- What is a Forex Demo Account?

- Benefits of a Free Forex Demo Account

- How to Choose the Right Forex Demo Account

- Getting Started with a Forex Demo Account

- Tips for Effective Forex Demo Account Usage

- Limitations of Forex Demo Accounts

- Real-World Applications of Forex Demo Accounts

- Concluding Remarks

- FAQs: Free Demo Account Forex

Free demo account forex – Free Forex demo accounts are a valuable tool for both novice and experienced traders. They offer a risk-free environment to practice trading strategies, explore different platforms, and learn the intricacies of the Forex market without risking real capital. These accounts provide virtual funds and access to real-time market data, allowing traders to develop their skills and build confidence before venturing into live trading.

The benefits of a free demo account extend beyond learning. They provide a platform for testing trading strategies, analyzing market trends, and understanding the nuances of risk management. By experimenting with different indicators, platforms, and trading styles, traders can refine their approach and identify the methods that best suit their individual needs and risk tolerance.

What is a Forex Demo Account?

A Forex demo account is a risk-free environment that simulates real-time trading conditions, allowing you to practice trading foreign currencies without using real money.

The Purpose of a Forex Demo Account

A Forex demo account serves as a virtual trading platform where you can learn the intricacies of Forex trading without risking your capital. It provides a safe space to experiment with different trading strategies, familiarize yourself with the trading platform, and develop your skills before venturing into live trading.

Benefits of Using a Forex Demo Account

For Beginners

- Learn the basics of Forex trading: A demo account allows you to understand the fundamental concepts of Forex, including currency pairs, pips, leverage, and order types, without the pressure of financial risk.

- Practice trading strategies: You can experiment with different trading strategies, such as scalping, day trading, and swing trading, and observe their effectiveness in a risk-free environment.

- Develop trading skills: A demo account provides a platform to hone your trading skills, including market analysis, risk management, and order execution, without risking your own funds.

For Experienced Traders

- Test new trading strategies: Experienced traders can use demo accounts to backtest new strategies, analyze market conditions, and evaluate the effectiveness of their trading plans before implementing them in live markets.

- Practice with different trading platforms: Demo accounts allow you to explore different trading platforms and choose the one that best suits your needs and trading style.

- Develop a trading plan: A demo account provides a structured environment to develop and refine your trading plan, including entry and exit points, stop-loss orders, and risk management strategies.

Key Features of a Forex Demo Account

- Virtual funds: Demo accounts typically provide a predetermined amount of virtual funds, allowing you to trade without risking your real money.

- Trading platforms: Demo accounts usually offer access to the same trading platforms used for live trading, providing a realistic trading experience.

- Educational resources: Many Forex brokers offer educational resources, such as tutorials, webinars, and market analysis tools, to support your learning journey.

Benefits of a Free Forex Demo Account

A free Forex demo account is an invaluable tool for traders of all levels, offering a risk-free environment to learn, practice, and refine their trading skills. It simulates real market conditions, allowing you to experiment with strategies, manage risk, and gain valuable experience without risking any real capital.

Learning and Practicing Trading Strategies

A demo account provides a safe space to experiment with different trading strategies without risking real money. You can test various technical indicators, chart patterns, and trading systems in a simulated environment. This allows you to identify profitable strategies and understand how they perform in different market conditions.

Developing Risk Management Skills

Risk management is crucial in Forex trading, and a demo account provides an ideal platform to practice and refine your risk management skills. You can experiment with different position sizes, stop-loss orders, and other risk management techniques to determine what works best for you. This experience will help you develop a robust risk management plan for when you start trading with real money.

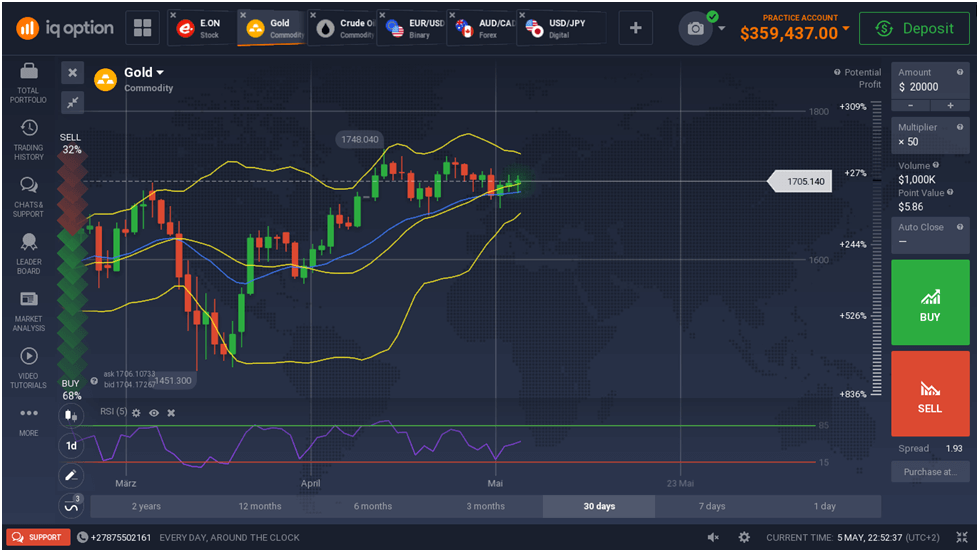

Testing Trading Platforms and Indicators

The Forex market offers a wide range of trading platforms and indicators. A demo account allows you to explore different platforms, compare their features, and find the one that best suits your trading style. You can also test various indicators to see how they perform in different market conditions and identify the ones that provide the most valuable insights.

How to Choose the Right Forex Demo Account

Choosing the right Forex demo account is crucial for beginners and experienced traders alike. It allows you to practice your trading strategies without risking real money and familiarize yourself with different platforms and brokers. This section will guide you through the process of selecting a demo account that meets your specific needs.

Factors to Consider When Choosing a Forex Demo Account

When choosing a Forex demo account, several factors need to be considered. These factors will help you identify a demo account that aligns with your trading goals and preferences.

- Platform Features: The platform should offer features that are essential for your trading style. Some key features to consider include charting tools, technical indicators, order types, and real-time market data. A user-friendly interface is also essential for a smooth trading experience.

- Trading Instruments: Different brokers offer access to a wide range of trading instruments, including currency pairs, commodities, indices, and cryptocurrencies. Choose a demo account that provides access to the instruments you are interested in trading.

- Account Types: Forex brokers offer various account types, each with different features and requirements. Some common account types include standard accounts, mini accounts, and micro accounts. Consider the minimum deposit requirements, leverage, and trading conditions offered by each account type.

- Customer Support: Reliable customer support is essential for any Forex broker. Look for a broker that offers responsive and helpful support, whether through phone, email, or live chat.

- Regulation: Ensure that the broker is regulated by a reputable financial authority. This helps ensure the safety of your funds and protects you from fraudulent activities.

Comparing Forex Brokers

Once you have identified the key factors for your demo account, it’s time to compare different Forex brokers.

- Read Reviews: Look for reviews from other traders to get an unbiased perspective on the broker’s reputation, platform performance, and customer support.

- Compare Demo Account Features: Check the demo account features offered by different brokers, such as the platform, trading instruments, account types, and trading conditions.

- Test the Platform: Most brokers offer a free demo account that allows you to test their platform without risking real money. This is a great opportunity to see if the platform is user-friendly and meets your trading needs.

- Contact Customer Support: Reach out to the broker’s customer support team to assess their responsiveness and helpfulness.

Tips for Finding a Reputable Forex Broker

Choosing a reputable Forex broker is crucial for a safe and enjoyable trading experience.

- Look for Regulation: Ensure that the broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK or the National Futures Association (NFA) in the US.

- Check for Transparency: A reputable broker will be transparent about its fees, trading conditions, and risk disclosures.

- Read Independent Reviews: Look for reviews from independent sources, such as Forex forums and websites, to get an unbiased perspective on the broker’s reputation.

Getting Started with a Forex Demo Account

Opening a Forex demo account is the first step towards exploring the exciting world of currency trading. It allows you to practice your trading skills in a risk-free environment, without risking any real money.

Steps to Open a Forex Demo Account

To open a Forex demo account, you typically need to follow these steps:

- Choose a Forex Broker: Select a reputable Forex broker that offers a demo account. Consider factors such as platform features, trading conditions, and customer support.

- Visit the Broker’s Website: Go to the broker’s website and navigate to the demo account section. You’ll usually find a prominent “Demo Account” or “Free Trial” button.

- Complete the Registration Form: Fill out the registration form, providing your basic personal details, such as your name, email address, and phone number. You may also be asked to choose a username and password for your demo account.

- Verify Your Email: The broker will send a verification email to your registered email address. Click on the verification link in the email to activate your demo account.

- Download the Trading Platform: Download the trading platform provided by the broker. Most brokers offer popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5).

- Log In to Your Demo Account: Use your chosen username and password to log in to the trading platform. You’ll have access to a virtual trading environment with a pre-loaded demo account balance.

Information Required for Demo Account Registration

The information you’ll typically need to provide when registering for a Forex demo account includes:

- Personal Details: Name, email address, phone number, and country of residence.

- Account Preferences: Preferred trading platform, account currency, and demo account balance.

Navigating the Demo Trading Platform and Placing Trades

Once you’ve logged in to your demo account, you can explore the trading platform and start placing virtual trades. Here’s a basic guide:

- Familiarize Yourself with the Interface: The trading platform’s interface may seem complex at first, but most platforms have user-friendly features and tutorials. Take some time to explore the various sections and menus.

- Choose a Trading Instrument: Select the currency pair you want to trade. Forex trading involves buying one currency and selling another. For example, you could trade EUR/USD, which means buying euros and selling US dollars.

- Place a Trade Order: Open a trade order by specifying the trade direction (buy or sell), the order size (the amount of currency you want to trade), and the entry price (the price at which you want to enter the trade).

- Monitor Your Trades: The trading platform will display your open trades and their current profit or loss. You can also set stop-loss and take-profit orders to manage your risk and protect your profits.

- Close Your Trades: When you’re ready to exit a trade, you can close it by placing a closing order at the current market price or at a specific price.

Tips for Effective Forex Demo Account Usage

A Forex demo account offers a valuable opportunity to hone your trading skills and gain experience in a risk-free environment. To make the most of this platform, consider implementing strategies that enhance your learning and prepare you for real-world trading.

Setting Realistic Goals and Tracking Performance

Setting realistic goals is crucial for effective demo account usage. Define specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your progress. Track your trading performance meticulously, recording your trades, profits, losses, and the reasons behind them. This data provides valuable insights into your trading patterns, strengths, and weaknesses, enabling you to refine your strategies.

Integrating Demo Account Trading with Real-World Practices

While a demo account provides a risk-free environment, it’s essential to integrate its practices with real-world trading. This involves mimicking real-world scenarios by:

- Utilizing realistic trading sizes: Experiment with various lot sizes to understand their impact on your account balance and risk exposure. This will prepare you for the financial implications of trading in a live environment.

- Adhering to a trading plan: Develop a comprehensive trading plan that Artikels your entry and exit points, risk management strategies, and profit targets. This discipline helps you stay focused and consistent, even in the absence of real-world financial consequences.

- Managing your emotions: The demo account allows you to practice emotional control, a critical aspect of successful trading. By simulating real-world pressures, you can learn to avoid impulsive decisions driven by fear or greed.

Utilizing Advanced Trading Features

Most Forex demo accounts offer advanced trading features that can enhance your learning experience. These features include:

- Technical analysis tools: Explore various technical indicators and charting tools to identify potential trading opportunities and gain a deeper understanding of market trends.

- Economic calendar: Stay informed about upcoming economic events and their potential impact on currency prices. This information can help you make informed trading decisions.

- Virtual trading contests: Participate in virtual trading competitions to test your skills against other traders and gain valuable experience in a competitive environment.

Staying Disciplined and Focused

Maintaining discipline and focus is essential for maximizing the effectiveness of your demo account. This involves:

- Avoiding overtrading: Limit the number of trades you make, focusing on high-quality setups rather than chasing every market movement. This helps you avoid impulsive decisions and manage your risk effectively.

- Regularly reviewing your performance: Analyze your trading results and identify areas for improvement. This ongoing evaluation helps you refine your strategies and optimize your trading approach.

- Staying updated on market trends: Keep abreast of current market conditions and economic events to ensure your trading strategies remain relevant and effective.

Limitations of Forex Demo Accounts

While Forex demo accounts are excellent tools for learning and practicing trading, they have limitations that distinguish them from real trading accounts. These limitations are crucial to understand before transitioning to live trading.

Market Conditions

The market conditions in a demo account often differ from those in a live trading environment. Demo accounts usually use simulated data, which may not accurately reflect the real-time fluctuations of the forex market.

- Slippage: In a live market, slippage occurs when the desired entry or exit price is not available due to rapid market movements. Demo accounts often don’t accurately simulate slippage, which can lead to unrealistic profit expectations.

- Spreads: Spreads, the difference between the bid and ask price, are a cost of trading. Demo accounts may not always accurately reflect the spreads charged by brokers in live trading.

- Market Volatility: The simulated market in a demo account may not accurately reflect the volatility of the real forex market, which can significantly impact trading outcomes.

Trading Psychology

Trading psychology is a crucial aspect of successful forex trading. Demo accounts can create a false sense of security, as there are no real financial risks involved. This can lead to overconfidence and risky trading decisions that may not be sustainable in a live trading environment.

- Risk Management: Demo accounts often don’t encourage disciplined risk management, as there are no real financial consequences for losses. This can lead to reckless trading and the potential for significant losses when transitioning to a live account.

- Emotional Control: The absence of real financial risk in a demo account can make it difficult to manage emotions like fear and greed, which are essential for successful trading in a live environment.

Transitioning to Live Trading, Free demo account forex

The transition from a demo account to a live trading account requires careful consideration and preparation.

- Start Small: Begin with a small trading capital in your live account to minimize potential losses. This allows you to test your strategies and adjust your risk management approach.

- Practice Patience: Trading in a live environment requires patience and discipline. Avoid impulsive decisions and focus on your pre-defined trading plan.

- Monitor Your Performance: Regularly analyze your live trading performance and identify areas for improvement. This includes evaluating your risk management, trading strategies, and emotional control.

Real-World Applications of Forex Demo Accounts

Forex demo accounts offer a valuable tool for traders of all levels, from beginners to experienced professionals. They provide a risk-free environment to practice trading strategies, explore new market dynamics, and develop essential trading skills without risking real capital.

Educational Programs and Trading Competitions

Demo accounts are widely used in educational programs and trading competitions to provide a safe and controlled environment for learning and skill development. They allow students to experiment with different trading strategies, understand market dynamics, and gain hands-on experience without financial risk.

Educational programs often incorporate demo accounts as a crucial component of their curriculum, enabling students to apply theoretical concepts to real-world scenarios.

Trading competitions often utilize demo accounts to create a level playing field for participants, ensuring that all competitors have equal access to market data and trading tools.

Testing and Refining Trading Strategies

Demo accounts serve as a virtual laboratory for traders to test and refine their trading strategies before deploying them in live markets. This allows traders to identify potential weaknesses in their strategies, optimize parameters, and gain confidence in their trading decisions.

Traders can experiment with different indicators, timeframes, and risk management techniques on a demo account to find the optimal settings for their trading style.

By backtesting their strategies on historical data, traders can assess their effectiveness and make adjustments before risking real capital.

Practice Trading Psychology and Risk Management

Demo accounts provide a valuable platform for traders to practice their trading psychology and risk management skills in a safe and controlled environment.

Traders can learn to control their emotions, manage their risk exposure, and develop a disciplined trading approach without the pressure of financial losses.

By simulating real-market conditions, demo accounts help traders develop a strong foundation in risk management principles and learn to avoid common trading pitfalls.

Concluding Remarks

A free Forex demo account is an essential stepping stone for anyone interested in Forex trading. It provides a safe and accessible way to gain practical experience, develop trading skills, and build confidence before committing real funds. By taking advantage of the resources and opportunities offered by a demo account, traders can pave the way for successful and profitable trading in the dynamic world of Forex.

FAQs: Free Demo Account Forex

How long can I use a free Forex demo account?

Most brokers offer free demo accounts with an indefinite timeframe, allowing you to practice as long as you need.

Can I use a demo account to trade real money?

No, demo accounts use virtual funds and do not allow you to trade with real money.

Do demo accounts reflect real market conditions?

While demo accounts provide access to real-time market data, they may not fully replicate the emotional and psychological factors present in live trading.