- Forex Trading Basics

- Introduction to MetaTrader

- Navigating the MetaTrader Interface

- Technical Analysis in MetaTrader

- Automated Trading with MetaTrader

- Risk Management in Forex Trading

- Forex Trading Strategies

- Resources and Support for MetaTrader Users

- Closing Summary: Forex Trading Metatrader

- Clarifying Questions

Forex Trading MetaTrader: A Beginner’s Guide delves into the exciting world of foreign exchange trading, where you can leverage the global financial market to potentially profit from currency fluctuations. This guide will walk you through the fundamentals of Forex trading, introduce you to the popular MetaTrader platform, and equip you with the knowledge and tools necessary to navigate the intricacies of this dynamic market.

The Forex market, often referred to as the “FX market,” is the largest and most liquid financial market in the world, operating 24 hours a day, 5 days a week. MetaTrader, a widely used platform, provides a user-friendly interface and advanced features to help traders analyze market trends, execute trades, and manage their risk effectively.

Forex Trading Basics

Forex trading, short for foreign exchange trading, involves the buying and selling of currencies in the global financial market. It is the largest and most liquid financial market in the world, with trillions of dollars exchanged daily. Understanding the fundamentals of Forex trading is essential for anyone seeking to participate in this dynamic market.

The Significance of Forex Trading

Forex trading plays a crucial role in the global economy, facilitating international trade, investment, and travel. It allows businesses and individuals to exchange currencies at competitive rates, enabling them to conduct transactions across borders seamlessly.

Key Characteristics of Forex Trading

Forex trading offers several distinct characteristics that differentiate it from other financial markets.

24/5 Availability

The Forex market operates 24 hours a day, 5 days a week, providing traders with ample opportunities to participate at any time. This continuous trading environment is a result of the global nature of the market, with different trading centers opening and closing throughout the day.

High Leverage Potential

Forex trading allows traders to leverage their investments, meaning they can control a larger position with a smaller amount of capital. This leverage can amplify potential profits but also increase the risk of losses.

Major Currency Pairs

The Forex market trades numerous currency pairs, but some are more popular than others due to their trading volume and liquidity.

Major Currency Pairs

Major currency pairs are the most traded in the Forex market, typically involving the US dollar (USD) and other major currencies. These pairs are known for their high liquidity and volatility.

- EUR/USD (Euro/US Dollar): This pair is the most traded in the world, reflecting the economic significance of the Eurozone and the United States.

- USD/JPY (US Dollar/Japanese Yen): This pair is influenced by the economic policies of the United States and Japan, and it often serves as a safe-haven currency during periods of global uncertainty.

- GBP/USD (British Pound/US Dollar): This pair is affected by the economic performance of the United Kingdom and the United States, and it can be volatile due to political events.

- USD/CHF (US Dollar/Swiss Franc): This pair is often considered a safe-haven currency, as the Swiss Franc is perceived as a stable currency during times of economic turmoil.

- AUD/USD (Australian Dollar/US Dollar): This pair is influenced by commodity prices, particularly gold and iron ore, as Australia is a major exporter of these commodities.

Minor Currency Pairs

Minor currency pairs involve one major currency and one minor currency, typically from emerging markets. These pairs may offer higher potential profits but also carry greater risks due to their lower liquidity.

Exotic Currency Pairs

Exotic currency pairs involve one major currency and one currency from a less developed country. These pairs are generally less liquid and more volatile than major or minor pairs, offering both higher potential profits and risks.

Introduction to MetaTrader

MetaTrader is a widely popular and versatile platform for trading Forex and other financial instruments. It is renowned for its user-friendly interface, advanced charting capabilities, and a comprehensive range of features that cater to both novice and experienced traders.

MetaTrader is available in two primary versions: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). While both versions offer a robust trading experience, MT5 boasts enhanced functionalities, including a wider range of trading instruments, more sophisticated order types, and advanced analytical tools.

MetaTrader Versions and Functionalities

MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are both popular platforms for Forex trading. They offer a range of features, including charting tools, technical indicators, and automated trading capabilities. MT5 is considered an upgrade to MT4, offering additional features and functionalities.

- MetaTrader 4 (MT4): MT4 is a widely used platform known for its simplicity and user-friendliness. It offers a comprehensive set of features, including:

- Real-time charting and analysis

- A wide range of technical indicators

- Automated trading capabilities through Expert Advisors (EAs)

- Multiple order types

- News and economic calendar

- MetaTrader 5 (MT5): MT5 is the newer version of MetaTrader, offering advanced features and functionalities. Some of the key advantages of MT5 include:

- Support for a wider range of trading instruments, including stocks, futures, and options

- More sophisticated order types, such as trailing stops and market orders

- Enhanced charting capabilities, including more indicators and drawing tools

- Advanced economic calendar and news feeds

- Improved backtesting and optimization tools for EAs

Downloading, Installing, and Configuring MetaTrader

MetaTrader is available for download on both desktop and mobile devices. The process for downloading, installing, and configuring MetaTrader is relatively straightforward.

Downloading MetaTrader

- Visit the official MetaTrader website or the website of your chosen broker.

- Select the version of MetaTrader you want to download (MT4 or MT5).

- Choose the appropriate download option based on your operating system (Windows, Mac, or Linux).

Installing MetaTrader

- Once the download is complete, double-click the installer file.

- Follow the on-screen instructions to install MetaTrader on your computer.

- Accept the terms and conditions of the software license agreement.

- Select the desired installation directory.

- Click “Install” to complete the installation process.

Configuring MetaTrader

- After installation, launch MetaTrader.

- You will be prompted to enter your broker’s server details and login credentials.

- If you are a new user, you will need to create a trading account with a broker.

- Once logged in, you can start exploring the platform’s features and functionalities.

Navigating the MetaTrader Interface

The MetaTrader platform is a powerful tool for Forex trading. Its interface is designed to be user-friendly, offering a comprehensive set of features that allow traders to analyze markets, execute trades, and manage their positions. This section will guide you through the key components of the MetaTrader interface and their functions.

Understanding the Interface Components

The MetaTrader interface consists of several key components that work together to provide a complete trading experience. These components are:

- Market Watch: This window displays the current prices of various financial instruments, including currency pairs, indices, and commodities. You can add or remove instruments from the Market Watch window by right-clicking on the window and selecting “Symbols.”

- Trade Tab: The Trade tab is where you can place and manage your trading orders. It displays your open trades, pending orders, and trading history. You can access the Trade tab by clicking on the “Trade” tab in the top menu.

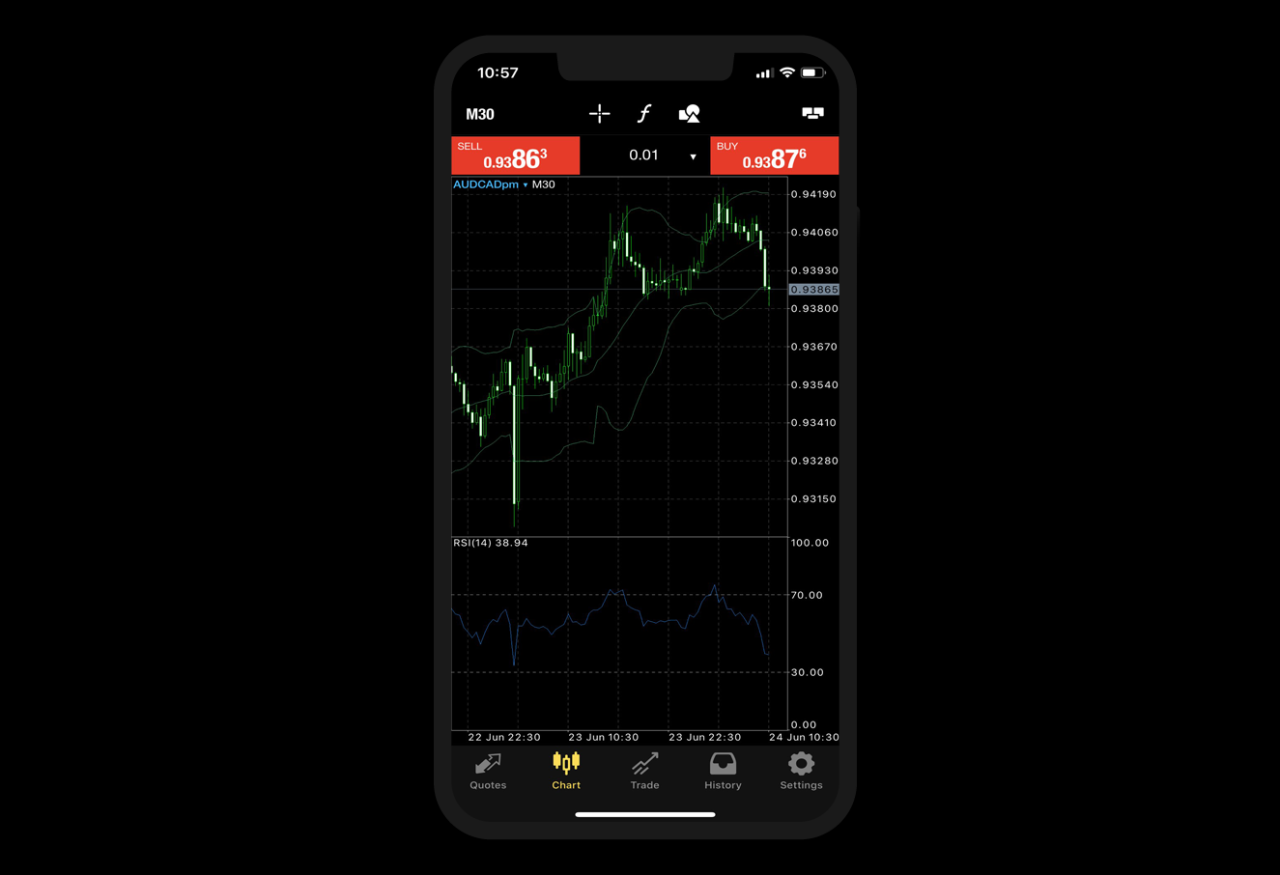

- Chart Window: The Chart window displays the price history of a selected financial instrument. You can customize the chart by adding indicators, drawing tools, and changing the time frame. The Chart window is essential for technical analysis and identifying trading opportunities.

- Terminal Window: The Terminal window provides access to various features, including trading history, account statements, and expert advisors. You can access the Terminal window by clicking on the “Terminal” tab in the top menu.

- Toolbox: The Toolbox contains a variety of tools and indicators that you can use to analyze markets and execute trades. You can access the Toolbox by clicking on the “Toolbox” tab in the top menu.

- Navigation Bar: The Navigation bar is located at the top of the MetaTrader interface. It provides access to various menus, including “File,” “View,” “Insert,” and “Tools.”

Opening and Managing Trading Orders

MetaTrader offers a variety of order types that you can use to execute trades. These include:

- Market Orders: Market orders are executed at the current market price. This type of order is suitable for traders who want to enter a trade immediately.

- Limit Orders: Limit orders are placed at a specific price level. They are only executed when the market price reaches your specified limit price. This type of order is suitable for traders who want to buy or sell at a specific price or better.

- Stop Orders: Stop orders are placed at a specific price level, but they are only triggered when the market price moves against your position. This type of order is suitable for traders who want to limit their losses or protect their profits.

To open a trading order, follow these steps:

- Select the financial instrument you want to trade from the Market Watch window.

- Click on the “New Order” button in the Trade tab.

- Choose the order type (Market, Limit, or Stop) and enter the desired order parameters.

- Click on the “Buy” or “Sell” button to execute the order.

To manage an open trading order, follow these steps:

- Select the order you want to manage from the Trade tab.

- Click on the “Modify” button to change the order parameters.

- Click on the “Close” button to close the order.

Technical Analysis in MetaTrader

Technical analysis is a method of forecasting future price movements by studying past price data and trading patterns. It is a powerful tool that can be used to identify potential trading opportunities and manage risk in Forex trading. MetaTrader provides a wide range of technical indicators and tools that traders can use to perform technical analysis.

Popular Technical Indicators

Technical indicators are mathematical calculations that are applied to price data to generate signals about potential price movements. MetaTrader offers a wide range of popular indicators, including:

- Moving Averages: These indicators smooth out price fluctuations and identify trends. They are calculated by averaging prices over a specific period. Common moving averages include simple moving averages (SMA), exponential moving averages (EMA), and weighted moving averages (WMA).

- Relative Strength Index (RSI): This momentum indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. The RSI ranges from 0 to 100. Readings above 70 are considered overbought, while readings below 30 are considered oversold.

- Stochastic Oscillator: This momentum indicator compares a security’s closing price to its price range over a given period. It oscillates between 0 and 100, with readings above 80 considered overbought and readings below 20 considered oversold.

- Moving Average Convergence Divergence (MACD): This trend-following momentum indicator identifies trend changes by comparing two moving averages. It consists of a MACD line, a signal line, and a histogram.

- Bollinger Bands: This volatility indicator plots bands around a moving average to indicate the expected price range. The bands widen during periods of high volatility and narrow during periods of low volatility.

Chart Types

MetaTrader offers various chart types, each with its advantages and disadvantages:

| Chart Type | Advantages | Disadvantages |

|---|---|---|

| Candlestick | Provides a visual representation of price action, including opening, closing, high, and low prices. Offers insights into market sentiment and potential reversals. | Can be visually complex, especially for beginners. |

| Bar | Similar to candlestick charts but only show the opening, closing, high, and low prices without the visual representation of the candlestick body. | Less visually informative than candlestick charts. |

| Line | Simple and easy to read, connecting closing prices over time. Suitable for identifying trends and support/resistance levels. | Does not provide information about price ranges or market sentiment. |

Automated Trading with MetaTrader

Automated trading, also known as algorithmic trading, allows you to execute trades based on predefined rules and parameters without manual intervention. This can be achieved in MetaTrader through Expert Advisors (EAs), which are custom-built programs that analyze market data and execute trades according to your defined strategy.

Creating and Testing Custom Trading Strategies

MetaTrader provides a comprehensive set of tools for developing and testing your own trading strategies.

- MetaTrader’s Strategy Tester: This powerful tool allows you to simulate your trading strategy on historical data, enabling you to evaluate its performance before deploying it in live markets. You can adjust parameters, optimize settings, and analyze various market conditions to fine-tune your strategy for optimal results.

- MQL4/MQL5 Programming Language: MetaTrader uses the MQL4/MQL5 programming language for creating EAs. This language provides a rich set of functions and libraries for accessing market data, managing trades, and implementing complex trading logic. While some basic knowledge of programming is required, MetaTrader offers extensive documentation and online resources to help you learn and build your own EAs.

Popular Expert Advisors

Several popular EAs are available for download, each offering unique trading strategies and functionalities. Some examples include:

- Trend Following EAs: These EAs aim to capitalize on long-term market trends, entering trades when a trend is identified and exiting when it reverses. They often utilize indicators like moving averages or MACD to identify trend direction.

- Scalping EAs: Scalping EAs focus on profiting from small price fluctuations within a short timeframe. They typically utilize high-frequency trading techniques and may rely on indicators like stochastic oscillators or RSI.

- News Trading EAs: These EAs leverage economic news releases to identify potential trading opportunities. They may analyze the impact of news events on market sentiment and trigger trades based on predefined criteria.

Benefits and Risks of Automated Trading

Automated trading offers several potential benefits:

- Objectivity: EAs eliminate emotional biases and impulsive decisions that can negatively impact trading performance.

- Efficiency: Automated trading allows you to execute trades 24/5, even when you’re not actively monitoring the markets.

- Backtesting: You can rigorously test your trading strategy on historical data before deploying it in live markets.

However, automated trading also carries risks:

- Overfitting: EAs may be overoptimized to historical data, leading to poor performance in live markets.

- Market Volatility: Market conditions can change rapidly, potentially rendering your EA’s strategy ineffective.

- Technical Issues: EAs are susceptible to technical glitches or errors, which can lead to unexpected trades or losses.

Risk Management in Forex Trading

Risk management is crucial in Forex trading, as it can protect your capital and ensure long-term profitability. It involves strategies and techniques to control potential losses and maximize your chances of success. MetaTrader provides tools and features that facilitate effective risk management.

Stop-Loss Orders

Stop-loss orders are essential tools for limiting potential losses. They are pre-set orders that automatically close your position when the price reaches a specified level. This helps to prevent significant losses in case of unfavorable market movements.

To set a stop-loss order in MetaTrader, follow these steps:

1. Open a trading order: Select the desired currency pair and specify the volume you wish to trade.

2. Set the stop-loss level: In the order window, you’ll find a field for setting the stop-loss price. Enter the desired level, which is the price at which you want your position to be automatically closed.

3. Confirm the order: Review the order details and confirm your stop-loss level before executing the trade.

By setting a stop-loss order, you define a maximum acceptable loss for each trade. This helps to protect your capital and avoid emotional trading decisions when the market moves against your position.

Risk Parameters in MetaTrader

MetaTrader offers various settings and features for managing risk. Here are some key risk parameters you can adjust:

- Maximum Trade Volume: This setting limits the maximum volume you can trade in a single order. By setting a maximum volume, you can control the potential loss for each trade.

- Maximum Loss: This parameter allows you to set a maximum total loss for a trading session or a specific period. When the total loss reaches this limit, MetaTrader will automatically stop further trading.

- Risk-Reward Ratio: This parameter helps you to define the desired ratio between the potential profit and potential loss for each trade. For example, a 1:2 risk-reward ratio means that you aim to make twice as much profit as the potential loss.

It’s crucial to experiment with these risk parameters and find a balance that suits your trading style and risk tolerance.

Position Sizing

Position sizing is another important aspect of risk management. It involves determining the appropriate volume for each trade based on your risk tolerance and account balance. A common approach is to risk a fixed percentage of your account balance on each trade.

For example, if you risk 1% of your account balance on each trade, and your account balance is $10,000, you would risk $100 per trade.

This approach helps to ensure that you don’t risk too much capital on a single trade and can withstand potential losses.

Managing Emotions

Risk management also involves managing your emotions. It’s essential to avoid emotional trading decisions, such as chasing losses or holding onto losing positions for too long. A disciplined approach to trading, based on your predetermined risk parameters and trading plan, can help you stay objective and avoid emotional biases.

Forex Trading Strategies

Developing a Forex trading strategy is crucial for success in the market. It provides a structured approach to making trading decisions, helps manage risk, and improves consistency.

Scalping

Scalping involves taking advantage of small price movements in the market. Scalpers aim to profit from short-term price fluctuations by opening and closing trades quickly. They use technical indicators, such as moving averages and oscillators, to identify entry and exit points.

Day Trading

Day traders hold positions for a shorter period, typically within the same trading day. They use technical analysis and market news to identify trading opportunities. Day trading requires high levels of focus and discipline, as it involves frequent monitoring of charts and market conditions.

Swing Trading

Swing traders aim to capture larger price swings in the market. They hold positions for a few days to a few weeks, using technical and fundamental analysis to identify trend reversals and support and resistance levels.

Trend Trading

Trend traders identify and follow strong trends in the market. They use technical indicators, such as moving averages, to confirm trends and enter trades in the direction of the trend.

News Trading

News traders capitalize on market reactions to economic announcements and events. They use fundamental analysis and news sources to identify potential trading opportunities based on anticipated market responses.

Breakout Trading

Breakout traders look for price breakouts from established trading ranges. They use technical indicators, such as Bollinger Bands, to identify breakouts and enter trades in the direction of the breakout.

Range Trading

Range traders focus on trading within defined price ranges. They use technical indicators, such as support and resistance levels, to identify entry and exit points within the range.

Arbitrage Trading

Arbitrage traders take advantage of price discrepancies between different markets. They simultaneously buy and sell the same asset in different markets, profiting from the price difference.

Copy Trading

Copy trading allows traders to automatically copy the trades of experienced traders. This can be a valuable tool for beginners who lack experience or are seeking guidance.

Trading Strategies Comparison, Forex trading metatrader

| Strategy | Risk Profile | Profitability Potential | Time Commitment |

|---|---|---|---|

| Scalping | High | Low | High |

| Day Trading | Medium | Medium | High |

| Swing Trading | Medium | Medium | Medium |

| Trend Trading | Low | Low | Low |

| News Trading | High | High | Medium |

| Breakout Trading | Medium | Medium | Medium |

| Range Trading | Low | Low | Low |

| Arbitrage Trading | Low | Low | High |

| Copy Trading | Variable | Variable | Low |

Example Trading Strategies

Technical Analysis

Moving Average Crossover Strategy

This strategy involves using two moving averages, such as a 50-period moving average and a 200-period moving average. When the shorter-term moving average crosses above the longer-term moving average, it signals a potential buy opportunity. Conversely, a crossover below signals a potential sell opportunity.

Fundamental Analysis

Economic Calendar Strategy

This strategy involves monitoring the economic calendar for key economic releases, such as interest rate decisions, inflation data, and employment figures. Traders can anticipate market reactions to these releases and enter trades accordingly.

Combination of Technical and Fundamental Analysis

Trend Following with News Confirmation Strategy

This strategy involves identifying a strong trend in the market using technical indicators and confirming the trend with positive news releases. This can increase the likelihood of a successful trade.

Resources and Support for MetaTrader Users

Navigating the world of Forex trading with MetaTrader can be both exciting and challenging. As you delve deeper into the intricacies of the platform, you’ll likely encounter questions, seek guidance, and want to connect with other traders. Thankfully, a wealth of resources and support channels are available to MetaTrader users, ensuring a smooth and enriching trading experience.

Official MetaTrader Resources

The official MetaTrader website is a treasure trove of information, offering a comprehensive suite of resources for traders of all levels.

- Documentation: The official MetaTrader documentation provides in-depth explanations of the platform’s features, functionalities, and technical aspects. It covers everything from basic navigation to advanced trading strategies and programming with MQL5.

- Tutorials: The MetaTrader website offers a library of video tutorials and step-by-step guides that walk you through various aspects of the platform. These tutorials are designed to be accessible and informative, catering to both beginners and experienced traders.

- Educational Materials: MetaTrader provides a range of educational materials, including articles, webinars, and ebooks, covering topics like fundamental and technical analysis, risk management, and trading psychology. These resources are invaluable for enhancing your trading knowledge and skills.

- Support Center: The MetaTrader Support Center provides a comprehensive FAQ section and a dedicated team available to answer your questions and resolve any technical issues you may encounter.

Online Communities and Forums

Joining online communities and forums dedicated to MetaTrader and Forex trading offers a fantastic opportunity to connect with fellow traders, exchange insights, and learn from experienced professionals. These platforms foster a collaborative learning environment where you can:

- Ask Questions and Get Answers: Pose your questions to a community of experienced traders who can provide insights, guidance, and solutions to your queries.

- Share Trading Strategies and Ideas: Engage in discussions about trading strategies, share your insights, and learn from the collective wisdom of the community.

- Stay Updated on Market Trends: Keep abreast of the latest market trends, news, and analysis shared by experienced traders within the community.

- Network with Other Traders: Build valuable connections with like-minded individuals, expand your trading network, and potentially collaborate on trading projects.

Closing Summary: Forex Trading Metatrader

By understanding the basics of Forex trading, familiarizing yourself with the MetaTrader platform, and implementing sound risk management practices, you can embark on your journey into the world of Forex trading with confidence. Remember, successful trading requires continuous learning, adaptation, and a disciplined approach. This guide provides a solid foundation, but it’s essential to stay informed about market dynamics, develop your own trading strategies, and seek ongoing support from experienced traders and resources.

Clarifying Questions

What are the minimum deposit requirements for Forex trading?

Minimum deposit requirements vary depending on the broker you choose. Some brokers offer micro accounts with low deposit requirements, while others may have higher thresholds. It’s crucial to research and select a broker that aligns with your trading goals and financial resources.

How do I choose the right broker for Forex trading?

Choosing the right broker is essential for a successful Forex trading experience. Consider factors such as regulation, trading platform, spreads, customer support, and educational resources. It’s also advisable to read reviews and compare different brokers before making a decision.

Is Forex trading suitable for beginners?

While Forex trading can be accessible to beginners, it’s important to approach it with caution and a thorough understanding of the risks involved. Start with a demo account to practice your trading skills and familiarize yourself with the platform before risking real capital. Seek guidance from experienced traders or educational resources to enhance your knowledge and skills.