US Forex brokers play a crucial role in facilitating foreign exchange trading for both individual investors and institutions. These brokers provide access to the global currency markets, allowing traders to speculate on currency fluctuations and potentially earn profits. However, navigating the world of US Forex brokers can be complex, with various regulations, trading platforms, and account types to consider. This guide aims to provide a comprehensive overview of US Forex brokers, covering their key features, regulatory landscape, and the risks involved.

Choosing the right US Forex broker is essential for a successful trading experience. Factors to consider include the broker’s reputation, trading platform, account types, fees, and customer support. It’s also important to understand the regulatory environment governing US Forex brokers, as this ensures investor protection and market integrity.

What is a US Forex Broker?

A US Forex broker is a financial intermediary that facilitates foreign exchange trading for clients residing in the United States. These brokers provide access to the global forex market, enabling traders to buy and sell currencies.

Role of a US Forex Broker

US Forex brokers play a crucial role in connecting traders to the forex market. They provide a platform for executing trades, offering tools and resources to facilitate trading decisions. They also act as custodians of client funds, ensuring the security and integrity of transactions.

Key Characteristics of US Forex Brokers

US Forex brokers are subject to stringent regulations that set them apart from brokers in other jurisdictions.

Regulatory Landscape

The regulatory landscape for US Forex brokers is overseen by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These agencies establish rules and guidelines to protect investors and ensure fair market practices.

- Registration: US Forex brokers must register with the CFTC and the NFA, demonstrating compliance with regulatory standards.

- Capital Requirements: Brokers are required to maintain adequate capital reserves to mitigate risks and ensure financial stability.

- Customer Protection: Regulations mandate that client funds be segregated from the broker’s own assets, protecting them in case of insolvency.

- Transparency and Disclosure: Brokers must provide detailed information about their services, fees, and risks associated with forex trading.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Policies: US Forex brokers are subject to stringent AML and KYC policies to prevent financial crime and ensure the integrity of the market.

Choosing a US Forex Broker

Choosing the right US Forex broker is crucial for a successful trading journey. A good broker will offer competitive pricing, a reliable trading platform, and excellent customer support. This section will guide you through the essential factors to consider when selecting a US Forex broker.

Factors to Consider When Choosing a US Forex Broker

When choosing a US Forex broker, several key factors should be carefully evaluated. These factors include:

- Trading Platforms: The trading platform is your interface for accessing the forex market. Look for a platform that is user-friendly, offers real-time quotes, and provides advanced charting and analysis tools. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and proprietary platforms developed by brokers.

- Account Types: US Forex brokers offer various account types catering to different trading styles and risk appetites. Common account types include standard accounts, micro accounts, and Islamic accounts. Each account type has its own features, minimum deposit requirements, and trading conditions.

- Fees: Forex brokers charge various fees, including spreads, commissions, and inactivity fees. Compare the fee structures of different brokers to determine the most cost-effective option for your trading strategy.

- Customer Support: Reliable customer support is essential, especially for beginners. Choose a broker with responsive and knowledgeable customer service available through multiple channels, such as phone, email, and live chat.

- Regulation and Security: Ensure that the broker is regulated by a reputable financial authority, such as the National Futures Association (NFA) or the Commodity Futures Trading Commission (CFTC). Regulation provides a layer of protection for traders by ensuring that the broker operates ethically and transparently.

- Educational Resources: Some brokers offer educational resources, such as webinars, tutorials, and market analysis, to help traders improve their skills. Consider brokers that provide these resources, especially if you are new to forex trading.

Types of US Forex Brokers

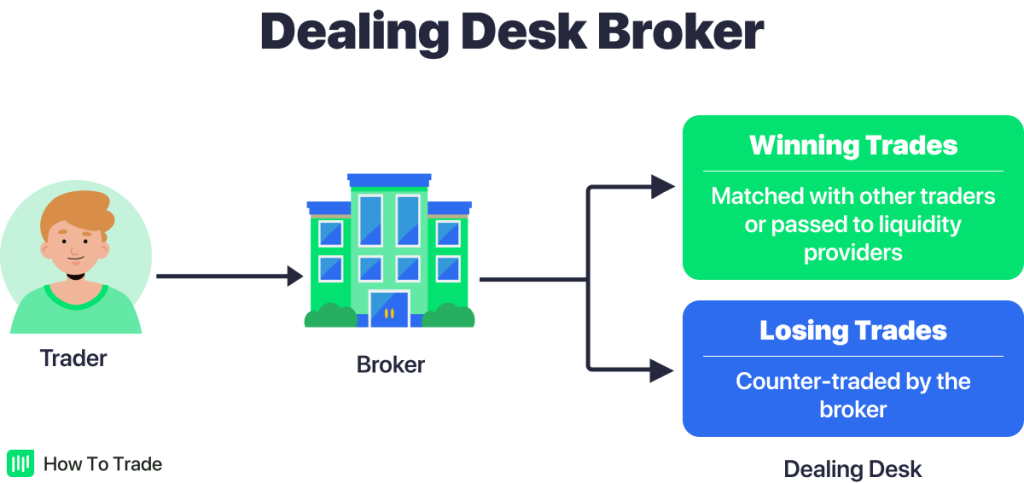

There are various types of US Forex brokers, each with its unique characteristics and advantages:

- Retail Brokers: Retail brokers cater to individual traders and offer a wide range of account types, trading platforms, and educational resources. They typically have lower minimum deposit requirements and offer more flexible trading conditions.

- Institutional Brokers: Institutional brokers cater to large institutional investors, hedge funds, and other financial institutions. They offer specialized trading platforms, advanced analytics, and lower spreads but often have higher minimum deposit requirements.

- ECN Brokers: Electronic Communication Network (ECN) brokers connect traders directly to the interbank market, offering the most transparent and competitive pricing. They typically have lower spreads but may charge higher commissions.

Comparison of Popular US Forex Brokers

| Broker | Minimum Deposit | Spreads | Trading Platforms | Regulation | Customer Support |

|—|—|—|—|—|—|

| FXCM | $50 | Variable | MT4, MT5 | NFA, CFTC | 24/5 |

| Oanda | $0 | Variable | Oanda Trade, MT4 | NFA, CFTC | 24/5 |

| TD Ameritrade | $0 | Variable | Thinkorswim | NFA, CFTC | 24/5 |

| Interactive Brokers | $10,000 | Variable | IBKR Trader, TWS | NFA, CFTC | 24/5 |

| Pepperstone | $200 | Variable | MT4, MT5, cTrader | NFA, ASIC | 24/5 |

Note: This table is for illustrative purposes only and does not constitute financial advice. The minimum deposit requirements, spreads, and other features may vary depending on the account type and trading conditions. It is essential to conduct thorough research and compare multiple brokers before making a decision.

Trading with a US Forex Broker

Trading with a US Forex broker involves accessing the global currency market and leveraging its fluctuations to generate profits. This process is facilitated by regulated platforms that offer a range of tools and resources for traders of all experience levels.

Opening a Trading Account, Us forex broker

Opening a trading account with a US Forex broker is a straightforward process that typically involves the following steps:

- Choose a Broker: Select a US Forex broker that meets your trading needs and regulatory requirements. Consider factors like trading platform, fees, customer support, and regulatory oversight.

- Provide Personal Information: Submit your personal information, including your name, address, phone number, and Social Security number, to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Fund Your Account: Deposit funds into your trading account using various methods, such as bank transfers, debit cards, or credit cards. The minimum deposit requirement may vary depending on the broker.

- Verify Your Account: Complete the account verification process by providing required documentation, such as a copy of your driver’s license or passport, to ensure account security and prevent fraud.

- Start Trading: Once your account is verified and funded, you can start trading forex using the broker’s platform.

Types of Trading Orders

US Forex brokers offer various types of trading orders to meet the diverse needs of traders. Understanding these order types is crucial for executing trades effectively and managing risk:

- Market Orders: Market orders are executed immediately at the best available price in the market. They are suitable for traders who want to enter or exit a trade quickly, but they may not always get the desired price.

- Limit Orders: Limit orders allow traders to specify a maximum price they are willing to pay (buy order) or a minimum price they are willing to sell (sell order). These orders are executed only if the market price reaches the specified limit. Limit orders are useful for traders who want to buy or sell at a specific price or avoid paying a higher price than desired.

- Stop-Loss Orders: Stop-loss orders are used to limit potential losses on a trade. They are placed at a specific price level below the entry price for a buy order or above the entry price for a sell order. Once the market price reaches the stop-loss level, the order is automatically executed, limiting further losses.

Using Trading Platforms

US Forex brokers provide advanced trading platforms that offer a wide range of features and tools to help traders analyze market data, execute trades, and manage their positions effectively.

- Charting and Technical Analysis: Trading platforms offer various charting tools and technical indicators that help traders identify trends, patterns, and potential trading opportunities. These tools allow traders to visualize price movements and analyze market data using technical analysis techniques.

- Real-Time Market Data: Trading platforms provide real-time market data, including live quotes, price charts, and news feeds, to keep traders informed about market movements and global events that may impact currency prices.

- Order Execution: Trading platforms allow traders to place various types of orders, including market orders, limit orders, and stop-loss orders, with just a few clicks. This streamlined order execution process ensures that trades are placed efficiently and accurately.

- Position Management: Trading platforms provide tools for managing open positions, including monitoring profit and loss, setting stop-loss orders, and adjusting trade sizes. These features help traders control their risk and optimize their trading strategies.

US Forex Broker Regulation and Security

Trading forex in the United States is subject to stringent regulations designed to protect investors and ensure market integrity. These regulations are implemented by the US government through various agencies and laws, including the Commodity Exchange Act (CEA) and the Dodd-Frank Wall Street Reform and Consumer Protection Act.

The Commodity Exchange Act (CEA)

The CEA, enacted in 1936 and subsequently amended, provides the legal framework for regulating commodity futures and options trading, including forex. It establishes the Commodity Futures Trading Commission (CFTC) as the primary regulator for forex brokers operating in the US. The CEA mandates that forex brokers must register with the CFTC and adhere to specific rules and regulations.

The Dodd-Frank Wall Street Reform and Consumer Protection Act

The Dodd-Frank Act, passed in 2010, further strengthened regulations for the financial industry, including forex trading. It expanded the CFTC’s authority to regulate forex brokers, requiring them to comply with additional rules related to capital adequacy, risk management, and customer protection.

The National Futures Association (NFA)

The NFA is a self-regulatory organization (SRO) authorized by the CFTC to oversee the forex industry. It plays a crucial role in ensuring that forex brokers comply with regulations and protect customer interests. The NFA sets forth specific rules and regulations for forex brokers, including requirements for capital adequacy, customer account segregation, and dispute resolution.

Key Provisions of the CEA and Dodd-Frank Act

The CEA and Dodd-Frank Act contain several key provisions that directly impact US forex brokers, including:

- Registration and Licensing: Forex brokers must register with the CFTC and obtain a license to operate in the US. This ensures that brokers meet specific requirements and are subject to regulatory oversight.

- Capital Adequacy: Forex brokers must maintain a certain level of capital to cover potential losses and ensure their financial stability. This requirement helps protect investors in case of broker insolvency.

- Customer Account Segregation: Forex brokers must segregate customer funds from their own operating capital. This means that customer funds are held in separate accounts, protecting them from potential losses incurred by the broker.

- Risk Management: Forex brokers must implement robust risk management practices to mitigate potential losses and protect customer funds. This includes establishing limits on trading positions and managing market risk.

- Transparency and Disclosure: Forex brokers are required to provide clients with clear and transparent information about their services, fees, and risks associated with forex trading. This ensures that clients make informed trading decisions.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Forex brokers must comply with AML and KYC regulations to prevent money laundering and other financial crimes. This involves verifying the identity of their clients and monitoring their transactions for suspicious activity.

The Role of the NFA in Regulating US Forex Brokers

The NFA plays a vital role in regulating and overseeing US forex brokers. It sets forth specific rules and regulations for forex brokers, including requirements for:

- Capital Adequacy: The NFA requires forex brokers to maintain a certain level of capital to cover potential losses and ensure their financial stability.

- Customer Account Segregation: The NFA mandates that forex brokers segregate customer funds from their own operating capital, ensuring that customer funds are protected from potential losses incurred by the broker.

- Dispute Resolution: The NFA provides a mechanism for resolving disputes between forex brokers and their clients. This ensures that clients have a fair and impartial process for addressing any complaints or grievances.

- Education and Training: The NFA offers educational resources and training programs for forex brokers and their employees, helping them stay up-to-date on regulatory requirements and best practices.

- Enforcement: The NFA has the authority to investigate and enforce its rules and regulations. This includes imposing fines, suspending licenses, or even revoking the registration of forex brokers that violate the rules.

Risks and Considerations

Forex trading, like any financial market, involves inherent risks. Understanding these risks and implementing effective risk management strategies is crucial for successful trading. This section will explore the key risks associated with Forex trading, the margin requirements and leverage limits imposed by US Forex brokers, and practical tips for managing risk.

Leverage and Margin Requirements

Leverage is a powerful tool that allows traders to control larger positions with a smaller amount of capital. However, it also amplifies both potential profits and losses. US Forex brokers are subject to regulations that limit the maximum leverage offered to retail clients.

- Margin Requirements: Forex brokers require traders to deposit a certain amount of funds, known as margin, to secure their trades. The margin requirement is a percentage of the total trade value, and it varies depending on the currency pair and the broker’s policies. For example, a broker may require a 1% margin for a trade in EUR/USD, meaning that a trader needs to deposit $100 to control a $10,000 position.

- Leverage Limits: US regulations typically limit leverage for retail clients to 50:1 for major currency pairs and 20:1 for minor currency pairs. This means that a trader can control a position 50 times larger than their initial margin deposit. While leverage can enhance returns, it also magnifies losses, potentially leading to significant financial losses if trades move against the trader.

Volatility and Market Manipulation

The Forex market is known for its high volatility, meaning that exchange rates can fluctuate significantly in a short period. This volatility can create opportunities for traders to profit from price movements but also poses significant risks.

- Market Manipulation: While regulated markets have measures in place to prevent manipulation, the sheer size and global nature of the Forex market can make it susceptible to manipulation by large institutional players. Such manipulation can lead to sudden and unexpected price movements that can adversely affect individual traders.

Managing Risk

Effective risk management is crucial for Forex trading. Here are some tips and strategies for managing risk:

- Use Stop-Loss Orders: Stop-loss orders are essential tools for limiting potential losses. They automatically close a trade when the price reaches a predetermined level, preventing further losses. For example, a trader may set a stop-loss order at a price point that is 1% below their entry price. If the price falls below this level, the trade will be closed automatically, limiting the potential loss to 1% of the total trade value.

- Diversify Your Portfolio: Diversifying your Forex portfolio across different currency pairs can help reduce risk. By spreading your investments across multiple currencies, you are less likely to be affected by the performance of any single currency. For example, instead of focusing solely on EUR/USD, you might consider adding positions in GBP/USD, AUD/USD, and USD/JPY.

- Control Your Position Size: The size of your trades should be proportionate to your account balance and risk tolerance. Overtrading, or taking on positions that are too large for your account, can lead to significant losses. It’s essential to start small and gradually increase your position size as you gain experience and confidence.

- Use a Demo Account: A demo account allows you to practice Forex trading in a risk-free environment. It’s a valuable tool for learning about different trading strategies, testing your risk management techniques, and gaining experience before risking real capital.

Closing Summary

Trading Forex with a US Forex broker offers both opportunities and risks. It’s crucial to approach trading with a well-defined strategy, risk management techniques, and a thorough understanding of the market dynamics. By carefully choosing a reputable broker, understanding the regulatory landscape, and managing risks effectively, you can enhance your chances of success in the dynamic world of Forex trading.

FAQ: Us Forex Broker

What are the main advantages of using a US Forex broker?

US Forex brokers are subject to stringent regulations, which provide a higher level of investor protection compared to brokers in some other jurisdictions. They also typically offer advanced trading platforms and a wide range of account types to suit different trading styles and risk appetites.

How do I choose the best US Forex broker for me?

Consider factors like trading platform, account types, fees, customer support, regulatory compliance, and the broker’s reputation. Research different brokers, compare their offerings, and read reviews from other traders before making a decision.

What are the risks involved in Forex trading with a US Forex broker?

Forex trading involves inherent risks, including leverage, volatility, and market manipulation. It’s crucial to understand and manage these risks effectively. Start with a small investment, use appropriate risk management strategies, and never invest more than you can afford to lose.