Emotional Impact: Demo trading lacks the emotional impact of live trading. When trading with real money, emotions such as fear and greed can influence your decisions. Demo trading cannot fully replicate this psychological aspect of trading.

- Market Conditions: Demo trading environments may not always accurately reflect real-time market conditions. The data used in demo accounts might not be as up-to-date or comprehensive as live market data, potentially leading to discrepancies in trading outcomes.

- Trading Discipline: Demo trading can create a false sense of security. It’s essential to maintain discipline and follow your trading plan, even in a demo environment, to prepare for the rigors of live trading.

Demo Trading: A Crucial Learning Tool

Imagine a scenario where a beginner forex trader is eager to enter the market but lacks experience. Demo trading provides a safe and effective way to bridge the gap between theory and practice. By practicing on a demo account, the trader can:

- Learn the basics of forex trading: Understand concepts like currency pairs, pips, leverage, and margin.

- Explore different trading strategies: Experiment with technical analysis, fundamental analysis, and various trading indicators.

- Develop a trading plan: Define their risk tolerance, entry and exit points, and stop-loss orders.

- Gain confidence: Build their trading skills and confidence before risking real capital.

How to Get Started with Demo Trading Forex?

Demo trading forex is an excellent way to learn the ropes of forex trading without risking real money. It allows you to experiment with different trading strategies, understand market dynamics, and familiarize yourself with the trading platform before venturing into live trading. Here’s a step-by-step guide to get you started with demo trading forex.

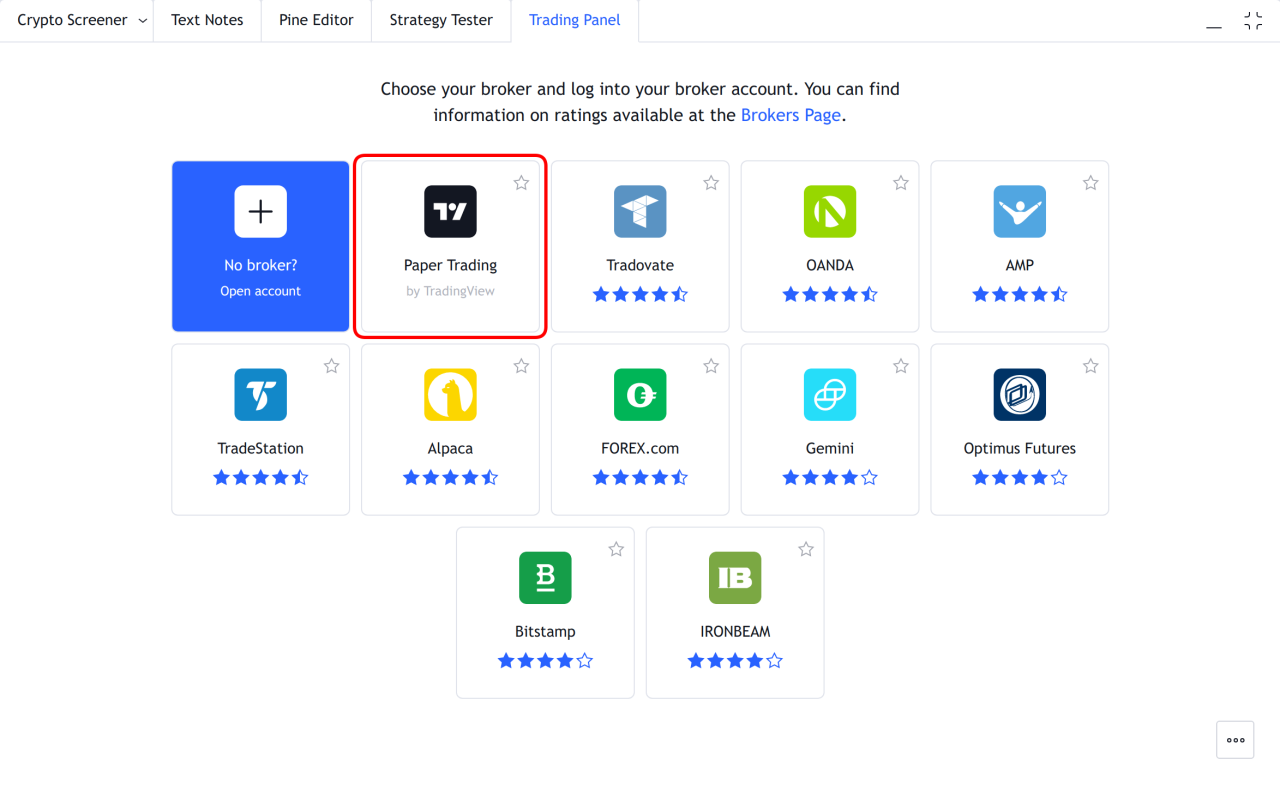

Choosing a Forex Broker, Demo trading forex

Selecting a reputable forex broker is crucial for a successful demo trading experience. Look for brokers offering user-friendly demo accounts with realistic market conditions and comprehensive trading tools. Here are some reputable forex brokers offering demo accounts:

- MetaTrader 4 (MT4): A popular trading platform with a user-friendly interface, advanced charting tools, and a wide range of technical indicators.

- MetaTrader 5 (MT5): The latest version of MT4, offering additional features such as economic calendar, news feed, and more advanced order types.

- cTrader: A powerful platform designed for professional traders, featuring advanced charting tools, real-time market depth, and order book.

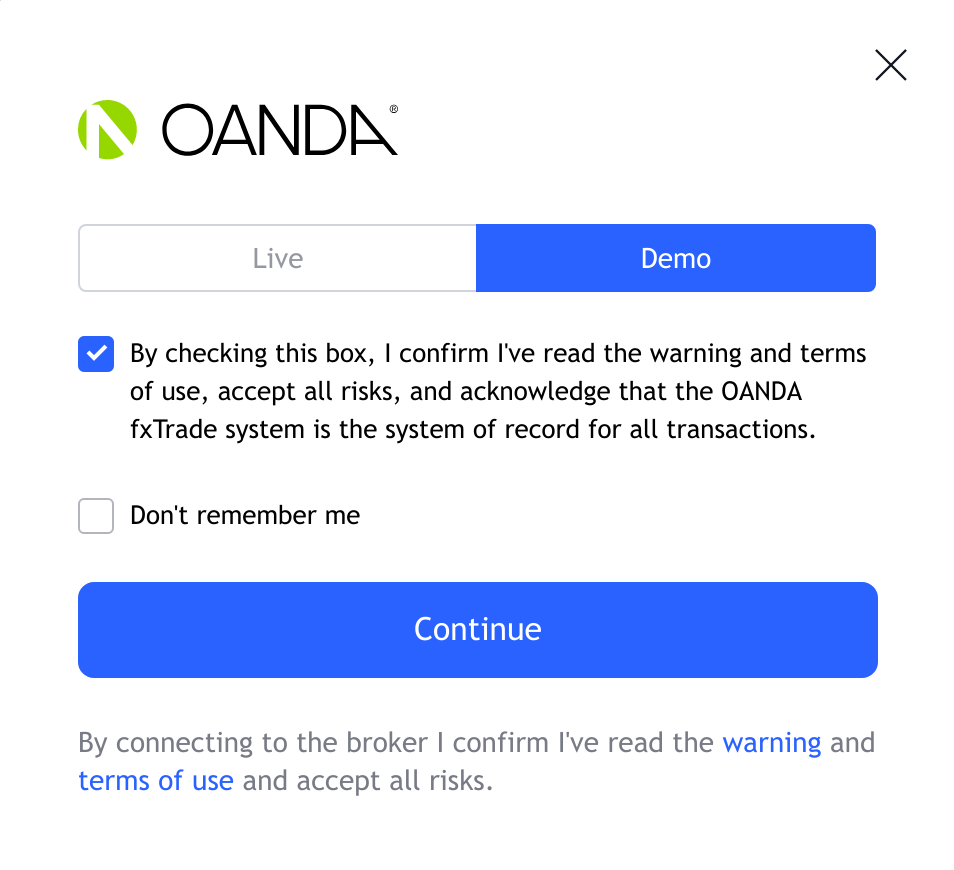

Opening a Demo Account

Once you’ve chosen a forex broker, opening a demo account is usually a straightforward process. Typically, you’ll need to provide basic information, such as your name, email address, and phone number. Some brokers may require additional verification steps, like identity verification.

Navigating the Demo Trading Platform

Each trading platform has its own interface, but most share common elements. You’ll find a chart displaying the current price of the currency pair you’re trading, order entry windows for placing buy and sell orders, and a history of your previous trades.

Maximizing the Learning Experience

To maximize your learning experience with a demo account, consider these tips:

- Start with a small demo account balance: This will help you understand the concept of risk management and avoid overtrading.

- Focus on one or two currency pairs: This will allow you to develop a deeper understanding of their price movements and trading strategies.

- Experiment with different trading strategies: Test various strategies, such as scalping, day trading, or swing trading, to see what works best for you.

- Keep a trading journal: Record your trades, including entry and exit points, profits and losses, and reasons for your decisions. This will help you identify patterns and improve your trading skills.

- Practice consistently: Regular practice is key to developing your trading skills and building confidence. Aim for at least 30 minutes of demo trading per day.

Key Concepts and Strategies for Demo Trading Forex

Demo trading forex provides a risk-free environment to learn and practice forex trading strategies before risking real money. Understanding key concepts and exploring strategies is crucial for success in the forex market.

Essential Forex Trading Concepts

Understanding core forex trading concepts is essential for navigating the market effectively. These concepts include pips, lots, and leverage.

- Pips (Points in Percentage): A pip is the smallest unit of price movement in a currency pair. It represents the fourth decimal place for most currency pairs, except for Japanese yen pairs, which use the second decimal place. For example, a move from 1.1000 to 1.1001 is a one-pip increase. Pips are crucial for calculating profits and losses on trades.

- Lots: A lot is a unit of measurement used to define the size of a forex trade. A standard lot is equal to 100,000 units of the base currency. Traders can also use mini lots (10,000 units), micro lots (1,000 units), and nano lots (100 units). The size of a lot determines the amount of margin required and the potential profit or loss on a trade.

- Leverage: Leverage allows traders to control a larger position in the market with a smaller amount of capital. Forex brokers typically offer leverage ratios of 1:50 to 1:500 or higher. For example, with 1:100 leverage, a trader can control $100,000 worth of currency with a $1,000 deposit. Leverage amplifies both profits and losses, making it essential to use it responsibly.

Common Forex Trading Strategies

There are various trading strategies that traders can employ in the forex market. Some common strategies suitable for demo accounts include:

- Scalping: Scalping involves taking advantage of small price movements by entering and exiting trades quickly. This strategy aims to generate small profits from numerous trades throughout the day. It requires close monitoring of price action and rapid execution of trades.

- Day Trading: Day traders open and close positions within the same trading day. They aim to profit from intraday price fluctuations by analyzing technical indicators and market sentiment. Day trading requires a high level of discipline and risk management.

- Swing Trading: Swing traders hold positions for a few days or weeks, aiming to capture larger price swings. They analyze charts and identify trends to identify potential entry and exit points. Swing trading requires a longer-term perspective and a focus on identifying significant market movements.

Types of Forex Orders

Different types of forex orders are available to traders, each with its specific function.

| Order Type | Function |

|---|---|

| Market Order | Executed immediately at the best available market price. |

| Limit Order | Executed at a specific price or better. |

| Stop Order | Triggered when the price reaches a specific level. |

| Stop-Limit Order | Combines the features of stop and limit orders. |

Applying Technical Indicators and Fundamental Analysis

Technical indicators and fundamental analysis are essential tools for forex traders.

Technical Indicators

Technical indicators analyze price action and volume to identify trends, patterns, and potential trading opportunities.

- Moving Averages: Moving averages smooth out price fluctuations and help identify trends. Popular moving averages include simple moving averages (SMAs) and exponential moving averages (EMAs).

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought and oversold conditions. It can help identify potential trend reversals.

- MACD (Moving Average Convergence Divergence): The MACD identifies trend changes by comparing two moving averages. It can signal potential buy or sell opportunities.

Fundamental Analysis

Fundamental analysis examines economic and political factors that influence currency values.

- Interest Rates: Central banks’ interest rate decisions can significantly impact a currency’s value. Higher interest rates attract foreign investment, boosting demand for the currency.

- Economic Growth: Strong economic growth can lead to increased demand for a country’s currency. Conversely, weak economic growth can weaken the currency.

- Political Stability: Political instability can negatively affect a currency’s value. Investors may avoid investing in countries with political uncertainties.

Demo Trading Forex for Different Skill Levels

Demo trading forex offers a valuable platform for traders of all skill levels to hone their skills, experiment with strategies, and gain experience without risking real money. The flexibility of demo accounts allows beginners to learn the basics, while experienced traders can refine their strategies and test new approaches.

Strategies and Tips for Beginners

Beginners can leverage demo trading to develop a solid foundation in forex trading. Here are some essential strategies and tips:

- Familiarize yourself with the platform: Start by navigating the demo trading platform and understanding its features, including order placement, chart analysis tools, and risk management settings.

- Practice basic technical analysis: Learn to identify trends, support and resistance levels, and common chart patterns using indicators like moving averages and MACD.

- Experiment with different order types: Explore market orders, limit orders, stop-loss orders, and take-profit orders to understand their functionality and application in different market conditions.

- Focus on risk management: Practice setting stop-loss orders and position sizing to limit potential losses and protect your virtual capital.

- Keep a trading journal: Record your trades, including entry and exit points, reasons for your decisions, and the outcome. This helps identify areas for improvement and track your progress.

Advanced Techniques for Experienced Traders

Experienced traders can utilize demo accounts to test advanced strategies, backtest historical data, and explore new trading instruments without risking real capital.

- Backtesting trading strategies: Use historical data to test the performance of your trading system and identify potential weaknesses or areas for optimization.

- Simulating real-market conditions: Adjust the demo account settings to mimic real-market volatility and liquidity, creating a more realistic trading environment.

- Exploring new trading instruments: Experiment with different currency pairs, exotic currencies, or other financial instruments to expand your trading knowledge and diversify your portfolio.

- Testing advanced trading techniques: Practice complex strategies like scalping, arbitrage, or high-frequency trading in a risk-free environment.

- Developing a trading plan: Refine your trading plan, including entry and exit criteria, risk management rules, and position sizing based on your experience and market analysis.

Improving Trading Skills Through Demo Trading

A structured program can enhance your trading skills through consistent practice and analysis on a demo account.

- Set clear goals: Define your objectives for demo trading, whether it’s mastering technical analysis, developing a specific trading strategy, or improving risk management.

- Develop a trading routine: Establish a regular schedule for demo trading, allocating dedicated time to practice and review your performance.

- Focus on specific areas: Identify your weaknesses and dedicate time to practicing those specific areas, such as risk management, order execution, or technical analysis.

- Track your progress: Monitor your trading performance on the demo account, analyze your results, and identify areas for improvement.

- Review and adjust your approach: Regularly review your trading journal and make adjustments to your strategies or risk management based on your analysis and experience.

Importance of Consistent Practice and Analysis

Consistent practice and thorough analysis are crucial for success in forex trading, whether on a demo or live account.

“Practice makes perfect.”

- Develop muscle memory: Consistent practice helps develop muscle memory for executing trades efficiently and confidently.

- Identify trading biases: Regular analysis of your trades can help identify and address any emotional biases or behavioral patterns that may be affecting your decision-making.

- Improve risk management: Consistent practice allows you to refine your risk management strategies and develop a disciplined approach to managing your trades.

- Build confidence: Successful trading on a demo account builds confidence and prepares you for the transition to live trading.

Transitioning from Demo Trading to Live Trading

The transition from demo trading to live trading is a crucial step for any aspiring forex trader. While demo trading provides a safe environment to learn and experiment, the real-world experience of live trading brings unique challenges and considerations. Understanding these differences and developing the necessary skills and mindset is essential for success in the live market.

Key Considerations When Transitioning from Demo to Live Trading

The transition from demo to live trading involves a significant shift in mindset and approach. The risk-free environment of demo trading doesn’t reflect the real financial consequences of live trading. Here are some key considerations to navigate this transition:

- Psychological Impact: The fear of losing real money can significantly impact trading decisions, leading to impulsive actions and emotional trading. It’s crucial to develop a disciplined and unemotional approach to trading.

- Risk Management: In demo trading, losses are virtual. However, in live trading, losses are real and can impact your capital. Implementing a robust risk management strategy, such as setting stop-loss orders and limiting position size, is crucial.

- Market Dynamics: The demo market is often less volatile and predictable compared to the live market. The live market is influenced by real-world events, news, and sentiment, making it more dynamic and unpredictable.

- Trading Costs: Demo trading doesn’t account for trading costs like commissions, spreads, and overnight fees. These costs can significantly impact profitability, and it’s essential to factor them into your trading plan.

- Trading Psychology: The psychological impact of trading with real money can be significant. Developing a disciplined and unemotional approach to trading is crucial to avoid impulsive decisions and emotional trading.

Potential Challenges and Strategies for Overcoming Them

The transition to live trading can be challenging, but with proper preparation and a well-defined strategy, you can overcome these hurdles.

- Fear of Loss: The fear of losing real money can lead to hesitation and indecisiveness. Overcoming this fear requires a disciplined approach, focusing on risk management and your trading plan.

- Emotional Trading: Emotional trading, driven by greed, fear, or excitement, can lead to poor decisions. Developing a detached and analytical approach to trading, focusing on objective data and signals, is essential.

- Overtrading: The excitement of live trading can lead to overtrading, taking on too many positions or trading too frequently. Maintaining a disciplined trading plan, respecting your risk management rules, and sticking to your strategy is crucial.

- Lack of Discipline: The lack of discipline can lead to deviations from your trading plan and poor risk management. Maintaining a consistent and disciplined approach to trading, even during periods of losses or market volatility, is essential.

- Inability to Adapt: The market is constantly evolving, and it’s crucial to adapt your strategies and approach. Continuous learning, staying updated on market trends, and adjusting your trading plan based on changing market conditions are vital for success.

Managing Risk and Emotions in Live Trading

Managing risk and emotions is paramount for successful live trading.

- Risk Management Strategies: Implementing a robust risk management strategy is crucial. This includes setting stop-loss orders to limit potential losses on each trade, defining position size based on your risk tolerance, and diversifying your portfolio to reduce overall risk.

- Emotional Control Techniques: Developing emotional control techniques is essential. This includes recognizing and managing your emotions, avoiding impulsive decisions, and sticking to your trading plan, even during periods of stress or market volatility.

- Trading Journal: Maintaining a trading journal can help you analyze your trading performance, identify patterns, and track your progress. It can also help you identify emotional biases and develop strategies for overcoming them.

- Seek Professional Guidance: If you’re struggling with managing risk and emotions, consider seeking guidance from a professional trading mentor or coach. They can provide valuable insights and support to help you develop the necessary skills and mindset.

Checklist for Ensuring Readiness for Live Trading

Before transitioning to live trading, ensure you have a solid foundation in forex trading and a well-defined plan.

- Thorough Understanding of Forex Trading: You should have a comprehensive understanding of forex fundamentals, including currency pairs, trading instruments, market analysis, and risk management.

- Developed Trading Strategy: You should have a clear and well-defined trading strategy that Artikels your entry and exit points, risk management rules, and profit targets.

- Proven Track Record: You should have a consistent track record of profitable trading in your demo account, demonstrating your ability to execute your strategy and manage risk effectively.

- Adequate Capital: You should have sufficient capital to fund your live trading account, allowing you to trade your strategy without risking more than you can afford to lose.

- Risk Management Plan: You should have a detailed risk management plan that Artikels your stop-loss orders, position size, and risk tolerance.

- Trading Journal: You should be prepared to maintain a trading journal to track your trades, analyze your performance, and identify areas for improvement.

Last Recap

Demo trading forex is an invaluable tool for aspiring traders, offering a safe space to learn, practice, and gain confidence. As you master the fundamentals, you can gradually transition to live trading with a solid foundation and a clear understanding of the market dynamics. The knowledge and experience gained through demo trading will empower you to navigate the forex market with greater skill and awareness, setting you on the path to success.

Popular Questions: Demo Trading Forex

How long should I use a demo account?

There’s no set timeframe. Spend as much time as needed to feel comfortable with the platform, strategies, and market dynamics before moving to live trading.

Can I use a demo account for a long time?

Yes, many brokers offer demo accounts with no expiration date. However, it’s essential to eventually transition to live trading to gain real-world experience.

Is demo trading the same as live trading?

While demo trading provides a realistic simulation, it lacks the emotional and psychological aspects of live trading. Real-world market conditions and your own emotions can influence your decisions in live trading.

Can I use a demo account to test automated trading systems?

Yes, demo accounts are ideal for backtesting and testing automated trading strategies before deploying them in a live environment.