Best forex trade brokers are the key to unlocking the potential of the foreign exchange market. Choosing the right broker can significantly impact your trading experience, from the quality of their platform to the availability of educational resources.

Navigating the world of forex trading can be daunting, but with the right broker by your side, you can gain access to a global market with vast opportunities. This guide explores the essential factors to consider when selecting a broker, the different types of brokers available, and how to identify the best fit for your individual needs.

Understanding Forex Trading

Forex trading, short for foreign exchange trading, is the act of buying and selling currencies in the global marketplace. It’s the largest and most liquid financial market in the world, with trillions of dollars exchanged daily.

Currency Pairs

Currency pairs are the foundation of forex trading. Each pair represents the exchange rate between two currencies. For example, the EUR/USD pair represents the exchange rate between the Euro (EUR) and the US Dollar (USD). When you buy a currency pair, you are essentially buying one currency and selling the other.

Leverage

Leverage allows traders to control a larger position in the market with a smaller initial investment. It’s a powerful tool that can amplify both profits and losses. For example, a leverage of 1:100 means that you can control $100,000 worth of currency with an initial investment of only $1,000.

Pips

Pips, or points in percentage, are the smallest unit of measurement in forex trading. They represent the smallest change in the exchange rate between two currencies. The value of a pip varies depending on the currency pair and the size of the trade.

Types of Forex Orders

Forex traders use different types of orders to execute their trades. Here are some common order types:

Market Orders

A market order is an order to buy or sell a currency pair at the current market price. Market orders are executed immediately, but they may not be filled at the exact price you want.

Limit Orders

A limit order is an order to buy or sell a currency pair at a specific price or better. Limit orders allow traders to control the price at which they enter or exit a trade.

Stop-Loss Orders

A stop-loss order is an order to buy or sell a currency pair when the price reaches a specific level. Stop-loss orders are used to limit potential losses on a trade.

Factors Influencing Forex Prices

Several factors can influence forex prices, including:

Economic Data

Economic data releases, such as GDP growth, inflation rates, and unemployment figures, can significantly impact currency values.

Political Events

Political events, such as elections, government policies, and international conflicts, can also influence forex prices.

Market Sentiment

Market sentiment refers to the overall mood of traders in the market. When traders are optimistic about a currency, its value tends to rise. Conversely, when traders are pessimistic, the currency’s value may fall.

Choosing the Right Forex Broker: Best Forex Trade Brokers

Choosing the right forex broker is crucial for your success in the forex market. A good broker will provide you with a reliable trading platform, competitive trading conditions, and excellent customer support.

Regulation

Regulation is essential for ensuring the safety of your funds and protecting you from fraudulent activities. A regulated broker is subject to strict rules and oversight by a financial authority, which helps to ensure that they operate fairly and transparently.

To verify a broker’s legitimacy, you can check if they are regulated by a reputable financial authority, such as:

- The Financial Conduct Authority (FCA) in the UK

- The National Futures Association (NFA) in the US

- The Australian Securities and Investments Commission (ASIC) in Australia

- The Cyprus Securities and Exchange Commission (CySEC) in Cyprus

You can also check the broker’s website for information about their regulation and licensing.

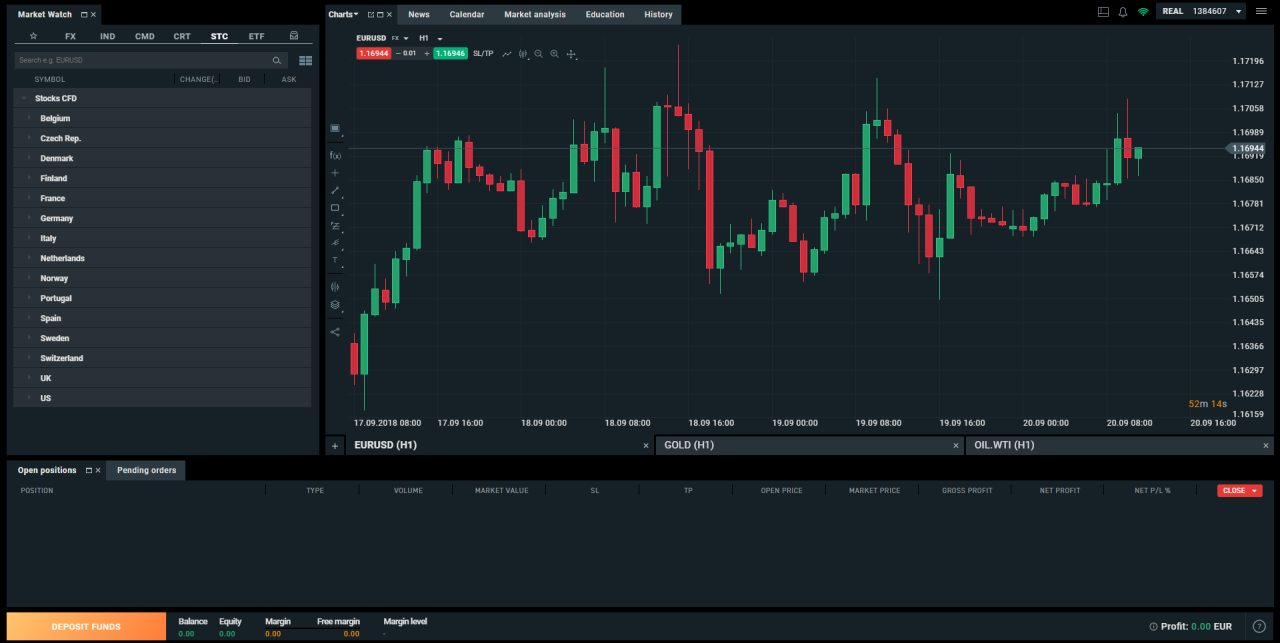

Trading Platform

The trading platform is the software that you use to access the forex market and place your trades. It is essential to choose a platform that is user-friendly, reliable, and offers the features that you need.

Some popular forex trading platforms include:

- MetaTrader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

Consider factors such as the platform’s charting capabilities, order execution speed, and availability of technical indicators when choosing a platform.

Spreads

The spread is the difference between the bid price (the price at which you can sell a currency) and the ask price (the price at which you can buy a currency). A lower spread means that you will pay less in trading costs.

When choosing a broker, it is important to compare the spreads offered by different brokers. Some brokers offer variable spreads, which fluctuate based on market conditions, while others offer fixed spreads, which remain constant.

Customer Support

Customer support is essential, especially when you are new to forex trading. A good broker will offer responsive and helpful customer support via phone, email, or live chat.

You should also consider the broker’s availability hours and the languages that they support.

Types of Forex Brokers

There are different types of forex brokers, each with its own advantages and disadvantages.

ECN Brokers

ECN brokers act as a middleman between you and the interbank market, allowing you to trade directly with other market participants. This means that you will generally get better prices and lower spreads. However, ECN brokers often have higher minimum deposit requirements and may charge commissions on trades.

STP Brokers

STP brokers use a “straight-through processing” model, which means that your trades are passed directly to a liquidity provider. This can result in faster execution speeds and lower spreads than market makers. However, STP brokers may not offer the same level of transparency as ECN brokers.

Market Makers

Market makers are brokers who act as counterparties to your trades. This means that they are the ones who buy or sell against your trades. Market makers often offer lower minimum deposit requirements and may have more generous bonus programs. However, they may also have higher spreads and may not always execute your trades at the best possible price.

Best Forex Trading Platforms

Choosing the right forex trading platform is crucial for success in the market. It’s your interface to the world of forex trading, providing tools and features that enable you to execute trades, analyze market data, and manage your positions.

Comparison of Popular Forex Trading Platforms

The forex trading platform landscape offers a variety of choices, each with its own set of features and functionalities. Let’s compare three of the most popular platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

| Feature | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) | cTrader |

|---|---|---|---|

| Charting Tools | Wide range of technical indicators and drawing tools | More advanced charting features, including depth of market (DOM) | Advanced charting capabilities with customizable layouts and indicators |

| Indicators | Extensive library of built-in indicators | Expanded library of indicators, including economic indicators | Customizable indicators and the ability to create your own |

| Order Execution | Supports market, limit, and stop orders | Supports market, limit, stop, and trailing stop orders | Fast and reliable order execution with advanced order types |

| Mobile App Availability | Available for both iOS and Android | Available for both iOS and Android | Available for both iOS and Android |

| Automated Trading | Supports Expert Advisors (EAs) for automated trading | Supports Expert Advisors (EAs) with more advanced functionality | Supports automated trading with advanced features and customization options |

| Other Features | News feeds, economic calendar, and trading signals | Advanced features, including a built-in strategy tester and multi-currency accounts | Advanced features, including a customizable workspace, and a wide range of order types |

Pros and Cons of Each Platform

Each platform has its own strengths and weaknesses. Consider the following pros and cons to determine the best fit for your trading style and needs:

| Platform | Pros | Cons |

|---|---|---|

| MetaTrader 4 (MT4) |

|

|

| MetaTrader 5 (MT5) |

|

|

| cTrader |

|

|

Choosing the Right Platform

The best forex trading platform for you depends on your individual trading style, needs, and experience level. Consider the following factors:

- Trading Style: Scalpers, day traders, and swing traders may have different requirements for order execution speed, charting tools, and indicators.

- Experience Level: Beginners may prefer a user-friendly platform with a wide range of educational resources, while experienced traders may prefer a more advanced platform with greater customization options.

- Features and Functionality: Evaluate the platform’s charting tools, indicators, order execution, mobile app availability, and automated trading capabilities.

- Broker Compatibility: Ensure that the platform is compatible with your chosen forex broker.

- Customer Support: Look for a platform with reliable customer support and comprehensive documentation.

Forex Trading Strategies

Forex trading strategies are essential for navigating the volatile world of currency markets. These strategies provide a framework for decision-making, helping traders to identify potential opportunities and manage risk. The choice of strategy depends on individual trading goals, risk tolerance, and available time commitment. Let’s delve into some popular Forex trading strategies, exploring their intricacies and suitability for different trader profiles.

Scalping

Scalping is a high-frequency trading strategy that aims to profit from small price fluctuations in the Forex market. Scalpers typically open and close trades within a short timeframe, often within seconds or minutes. The goal is to capitalize on small price movements by taking advantage of market volatility.

Scalping requires a high level of technical analysis skills and quick reflexes. It involves constantly monitoring charts for short-term trends and identifying potential entry and exit points. Scalpers often rely on technical indicators and candlestick patterns to identify trading opportunities.

Scalping can be highly profitable if executed correctly, but it also carries significant risks. The rapid pace of trading can lead to emotional decisions and potential losses if the market moves against the trader. Scalpers need to be disciplined and have a clear exit strategy to manage risk effectively.

Day Trading

Day trading involves opening and closing trades within the same trading day, aiming to profit from intraday price movements. Unlike scalping, day traders may hold positions for longer periods, ranging from minutes to hours. The focus is on capturing short-term trends and momentum within the daily trading session.

Day trading requires a strong understanding of technical analysis and market sentiment. Traders need to identify potential support and resistance levels, monitor price action, and analyze trading volume to anticipate market direction. Day traders often use charting tools, technical indicators, and news events to make trading decisions.

Day trading can be a rewarding strategy for traders who are willing to devote time and effort to market analysis. However, it also carries risks associated with market volatility and the potential for overnight price gaps. Day traders need to have a solid risk management plan and be prepared to manage potential losses.

Swing Trading

Swing trading is a medium-term trading strategy that aims to capture price swings or “swings” in the Forex market. Swing traders typically hold positions for several days or weeks, seeking to profit from larger price movements. They often rely on technical analysis, fundamental analysis, and market sentiment to identify potential trading opportunities.

Swing traders look for key levels of support and resistance, chart patterns, and economic indicators to identify potential entry and exit points. They may also use fundamental analysis to assess the economic outlook of a currency pair and identify potential catalysts for price movements.

Swing trading offers the potential for larger profits than scalping or day trading, but it also requires a longer time commitment and a higher risk tolerance. Swing traders need to be patient and able to ride out short-term fluctuations in the market while waiting for their trade to reach its target.

Long-Term Investing

Long-term investing in Forex involves holding currency positions for extended periods, often months or even years. This strategy focuses on capturing long-term trends and benefiting from the long-term appreciation of a currency. Long-term investors often rely on fundamental analysis to identify undervalued currencies and economies with strong growth potential.

Long-term Forex investing is typically a lower-risk strategy than short-term trading, as investors have more time to ride out market fluctuations. However, it also requires a higher level of patience and a longer-term perspective. Long-term investors need to be able to withstand market volatility and maintain their investment strategy over extended periods.

The choice of a suitable Forex trading strategy depends on individual preferences, risk tolerance, and trading goals. Each strategy has its own unique characteristics and associated risks. Understanding these factors is crucial for selecting the right strategy and maximizing trading success.

Forex Trading Strategies: A Comparison

| Strategy | Timeframe | Risk Profile | Suitability |

|---|---|---|---|

| Scalping | Seconds to minutes | High | Experienced traders with high risk tolerance and quick reflexes |

| Day Trading | Minutes to hours | Medium | Active traders with strong technical analysis skills and a disciplined approach |

| Swing Trading | Days to weeks | Medium to high | Traders with patience and a willingness to ride out market fluctuations |

| Long-Term Investing | Months to years | Low | Investors with a long-term perspective and a lower risk tolerance |

Managing Risk in Forex Trading

In the dynamic world of forex trading, where currency values fluctuate constantly, managing risk is not just a good practice; it’s an essential survival strategy. Risk management helps protect your capital and ensures you can stay in the market long enough to capitalize on profitable opportunities. It’s about making informed decisions and taking calculated steps to minimize potential losses while maximizing the potential for gains.

Stop-Loss Orders

Stop-loss orders are your safety net in forex trading. They are pre-set instructions that automatically close your position when the price of the currency pair reaches a specified level. This helps limit your potential losses if the market moves against your position.

For example, if you buy EUR/USD at 1.1000 and set a stop-loss order at 1.0950, your position will automatically close when the price falls to 1.0950, preventing further losses.

Leverage Management

Leverage is a powerful tool in forex trading, allowing you to control a larger position with a smaller initial investment. However, leverage can amplify both profits and losses. Using leverage responsibly is crucial for risk management.

- Understand the Risks: Leverage can magnify losses, so use it with caution and only after carefully assessing your risk tolerance.

- Start Small: Begin with a small leverage ratio and gradually increase it as you gain experience and confidence.

- Monitor Your Margin: Keep a close eye on your margin requirements and ensure you have sufficient funds to cover potential losses.

Diversifying Trades

Diversification is a fundamental principle of risk management. It involves spreading your investment across different assets or currency pairs to reduce the impact of losses on any single position.

- Currency Pair Selection: Choose a mix of currency pairs with varying levels of volatility and correlation. For example, you could diversify your portfolio by trading major, minor, and exotic currency pairs.

- Trading Strategies: Utilize different trading strategies, such as scalping, day trading, or swing trading, to reduce the impact of any single strategy’s performance.

Position Sizing

Position sizing refers to determining the appropriate amount of capital to allocate to each trade. It plays a crucial role in risk management by ensuring that your individual trades don’t expose you to excessive risk.

- Risk Tolerance: Your position size should align with your risk tolerance. If you’re risk-averse, you’ll likely take smaller positions, while a more aggressive trader might allocate a larger portion of their capital to each trade.

- Account Balance: Consider your overall account balance when determining position size. A general rule of thumb is to risk no more than 1-2% of your account balance on any single trade.

Educational Resources for Forex Traders

The forex market is constantly evolving, making continuous learning essential for success. Understanding market dynamics, trading strategies, and risk management is crucial for making informed trading decisions. Fortunately, numerous resources are available to help forex traders of all levels enhance their knowledge and skills.

Online Forex Education Platforms

These platforms offer a wide range of educational materials, including articles, tutorials, videos, and interactive courses. They provide valuable insights into forex fundamentals, technical analysis, trading psychology, and risk management.

- Babypips: A popular platform known for its beginner-friendly approach to forex education. It offers comprehensive courses, articles, and interactive tools to help traders learn the basics of forex trading.

- Forex Factory: A comprehensive platform that provides a wealth of resources, including news, analysis, economic calendar, and educational articles. Its forum section allows traders to connect and share their insights.

- DailyFX: A leading provider of forex education and analysis. It offers educational articles, webinars, and trading courses designed to help traders improve their understanding of the market.

Books on Forex Trading, Best forex trade brokers

Books provide a structured and in-depth understanding of forex trading concepts. They offer valuable insights into trading strategies, risk management, and market psychology.

- “Trading in the Zone” by Mark Douglas: A classic book that focuses on the psychological aspects of trading and emphasizes the importance of emotional control.

- “Japanese Candlestick Charting Techniques” by Steve Nison: A comprehensive guide to candlestick charting, a popular technical analysis tool used by forex traders.

- “The Complete Guide to Forex Trading” by Michael Martin: A beginner-friendly book that covers the fundamentals of forex trading, from basic concepts to trading strategies.

Forex Trading Courses

Structured courses provide a comprehensive and interactive learning experience. They often include live sessions, assignments, and personalized feedback from experienced instructors.

- FXTM Academy: Offers a range of online courses covering various aspects of forex trading, from beginner to advanced levels.

- IG Academy: Provides a comprehensive selection of courses and webinars on forex trading, technical analysis, and market fundamentals.

- Traders University: A platform offering online courses, webinars, and mentorship programs designed to help traders develop their skills and knowledge.

Forex Trading Webinars

Webinars offer live sessions with industry experts, providing insights into market trends, trading strategies, and current events. They allow traders to interact with speakers and ask questions in real-time.

- DailyFX Webinars: Offers regular webinars on various topics, including technical analysis, fundamental analysis, and trading strategies.

- FXTM Webinars: Provides a series of webinars covering different aspects of forex trading, from beginner to advanced levels.

- IG Webinars: Offers live webinars on market analysis, trading strategies, and economic events.

Reputable Organizations Offering Forex Trading Education and Certification Programs

These organizations offer structured programs that provide a comprehensive understanding of forex trading and industry best practices.

- The Chartered Institute for Securities & Investment (CISI): A global professional body that offers qualifications in financial markets, including forex trading.

- The International Financial Markets Association (IFMA): A professional association for individuals involved in the financial markets, including forex trading.

- The Financial Industry Regulatory Authority (FINRA): A self-regulatory organization for the securities industry in the United States, offering certification programs for forex brokers and traders.

Benefits of Continuous Learning

- Staying Updated on Market Trends: The forex market is constantly evolving, and staying informed about current trends and events is essential for making informed trading decisions.

- Improving Trading Strategies: Continuous learning allows traders to refine their trading strategies, adapt to changing market conditions, and improve their overall performance.

- Enhancing Risk Management Skills: Understanding risk management principles and staying updated on market volatility is crucial for protecting trading capital and minimizing losses.

- Developing a Trading Edge: Continuous learning can help traders develop a competitive edge by gaining a deeper understanding of market dynamics, trading strategies, and risk management techniques.

Tips for Successful Forex Trading

Navigating the world of forex trading can be both exhilarating and challenging. While the potential for profits is enticing, it’s crucial to approach trading with a strategic mindset and a disciplined approach. This section delves into essential tips that can significantly enhance your trading performance, regardless of your experience level.

Developing a Trading Plan

A well-defined trading plan serves as your roadmap to success in forex trading. It Artikels your trading goals, risk management strategies, and specific trading rules, providing a structured framework for your decisions.

- Define Your Trading Goals: Clearly articulate your objectives, whether it’s generating a specific return on investment, achieving a certain profit margin, or simply learning the intricacies of forex trading.

- Determine Your Risk Tolerance: Understand your comfort level with risk and establish a maximum loss limit for each trade. This prevents impulsive decisions and protects your capital.

- Choose Your Trading Style: Decide on your preferred trading approach, whether it’s scalping, day trading, swing trading, or long-term investing. Each style requires different strategies and time commitments.

- Select Your Trading Instruments: Focus on a few currency pairs that align with your trading style and risk tolerance. Thoroughly research their historical price movements and market dynamics.

- Establish Entry and Exit Points: Define precise criteria for entering and exiting trades based on technical indicators, fundamental analysis, or a combination of both. Avoid emotional decisions and stick to your plan.

Discipline and Patience

The forex market is dynamic and unpredictable, making it crucial to exercise discipline and patience in your trading decisions. Emotional biases can cloud judgment and lead to impulsive actions that can erode your profits.

- Avoid Overtrading: Resist the temptation to trade frequently or with excessive leverage. Focus on high-quality trades with a clear understanding of potential risks.

- Stick to Your Plan: Once you’ve established your trading plan, adhere to its rules consistently, even when faced with temptation or pressure. Avoid deviating from your strategy, as it can lead to inconsistency and poor results.

- Manage Your Emotions: Recognize and manage your emotions, particularly fear and greed. Don’t let fear prevent you from taking profitable trades, and don’t let greed lead to excessive risk-taking.

- Embrace Patience: Forex trading is a marathon, not a sprint. Be patient and allow your trades to develop according to your plan. Don’t expect quick riches or get discouraged by short-term losses.

Emotional Control

Emotions can significantly impact trading decisions, leading to impulsive actions that can jeopardize your profits. Developing emotional control is essential for successful forex trading.

- Recognize Your Emotional Triggers: Identify the factors that tend to trigger emotional reactions in your trading, such as fear of missing out (FOMO), greed, or frustration. Once you understand your triggers, you can develop strategies to manage them.

- Take Breaks When Needed: If you find yourself becoming overly emotional or stressed, take a break from trading. Stepping away allows you to regain composure and approach trading with a clear mind.

- Use Stop-Loss Orders: Implement stop-loss orders to automatically exit trades when they reach a predetermined loss level. This helps prevent significant losses due to emotional decisions.

- Practice Mindfulness: Mindfulness techniques, such as meditation or deep breathing exercises, can help you stay calm and focused during trading sessions. These practices can enhance emotional control and reduce impulsive reactions.

Evaluating Trading Results

Regularly evaluating your trading performance is crucial for identifying areas for improvement and refining your strategies. By analyzing your trades, you gain valuable insights into your strengths and weaknesses, enabling you to optimize your approach.

- Keep a Trading Journal: Maintain a detailed record of your trades, including entry and exit points, reasons for your decisions, and the outcomes. This journal provides a valuable source of data for analysis.

- Track Your Profitability: Monitor your win-loss ratio, average profit per trade, and overall return on investment. This data helps you assess your trading performance and identify areas for improvement.

- Analyze Your Mistakes: Don’t shy away from analyzing your trading errors. Identify patterns in your mistakes and learn from them to avoid repeating them in the future.

- Adjust Your Strategies: Based on your performance analysis, adjust your trading plan and strategies as needed. This iterative process helps you refine your approach and improve your results over time.

Last Point

In conclusion, choosing the best forex trade brokers is a crucial step in your forex trading journey. By carefully evaluating factors like regulation, trading platforms, spreads, and customer support, you can find a broker that empowers you to navigate the market confidently and maximize your trading potential. Remember, continuous learning and staying updated on market trends are essential for success in the dynamic world of forex trading.

Question Bank

What is the minimum deposit required for forex trading?

Minimum deposit requirements vary significantly between brokers. Some brokers offer micro accounts with as low as $5 or $10, while others may require several hundred dollars or more. It’s essential to research the minimum deposit requirements of your chosen broker before opening an account.

How can I learn more about forex trading?

There are numerous resources available for learning about forex trading. Many brokers offer free educational materials, including webinars, tutorials, and eBooks. You can also find reputable websites, books, and online courses that provide in-depth knowledge about forex trading concepts and strategies.

What are the risks associated with forex trading?

Forex trading involves inherent risks, including the potential for losing your entire investment. It’s crucial to understand and manage these risks effectively. This includes using stop-loss orders, diversifying your trades, and avoiding over-leveraging.